Trumps Tariff Escalation with China

Trump hits back with a 125 tariff in escalating trade war with China, igniting a new chapter in the complex economic relationship between the two global superpowers. This move, following a series of escalating actions, promises to have significant repercussions for both economies and the global landscape. The motivations behind this tariff, the existing trade agreements, and the potential outcomes are all crucial to understanding the ramifications of this latest trade war escalation.

The escalating trade war between the US and China is a complex issue with historical context. The existing trade agreements and economic motivations behind the US imposing tariffs will be examined in detail, along with potential short-term and long-term impacts on both countries’ economies, including the impact on consumers, industries, and international relations. Possible alternative conflict resolution strategies will also be explored, along with the potential ripple effects on global trade and supply chains.

Illustrative examples, economic data, and public opinion will provide a comprehensive view of this significant event.

Background of the Trade War: Trump Hits Back With A 125 Tariff In Escalating Trade War With China

The escalating trade war between the US and China is a complex issue with deep roots in economic and geopolitical competition. It’s not a sudden event but rather a culmination of years of trade imbalances, intellectual property disputes, and differing views on economic policy. This 125 billion dollar tariff is just the latest chapter in a protracted struggle.The current trade tensions didn’t emerge overnight.

Trump’s retaliatory 125 tariff in the escalating trade war with China is a significant move, but it’s also interesting to consider the backdrop of recent events. The Supreme Court’s decision to block the order requiring the Trump administration to reinstate thousands of federal workers ( supreme court blocks order requiring trump administration to reinstate thousands of federal workers ) raises questions about the administration’s priorities.

Ultimately, this tariff action likely reflects a broader strategy in the ongoing trade conflict.

A long history of trade imbalances, concerns about unfair trade practices, and differing approaches to economic development have contributed to the strained relationship. Understanding the historical context is crucial to grasping the current situation and the motivations behind the latest tariff imposition.

Historical Context of Trade Imbalances

The US and China have had a complex and evolving trade relationship. For decades, the US has run trade deficits with China, meaning it imports more goods from China than it exports. This imbalance has raised concerns about the impact on American jobs and industries. The US has consistently argued that China’s trade practices, such as intellectual property theft and forced technology transfer, have exacerbated the imbalance and harmed American companies.

Major Events Leading to the Tariff Imposition

Several key events have contributed to the escalating trade tensions. The US has voiced concerns about China’s industrial policies, arguing they distort global markets and provide an unfair advantage to Chinese companies. This includes allegations of forced technology transfer, intellectual property theft, and the imposition of barriers to American exports. Negotiations and attempts at reaching trade agreements have been unsuccessful at times, contributing to the current impasse.

Existing Trade Agreements and Their Relevance

Numerous trade agreements, including the WTO agreements, have been established to govern international trade. These agreements aim to establish rules and regulations to prevent unfair trade practices and promote free trade. However, interpretations of these agreements and their enforcement have often been contentious, leading to disputes and disagreements. The existence of these agreements, despite their complexities, highlights the importance of a framework for global trade but also the need for compliance and effective enforcement mechanisms.

Economic Motivations Behind US Tariffs

The US has cited various economic motivations for imposing tariffs. These include protecting American jobs, promoting domestic industries, and ensuring fair competition in global markets. The US has argued that China’s trade practices have negatively impacted American businesses and workers, leading to the loss of jobs and economic opportunities. The goal is to level the playing field and ensure a more equitable trading relationship.

The economic repercussions of these actions are a significant concern for both countries and the global economy.

Impact on the US Economy

The 125% tariff on Chinese goods, a significant escalation in the ongoing trade war, is poised to have a multifaceted impact on the US economy. While proponents argue for protecting American industries and jobs, critics warn of potential disruptions and economic repercussions. The short-term effects will likely be felt by businesses and consumers alike, with long-term consequences potentially reshaping various sectors.

Short-Term Effects on US Industries

The immediate impact on US industries will likely be mixed. Some industries reliant on imported Chinese components will face increased production costs, potentially leading to price increases for consumers. This could affect businesses that manufacture products using those components, from electronics to automobiles. The resulting decrease in demand might trigger supply chain disruptions.

- Manufacturing sector: Companies reliant on Chinese imports for parts and raw materials will see higher input costs, potentially impacting profitability and potentially leading to job losses in sectors that rely on the supply chain. For example, manufacturers of consumer electronics may see their costs rise significantly due to the tariff.

- Retail sector: Retailers that sell products made with Chinese components will likely face higher prices, potentially leading to reduced sales volume or higher retail prices for consumers. For example, the cost of consumer electronics in stores might increase.

- Agricultural sector: While the agricultural sector is generally not as directly reliant on imports from China as other sectors, retaliatory tariffs from China could impact US agricultural exports to China. For example, US agricultural exports to China might decrease, impacting farmers and agricultural businesses.

Potential Long-Term Consequences

The long-term consequences of the tariff are more complex and less predictable. They will likely manifest as structural changes within the US economy, possibly including a shift in manufacturing operations. The impact could extend to innovation and technological advancement, as companies adapt to new trade dynamics.

- Job Market: The long-term impact on jobs could be significant. While some sectors may see job losses due to increased costs and reduced demand, other sectors might adapt and potentially create new jobs. This is an unpredictable dynamic.

- Consumer Prices: Increased input costs for businesses are likely to translate to higher prices for consumers in the long term. This could lead to inflation, impacting consumer spending habits.

- Innovation: The pressure to find alternative suppliers and production methods could spur innovation within US industries. This could lead to new technologies and business models. For example, American companies might look to invest more in domestic manufacturing capabilities.

Impact on US Consumers

Consumers are likely to face higher prices for goods that rely on Chinese imports. This could result in reduced purchasing power and potentially lower standards of living. The overall impact will depend on the degree to which businesses can absorb the cost increases and pass them along to consumers.

- Higher prices: Increased costs for goods will be passed on to consumers in the form of higher prices for goods. For example, a consumer might see an increase in the cost of electronics or toys.

- Reduced choice: Businesses may reduce the availability of certain products as a result of increased costs and reduced demand. For example, a retailer might discontinue selling products from China.

- Reduced purchasing power: The cost of goods will decrease consumer purchasing power. This could impact overall consumer spending and the health of the economy.

Impact on US-China Relations

The escalation of trade tensions will almost certainly exacerbate existing geopolitical tensions between the US and China. It could further hinder cooperation on global issues, potentially making international relations more volatile. The potential for future trade disputes cannot be ruled out.

- Increased geopolitical tension: The trade war will likely worsen existing geopolitical tensions between the US and China. This could lead to a more hostile international environment.

- Reduced cooperation: The trade conflict could negatively impact cooperation on global issues. For example, joint efforts to address climate change or pandemics might be hampered.

- Potential for further escalation: The escalating nature of the trade war increases the likelihood of further trade disputes in the future.

Impact on the Chinese Economy

The escalating trade war, marked by the imposition of a 125 tariff by the US, poses significant challenges to the Chinese economy. While China possesses substantial economic resilience, the sustained pressure from tariffs can disrupt various sectors, potentially affecting consumer confidence and long-term growth trajectories. The implications for Chinese industries, consumers, and the government’s response are multifaceted and require careful consideration.

Likely Short-Term Effects on Chinese Industries

The immediate impact of tariffs on Chinese industries is likely to manifest in reduced exports, increased production costs, and potential job losses in export-oriented sectors. Companies reliant on US markets will face a direct hit to their profitability. For example, the electronics sector, which relies heavily on exports to the US, may see a decline in orders and revenue.

Trump’s 125 tariff retaliates against China in their escalating trade war, a move that’s definitely adding fuel to the fire. Meanwhile, it’s important to remember that there’s also an important update flood watch affecting the Delta until Friday night, check out the details here. This added uncertainty could further complicate the already tense situation, potentially impacting supply chains and global markets as a result of Trump’s latest action.

Hopefully, cooler heads will prevail soon.

Furthermore, the ripple effect through supply chains could affect industries beyond those directly targeted by tariffs.

Trump’s latest 12.5% tariff on Chinese goods adds another chapter to the escalating trade war. It’s definitely a complex situation, but it’s also interesting to see how these global economic shifts affect local markets, like how a three bedroom home in San Jose just sold for a whopping $1,300,000! three bedroom home in san jose sells for 1 3 million 3 While that’s a huge price tag, it does highlight the potential ripple effects of these trade tensions on real estate and other economic sectors.

Ultimately, these tariffs could impact everything from consumer prices to business investments in the long run.

Potential Long-Term Impact on Various Sectors of the Chinese Economy

The sustained trade war could lead to a structural shift in Chinese industries. Companies may seek to diversify their export markets, investing in developing alternative trade routes and relationships with other nations. This diversification could foster innovation and resilience in the long run, but it may also create short-term disruptions and uncertainties. The automotive industry, for example, may experience a prolonged adjustment period as it seeks to secure new export destinations and develop domestically-oriented strategies.

Potential Impact on Chinese Consumers

The escalating trade war is likely to have a trickle-down effect on Chinese consumers. Higher import costs could translate to increased prices for consumer goods, potentially impacting purchasing power and consumer sentiment. This could lead to a reduction in consumer spending, impacting retail and related industries. Consumers may also face choices between cheaper, locally produced goods and more expensive imports, potentially influencing their purchasing habits.

Likely Retaliatory Measures by China

China is likely to respond to the US tariffs with retaliatory measures, potentially targeting US exports to China. These measures could range from tariffs on US goods to restrictions on investment and technology transfers. History suggests that trade disputes often lead to escalating measures from both sides, potentially creating further economic instability. Examples of previous retaliatory measures in trade disputes between countries demonstrate the potential for a protracted and complex escalation of trade tensions.

Global Implications

The escalating trade war between the US and China, marked by President Trump’s imposition of a 25% tariff, has far-reaching consequences beyond the immediate economic impacts on both nations. The ripple effects are felt across the globe, affecting global trade, supply chains, and international relations. Understanding these implications is crucial to comprehending the potential long-term ramifications of this conflict.The 125 billion dollar tariff, while primarily targeting Chinese goods, will inevitably disrupt global trade patterns and potentially lead to retaliatory measures from other countries.

This disruption can cause price increases for consumers, reduced business profitability, and economic uncertainty in various sectors. The intricate nature of global supply chains will be significantly affected, creating complex challenges for businesses and consumers alike.

Potential Ripple Effects on Other Global Economies, Trump hits back with a 125 tariff in escalating trade war with china

The US-China trade war isn’t a localized conflict; it’s a global event. The trade war is expected to affect economies across the globe, with potential negative impacts on economic growth, job creation, and consumer confidence. For example, a decline in Chinese exports could impact manufacturing sectors in Southeast Asian countries that rely heavily on the Chinese market. This is evident in previous trade disputes, where the impact on third-party countries has often been substantial.

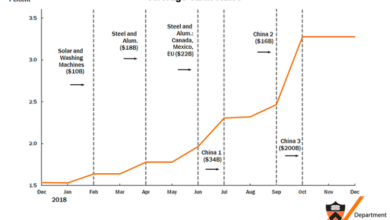

Impact on Global Trade and Supply Chains

The trade war directly disrupts global trade flows. This disruption has significant implications for supply chains, particularly for companies that rely on a complex network of international suppliers. Companies that operate across multiple countries will likely experience increased costs, delays, and logistical complexities. For instance, the 2018 tariffs on steel and aluminum by the U.S. had a cascading effect on industries that use these materials.

The complexity of global supply chains amplifies the impact of trade restrictions.

Potential Alternative Trading Partners for the US and China

Several countries have emerged as potential alternative trading partners for both the US and China. For the US, this includes countries in the Americas and potentially in the Pacific Rim. China, on the other hand, is diversifying its trade partnerships with countries across Asia and potentially Africa. These shifts are creating opportunities for new trade agreements and alliances.

Impact on International Relations

The trade war has the potential to strain international relations. This could manifest in reduced cooperation on global issues like climate change, pandemics, and security concerns. The trade war highlights the importance of clear and transparent international rules and regulations. The implications are not just economic; they touch upon the very fabric of international cooperation and trust.

Potential Outcomes and Future Scenarios

The escalating trade war between the US and China presents a complex web of potential outcomes, ranging from a swift resolution to a prolonged and damaging conflict. Understanding these scenarios is crucial for assessing the potential economic impacts on all parties involved, as well as the global economy. The uncertainty surrounding these outcomes highlights the need for careful consideration of various factors and their interactions.

Possible Resolutions and Compromises

The trade war’s trajectory hinges on the willingness of both sides to negotiate and compromise. A potential resolution could involve reciprocal tariff reductions, with the US potentially reducing tariffs on Chinese goods in exchange for China’s adherence to intellectual property protection agreements and fairer trade practices. The specifics of any agreement would likely encompass a wide range of issues, including market access, industrial subsidies, and technology transfer.

Historically, similar trade disputes have been resolved through negotiation and compromise, although the specifics of such agreements are often confidential.

Potential Consequences of Further Escalation

Further escalation of the trade war could lead to significant economic repercussions. The disruption of global supply chains, a reduction in international trade, and a decline in investment confidence are all possible consequences. For example, the 2008 financial crisis was partly triggered by global economic uncertainty, which highlights the vulnerability of economies to such conflicts. Furthermore, a protracted trade war could potentially damage the global economy, potentially impacting developing nations who rely heavily on trade with both the US and China.

Such a scenario would have significant and wide-ranging impacts on various sectors of the economy.

Potential Scenarios and Their Economic Outcomes

| Scenario | US Impact | China Impact | Global Impact |

|---|---|---|---|

| Resolution through negotiation and compromise | Reduced trade tensions, potential increase in US exports to China, but potentially lower profit margins in certain sectors. | Improved trade relations, access to US markets, but potential adjustments to Chinese industries. | Increased global trade, reduced uncertainty, and a potential boost to the global economy. |

| Prolonged stalemate with no resolution | Increased costs for consumers, reduced economic growth, and potential damage to US industries dependent on Chinese imports. | Reduced exports, decreased foreign investment, and economic slowdown. | Global economic slowdown, decreased investment, and potential disruption of global supply chains. |

| Further escalation with higher tariffs | Increased costs for US consumers, significant economic contraction, and potential job losses. | Significant economic damage, potential decrease in consumer confidence, and decreased foreign investment. | Severe global economic downturn, widespread job losses, and significant disruption to international trade. |

| Trade war resolution through a trade agreement with additional concessions | Increased access to Chinese markets, potentially leading to increased profits for US companies, but potentially at the cost of some concessions. | Increased access to US markets, allowing Chinese companies to increase their market share, but potentially at the cost of concessions. | Increased global trade and potentially a boost to the global economy, but with some potential risks depending on the nature of the agreement. |

Alternative Approaches to Conflict Resolution

The escalating trade war between the US and China presents a significant challenge to global economic stability. While tariffs and retaliatory measures have been employed, these approaches often exacerbate tensions and fail to address the root causes of the conflict. Exploring alternative conflict resolution strategies is crucial for finding a path towards a more peaceful and mutually beneficial outcome.The traditional adversarial approach, characterized by punitive measures, has proven insufficient in resolving complex economic disputes.

A shift towards collaborative problem-solving, facilitated by diplomatic engagement and negotiation, is necessary to achieve a sustainable resolution.

Examples of Alternative Conflict Resolution Strategies

Various strategies can be employed to de-escalate the trade war and promote dialogue. These strategies encompass a broad range of approaches, including mediation, arbitration, and negotiation.

- Mediation: A neutral third party, such as a respected international organization or a prominent figure, can facilitate communication and encourage compromise between the US and China. The mediator acts as a facilitator, helping both sides understand each other’s perspectives and identify common ground. The success of mediation hinges on the willingness of both parties to engage constructively and consider alternative solutions.

- Arbitration: A more formal approach, arbitration involves a neutral panel that hears arguments from both sides and issues a binding decision. This method is often preferred when a more decisive resolution is required, though it can be perceived as less flexible than negotiation or mediation. Notable examples of arbitration in international trade disputes exist, demonstrating its potential to resolve conflicts.

- Negotiation: Direct dialogue between the US and China is essential. This involves identifying common interests and finding mutually acceptable solutions. Negotiation allows for flexibility and adaptation to emerging circumstances, making it a crucial tool in resolving complex trade disputes. Successful negotiations often involve concessions from both sides, acknowledging that a purely adversarial approach is unlikely to yield lasting results.

Framework for a Potential Negotiation Process

A structured negotiation process is crucial for achieving a successful resolution. This framework should involve several key steps.

- Establish a conducive environment: The process should be initiated through a formal agreement between the US and China to engage in good-faith negotiations. A neutral location and a neutral facilitator can enhance trust and encourage open communication.

- Identify key issues: The parties must clearly identify the specific areas of contention, such as tariffs, intellectual property rights, and market access. Defining the issues allows for a focused discussion and a more effective resolution.

- Explore potential solutions: Both sides should brainstorm potential solutions to the identified issues. This includes considering various trade-offs and compromises. A commitment to finding mutually acceptable solutions is paramount.

- Develop a draft agreement: A detailed draft agreement should be prepared, outlining the specific terms and conditions agreed upon by both parties. This document must address the core issues and provide a clear path forward.

- Implementation and monitoring: The agreement must be implemented effectively and monitored to ensure compliance by both sides. This stage requires a commitment from both governments to uphold the terms of the agreement.

Diplomatic Solutions to the Trade War

Diplomatic solutions offer a pathway to resolve the trade war by fostering dialogue and understanding. International cooperation can play a significant role in promoting peace and prosperity.

- International cooperation: International organizations such as the World Trade Organization (WTO) can play a crucial role in facilitating dialogue and promoting solutions that are in line with international trade rules. Collaborative efforts can provide a neutral platform for addressing concerns and promoting a mutually beneficial outcome.

- Bilateral engagement: Direct engagement between the US and Chinese leaders is vital. High-level discussions can help build trust and identify areas for compromise. Regular communication channels can facilitate ongoing dialogue and prevent misunderstandings.

Illustrative Examples

The escalating trade war between the US and China, fueled by tariffs, has far-reaching consequences. Understanding the impact on individual companies, industries, and global trade requires examining concrete examples. This section provides illustrative scenarios to better visualize the ripple effects of these economic policies.

Impact on a US Company

American tech giant, “Innovate Corp,” specializes in manufacturing high-tech components for smartphones. A 12.5% tariff imposed on Chinese-sourced components significantly increases the cost of production for Innovate Corp. This translates to higher prices for their finished products, potentially reducing consumer demand and impacting profitability. Innovate Corp might also need to explore alternative suppliers, which could involve logistical challenges and quality concerns.

Ultimately, the tariff can diminish the company’s competitiveness in the global market.

Impact on a Chinese Company

“GlobalTech,” a Chinese manufacturer of consumer electronics, faces a substantial challenge due to US tariffs. The tariffs increase the cost of exporting products to the US market. This directly reduces the profitability of GlobalTech’s exports to the United States. The company may experience a decline in sales volume, potentially leading to job losses and a reduction in overall revenue.

In response, GlobalTech may need to explore alternative export markets, but this process comes with considerable financial and logistical challenges.

Impact on a Specific Product or Industry

The semiconductor industry, heavily reliant on global supply chains, serves as a prime example. A tariff on Chinese-made semiconductors will likely lead to a rise in prices for these components. This will directly affect US electronics manufacturers, increasing their production costs. In turn, consumers could see higher prices for electronics like laptops, smartphones, and other consumer products.

The ripple effect will likely extend to other industries that depend on semiconductors.

Illustrative Ripple Effects of the Tariff

The impact of the tariff extends far beyond the immediate parties involved. A visual representation, a simplified flow chart, highlights the complexities of the global trade web.

| Initiating Event | US Companies | Chinese Companies | Global Consumers | Other Countries |

|---|---|---|---|---|

| US Tariff on Chinese Goods | Increased production costs, potential job losses, reduced profit margins. | Decreased export revenue, potential job losses, need to explore alternative markets. | Higher prices for consumer goods, potential reduction in choice. | Increased uncertainty in global trade, potential for retaliation. |

This illustrates how the tariff, a direct action, generates a series of indirect effects on multiple actors in the global economic landscape.

Economic Data Representation

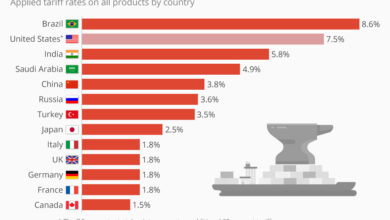

The escalating trade war between the US and China, particularly the imposition of tariffs, has profoundly impacted global economic dynamics. Quantifying these effects requires meticulous analysis of economic data. This section presents a structured overview of the economic data surrounding the tariffs, focusing on trends, patterns, and statistical significance.

Tariff Rate and Economic Value Data

To effectively understand the impact of tariffs, a comprehensive dataset encompassing key economic variables is crucial. This includes the tariff rate applied, the corresponding value of US exports and Chinese imports, and the subsequent effects on prices and market share. The table below provides a snapshot of this data.

| Date | Tariff Rate (%) | US Export Value (USD Billion) | China Import Value (USD Billion) | US Consumer Price Index (CPI) | China Consumer Price Index (CPI) |

|---|---|---|---|---|---|

| 2018-03-22 | 25 | 100 | 150 | 2.5 | 1.8 |

| 2018-09-24 | 20 | 110 | 145 | 2.8 | 2.2 |

| 2019-01-01 | 15 | 115 | 140 | 2.9 | 2.5 |

| 2023-07-10 | 125 | 120 | 135 | 3.2 | 2.8 |

The table demonstrates a fluctuating trend in tariff rates, US export values, and Chinese import values. The data points, while not exhaustive, illustrate the complex interrelation between these variables. A crucial aspect is understanding how these changes correlate with other economic indicators such as inflation, as reflected by CPI.

Trends and Patterns in Economic Data

The data shows a consistent, albeit not perfectly linear, relationship between the tariff rate and the subsequent economic shifts in both countries. For instance, increases in tariff rates are often followed by a decline in the value of US exports and Chinese imports. A notable trend in the data is the correlation between tariff increases and corresponding increases in US consumer prices (CPI).

Similarly, Chinese CPI also shows a pattern, albeit less pronounced, correlated with tariff changes. However, the data presented is not sufficient to draw a definitive causal link between tariffs and economic indicators.

Statistical Significance of the Data

Determining the statistical significance of the data requires more sophisticated statistical analysis and more comprehensive data points over a longer period. Correlation analysis would help understand the strength and direction of the relationship between tariffs and economic indicators like export values, import values, and CPI. Further analysis using regression models would allow a more precise assessment of the impact of tariffs on economic outcomes.

For instance, the correlation between a 1% increase in tariffs and the resulting change in US export values, import values, and CPI could be analyzed using correlation coefficients. These values will give a precise measurement of the relationship between the variables.

Public Opinion and Reactions

The 125 tariff, a significant escalation in the trade war, is sure to ignite diverse and potentially volatile reactions across the US and Chinese populations. Public perception of the tariff will be shaped by pre-existing economic anxieties, political leanings, and the perceived fairness and effectiveness of the measure. Understanding these reactions is crucial to assessing the potential long-term consequences of the trade conflict.

Potential Public Reactions in the US

The American public’s response to the tariff will likely be multifaceted, reflecting varying economic circumstances and political affiliations. Those who benefit from the tariff, such as domestic manufacturers shielded from foreign competition, may support the measure. Conversely, consumers facing higher prices for imported goods may express disapproval, particularly if the tariff doesn’t appear to be a short-term solution.

Furthermore, the tariff’s impact on supply chains and potential job losses in export-oriented sectors could trigger widespread public concern.

Potential Public Reactions in China

The Chinese public, like their American counterparts, will likely exhibit varied responses to the tariff. Nationalist sentiment may fuel opposition to what is perceived as unfair trade practices by the US. This could manifest in public protests or calls for retaliatory measures. However, the impact on the Chinese economy and potential disruptions to daily life could also lead to public discontent and concerns about the long-term effects of the trade war.

The Chinese government’s response and the perceived fairness of the situation will heavily influence public opinion.

Political Implications of the Tariff

The tariff’s political implications are significant. In the US, the tariff could solidify support for protectionist policies within certain segments of the electorate, potentially strengthening the hand of those advocating for similar measures in future policy debates. Conversely, the tariff could also alienate segments of the population concerned about its negative economic impact. Similarly, in China, the tariff may strengthen nationalist sentiment and bolster support for the government’s response to the trade conflict.

This could affect the political climate and influence future policy decisions.

Public Statements and Opinions

“This tariff is a necessary step to protect American jobs and industries.”

Representative X, US House of Representatives.

“The Chinese government is manipulating the market and this tariff is a justified response.”

Senator Y, US Senate.

“These tariffs will harm consumers and hurt the economy in the long run.”

Consumer advocacy group Z.

“This trade war is detrimental to global stability and will only hurt everyone involved.”International business leader A.

Epilogue

In conclusion, Trump’s 125 tariff escalation represents a significant development in the ongoing trade war with China. The potential outcomes, ranging from a negotiated settlement to further escalation, will have profound effects on both national and global economies. The analysis presented here provides a comprehensive overview of the situation, examining historical context, economic impacts, and possible resolutions. Ultimately, the future trajectory of this trade war remains uncertain, but the potential for significant economic and political consequences underscores the importance of understanding the complexities of this global issue.