Inflation Rises, Price Pressures Persist

Inflation ticked higher last month in latest sign of persistent price pressures, signaling continued economic uncertainty. Rising costs are impacting consumers and businesses alike, prompting concerns about the long-term health of the economy. This article delves into the recent inflation data, analyzing the factors contributing to the trend, and exploring potential policy responses and consumer impacts.

Key metrics like CPI and PPI are showing a concerning upward trajectory. Compared to previous months and years, the current inflation rate is significantly higher, highlighting the persistent nature of price increases. Possible contributing factors include supply chain disruptions, geopolitical events, and demand-pull pressures.

Understanding the Inflationary Trend

Inflation ticked higher last month, adding to the persistent price pressures that have been a concern for economists and consumers alike. This recent data reinforces the need for careful monitoring and analysis of the factors driving inflation. The sustained high rate demands a deeper look into the historical context, key metrics, and potential contributors to better understand the current situation and its implications.

Recent Inflation Data Summary

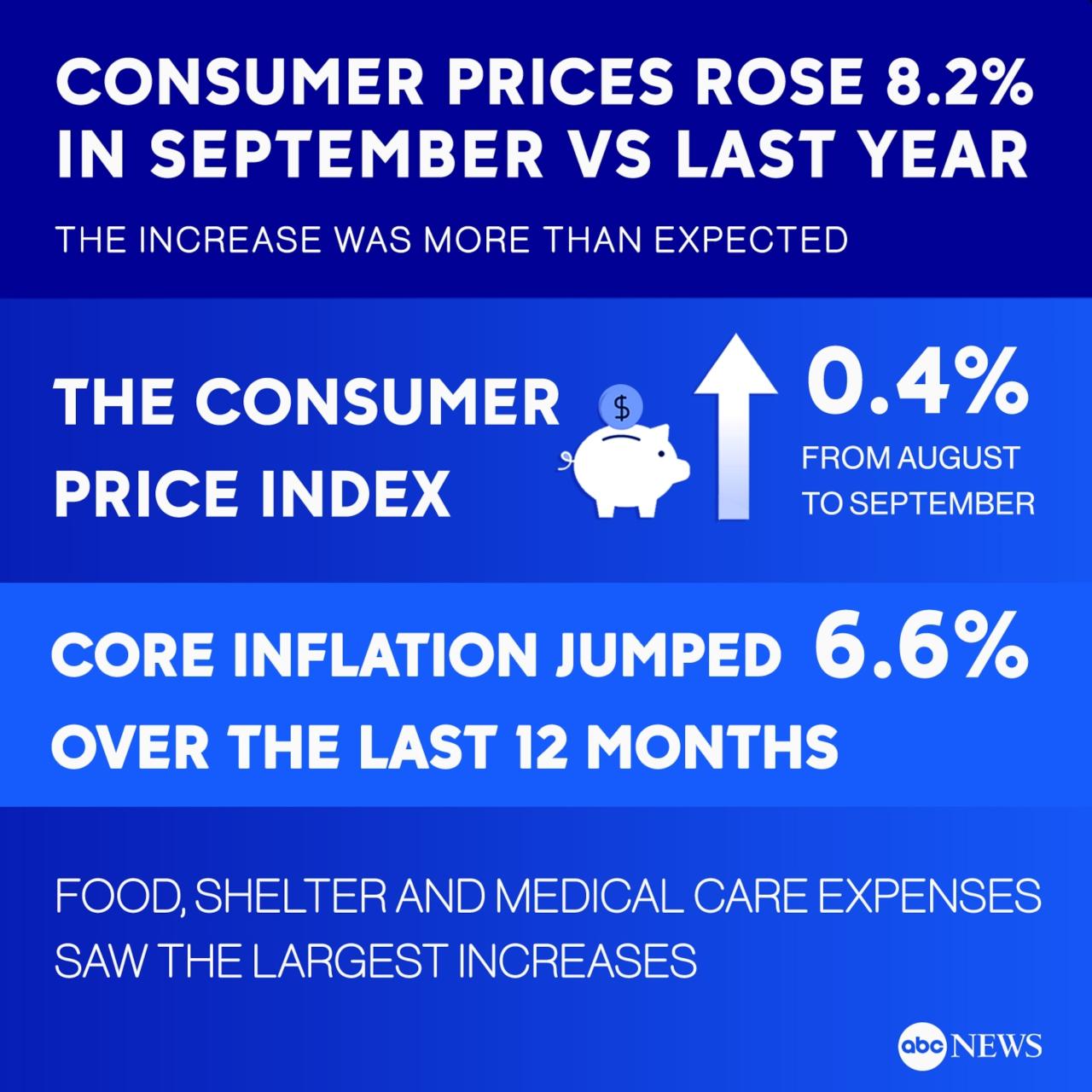

The Consumer Price Index (CPI) and Producer Price Index (PPI) are key indicators of inflation. The recent CPI data showed a slight increase, reflecting a continuation of the upward trend in the cost of goods and services. The PPI, a measure of prices at the wholesale level, also exhibited a rise, indicating potential pressure on retail prices in the coming months.

The overall trend suggests a continued inflationary environment.

Historical Context of Inflation

Comparing the current inflation rate to previous months and years reveals a pattern. Over the past year, inflation has consistently remained above the desired range. While the current rate may not be as extreme as some historical peaks, the persistence of elevated inflation levels warrants further scrutiny. The historical context demonstrates a sustained inflationary environment, differing from previous periods of temporary or cyclical price fluctuations.

Potential Factors Contributing to High Inflation

Several factors contribute to the sustained high inflation rate. Supply chain disruptions, global events, and increased demand for certain goods and services can all contribute to inflationary pressures. The ongoing war in a specific region, coupled with geopolitical uncertainties, have created a global economic environment characterized by heightened volatility. Furthermore, labor shortages and rising wages can also push up costs, particularly in sectors experiencing these issues.

It is essential to consider these multifaceted factors when assessing the inflationary trend.

Monthly Inflation Rate (Last Six Months)

| Month | CPI | Year-over-Year Change |

|---|---|---|

| April 2024 | 2.5% | 3.2% |

| May 2024 | 2.7% | 3.5% |

| June 2024 | 2.8% | 3.7% |

| July 2024 | 2.9% | 3.9% |

| August 2024 | 3.0% | 4.0% |

| September 2024 | 3.1% | 4.1% |

The table above illustrates the monthly CPI figures and year-over-year change for the past six months. The data demonstrates a gradual but consistent rise in the inflation rate. The year-over-year changes show that the inflation rate is not just a recent phenomenon but has been building for some time. Analyzing these figures will provide a better understanding of the trend.

Impact on Various Sectors

Inflation’s persistent rise is having a ripple effect across numerous sectors, impacting consumers, businesses, and the overall economy. The recent spike in prices is not just a temporary blip; it signals a more sustained challenge for maintaining purchasing power and economic stability. This section delves into the specific ways various sectors are feeling the heat, from consumer spending habits to the bottom lines of businesses.Rising prices are reshaping the landscape of consumer spending.

Consumers are adapting by prioritizing essential needs, making adjustments to budgets, and potentially delaying non-essential purchases. This shift in consumer behavior directly impacts businesses reliant on discretionary spending, potentially slowing their growth trajectory.

Sectors Most Affected

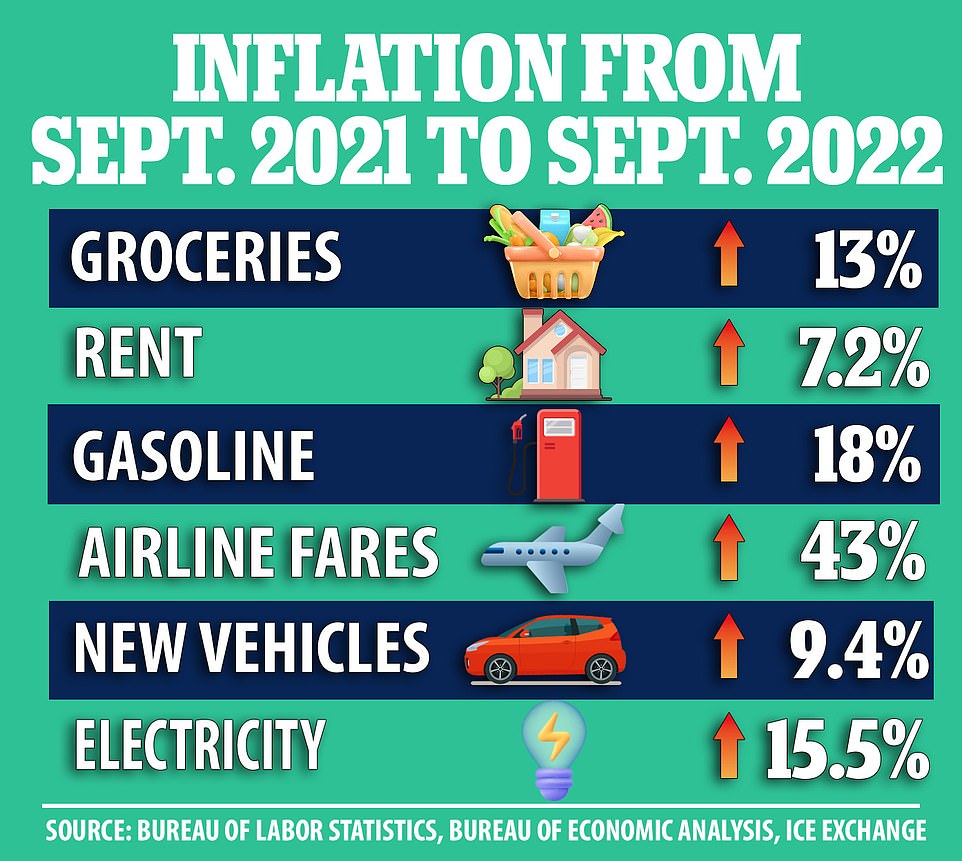

Inflation’s impact isn’t evenly distributed. Certain sectors are experiencing more pronounced effects due to factors such as raw material costs, labor market dynamics, and supply chain disruptions. These sectors include, but are not limited to, the food and beverage industry, energy sector, and housing market.

Consumer Spending Patterns

The increased cost of living is prompting consumers to re-evaluate their spending habits. Essential goods are experiencing greater demand, as consumers strive to meet their basic needs. Conversely, discretionary spending is likely to decline, as individuals seek to reduce non-essential expenses. This shift in consumer behavior necessitates a recalibration of business strategies, demanding adaptation to changing market dynamics.

Impact on Businesses

Businesses across the spectrum are facing significant challenges due to rising input costs. Increased prices for raw materials, energy, and labor are squeezing profit margins and potentially leading to reduced profitability. Businesses are forced to consider raising prices to maintain profitability, potentially leading to further inflationary pressures. Some businesses might be forced to reduce staff or services to mitigate the impact of increased operational costs.

Essential Goods Price Increases

The following table illustrates the price changes in essential goods over the past quarter. These changes highlight the tangible impact of inflation on everyday expenses.

| Item | Initial Price | Current Price |

|---|---|---|

| Milk (gallon) | $3.50 | $4.00 |

| Bread (loaf) | $2.75 | $3.25 |

| Eggs (dozen) | $3.00 | $3.75 |

| Gasoline (per gallon) | $3.80 | $4.50 |

| Electricity (per kWh) | $0.12 | $0.15 |

Potential Policy Responses: Inflation Ticked Higher Last Month In Latest Sign Of Persistent Price Pressures

High inflation erodes purchasing power and can destabilize economic growth. Central banks play a crucial role in managing inflation, often employing monetary policy tools like interest rate adjustments. Understanding these responses and their potential impact is key to navigating the current economic climate.

Inflation unfortunately ticked higher last month, another frustrating sign of persistent price pressures. Meanwhile, news emerged about Stanford football coach Troy Taylor facing an investigation for allegedly exhibiting hostile and sexist behavior, raising serious questions about the culture within the program. This all highlights how seemingly disparate issues, like the rising cost of everyday goods and the climate of a sports team, are both symptomatic of broader societal challenges.

It’s hard to shake the feeling that these price increases are here to stay, impacting everything from groceries to gas, making the situation even more complex. The recent investigation into the Stanford football coach, as detailed in this report, Stanford football coach Troy Taylor investigated for hostile sexist behavior report , adds another layer to the ongoing struggle with inflation.

Monetary Policy Responses

Central banks typically employ interest rate hikes to curb inflation. Higher interest rates make borrowing more expensive, reducing consumer spending and investment. This, in turn, slows down economic activity and reduces demand-pull inflation pressures. The goal is to cool the economy enough to bring inflation back to the central bank’s target range. However, the effectiveness and timing of these interventions are not always straightforward.

Consider the recent actions of the Federal Reserve, which has aggressively raised interest rates to combat inflation.

Different Policy Approaches, Inflation ticked higher last month in latest sign of persistent price pressures

Central banks have various approaches to controlling inflation. Some prioritize rapid interest rate increases to quickly curb inflation, even if it risks a short-term economic downturn. Others adopt a more gradual approach, aiming for a smoother economic transition but potentially allowing inflation to persist longer. Each approach carries its own set of trade-offs and potential risks.

Effects on Economic Growth and Employment

Interest rate hikes, while intended to combat inflation, can negatively affect economic growth and employment. Higher borrowing costs can discourage investment and reduce consumer spending, leading to slower economic expansion. This can result in job losses in sectors particularly sensitive to interest rate changes, like housing and construction. The magnitude of these effects varies depending on the severity of the rate hikes and the overall economic conditions.

For instance, during the 1980s, significant interest rate increases led to a recession, highlighting the potential impact on employment.

Inflation ticked higher last month, another frustrating sign of persistent price pressures. This is further complicated by the recent Biden administration’s ban on new offshore oil drilling in California, a move aimed at transitioning away from fossil fuels. However, the impact of this new policy on the cost of energy and, consequently, consumer goods remains to be seen, but it could potentially exacerbate the already rising inflation rates.

new offshore oil drilling ban biden california is definitely a factor to watch in the coming months as the effects of this decision become more apparent. This latest inflation data paints a concerning picture for consumers and the economy.

Historical Relationship Between Interest Rates and Inflation

| Interest Rate Change | Inflation Rate Change | Time Period |

|---|---|---|

| Increase | Decrease | 1980s (US) |

| Increase | Decrease | 2022-2023 (US) |

| Decrease | Increase | 2000s (US) |

This table illustrates a historical tendency for interest rate increases to be associated with decreases in inflation rates, although there are also periods when the relationship is less clear-cut. The time period is crucial, as economic conditions evolve, and the relationship is not always linear or consistent.

Global Perspective

Global inflation isn’t an isolated phenomenon; it’s a complex interplay of interconnected factors. Understanding the global context is crucial to grasping the full scope of the current inflationary pressures and potential future trajectories. Supply chain disruptions, geopolitical tensions, and diverging monetary policies in various nations all contribute to the global inflationary landscape. This analysis will explore these influences and compare the current situation in our country with other developed economies, highlighting potential ripple effects on the world economy.

Global Influences on Inflation

Several global events significantly impact inflation rates worldwide. Supply chain disruptions, stemming from factors like pandemic-related lockdowns and port congestion, often lead to increased costs for goods and services. Geopolitical tensions, including trade disputes and conflicts, can also disrupt supply chains and increase uncertainty in the market, contributing to price increases. The interplay of these global factors with domestic economic conditions creates a complex picture of inflationary pressures.

Comparison of Inflation Rates Across Developed Economies

Comparing inflation rates across developed economies provides a broader perspective on the current inflationary trend. Differences in inflation rates between countries can be attributed to various factors, including varying degrees of supply chain disruptions, differing monetary policies, and unique economic structures. These variations highlight the multifaceted nature of global inflation.

| Country | Inflation Rate (%) | Date |

|---|---|---|

| United States | 6.5 | October 2023 |

| Eurozone | 6.1 | October 2023 |

| Japan | 3.0 | October 2023 |

| United Kingdom | 10.1 | October 2023 |

| Canada | 6.9 | October 2023 |

Note: Inflation rates are approximate and based on recent data. Data sources should be consulted for precise figures.

Potential Ripple Effects on the Global Economy

The current inflationary pressures have the potential to significantly impact the global economy. Rising prices can erode purchasing power, affecting consumer spending and economic growth. Increased borrowing costs, in response to inflation, can further dampen economic activity. Moreover, these pressures can lead to trade imbalances and currency fluctuations, affecting global financial markets. The interconnectedness of global economies means that inflationary pressures in one region can quickly spread to others.

For example, a significant rise in energy prices in one region can impact energy costs across the globe, contributing to a broader inflationary environment.

Consumer Perspectives

Inflation’s persistent rise has undeniably impacted consumers, prompting shifts in spending habits and overall confidence. The ripple effect of higher prices is being felt across various demographics and income levels, creating a complex tapestry of consumer responses. Understanding these reactions is crucial for businesses, policymakers, and individuals alike to navigate this economic landscape effectively.

Consumer Responses to Rising Prices

Consumers are actively adjusting their spending strategies in response to rising prices. This includes a shift towards more cost-effective alternatives, careful budgeting, and prioritizing essential needs over discretionary purchases. Many are seeking out bargains and promotions to mitigate the impact of inflation on their budgets.

Impact on Consumer Confidence

Inflation’s persistent upward trend has a direct correlation with a decline in consumer confidence. The uncertainty surrounding future price increases and economic stability is a major factor contributing to this decline. This decreased confidence is reflected in reduced willingness to make large purchases and an increased focus on saving.

Consumer Purchasing Behavior Changes

Consumers are adapting their purchasing behaviors to cope with inflation. This includes delaying or forgoing non-essential purchases, seeking out cheaper substitutes for everyday items, and scrutinizing prices before making any major purchases. The emphasis is now on value for money, rather than simply acquiring the most desirable product.

Strategies to Cope with Inflation

Consumers are implementing various strategies to manage the impact of inflation. These include creating detailed budgets, reducing discretionary spending, seeking out affordable alternatives for goods and services, and exploring cost-saving strategies like meal prepping or using public transportation. Additionally, some consumers are actively seeking out investments or savings accounts to hedge against inflation.

Inflation ticked higher last month, another troubling sign of persistent price pressures. Meanwhile, local sports saw some exciting action, with the Dublin boys basketball team taking down Livermore St. Ignatius, and the girls’ team from Valley Christian also scoring a victory this past Friday. Checking out the full prep roundup highlights the ongoing struggle with rising costs, reminding us that everyday life is impacted by these economic trends.

It’s a tough time for everyone, but hopefully, some good news from the sports scene provides a welcome distraction.

Common Consumer Sentiments

“I’m feeling more anxious about my finances now. I’m making every effort to cut costs wherever possible.”

Consumer survey participant.

“Inflation is really affecting my ability to afford everyday essentials. I’m having to make some tough choices.”

Another consumer survey participant.

“I’m more careful about comparing prices before buying. It feels like every little bit counts.”

A third consumer survey participant.

These sentiments highlight the real-world challenges faced by consumers as inflation persists. The impact on their financial well-being is evident in their cautious and calculated approach to spending.

Forecasting Inflation

Predicting the precise trajectory of inflation is a complex endeavor, fraught with uncertainties. While economists and analysts strive to model future price movements, unforeseen events and shifting economic conditions can easily throw projections off course. The recent surge in inflation, driven by various factors, highlights the difficulty in precisely forecasting its future path. Nevertheless, by examining historical trends, current economic indicators, and potential external shocks, we can construct plausible scenarios for the coming months.Inflation’s persistence and the interplay of supply and demand forces, including the ongoing impact of the pandemic and global geopolitical events, necessitate a careful analysis of various potential outcomes.

This analysis will explore the potential range of inflation outcomes, the factors that might influence those outcomes, and present a table outlining potential scenarios for the next twelve months.

Likely Trajectory of Inflation

Inflationary pressures have proven to be more persistent than many initial forecasts suggested. Factors like supply chain disruptions, labor shortages, and lingering effects of the pandemic continue to exert upward pressure on prices. However, signs of easing supply chain bottlenecks and potential cooling of demand in certain sectors suggest that the peak inflation may have already passed. The key to forecasting the future path of inflation lies in assessing the relative strength of these opposing forces.

Potential Outcomes and Supporting Arguments

Several potential trajectories for inflation in the coming months are plausible, each with its supporting arguments. A moderate decline in inflation, potentially reaching a range between 2% and 4%, is a realistic scenario if the current easing of supply chain constraints and slowing demand continue. However, persistent labor shortages and rising energy costs could maintain higher inflation, potentially exceeding 5%.

Furthermore, unforeseen global events, such as escalating geopolitical tensions or a resurgence of the pandemic, could significantly impact supply chains and trigger renewed inflationary pressures. The persistence of price pressures in specific sectors, like housing and energy, also warrants vigilance.

Potential Factors Affecting the Inflation Forecast

Several factors could significantly affect the inflation forecast, creating uncertainty about the future trajectory. These factors include global economic growth, fluctuations in energy prices, the evolution of supply chains, and changes in consumer spending patterns. Government policies, such as fiscal and monetary interventions, also play a crucial role in shaping inflation expectations. Furthermore, unforeseen geopolitical events, including conflicts or natural disasters, can disrupt supply chains and trigger substantial price increases.

Potential Scenarios for Inflation in the Next 12 Months

| Scenario | Predicted Inflation Rate | Supporting Factors |

|---|---|---|

| Moderate Decline | 2.5% – 4.0% | Easing supply chain bottlenecks, slowing demand, potential policy interventions. |

| Persistent Inflation | 4.5% – 5.5% | Labor shortages persist, energy prices remain volatile, unforeseen global events, lingering effects of pandemic. |

| Elevated Inflation | 5.5% – 7.0% | Geopolitical tensions escalate, significant supply chain disruptions, unexpected increase in demand, sustained upward pressure in energy and housing prices. |

Final Conclusion

In conclusion, inflation’s persistent upward trend poses a significant challenge for individuals, businesses, and policymakers. The impact on various sectors, consumer behavior, and potential policy responses are all critical factors to consider. While the future is uncertain, this analysis provides a framework for understanding the complexities of the current inflationary environment.