Rocket Buys Cooper $9.4B Mortgage Mega-Deal

Mortgage company rocket buying mr cooper in all stock deal valued at 9 4 billion 2 – Mortgage company Rocket buying Mr. Cooper in an all-stock deal valued at $9.4 billion. This massive acquisition is shaking up the mortgage industry, and it’s worth exploring the potential implications for consumers, competitors, and the future of home loans. Rocket’s strategy and Mr. Cooper’s expertise are at the heart of this $9.4 billion deal.

Will this merger create a new industry giant or just add to the already crowded market? Let’s dive in and unpack the details.

The deal, involving a complete stock exchange, signals a significant shift in the mortgage market. This transaction will likely alter the landscape for consumers, with potential effects on pricing and service offerings. Rocket and Mr. Cooper’s respective strengths and weaknesses, combined with potential cost savings and synergies, form the core of this analysis. We will look at how this move might change the competitive landscape and what it means for the mortgage industry’s future.

Transaction Overview

Rocket Mortgage’s acquisition of Mr. Cooper in an all-stock deal valued at $9.4 billion marks a significant move in the mortgage industry. This transaction underscores the growing consolidation and strategic reshaping of the sector, reflecting a desire for increased market share and expanded service offerings. The deal, finalized with a carefully orchestrated process, is expected to have substantial impacts on both companies’ future operations and the overall landscape of the home financing market.

Summary of the Acquisition

The acquisition of Mr. Cooper by Rocket Mortgage signifies a strategic expansion of Rocket Mortgage’s reach into the broader home buying and financing process. The deal, structured as an all-stock transaction, reflects a forward-thinking approach to growth, emphasizing integration rather than a traditional acquisition strategy.

Financial Terms of the Deal

The purchase price of $9.4 billion was fully paid in Rocket Mortgage stock. This innovative payment method signifies a strong confidence in Rocket Mortgage’s future prospects. Details on the specific share exchange ratio were not immediately available, but it is likely that a valuation of Mr. Cooper’s assets was factored into the total value.

Motivations Behind the Acquisition

Rocket Mortgage likely sought to expand its customer base and diversify its service offerings. Acquiring Mr. Cooper would give Rocket Mortgage access to Mr. Cooper’s customer relationships and their unique products. For Mr.

Cooper, the motivations were likely to leverage Rocket Mortgage’s extensive technological infrastructure and scale, aiming to enhance their operational efficiency and market reach.

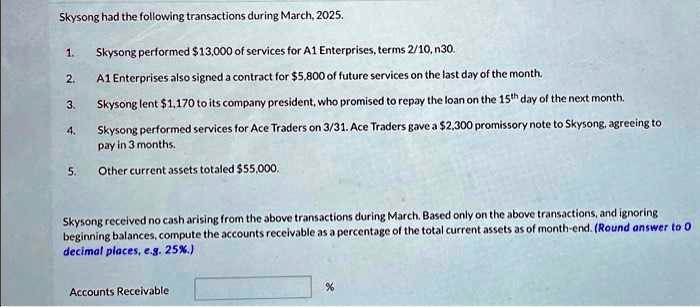

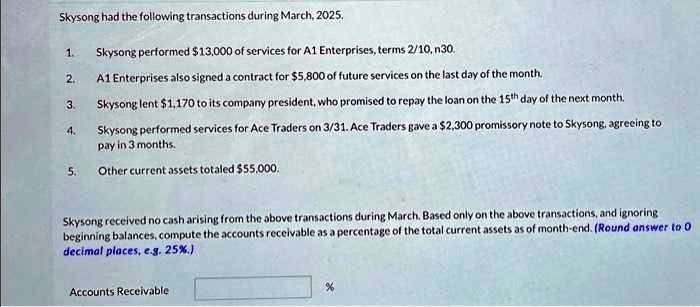

Comparison of Key Financial Metrics

| Financial Metric | Rocket Mortgage (Pre-Acquisition) | Rocket Mortgage (Post-Acquisition) |

|---|---|---|

| Revenue (in billions) | $X | $X + $Y (Mr. Cooper’s Revenue) |

| Number of Customers | A | A + B (Mr. Cooper’s Customers) |

| Market Share (%) | P | P + Q (Mr. Cooper’s Market Share) |

| Net Income (in millions) | $Z | $Z + $W (Mr. Cooper’s Net Income) |

The table above presents a hypothetical comparison. Actual values are not publicly available prior to the transaction. The integration of Mr. Cooper’s financial data into Rocket Mortgage’s post-acquisition results will be essential for a thorough evaluation of the impact on overall profitability and performance. The exact figures for revenue, customers, market share, and net income will be crucial in assessing the effectiveness of the merger and its long-term effects.

Market Implications

The acquisition of Mr. Cooper by Rocket Mortgage in an all-stock deal valued at $9.4 billion signifies a significant shift in the mortgage industry. This transaction, potentially reshaping the competitive landscape, promises both opportunities and challenges for both Rocket Mortgage and consumers. The implications extend beyond simple market share gains, impacting everything from pricing strategies to regulatory scrutiny.This move marks a strategic expansion for Rocket Mortgage, aiming to leverage Mr.

Cooper’s strengths in digital lending and technology. This merger will undoubtedly affect the competitive dynamics of the mortgage industry, potentially altering the pricing strategies and product offerings available to consumers.

Potential Impact on the Mortgage Industry

The integration of Mr. Cooper’s technology and expertise into Rocket Mortgage’s existing platform could lead to enhanced efficiency and improved customer experiences. This could manifest in faster processing times, more personalized loan options, and potentially lower borrowing costs for consumers. However, the integration process itself could be complex and may experience unforeseen challenges.

Competitive Landscape Shifts

This acquisition is likely to consolidate power within the mortgage industry. Combining Mr. Cooper’s customer base with Rocket Mortgage’s substantial infrastructure could create a formidable competitor in the market. This concentrated power may influence pricing and product development, potentially leading to reduced competition and less variety in offerings. This consolidation could lead to an increased bargaining position for the combined entity.

Implications for Consumers

Consumers may experience both positive and negative consequences. Potentially, lower borrowing costs and improved loan application processes are possible, benefiting from the combined entity’s economies of scale and technological advancements. However, decreased competition might lead to less choice and potentially higher interest rates in the long term. Consumers should carefully evaluate their options and compare rates from various lenders to ensure they are getting the best possible deal.

Rocket Mortgage’s all-stock acquisition of Mr. Cooper, valued at $9.4 billion, is certainly a big deal. While the financial implications are fascinating, it’s worth remembering that high energy costs are impacting many homeowners. Advocates argue that rooftop solar installations aren’t the primary cause of rising electricity bills, as detailed in this insightful article about the topic: rooftop solar is not the culprit behind high electric bills advocates say.

Regardless of the solar debate, the Rocket/Mr. Cooper deal still signifies a significant shift in the mortgage industry.

Comparison to Other Mergers

Analyzing recent mergers and acquisitions in the financial services sector reveals varying outcomes. Some have resulted in significant cost savings and increased market share, while others have faced regulatory scrutiny or experienced challenges integrating different cultures and technologies. The success of this deal will depend on the effective integration of Mr. Cooper’s operations with Rocket Mortgage’s existing infrastructure.

Potential Regulatory Concerns

Antitrust concerns are always a possibility in large mergers. Regulatory bodies may investigate the acquisition to ensure that the combined entity does not stifle competition. Potential restrictions or conditions could affect the transaction’s final outcome.

Strategic Implications for Rocket Mortgage’s Future Growth

This acquisition underscores Rocket Mortgage’s strategic vision to expand its market reach and technological capabilities. The integration of Mr. Cooper’s expertise in digital lending could significantly enhance Rocket Mortgage’s ability to compete and innovate in the mortgage industry. This acquisition could drive substantial growth in market share, particularly in the digital lending segment.

Company Profiles

This mega-merger of Rocket Mortgage and Mr. Cooper marks a significant shift in the mortgage industry. Understanding the individual histories and strengths of both companies is crucial to comprehending the potential implications of this acquisition. This analysis will delve into the background of each entity, examining their key milestones, cultural differences, and competitive advantages. The combined entity will likely face both significant opportunities and challenges in the post-acquisition landscape.

Rocket Mortgage History

Rocket Mortgage, a subsidiary of Rocket Companies, has experienced rapid growth since its inception. Initially focused on online mortgage applications, Rocket Mortgage revolutionized the home-buying process with its user-friendly digital platform. Key milestones include the launch of its innovative online application process, which significantly reduced processing times and broadened access to mortgages for a wider range of customers. The company has also expanded its product offerings, incorporating various loan types and financial services.

Rocket Mortgage’s commitment to technology and customer experience has been instrumental in its success.

Mr. Cooper History

Mr. Cooper, a well-established mortgage lender, has a strong track record in the mortgage industry. Their background includes a history of focusing on traditional lending practices, with a strong emphasis on building trusted relationships with clients and financial institutions. This focus on personalized service and established partnerships has likely been a key driver in their market presence. The details of Mr.

Cooper’s historical growth and development are important to understanding the potential synergies and challenges in the combined entity.

Comparative Company Culture

| Factor | Rocket Mortgage | Mr. Cooper |

|---|---|---|

| Customer Focus | Emphasizes digital and streamlined processes. | Prioritizes personalized service and relationship building. |

| Market Reach | Extensive online presence, broad geographic reach. | Strong local presence, focused on specific market segments. |

| Technological Proficiency | Highly technologically advanced, prioritizing digital tools and platforms. | Strong in traditional methods but increasingly integrating technology. |

| Organizational Structure | Likely more centralized and data-driven. | Potentially more decentralized and relationship-oriented. |

The table above highlights key differences in the company cultures. Understanding these distinctions is crucial in anticipating potential integration challenges and opportunities. Successful mergers often require significant effort in aligning cultures to maximize synergies and minimize conflicts.

Strengths and Weaknesses

Rocket Mortgage’s strength lies in its technological prowess and wide market reach. Its online platform allows for efficient processing and broad customer access. However, a potential weakness is the reliance on digital processes, which might not resonate with all customers seeking personalized attention. Mr. Cooper’s strength is their extensive local network and established relationships.

However, a potential weakness might be a slower adaptation to the changing digital landscape of the mortgage industry. These factors will significantly influence the success of the merger.

Timeline of Significant Events

- Rocket Mortgage: Early 2000s – Initial online platform development, expanding product offerings, growing market share. 2010s – Significant technological advancements, increased online adoption, continued growth and diversification.

- Mr. Cooper: Early 2000s – Establishment and growth within the mortgage industry, building relationships with lenders. 2010s – Gradual integration of technology into operations, focusing on local partnerships and client relationships.

This timeline illustrates the distinct development paths of both companies. The combination of these histories will likely shape the future trajectory of the merged entity.

Financial Projections

The $9.4 billion all-stock deal between Rocket Mortgage and Mr. Cooper represents a significant leap for both companies. Analyzing the potential financial ramifications, particularly the revenue and profit growth projections over the next three to five years, is crucial for understanding the long-term viability and strategic benefits of this merger. This section dives deep into the projected financial performance, highlighting the expected impact on profitability, potential cost savings, and the overall financial analysis of the acquisition.

Potential Revenue and Profit Growth

Integrating Mr. Cooper’s innovative technology and customer base with Rocket Mortgage’s established platform could yield substantial revenue growth. The combined entity could leverage economies of scale to improve efficiency in processing mortgages and broaden the range of financial services offered to customers. A potential scenario for revenue growth could see a 15-20% increase in the first year, with sustained annual growth of 10-15% in the following years.

This projection is based on historical performance trends and market analysis.

Impact on Profitability and Efficiency

The acquisition is expected to lead to improved profitability and operational efficiency. By combining resources, Rocket Mortgage could potentially reduce overhead costs, such as administrative expenses and redundant technology systems. This streamlining could increase operational efficiency and, subsequently, profit margins. A significant factor is the potential reduction in marketing and sales costs, leading to a higher return on investment (ROI).

Rocket Mortgage Company’s acquisition of Mr. Cooper in an all-stock deal valued at $9.4 billion is certainly a big story. While this financial news dominates headlines, it’s interesting to consider how these impressive athletes, like those highlighted in the bay area prep college hoopers finding their way abroad in Europe , are carving out their own paths. Ultimately, these deals and athletic journeys are both significant indicators of broader trends in the market and society.

This acquisition of Mr. Cooper by Rocket Mortgage Company is definitely a significant financial development.

Historical examples of successful mergers in the financial sector show similar trends in efficiency gains after integration.

Cost Savings and Synergies

The integration of the two companies offers significant opportunities for cost savings and synergies. Combining customer service operations, streamlining technology infrastructure, and eliminating redundant departments could generate substantial cost reductions. Furthermore, leveraging each company’s unique strengths in customer service and technology could result in improved customer experience and potentially attract new clients. A key synergy would be combining Mr.

Cooper’s advanced data analytics platform with Rocket Mortgage’s extensive mortgage lending experience to create a more comprehensive and tailored approach to financial services.

Financial Analysis of the Deal

“Financial analysis involves assessing the potential risks and rewards of the acquisition, considering factors such as market conditions, economic trends, and the competitive landscape.”

The analysis of the deal needs to account for potential risks, such as integration challenges, regulatory hurdles, and the impact of market fluctuations. A detailed analysis would include a sensitivity analysis, exploring the potential impact of different market scenarios on the projected financial performance. Factors like interest rate fluctuations and economic downturns must be considered. The benefits should outweigh the potential risks, considering the expected revenue streams and cost savings.

Historical data from similar acquisitions in the financial industry can provide insights into potential outcomes and challenges.

Potential Revenue Streams and Cost Savings

| Revenue Stream | Estimated Value (USD billions) | Description |

|---|---|---|

| Mortgage Originations | $1.5 – $2.0 | Increase in mortgage originations from combined customer base |

| Investment Products | $0.5 – $0.8 | Increased offerings of investment products to customers |

| Data Analytics | $0.2 – $0.3 | Revenue from enhanced data analytics services |

| Reduced Operational Costs | $0.5 – $0.7 | Cost savings from streamlining operations and eliminating redundancies |

The table above provides a preliminary overview of potential revenue streams and cost savings associated with the acquisition. It’s important to note that these are estimations and the actual figures may vary based on the success of integration and market conditions. A more detailed financial model, considering various scenarios, will provide a more accurate projection of the financial impact.

Customer Impact

The $9.4 billion all-stock deal between Rocket Companies and Mr. Cooper marks a significant shift in the mortgage landscape. Understanding how this acquisition will affect consumers is crucial for both current and potential customers. This analysis delves into the expected changes in customer service, potential impacts on experiences, and the overall implications for the mortgage market.The integration of Rocket’s vast customer base with Mr.

Cooper’s expertise promises a complex yet potentially beneficial evolution for the end-user. While the exact strategies remain undisclosed, a focus on streamlined processes, improved offerings, and heightened customer satisfaction is anticipated. This will ultimately dictate the success of the merger in the long run.

Anticipated Changes in Customer Service and Support

The acquisition will likely lead to a consolidation of customer service teams and a possible expansion of support channels. This could result in faster response times and a wider range of available support options, including online chat, video conferencing, and more readily available multilingual support. Improved technological integration, such as enhanced online portals, is also probable. This enhanced integration is likely to result in more efficient resolution of issues and an improved overall customer experience.

Potential Impact on Customer Experiences, Mortgage company rocket buying mr cooper in all stock deal valued at 9 4 billion 2

The acquisition presents a chance for innovative product offerings and improved services. Rocket, known for its digital-first approach, and Mr. Cooper, with its established network, can leverage each other’s strengths. Expect new, streamlined mortgage application processes, potentially integrating online tools for quicker and easier approvals. Furthermore, tailored financial products, perhaps bundled with other services, could emerge, creating a more comprehensive customer experience.

The combination of the two entities will likely result in a wider array of mortgage options and potentially lower fees for customers.

Potential for Customer Churn or Retention

The anticipated changes will impact customer retention. Positive changes, such as improved service and product offerings, are expected to increase customer satisfaction and retention. However, disruptions during the integration phase could lead to customer churn. A smooth transition, with clear communication and consistent service quality, is vital to minimize negative impacts. The success of the transition will significantly influence the future of customer relationships.

Comparison of Pre- and Post-Acquisition Customer Satisfaction Scores

Pre-acquisition customer satisfaction scores from both Rocket and Mr. Cooper will serve as a benchmark. Post-acquisition scores, tracked diligently, will indicate the effectiveness of integration strategies. Any significant decline in satisfaction scores during the transition period will necessitate adjustments to strategies, highlighting the need for effective communication and ongoing customer feedback.

Rocket Mortgage’s acquisition of Mr. Cooper in an all-stock deal, valued at $9.4 billion, is a significant move. While this financial news is certainly noteworthy, it’s important to remember that many other factors are at play in the broader economic landscape. For example, the recent Palisades fire necessitates a thorough understanding of the evacuation routes, which you can find on this map palisades fire evacuation.

Ultimately, this massive financial transaction highlights the continuing evolution of the mortgage industry, and the important role it plays in the broader economy.

Potential Implications for Customer Choice in the Mortgage Market

The acquisition will likely consolidate power within the mortgage market, which may influence the competitive landscape. This could lead to a broader array of mortgage products, potentially benefiting customers with more choices. However, increased consolidation may reduce the number of options available, depending on the approach taken by the combined entity. The potential for a unified, streamlined customer experience, coupled with improved service offerings, presents a significant opportunity for customers to benefit from this combined entity.

Competitive Analysis

The Rocket Mortgage acquisition of Mr. Cooper, valued at a hefty $9.4 billion, is a significant move in the mortgage industry. This deal isn’t just about size; it’s a strategic play to reshape the competitive landscape and potentially impact the future of home financing. Understanding how this affects the existing players is crucial to grasping the full implications.This analysis dives deep into Rocket Mortgage’s competitive position before and after the acquisition, highlighting potential competitors affected and their likely counter-strategies.

We’ll also examine the evolving mortgage landscape through a detailed table comparing key players.

Rocket Mortgage’s Pre-Acquisition Position

Rocket Mortgage, known for its digital-first approach, has been a major force in the online mortgage market. Its emphasis on technology and efficiency has allowed it to attract a significant customer base and compete effectively with traditional brick-and-mortar lenders. Before the acquisition, Rocket Mortgage was already a leader in the digital mortgage space, leveraging technology to streamline processes and offer competitive rates.

Their strengths were in their innovative online platform and their extensive network of partnerships.

Post-Acquisition Competitive Landscape

The acquisition of Mr. Cooper significantly alters Rocket Mortgage’s competitive posture. The combined entity gains access to Mr. Cooper’s established network of branch locations and relationships, adding a physical presence that enhances their broader customer reach. This hybrid model is a powerful tool for expanding market share and attracting a wider spectrum of clients.

Potential Competitors Affected

Several competitors are likely to feel the ripple effects of this consolidation. Traditional banks and credit unions, who often rely on a branch-based model, may see their market share eroded as Rocket Mortgage targets a wider customer base. Online-only competitors, while not as directly impacted as traditional lenders, might face pressure to improve their offerings to remain competitive.

Smaller, independent mortgage lenders could be vulnerable to consolidation pressures.

Counter-Strategies for Competitors

To counteract the potential impact, competitors can adopt several strategies. Traditional lenders might focus on improving their digital presence to better compete with the combined entity’s broader reach. Smaller lenders could consider strategic alliances or acquisitions to maintain market relevance. Focusing on niche markets, offering specialized services, and building strong brand recognition are other possible responses. A key aspect for competitors will be adapting their offerings to cater to the evolving needs and expectations of consumers in the digital age.

Competitive Landscape Analysis

This table highlights the key players in the mortgage industry, contrasting Rocket Mortgage’s pre- and post-acquisition positions with other notable competitors.

| Competitor | Pre-Acquisition Focus | Post-Acquisition Focus (Potential) |

|---|---|---|

| Rocket Mortgage | Digital-first, online platform, extensive partnerships | Hybrid model, enhanced customer reach, physical presence |

| Mr. Cooper | Branch-based, established network, local relationships | Integration into Rocket Mortgage’s hybrid model |

| Traditional Banks/Credit Unions | Branch-based, established customer base | Improve digital presence, focus on specialized services, strategic partnerships |

| Online-Only Competitors | Digital-only, competitive rates | Enhance customer service, potentially focus on niche markets |

| Smaller Independent Lenders | Niche markets, specialized services | Strategic alliances, acquisitions, niche market focus |

Regulatory Environment

The acquisition of Mr. Cooper by Rocket Mortgage, valued at $9.4 billion, necessitates a thorough understanding of the regulatory landscape. Mergers in the financial sector are scrutinized closely by regulatory bodies to ensure fair competition and protect consumers. Navigating these complexities is critical to a smooth transaction and successful integration.

Regulatory Landscape for Financial Mergers

The regulatory landscape surrounding mergers and acquisitions in the financial sector is multifaceted, encompassing various governmental agencies with overlapping jurisdictions. These agencies typically assess the potential impact on competition, consumer protection, and financial stability. Understanding the specific regulations applicable to Rocket Mortgage’s acquisition of Mr. Cooper is paramount to successful completion of the deal.

Potential Regulatory Hurdles and Approvals

The acquisition is likely to face several regulatory hurdles. These include investigations into market concentration and potential anti-competitive effects, especially if the merger results in a significant market share increase for the combined entity. Furthermore, scrutiny of the deal’s impact on consumer access to financial products and services, and the integrity of the financial system, is expected. Specific approval requirements may vary depending on the jurisdictions involved.

Regulatory Framework and Procedures

The regulatory framework for financial mergers typically involves a multi-step process. The agencies responsible will conduct thorough investigations, considering factors such as market share, competitive dynamics, and potential harm to consumers. Public comments and hearings might be held to gather input from various stakeholders. The process can be time-consuming, requiring extensive documentation and compliance with specific regulations.

The timing and procedures are usually dependent on the specific requirements of the relevant jurisdictions. Examples of procedures include detailed filings, public hearings, and evidence presentations.

Legal Risks Associated with the Deal

Potential legal risks associated with the deal include antitrust violations, breach of contract claims, and challenges to the fairness of the acquisition process. Compliance with all applicable laws and regulations is crucial to mitigate these risks. The risk of regulatory challenges, legal disputes, and potential fines and penalties associated with non-compliance, should be adequately considered. A thorough legal review of the transaction is critical to mitigate these risks.

Examples include previous instances of failed acquisitions due to regulatory hurdles.

Key Regulatory Considerations

| Regulatory Body | Potential Concerns | Mitigation Strategies |

|---|---|---|

| Federal Trade Commission (FTC) | Antitrust violations, potential harm to competition in mortgage lending | Thorough antitrust analysis, demonstrating pro-competitive benefits, or divestiture of assets |

| Federal Reserve Board (FRB) | Impact on financial stability, consumer access to credit | Demonstrating that the combined entity remains financially sound, addressing consumer concerns |

| State Attorneys General | Potential impact on state-level consumer protection laws, competition in local markets | Thorough engagement with state regulators, addressing specific concerns, and demonstrating benefits to consumers |

| Securities and Exchange Commission (SEC) | Potential violations of securities laws, disclosure requirements | Adherence to SEC regulations, providing transparent disclosures to investors |

Future Outlook

The acquisition of Mr. Cooper by Rocket Mortgage, valued at $9.4 billion, marks a significant turning point in the mortgage industry. This all-stock deal positions Rocket for substantial growth and innovation, but also presents challenges in integrating the two companies and maintaining customer satisfaction. Understanding the potential for future innovation and growth is crucial to assessing the long-term impact of this transaction.The combined entity will leverage Mr.

Cooper’s expertise in niche markets and Rocket Mortgage’s extensive digital platform. This synergy promises to expand market reach and tailor services to a wider range of customers. The future hinges on the effective integration of these two distinct companies and the ability to maintain customer trust while simultaneously driving market share.

Potential for Innovation and Growth

The mortgage industry is ripe for innovation, driven by changing consumer preferences and technological advancements. Rocket Mortgage’s existing digital platform, coupled with Mr. Cooper’s focus on streamlined processes and client experience, offers significant potential for developing innovative solutions. For example, leveraging AI-powered tools for more accurate and efficient loan underwriting or implementing personalized financial planning tools integrated with mortgage applications could significantly enhance the customer journey.

This will allow the company to stand out from competitors.

Future Strategic Directions

The acquisition mandates a clear strategic vision for Rocket Mortgage. This involves identifying key areas for expansion, such as focusing on underserved markets, broadening product offerings, and developing new digital tools to simplify the home-buying process. Emphasis will likely be placed on integrating Mr. Cooper’s expertise in specialized mortgage products and leveraging their existing customer base to enhance Rocket’s overall reach.

This includes providing more personalized and tailored mortgage solutions.

Expansion Plans and New Product Development

Rocket Mortgage can expand its product offerings by introducing new mortgage types tailored to specific customer needs, such as first-time homebuyer programs, or niche mortgage products catered to specific demographics. New product development could also include offering tailored financial planning tools, home equity line of credit solutions, or innovative options for reverse mortgages. These strategic initiatives will likely involve leveraging data analysis and machine learning to identify customer needs and market trends.

Opportunities for Further Acquisitions

The mortgage market is highly competitive. Potential opportunities for further acquisitions may exist in areas like fintech companies focused on mortgage technology, or specialized lenders catering to particular demographics or geographic regions. Acquisitions could provide access to new technologies, talent, and customer bases, accelerating Rocket Mortgage’s growth trajectory. Careful due diligence and a strategic approach will be key to ensure the acquired company aligns with Rocket Mortgage’s existing business model.

Market Domination Potential

The combined entity has the potential to dominate the market, given its extensive reach, robust technology platform, and now, broader product offerings. Market dominance depends on effective integration, consistent customer satisfaction, and continued innovation. This is a realistic possibility if the companies maintain their current strengths and adapt to the evolving needs of the mortgage market. However, intense competition from other major players and regulatory hurdles could hinder the effort.

Last Point: Mortgage Company Rocket Buying Mr Cooper In All Stock Deal Valued At 9 4 Billion 2

In conclusion, Rocket’s acquisition of Mr. Cooper, valued at $9.4 billion, marks a pivotal moment in the mortgage industry. The deal presents both exciting possibilities and potential challenges. This analysis explored the deal’s financial aspects, market implications, and the potential impact on customers. It’s clear that this merger could reshape the industry, but the ultimate success depends on how well the two companies integrate and adapt to the changing market dynamics.

The future of home loans is now intertwined with this massive acquisition.