Wealthiest Silicon Valley Households A Deep Dive

Wealthiest Silicon Valley households sets the stage for this enthralling narrative, offering readers a glimpse into the extravagant lives and immense wealth of the tech elite. From venture capital triumphs to sprawling estates, this deep dive explores the factors contributing to their astronomical fortunes and the impact on the broader Silicon Valley landscape.

This exploration delves into the sources of their wealth, from pioneering venture capital investments to substantial stock holdings and lucrative real estate portfolios. We’ll examine the lifestyles of these families, revealing the luxury goods and philanthropic endeavors that shape their spending habits. The analysis will also uncover the intricate social and cultural implications of this extreme wealth concentration within Silicon Valley, comparing them to other wealthy groups worldwide.

Wealthiest Silicon Valley Households

The wealthiest households in Silicon Valley represent a unique and influential demographic within the broader tech industry. Their immense wealth, often derived from entrepreneurial ventures and successful investments, significantly impacts the regional and national economy. Their influence extends beyond financial contributions, shaping innovation, philanthropy, and even political discourse. Understanding their characteristics and the factors driving their success provides valuable insights into the dynamics of the modern tech landscape.

Key Characteristics of the Wealthiest Silicon Valley Households

This group of ultra-high-net-worth individuals exhibit a distinctive set of characteristics that differentiate them from other affluent populations. Their financial success is often intertwined with significant investments in startups, venture capital, and other high-growth industries.

- Significant Entrepreneurial Ventures: Many of these households originate from founding or investing in successful tech companies. This includes early-stage investments that yielded exponential returns as the companies scaled and went public. For example, early investors in companies like Google, Amazon, and Facebook have accumulated massive wealth through equity gains.

- Strategic Investments in High-Growth Sectors: The pursuit of high-growth investments is a common thread. Their portfolios frequently include venture capital, private equity, and real estate, capitalizing on promising market trends and future growth potential. For instance, investments in renewable energy and biotechnology startups reflect a proactive approach to long-term opportunities.

- Sophisticated Financial Management: These households typically employ specialized financial advisors and asset managers to optimize wealth management strategies. They have access to advanced investment tools and strategies that maximize returns and minimize risks.

- Philanthropic Activities: A notable characteristic is a strong commitment to philanthropic causes. Their charitable donations often support educational initiatives, scientific research, and environmental conservation, impacting the communities they reside in and beyond.

- Global Network of Connections: Strong international business relationships and global investment strategies are frequently employed. This is facilitated by a vast network of contacts, both domestically and internationally, fostering opportunities for expansion and diversification of their investments.

Factors Contributing to Immense Wealth

Several factors contribute to the accumulation of immense wealth among these households. Understanding these factors provides insights into the unique dynamics of wealth creation in the tech industry.

- Early-Stage Investments: The ability to recognize promising startups and invest in them at early stages often results in exponential returns as these companies achieve market success. This strategy is frequently employed by individuals with significant financial resources and deep industry expertise.

- Risk Tolerance and Strategic Decisions: A willingness to take calculated risks, coupled with strategic decision-making, is vital. This often involves making substantial investments in potentially disruptive technologies or ventures with significant market potential.

- Long-Term Vision: A long-term vision, often spanning decades, is a key element in wealth accumulation. This encompasses an understanding of industry trends and a commitment to long-term investments, as opposed to short-term gains.

- Technological Expertise: Many of these individuals possess a deep understanding of technology and the potential of new innovations. This knowledge allows them to identify opportunities and make well-informed investment decisions.

- Access to Capital and Resources: Access to significant capital and resources allows for diversification and investment across various sectors and geographies. This often involves leveraging relationships and networks to gain access to capital.

Significance in the Broader Tech Industry

The presence of these wealthy households significantly influences the broader tech industry. Their investments, entrepreneurial endeavors, and philanthropic activities have a wide-ranging impact on innovation and societal progress.

- Driving Innovation: Their investment in startups often fuels innovation, pushing the boundaries of technology and driving economic growth. This investment in new technologies leads to advancements in various fields.

- Creating Employment Opportunities: The creation of new companies and businesses associated with these households creates job opportunities in the tech sector and beyond.

- Shaping Future Trends: Their involvement often influences the direction of technological advancements and future trends.

Sources of Wealth

Silicon Valley’s wealthiest households have accumulated their fortunes through a complex interplay of factors. These fortunes aren’t solely the result of luck, but are built upon strategic investments, calculated risks, and sometimes, even serendipitous opportunities. Understanding the diverse sources of wealth sheds light on the intricate paths taken by these individuals and families to achieve such extraordinary financial success.

Venture Capital Investments

Venture capital (VC) investments have played a pivotal role in shaping the fortunes of many Silicon Valley families. Early-stage investments in promising startups often yield substantial returns if those ventures achieve significant growth and profitability. Founders, in particular, often leverage their expertise and network to secure VC funding and, subsequently, significant capital gains. Early adoption of innovative technologies, coupled with meticulous market analysis and execution, are critical to success.

Stock Holdings

Publicly traded stock holdings are another crucial component of wealth accumulation. Companies founded by Silicon Valley families frequently become major players in their respective industries, and the corresponding stock appreciation can be immense. Holding shares of these companies, coupled with strategic investment decisions, allows for substantial returns over time. Further, diversification into other successful tech companies can also increase the overall value of their portfolio.

Real Estate Holdings

Real estate plays a substantial role in wealth accumulation, often serving as a safe haven for investment and a source of passive income. The high demand for premium housing in desirable Silicon Valley locations can translate into significant capital appreciation over time. Families with established financial foundations can often capitalize on this, leveraging their resources to acquire prime properties.

The relative importance of real estate holdings can differ significantly between families, depending on their individual strategies and investment priorities.

Roles of Founders, Employees, and Family Members

The interplay between founders, employees, and family members is essential in the accumulation of wealth. Founders often have a direct stake in their company’s success, earning significant returns through stock options and company equity. Employees with key roles in the growth of a company, and with long-term commitment, may also accrue substantial wealth through stock options and performance-based incentives. Family members, particularly in later generations, may benefit from inheritance and established business structures, often taking on roles in management or expansion.

Relative Importance of Each Source

The relative importance of each source of wealth varies significantly among different families. Some families may have a strong focus on venture capital investments, reflecting their entrepreneurial roots. Others may prioritize stock holdings, capitalizing on the growth of publicly traded companies. Still others may have concentrated their wealth in real estate, leveraging the high demand and appreciation in desirable locations.

Comparison of Wealth Sources, Wealthiest silicon valley households

| Family | Venture Capital | Stock Holdings | Real Estate |

|---|---|---|---|

| Example Family 1 | High | Medium | Low |

| Example Family 2 | Medium | High | Medium |

| Example Family 3 | Low | Medium | High |

This table provides a simplified illustration. Real-world scenarios are far more complex, involving a combination of these factors and nuanced investment strategies tailored to each family’s unique circumstances.

Lifestyle and Spending Habits

Silicon Valley’s wealthiest households exhibit a distinctive lifestyle, characterized by extravagant spending habits and a profound impact on various sectors. Their choices often reflect a desire for exclusivity and innovation, influencing the market for luxury goods and services. These habits, while seemingly lavish, are often intertwined with philanthropic endeavors and strategic investments.The spending patterns of these high-net-worth individuals are frequently driven by a pursuit of experiences and a focus on enhancing their quality of life.

This includes investments in cutting-edge technology, personal well-being, and support for causes they deem important.

Extravagant Homes and Estates

The most visible manifestation of this lifestyle is often found in their real estate holdings. Mega-mansions, sprawling estates, and exclusive vacation homes are common. These properties often incorporate state-of-the-art amenities, including custom-designed kitchens, high-tech entertainment systems, and private gardens. Security measures are also paramount, reflecting the need for privacy and protection.

Luxury Transportation

Private jets and helicopters are frequently employed for travel, enabling seamless access to various destinations. High-end automobiles, often featuring custom features and unique designs, are another hallmark of this lifestyle. The acquisition of these luxury vehicles is frequently driven by a desire for exclusivity and the unique experience they provide.

Luxury Goods and Experiences

Beyond homes and transportation, the spending habits of these individuals extend to a wide range of luxury goods. This includes designer clothing, high-end jewelry, and bespoke furniture. Rare and limited-edition items are often sought after, highlighting the desire for exclusivity and status. Furthermore, experiences, such as private concerts, exclusive sporting events, and curated travel adventures, are also significant components of their spending patterns.

Philanthropic Activities

A notable pattern is the integration of philanthropy into their lifestyle. Contributions to educational institutions, healthcare facilities, and the arts are common. These investments frequently reflect the values and interests of the individuals involved, demonstrating a commitment to societal betterment. The philanthropic activities often align with specific causes, emphasizing areas of expertise or personal interest.

Investments in Education, Healthcare, and the Arts

These investments often involve direct contributions to educational institutions, providing scholarships, establishing endowments, or supporting specific programs. In healthcare, funding may go towards research initiatives, medical facilities, or charitable organizations focusing on health and well-being. Support for the arts frequently takes the form of funding for museums, cultural institutions, and artistic endeavors. These activities often create long-term impact, shaping the future of various sectors.

Table of Common Luxury Items

| Category | Examples |

|---|---|

| Real Estate | Mega-mansions, estates, vacation homes, beachfront properties, historic estates |

| Transportation | Private jets, helicopters, luxury cars (e.g., Rolls-Royce, Bentley, Bugatti), custom-designed vehicles |

| Fashion & Accessories | Designer clothing, high-end jewelry, bespoke watches, luxury handbags |

| Arts & Experiences | Private concerts, exclusive sporting events, curated travel adventures, rare art collections, bespoke furniture |

Impact on Silicon Valley: Wealthiest Silicon Valley Households

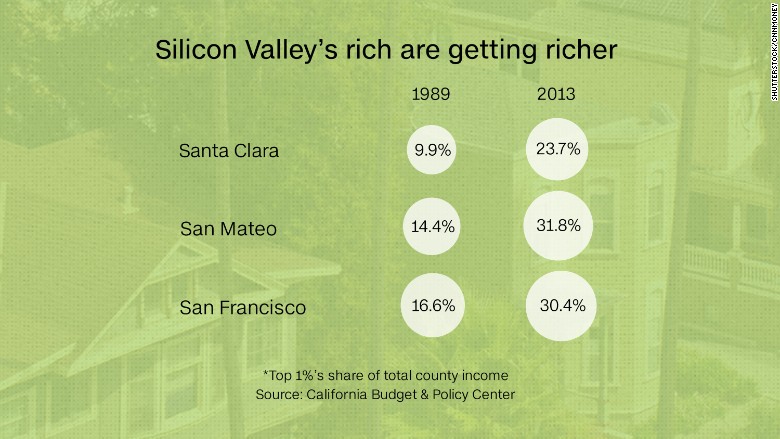

The concentration of wealth in the hands of a few Silicon Valley households raises complex questions about its impact on the region. This influence extends far beyond individual fortunes, shaping the local economy, communities, and even the very fabric of life in the area. The effects are multifaceted, encompassing job creation, housing dynamics, community resources, and philanthropic endeavors.This concentrated wealth, while potentially driving innovation and economic growth, also presents challenges related to equitable distribution of resources and opportunities.

Silicon Valley’s wealthiest households often manage substantial digital assets. Navigating the complexities of cryptocurrency requires secure storage solutions, and choosing the best non custodial wallets best non custodial wallets is crucial for safeguarding those holdings. Ultimately, these high-net-worth individuals are at the forefront of innovative financial strategies, constantly pushing the boundaries of wealth management.

Understanding these effects is crucial for evaluating the long-term consequences of this unique economic phenomenon.

Influence on the Local Economy

The presence of extremely wealthy households significantly influences the local economy, primarily through investment and job creation. Their substantial capital often flows into local businesses, providing crucial funding for startups, established companies, and infrastructure projects. This can stimulate job growth and economic activity, particularly in sectors like technology, real estate, and high-end services. However, the specific impact varies based on the investment strategies and priorities of these individuals.

- Investment in local businesses: Wealthy individuals often establish venture capital firms or invest directly in local startups and businesses, providing crucial funding for growth and expansion. This can lead to job creation, increased revenue, and economic prosperity for the community. Examples include investments in renewable energy, biotech, or AI startups.

- Job creation in supporting industries: The demand for high-end services, such as personal assistants, security, and luxury goods, also creates jobs in related industries. This often translates into the creation of specialized jobs in sectors like design, architecture, and concierge services.

Effect on the Housing Market

The presence of extremely wealthy households often has a profound impact on the housing market. Their high demand for luxury homes drives up property values in certain neighborhoods, creating a disparity in housing affordability for other residents. This can lead to gentrification, where lower-income residents are displaced by rising property values. It also often leads to a significant demand for luxury amenities, influencing the development of premium residential areas.

- Increased property values: The demand for high-end properties from wealthy households directly impacts the market. As these individuals purchase luxury homes, the price of comparable properties in the area increases, making homeownership more expensive for the average resident.

- Strain on housing affordability: The significant increase in property values can put a strain on the affordability of housing for many residents. This disparity can create social and economic challenges for lower-income individuals and families.

Impact on Local Communities

The influx of wealth into specific neighborhoods can significantly alter the social and economic landscape. This can manifest in improvements to infrastructure, parks, and public spaces. However, there can also be challenges associated with maintaining community character and access to resources for all residents. The presence of wealthier households can influence the availability and quality of amenities and services within a community.

- Improved community amenities: The investment by wealthy households can contribute to the improvement of community amenities such as parks, schools, and public spaces. This often leads to increased quality of life for all residents.

- Challenges to community character: The influx of wealth can sometimes lead to gentrification and a change in the community’s character, potentially displacing long-term residents and altering the social fabric of the area.

Impact on Local Charities and Philanthropic Organizations

The significant wealth in Silicon Valley often translates into substantial philanthropic contributions to local charities and philanthropic organizations. This can support vital community programs, such as education, healthcare, and arts initiatives. However, the distribution of these contributions and their impact on specific communities need to be carefully evaluated.

- Increased funding for local charities: Wealthy donors often provide substantial support to local charities, supporting initiatives that address critical needs within the community.

- Uneven distribution of funding: The distribution of these funds might not always be equitable, potentially leading to disparities in access to resources for different communities.

Social and Cultural Implications

The concentration of extreme wealth in Silicon Valley has profound social and cultural implications, shaping perceptions of success, opportunity, and the very fabric of the region. This disparity creates a complex interplay between the lifestyles of the ultra-wealthy and the experiences of the broader community. The resulting tension can manifest in various ways, impacting everything from public policy to social interactions.The presence of such significant wealth inevitably fuels discussions about fairness, opportunity, and the role of government in addressing inequality.

The narrative surrounding these individuals, whether perceived positively or negatively, often influences the public’s understanding of the tech industry and its impact on society as a whole. Understanding these dynamics is crucial for comprehending the evolving social landscape of Silicon Valley.

Perceptions and Reactions of the Public

Public perception of Silicon Valley’s ultra-wealthy is multifaceted. Some view these individuals as innovators and job creators, contributing significantly to technological advancement. Others harbor resentment or skepticism, feeling that their success has come at the expense of others or through practices perceived as unethical. These perceptions are often shaped by factors like media portrayals, personal experiences, and broader societal anxieties about economic inequality.

Comparison with Other Wealthy Groups

The wealth concentration in Silicon Valley differs from other wealthy regions in several ways. The rapid pace of technological advancement and the emphasis on entrepreneurialism contribute to a unique ethos surrounding wealth accumulation in the Valley. This contrasts with, for example, wealthy families rooted in traditional industries or inherited fortunes in other parts of the country. Comparing these groups reveals different historical trajectories and societal implications.

Silicon Valley’s wealthiest households often have impressive tech setups. Managing their massive media libraries requires a robust solution, and a top-tier Linux media server, like the ones reviewed in best linux media server software , is likely part of their sophisticated home entertainment systems. This highlights the importance of powerful tech for these elite households.

The rapid rise and fall of fortunes in the tech world also stands in contrast to more stable, generational wealth in other sectors.

Historical Perspective on Wealth Concentration

Wealth concentration is a historical phenomenon, with societal consequences varying across eras. Throughout history, periods of significant wealth accumulation have been followed by social and political upheaval, highlighting the tension between economic growth and social equity. The Industrial Revolution, for instance, witnessed the emergence of industrialists and the widening gap between the wealthy and the working class. These historical parallels offer valuable context for understanding the potential ramifications of the current concentration of wealth in Silicon Valley.

Impact on Public Services and Infrastructure

The extreme wealth of some Silicon Valley households can significantly impact public services and infrastructure. The demand for high-quality schools, healthcare, and other public amenities can strain existing resources. The sheer scale of wealth can potentially influence political decisions and policy priorities, raising questions about the equitable distribution of resources and the needs of the wider community. A possible example of this would be increased pressure on local governments to prioritize projects that benefit affluent residents.

Social Mobility and Opportunity

The concentration of wealth can also affect social mobility and opportunities for future generations. The availability of high-quality education, networking opportunities, and access to capital can be significantly skewed towards the children of the wealthy. This creates a potential barrier for those from less privileged backgrounds, hindering upward mobility and perpetuating existing inequalities. This disparity is particularly pronounced in Silicon Valley, where high housing costs and competition for limited resources further compound the issue.

Cultural Impact on the Community

The presence of extremely wealthy individuals can influence the cultural landscape of Silicon Valley. The demand for luxury goods, exclusive experiences, and highly specialized services can shape the local economy and the available offerings. This can also influence the overall lifestyle and values of the community, creating a dichotomy between the lives of the ultra-wealthy and the rest of the population.

Comparison to Other Wealthy Groups

Silicon Valley’s tech-driven wealth often garners attention, but it’s essential to understand how it stacks up against other global powerhouses of wealth. This comparison reveals both similarities and stark differences, shedding light on the unique characteristics of this particular economic phenomenon. The origins and growth patterns of wealth often vary dramatically based on the industry and historical context.Examining the characteristics of wealth accumulation in other regions and sectors provides valuable context.

Different historical periods and economic structures have influenced the accumulation of wealth in various parts of the world, and the specific industries that drive wealth creation are crucial to understanding the dynamics. This comparative analysis helps illuminate the unique characteristics of Silicon Valley’s wealth and its implications.

Comparing Wealth Origins and Growth

The origins of wealth often differ significantly between Silicon Valley tech entrepreneurs and other wealthy groups. While Silicon Valley fortunes are frequently tied to innovative technologies and disruptive business models, other wealthy groups may derive their wealth from established industries, inherited assets, or traditional financial investments.

- Family Businesses: Many wealthy families around the world have built fortunes over generations through family-owned businesses. These businesses often have deep roots in their respective communities, and their wealth is often tied to the long-term success and continuity of the family enterprise. Examples include prominent families in the agricultural sector, real estate, or manufacturing.

- Real Estate Moguls: Across the globe, individuals and families have amassed considerable wealth through real estate investment and development. This often involves strategic acquisitions, urban planning, and long-term holding of properties. The success of these strategies is tied to market trends, local economic growth, and government policies.

- Oil and Mining: In many parts of the world, significant fortunes have been generated from oil and mining operations. The volatility of these sectors, coupled with the scarcity and strategic importance of the resources, often results in the creation of substantial wealth. A notable example is the historical development of oil-rich nations.

Strategies for Wealth Accumulation

Different strategies are employed by various wealthy groups to amass and manage their wealth. While Silicon Valley entrepreneurs often focus on scaling startups and disruptive technologies, other groups use different approaches.

Silicon Valley’s wealthiest households are often in the spotlight, but their impact extends beyond their impressive bank accounts. Their investments and consumption habits, while significant, are intertwined with the urgent need for a greener future. For instance, the push for climate-clean American ports, like the initiatives detailed in climate clean american ports , will inevitably affect the bottom lines of these tech giants, and ultimately, the lifestyles of the wealthiest households in the area.

Ultimately, these influential individuals are key players in shaping a sustainable future for the region.

- Value Investing: Investors focused on value investing often seek undervalued assets and companies, hoping to profit from the perceived underestimation of their intrinsic worth. This strategy is prevalent in traditional financial markets.

- Capital Markets and Financial Instruments: Many wealthy individuals utilize sophisticated financial instruments and leverage the capital markets to grow their wealth. This often involves complex investment strategies and access to specialized financial expertise.

- Private Equity and Venture Capital: Venture capital and private equity firms play a significant role in wealth accumulation by providing capital to businesses and companies, often at high risk but with the potential for substantial returns. This is a common approach in the realm of technology and innovation.

Unique Characteristics of Silicon Valley Wealth

Silicon Valley’s wealth, while exhibiting similarities with other wealthy groups, possesses unique characteristics. The rapid pace of technological advancement, the emphasis on innovation, and the often-short lifespan of some of the companies that drive this wealth are distinguishing features.

- Disruptive Innovation: Silicon Valley wealth is often associated with disruptive technologies that fundamentally alter industries and consumer behavior. This rapid innovation leads to rapid wealth creation and significant market shifts, a distinct characteristic compared to wealth generated from traditional industries.

- Global Reach: The influence of Silicon Valley companies extends across the globe, impacting markets and economies worldwide. This global reach contributes to the scale and influence of the wealth generated within the region.

- Emphasis on Human Capital: The development and retention of talented individuals are crucial to the success of Silicon Valley companies. This focus on human capital is a significant factor in the region’s ability to create and maintain wealth.

Trends and Future Projections

The future of wealth accumulation in Silicon Valley’s tech elite is complex and multifaceted, shaped by evolving technological landscapes and societal shifts. Predicting precise outcomes is challenging, but understanding emerging trends and potential scenarios is crucial for appreciating the dynamic nature of this wealth. Factors like regulatory changes, economic fluctuations, and the ever-accelerating pace of innovation all play a significant role in shaping the future of these fortunes.The current tech boom is fostering a rapid increase in the concentration of wealth, driven by the high valuations of innovative companies.

However, this concentration is not immune to external pressures. Factors like increasing scrutiny of tech monopolies, potential regulatory changes, and the broader economic climate could influence the trajectory of these fortunes. The next decade will be critical in determining how these factors interplay and shape the future of wealth distribution in the region.

Emerging Trends in Wealth Accumulation

Several trends are reshaping how wealth is accumulated in the Silicon Valley tech sector. These include the rise of venture capital-backed startups, the increasing importance of intellectual property, and the growth of the private equity sector within the tech industry. The diversification of investment strategies is also notable, with entrepreneurs and executives increasingly investing in real estate, alternative assets, and philanthropic endeavors.

Future of Wealth Distribution

Predicting the future of wealth distribution is inherently uncertain, but some projections suggest a continued concentration of wealth in the hands of a select few, driven by factors like the exponential growth potential of technology companies. However, the rise of entrepreneurship and the emergence of new companies with innovative ideas could lead to a more dispersed distribution of wealth.

The impact of potential regulatory changes and economic downturns on these projections is significant. The ongoing trend of consolidation within the tech industry, with large companies acquiring smaller ones, might lead to a concentration of wealth within these dominant players.

Challenges and Opportunities

The wealthiest Silicon Valley households face both significant challenges and substantial opportunities. Challenges include the ever-increasing scrutiny of the tech industry, regulatory pressures, and potential economic downturns. Opportunities arise from investments in emerging technologies, the potential for further entrepreneurial endeavors, and the development of innovative products and services.

Impact of Technological Advancements

Technological advancements are fundamentally reshaping the landscape of wealth accumulation. Artificial intelligence, machine learning, and blockchain technologies are creating new avenues for investment and generating substantial wealth for those who understand and capitalize on these opportunities. The rapid pace of technological change necessitates a proactive approach to adaptation and investment in new technologies for these wealthy households. For instance, the increasing use of AI and automation in various sectors has the potential to increase productivity and generate wealth, though it also poses potential challenges in terms of job displacement and economic inequality.

This necessitates a strategic approach to adapting to these changes and exploring new investment avenues.

Wealth and Philanthropy

The philanthropic activities of the wealthiest Silicon Valley households are becoming increasingly important. Their involvement in charitable causes, supporting education, healthcare, and environmental initiatives is often significant. This engagement is both a reflection of their wealth and a means of contributing to society. For example, large-scale donations to research institutions, university endowments, and social programs demonstrate the profound impact these households can have on the region and beyond.

Conclusion

In conclusion, the wealthiest Silicon Valley households represent a fascinating case study in modern wealth accumulation. Their influence on the local economy, from job creation to property value surges, is undeniable. This exploration unveils the complex interplay of innovation, investment, and lifestyle that defines this elite group, leaving us pondering the long-term implications of their presence on the tech industry and broader society.