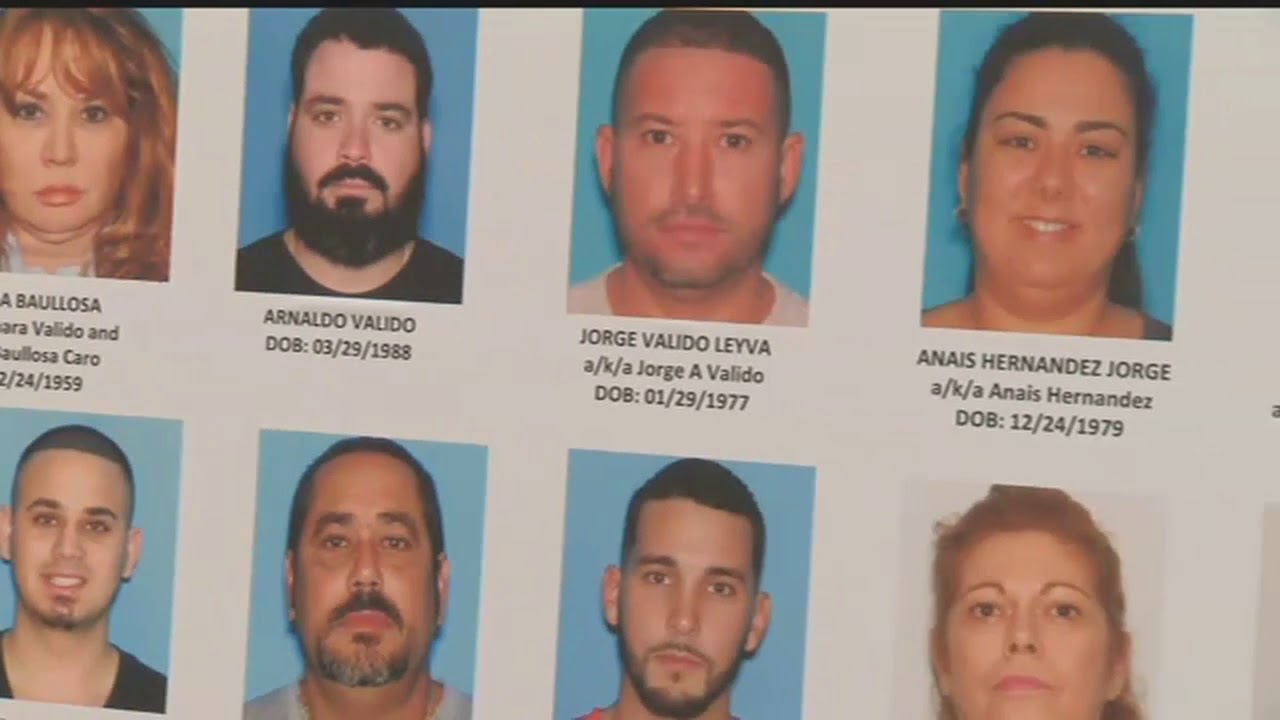

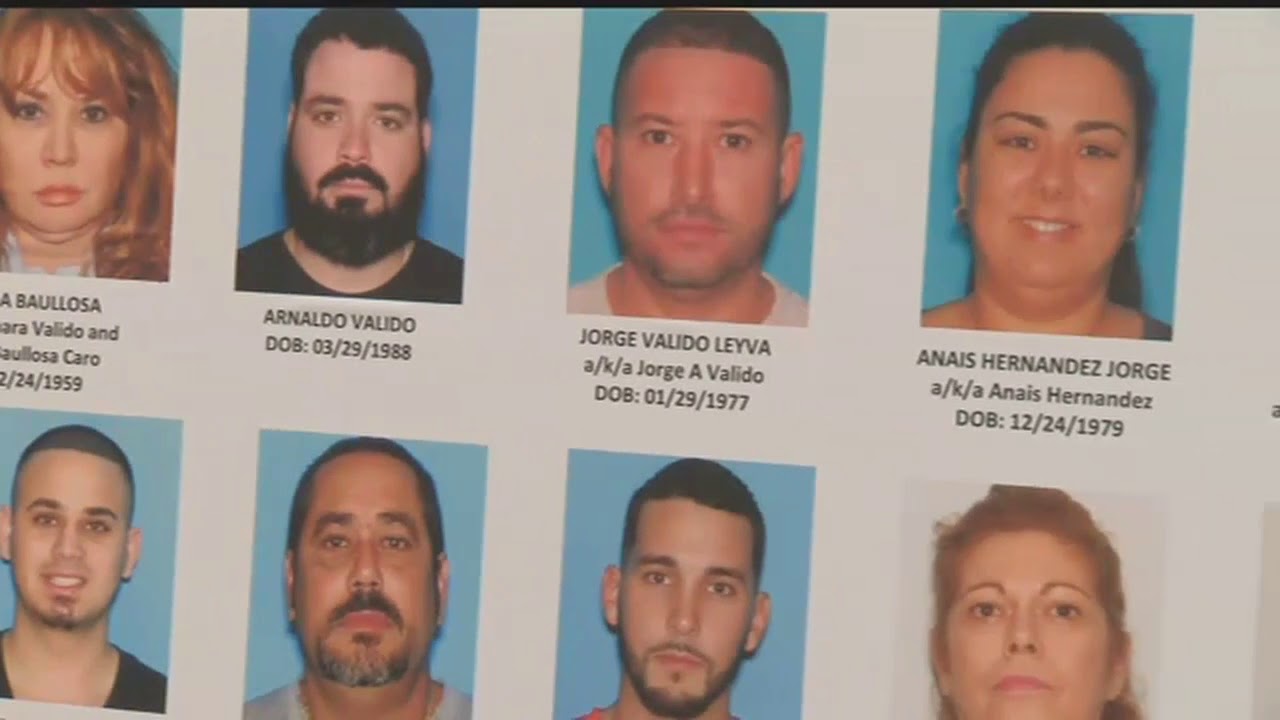

16 Arrested in Auto Fraud Scheme Hostage Scams

16 arrested in alleged auto insurance fraud scheme officials warn of vehicle hostage scams. This elaborate scheme targets unsuspecting victims, manipulating the system with a terrifying new twist: the “vehicle hostage” scam. Insurance fraud, unfortunately, isn’t new, but these sophisticated tactics are pushing the boundaries of what’s considered acceptable. The alleged perpetrators are using increasingly inventive methods to defraud insurance companies, highlighting the urgent need for improved preventative measures.

This investigation dives deep into the details of this complex crime, exploring the tactics employed, the consequences for victims and perpetrators, and potential strategies to combat this emerging threat.

The alleged fraud scheme involves a network of individuals coordinating various roles to orchestrate fraudulent claims. Victims are seemingly trapped in a web of deception, losing not only their vehicles but potentially facing significant financial repercussions. This intricate web of deceit underscores the critical importance of vigilance and consumer awareness. The scheme’s impact extends beyond individual victims, threatening the entire insurance industry and potentially increasing premiums for honest policyholders.

Understanding the modus operandi of these perpetrators is key to stopping this growing menace.

Overview of the Auto Insurance Fraud Scheme

Recent arrests highlight a sophisticated auto insurance fraud scheme, raising concerns about the integrity of the insurance industry. This intricate network of individuals appears to have employed various methods to defraud insurance companies, causing significant financial losses. Understanding the details of this scheme is crucial for preventing similar incidents and maintaining public trust in the insurance system.This scheme likely involved coordinated actions by individuals with specific roles, potentially leveraging vulnerabilities in existing systems.

The impact of such fraud extends beyond financial losses, potentially influencing insurance premiums for legitimate policyholders. Detailed examination of the alleged methods used will illuminate the nature of the scheme and its potential repercussions.

Summary of the Alleged Fraudulent Activities

The alleged auto insurance fraud scheme appears to involve multiple coordinated fraudulent activities. These activities likely included staged accidents, false claims, and inflated valuations of damages. The perpetrators may have used forged documents, identities, and potentially compromised databases to support their fraudulent claims. Such actions severely undermine the principles of honest and fair insurance practices.

Methods Employed in the Fraudulent Activities, 16 arrested in alleged auto insurance fraud scheme officials warn of vehicle hostage scams

Insurance fraudsters employ a variety of techniques to deceive insurers. Common methods in this scheme may include:

- Staging Accidents: Participants might deliberately cause or stage minor accidents, inflating damage claims to maximize financial gain. This could involve using pre-arranged accomplices and vehicles.

- Filing False Claims: Claims for damages, injuries, or vehicle repairs might be filed without any actual incident having occurred. This often involves presenting fabricated evidence, such as medical reports or repair invoices.

- Inflating Damage Estimates: The value of damages sustained in an accident might be exaggerated to receive higher payouts than justified. This could involve using inflated repair estimates, or fabricated appraisals of the vehicle.

- Using False Identities and Documents: Participants might use false identities or documents to mask their involvement in the fraudulent activities, making tracing and prosecuting them more difficult. This could include forging medical records or accident reports.

Potential Impact on the Insurance Industry

The impact of such a fraud scheme extends beyond the direct financial losses to insurance companies. This type of coordinated fraud can potentially lead to:

- Increased Premiums for Legitimate Policyholders: Insurance companies may raise premiums for all policyholders to offset the losses from fraudulent claims. This burden falls disproportionately on honest policyholders.

- Erosion of Public Trust: When insurance fraud schemes come to light, it can erode public trust in the integrity of the insurance industry. This can make it more difficult for legitimate policyholders to trust the system.

- Undermining Insurance Company Operations: Extensive fraud can significantly impact the operational efficiency and financial stability of insurance companies, potentially leading to service disruptions and higher costs.

Key Players and Their Alleged Roles

The intricate nature of the scheme likely involved multiple individuals with varying roles. A breakdown of these roles is presented below:

| Key Player | Alleged Role |

|---|---|

| Claimant | Filing fraudulent claims, staging accidents, or manipulating documentation. |

| Repair Shop Personnel | Accepting inflated repair estimates, or forging repair records to support fraudulent claims. |

| Medical Providers | Creating fraudulent medical records to support inflated injury claims. |

| Conspirators/Coordinators | Organizing and directing the scheme, managing the flow of information and resources. |

The “Vehicle Hostage” Scam

The recent surge in auto insurance fraud cases has highlighted a particularly insidious tactic: the “vehicle hostage” scam. This scheme preys on the vulnerabilities of individuals and businesses, exploiting their need for transportation and financial stability. Understanding how it operates is crucial for both victims and those working to combat this growing problem.This scheme leverages the victim’s dependence on a vehicle for work or daily life to pressure them into accepting illicit settlements.

The perpetrators exploit the victim’s financial and emotional distress, creating a sense of urgency and fear to coerce a favorable outcome.

Modus Operandi of the Vehicle Hostage Scam

The vehicle hostage scam typically involves a series of staged events designed to trap the victim. Perpetrators often use fabricated scenarios involving accidents, damaged vehicles, or purported insurance claims to manipulate the victim’s trust. They may even employ individuals posing as law enforcement or insurance representatives to further their fraudulent activities.

Tactics Used to Trap Victims

Perpetrators employ various tactics to trap victims. These include:

- False Accusations: Victims are falsely accused of causing accidents or damage to a vehicle, often with fabricated evidence.

- Threat of Legal Action: Victims are threatened with legal action, fines, or even imprisonment if they don’t comply with the perpetrator’s demands.

- Pressure Tactics: Perpetrators use high-pressure sales tactics to manipulate victims into accepting a deal.

- Emotional Distress: The scam often leverages emotional distress by creating a sense of urgency and fear to coerce a quick settlement.

Types of Vehicle Hostage Scams

This type of scam can manifest in various forms.

- Fake Accident Claims: The perpetrators might stage a false accident or create evidence of one, then demand compensation from the victim.

- Vehicle Impoundment Schemes: Victims are told their vehicles are impounded due to false reasons, leading to demands for payment to release them.

- Fake Insurance Representatives: Perpetrators pose as insurance adjusters or representatives, pressuring victims to pay a settlement to avoid penalties.

- Fictitious Towing Companies: Victims are targeted by fictitious towing companies claiming to be acting on behalf of insurance or legal authorities, requiring payment for release of the vehicle.

Comparison with Other Auto Insurance Fraud Schemes

While other auto insurance fraud schemes may involve falsified claims or inflated damages, the vehicle hostage scam uniquely targets the victim’s dependence on their vehicle. It uses coercion and pressure tactics, aiming to exploit the victim’s vulnerability and sense of urgency.

Vehicles Commonly Targeted

The following table illustrates the different types of vehicles commonly targeted in these scams. This data is based on observed trends and reported cases.

| Vehicle Type | Frequency of Targeting |

|---|---|

| Passenger Cars | High |

| Trucks (Commercial and Personal) | Medium |

| Motorcycles | Low |

| Recreational Vehicles (RVs) | Medium |

Consequences and Implications

This auto insurance fraud scheme, involving the alleged “vehicle hostage” scam, carries severe consequences for everyone involved. The individuals arrested face potential financial ruin, severe legal penalties, and the erosion of trust within their communities. Beyond the immediate repercussions, this type of fraud can ripple through the entire financial system, affecting the insurance industry and ultimately impacting consumers.

Officials are warning about vehicle hostage scams, following the arrest of 16 people in an alleged auto insurance fraud scheme. This type of fraud often involves intricate schemes, and unfortunately, individuals like Gertrude Maria Huygen Waterreus in San Jose, CA, are sometimes caught up in these complex situations. gertrude maria huygen waterreus san jose ca highlights the potential for such scams to impact local communities.

The ongoing investigation into the 16 arrested underscores the need for vigilance in protecting against these kinds of elaborate auto insurance fraud schemes.

Financial Penalties

The financial penalties for those involved in such a scheme can be substantial. Participants could face significant fines, ranging from tens of thousands to hundreds of thousands of dollars, depending on the severity of their involvement and the amount of fraudulent activity. Additionally, restitution to victims may be required. The sheer amount of fraudulent activity could result in the perpetrator being held liable for the full amount, or a portion of the total.

Legal Ramifications

The legal ramifications of these alleged crimes are equally severe. Depending on the specifics of the case, individuals could face felony charges, potentially leading to lengthy prison sentences. The precise nature of the charges and the potential punishments vary based on the specific laws in place and the extent of the individuals’ participation. Convictions could result in a criminal record that could impact future employment and housing opportunities.

Impact on Victims’ Financial Stability

Victims of this type of fraud often experience significant financial instability. The scheme’s goal is to create a financial burden for the victim, forcing them to pay large sums of money to retrieve their vehicle. The victims may be forced to take on significant debt or incur other financial hardships to compensate for the fraudulent activity. This can have a lasting impact on their financial well-being.

Social and Ethical Implications

Such fraud schemes have significant social and ethical implications. They erode trust in the insurance industry and create a climate of distrust within communities. The fraudulent activities damage the integrity of the system and can lead to increased premiums for all policyholders. Critically, the ethical breach represents a violation of public trust and responsible financial practices.

Potential Punishments for Different Degrees of Involvement

This table illustrates the potential punishments for varying degrees of involvement in the scheme, acknowledging that specific penalties depend on the laws of the jurisdiction and the specifics of the case.

| Degree of Involvement | Potential Punishments |

|---|---|

| Perpetrators (Primary Actors) | Significant fines (potentially hundreds of thousands of dollars), substantial prison sentences (years), and restitution to victims. |

| Facilitators (Supporting Roles) | Fines, prison sentences (potentially shorter than primary actors), and restitution to victims. |

| Indirect Participants (Aiding and Abetting) | Fines, probation, and other penalties that reflect their level of knowledge and participation in the scheme. |

| Victims (Unintentionally Involved) | While victims are not criminally liable, they may face significant financial hardship as a result of the scheme. |

Prevention and Mitigation Strategies

Auto insurance fraud, particularly the “vehicle hostage” scam, poses a significant threat to both individuals and the insurance industry. Effective prevention relies on a multi-faceted approach, encompassing individual vigilance, robust insurer protocols, and proactive law enforcement strategies. Implementing these strategies is crucial for minimizing the financial and emotional impact of these fraudulent schemes.

Individual Precautions to Avoid Victimization

Understanding the tactics employed in these scams is paramount for individuals to avoid becoming victims. Individuals should be wary of unsolicited contact regarding their vehicles, especially those claiming ownership issues or requiring payment for release. Verify all communications and demands through official channels, such as the insurance company or law enforcement.

- Verify all communication channels. Do not engage in conversations or transactions initiated through unofficial or anonymous means. Always seek verification through official channels.

- Demand written documentation. Any request for payment or release of a vehicle should be accompanied by official, documented communication. Refuse to comply with demands lacking proper documentation.

- Report suspicious activity immediately. If an individual encounters suspicious activity related to their vehicle, they should report it to law enforcement and their insurance provider without delay.

- Seek legal advice if needed. If an individual feels they have been targeted by a scam, consulting with an attorney or legal representative is advisable for guidance and protection.

Insurance Company Detection and Prevention Strategies

Insurance companies play a vital role in mitigating the impact of fraudulent claims. Developing robust internal procedures for verifying claims is crucial. A comprehensive system should encompass detailed investigation protocols, cross-referencing data, and fraud detection software.

So, sixteen people got busted in a massive auto insurance fraud scheme, and officials are worried about a rise in “vehicle hostage” scams. It’s a pretty serious issue, especially when you consider how much people rely on their vehicles for daily life. Meanwhile, China is reportedly considering selling TikTok’s US operations to Elon Musk as a possible solution, china weighs sale of tiktok us to musk as a possible option.

While that’s a fascinating development, the focus should remain on catching these fraudsters and protecting consumers from losing their cars. It’s a much more immediate concern.

- Implement comprehensive claim verification processes. Insurance companies should employ detailed investigation procedures, including verification of vehicle ownership, inspection of supporting documents, and cross-referencing data with various sources.

- Utilize advanced fraud detection software. Implementing sophisticated software solutions can significantly improve the identification of fraudulent patterns and anomalies in claim data.

- Maintain consistent communication with law enforcement. Collaborating with law enforcement agencies on suspicious claims can aid in the investigation and prosecution of fraud schemes.

- Conduct regular internal audits. Periodic internal audits can help identify weaknesses in claim processing procedures and facilitate the implementation of corrective measures.

Law Enforcement Investigation and Prosecution

Effective law enforcement response is crucial in combating these schemes. This requires dedicated resources, specialized training, and collaboration between agencies. Prosecution strategies should target the perpetrators of these scams, while also deterring future instances.

- Prioritize investigations of suspicious claims. Law enforcement agencies should allocate resources to investigate claims that exhibit characteristics of fraudulent activity, focusing on the network behind these schemes.

- Develop specialized training programs. Law enforcement officers should receive specialized training in identifying and investigating vehicle hostage scams.

- Collaborate with insurance companies. Establishing strong communication channels between law enforcement and insurance companies can facilitate the exchange of information and coordination of efforts.

- Seek to prosecute offenders effectively. Law enforcement should pursue the prosecution of those involved in fraudulent schemes to send a clear message that these activities will not be tolerated.

Consumer Verification of Insurance Company Legitimacy

Consumers can verify the legitimacy of auto insurance companies by confirming their license and registration with the state’s insurance department. Checking online databases or contacting the relevant regulatory body will provide assurance of an insurance company’s authorized status.

- Verify the insurance company’s license. Consumers should verify the company’s authorization to operate in their state by consulting the state’s insurance department website or contacting the relevant regulatory body.

- Check for negative reviews or complaints. Reviewing online forums or consumer complaint websites can provide insight into potential issues or complaints regarding the insurance company.

- Seek recommendations from trusted sources. Consulting trusted sources, such as friends, family, or financial advisors, can provide insights into the reliability of an insurance provider.

- Contact the insurance company directly. Consumers should contact the insurance company directly to verify their information and clarify any doubts.

Consumer Protection Tips

Implementing preventative measures can significantly reduce the risk of falling victim to auto insurance fraud. Proactive steps taken by consumers can mitigate potential losses and maintain financial security.

- Keep detailed records of all transactions. Maintaining comprehensive records of all communications, payments, and documentation related to insurance claims is essential for verification purposes.

- Be cautious of unsolicited contact. Avoid responding to or engaging in conversations initiated by individuals or entities not affiliated with your insurance provider.

- Seek clarification on suspicious requests. If an individual receives requests that appear suspicious or unusual, they should seek clarification from their insurance provider.

- Report any suspicious activity to the authorities. Report any suspicious activity related to insurance claims to the appropriate law enforcement agencies.

Illustrative Case Studies

The complexities of auto insurance fraud, particularly the insidious “vehicle hostage” scam, often necessitate intricate investigations and rigorous legal proceedings. Successful prosecutions in similar cases serve as crucial precedents, guiding future investigations and deterring potential perpetrators. Understanding these precedents offers valuable insights into the methods employed by fraudsters and the strategies used by law enforcement and insurance companies to combat them.Real-world examples illuminate the tactics used in these schemes, from the initial deception to the final resolution.

The 16 arrests in the alleged auto insurance fraud scheme highlight a disturbing trend of vehicle hostage scams. Criminals are clearly exploiting vulnerabilities in the system, and unfortunately, this kind of fraud is often connected to other serious crimes. For example, a recent shooting in Oakland left a man in critical condition, man in critical condition after oakland shooting , which tragically demonstrates the devastating consequences of violence that can unfortunately be linked to these kinds of elaborate insurance scams.

The focus needs to remain on cracking down on these criminal organizations and ensuring that victims aren’t left with significant financial and emotional burdens, as seen in the recent insurance fraud cases.

Analyzing successful prosecutions reveals the critical role of meticulous investigation and the importance of strong evidence in securing convictions. This analysis further highlights the collaboration required between law enforcement agencies, insurance companies, and victims in bringing fraudsters to justice.

Successful Prosecutions of Auto Insurance Fraud Schemes

Investigations into auto insurance fraud schemes frequently involve meticulous examination of financial records, witness testimonies, and surveillance footage. The intricate nature of these schemes often requires expertise in various fields, from insurance regulations to financial analysis. This multi-faceted approach ensures that the prosecution effectively addresses all aspects of the fraudulent activity.

- In one notable case, a group of individuals orchestrated a sophisticated vehicle hostage scam targeting multiple insurance companies. The investigation uncovered a network of individuals responsible for fabricating accidents and manipulating claims, resulting in significant financial losses. Detailed financial records and witness testimony were crucial to linking the perpetrators to the fraudulent activities. The prosecution meticulously documented the scheme’s timeline, identifying key players and establishing a clear chain of evidence, leading to successful convictions and significant restitution.

- Another example demonstrates how meticulous documentation and analysis of insurance policies and claim procedures played a vital role in identifying fraudulent activities. The case involved a series of staged accidents where individuals intentionally damaged their vehicles to file false insurance claims. Through a comprehensive review of policy provisions and claim histories, investigators identified inconsistencies and patterns indicative of fraud, ultimately leading to successful prosecution and substantial financial recovery.

Identifying and Resolving Vehicle Hostage Scams

Insurance companies play a pivotal role in detecting and reporting fraudulent activities. Their sophisticated claim review processes, coupled with their expertise in insurance regulations and policies, enable them to identify suspicious patterns and inconsistencies in claims.

- A key indicator is the discrepancy between reported damage and the actual condition of the vehicle. Discrepancies in the timeline of events reported and physical evidence found are also important markers. Insurance adjusters are trained to recognize these subtle inconsistencies, often acting as the first line of defense against fraudulent claims.

- Insurance companies employ various techniques to verify the authenticity of claims. This includes independent inspections of the vehicles involved, review of supporting documentation, and cross-referencing with other insurance companies to detect patterns or overlapping claims. This proactive approach strengthens the investigation process and reduces the likelihood of fraudulent claims being approved.

Role of Insurance Companies in Identifying Fraud

Insurance companies have sophisticated claim review processes, equipped to identify potential fraudulent activities.

- A crucial aspect is the meticulous examination of claim documentation, looking for inconsistencies or discrepancies that may indicate fraud. This includes reviewing the accuracy of reported damages, the timeline of events, and the supporting documentation provided by the claimant.

- Insurance companies frequently use advanced data analysis tools and techniques to identify patterns and anomalies in claim data. These tools enable the detection of suspicious claims and the identification of potential fraud rings.

Investigating a Vehicle Hostage Scam

A thorough investigation into a vehicle hostage scam involves a multi-pronged approach.

- A critical initial step is securing the vehicle for inspection and gathering physical evidence. This includes detailed photographs and documentation of any damage or inconsistencies. Further steps include interviewing witnesses and collecting statements to establish a comprehensive understanding of the circumstances surrounding the alleged incident.

- Investigators frequently use forensic analysis to determine the authenticity of the damage reported. This includes analyzing paint chips, examining body damage, and utilizing other forensic techniques to determine the true nature of the incident. This process often requires collaboration with law enforcement agencies and specialized forensic experts.

Public Awareness Campaigns

Auto insurance fraud, particularly the insidious “vehicle hostage” scam, thrives on public ignorance. Effective public awareness campaigns are crucial in dismantling these schemes and empowering individuals to protect themselves. By educating the public, we can equip them with the knowledge and tools necessary to identify and report fraudulent activities. This proactive approach significantly reduces the likelihood of individuals falling victim to these scams.Public awareness campaigns aren’t just about disseminating information; they’re about fostering a culture of vigilance and skepticism.

This involves understanding the psychological tactics fraudsters employ and recognizing the red flags that indicate fraudulent activity. When the public is better informed, they become active participants in preventing these crimes, not just passive recipients of information.

Strategies for Educating the Public

Public awareness campaigns should employ a multifaceted approach, utilizing diverse media channels to reach a broad audience. Key strategies include:

- Targeted Public Service Announcements (PSAs): PSAs should be concise, impactful, and easily understandable. They should focus on specific scams, like the vehicle hostage scheme, and highlight common characteristics of these frauds. An example PSA could feature a short, dramatic skit showing a victim being manipulated by fraudsters, ending with a clear call to action, such as reporting suspicious activity or contacting a reputable insurance agency.

Another PSA could focus on the financial and emotional toll these scams can have on individuals and families.

- Media Partnerships: News outlets, radio stations, and local community newspapers are powerful tools for spreading awareness. Media partnerships allow for the amplification of messages and ensure wider reach, thereby maximizing the impact of the campaign. News stories about arrests in insurance fraud cases, or testimonials from victims who have successfully recovered from scams, can serve as impactful media coverage.

Using local media personalities or trusted community figures in the PSAs can enhance credibility and encourage public engagement.

- Community Outreach Programs: Engaging local communities directly is essential. This can involve workshops, seminars, and presentations at community centers, libraries, and senior centers. These events can feature interactive elements, allowing attendees to ask questions, share experiences, and receive direct guidance on how to protect themselves from fraud. Community outreach should also involve partnering with local businesses to disseminate information through posters and pamphlets.

- Demographic-Specific Campaigns: Recognizing that different demographics may respond to various communication styles, tailoring the campaign’s messaging to specific groups can significantly improve effectiveness. For instance, a campaign targeting senior citizens might employ simpler language and emphasize the emotional toll of scams. Another campaign might target immigrant communities with culturally sensitive materials.

Design of a Public Awareness Campaign

A comprehensive public awareness campaign requires careful planning and execution. A campaign targeting senior citizens, for example, could focus on the tactics fraudsters employ to exploit vulnerabilities. The campaign could include:

- Materials: Print materials, like brochures and pamphlets, should be clear, concise, and visually appealing. They should contain clear and concise information about the vehicle hostage scam, and practical steps individuals can take to avoid becoming a victim. A dedicated website, or social media pages, should also be created for further information and community engagement.

- Messaging: The message should be consistent across all platforms, using clear, straightforward language. Emphasize the importance of verifying information, and encourage the public to report suspicious activity.

- Partnerships: Collaborate with local law enforcement, insurance companies, and consumer protection agencies. These partnerships can provide legitimacy and support for the campaign. For example, having representatives from law enforcement agencies explain the legal ramifications of these scams can strengthen the message.

- Evaluation: Monitor the campaign’s effectiveness through feedback surveys, social media engagement, and media coverage. This feedback can inform adjustments to improve future campaigns.

Impact on the Economy

Auto insurance fraud schemes aren’t just a nuisance; they have significant and far-reaching consequences for the economy. These crimes divert resources, inflate costs, and ultimately undermine the stability of communities and the insurance industry itself. The impact extends beyond the direct victims to include everyone who pays premiums.The economic costs of auto insurance fraud are substantial and multifaceted.

From the direct financial losses incurred by insurance companies to the indirect costs borne by honest policyholders and society as a whole, the repercussions are considerable. The fraudulent schemes, especially those involving “vehicle hostage” scams, create a ripple effect across the entire financial landscape, necessitating investigation and prosecution, further impacting the economy.

Economic Costs of Fraud Schemes

The cost of auto insurance fraud encompasses various direct and indirect expenses. These expenses are borne by insurance companies, individuals, and the wider community.

- Increased Insurance Premiums for Honest Policyholders: Insurance companies, to compensate for fraudulent claims and losses, must raise premiums for honest policyholders. This disproportionately affects low-income individuals and families, placing a financial burden on those who are already struggling. For example, if a company experiences a 10% increase in fraudulent claims, they might increase premiums for all customers by 5% to maintain profitability, thus impacting the cost of living for those with insurance policies.

- Investigation and Prosecution Costs: The investigation and prosecution of auto insurance fraud cases require significant resources, including law enforcement personnel, investigators, and legal professionals. These costs are borne by taxpayers, further increasing the burden on the economy. For instance, the investigation of a large-scale insurance fraud scheme can involve numerous interviews, forensic analysis of documents, and expert testimony, which all come at a substantial cost.

- Reduced Efficiency in the Insurance Industry: Fraudulent activities divert resources and attention away from legitimate insurance operations. This can lead to a decline in efficiency and productivity, impacting the overall performance of the insurance industry. For instance, time spent investigating fraudulent claims could be used to process legitimate claims or improve customer service.

- Damage to Community Trust: Auto insurance fraud schemes erode public trust in the insurance industry and the legal system. This can lead to decreased consumer confidence, impacting economic activity and growth. For instance, when people lose faith in the system, they may be less inclined to invest in businesses or participate in the economy.

Financial Burden on the Economy

Quantifying the precise financial burden of auto insurance fraud is challenging. However, various studies and reports provide estimates of the magnitude of the problem.

- Insurance Industry Losses: Insurance companies face substantial losses due to fraudulent claims. These losses can range from tens of thousands to millions of dollars, depending on the scale and complexity of the fraud scheme. For instance, a large-scale scheme targeting a specific insurance company could result in millions of dollars in losses, impacting the company’s financial health and stability.

- Hidden Costs: The true cost of auto insurance fraud often goes beyond the direct financial losses. Hidden costs include the time and resources wasted on investigations, the negative impact on community trust, and the burden on the legal system. This makes it difficult to put a precise figure on the total economic impact.

- Data on Fraudulent Activities: Various reports and studies from reputable organizations provide data on the prevalence and cost of auto insurance fraud. These reports highlight the need for proactive measures to combat these crimes and mitigate their negative effects.

Final Conclusion: 16 Arrested In Alleged Auto Insurance Fraud Scheme Officials Warn Of Vehicle Hostage Scams

The 16 arrests in the alleged auto insurance fraud scheme serve as a stark reminder of the sophisticated tactics employed by criminals. The “vehicle hostage” scam is a chilling new element, highlighting the evolving nature of insurance fraud. This comprehensive look at the scheme reveals the devastating consequences for victims, the potential financial burden on the insurance industry, and the importance of proactive measures to prevent future occurrences.

By understanding the intricacies of this scheme and the measures taken to combat it, we can better protect ourselves and our communities from this dangerous type of fraud.