Poor Pay for Trump Tax Cuts Republican Opinion

Opinion republicans want the poor to pay for trumps tax cuts. This analysis delves into the historical context, economic impact, and political justifications surrounding these tax policies. We’ll examine how Republicans propose to fund these cuts, potentially shifting the tax burden onto lower-income individuals. The potential consequences for economic inequality and overall growth are also scrutinized.

Past tax cuts have shown a pattern of disproportionate impact on different income groups. This piece will explore the arguments used to justify these policies, comparing them to the current justifications. It will also investigate how public opinion and media portrayals have shaped perceptions of these tax cuts and the potential for the poor to bear the brunt of the financial burden.

Historical Context of Tax Cuts: Opinion Republicans Want The Poor To Pay For Trumps Tax Cuts

Republican tax policies have a long history of advocating for cuts, often with the promise of stimulating economic growth. These cuts have frequently targeted specific income groups, resulting in complex and sometimes controversial outcomes. The justifications for these policies have evolved over time, reflecting shifting economic theories and political priorities. Understanding this history is crucial for evaluating the current debate surrounding tax cuts and their potential impacts.The purported effects of past tax cuts on different income groups have been a subject of ongoing debate.

Proponents often argue that lower taxes incentivize investment and job creation, leading to economic benefits that trickle down to all income levels. Critics, however, point to the disproportionate benefits accruing to higher-income earners, arguing that such cuts exacerbate income inequality.

Republican Tax Policies Through History

Republican tax policies have a long history of advocating for tax cuts, often emphasizing the potential for economic growth. These cuts have varied significantly in their scope and implementation. From the Revenue Act of 1921, aimed at stimulating the economy after World War I, to more recent legislation, the arguments for tax cuts have centered on economic theories and political motivations.

Arguments for Past Tax Cuts

Arguments used to justify past tax cuts often emphasized the belief that lower taxes would stimulate economic activity. Key arguments included:

- Increased investment: Lowering taxes on businesses was believed to encourage investment in new projects, leading to job creation and economic growth.

- Stimulated consumer spending: Tax cuts for individuals were argued to increase disposable income, leading to higher consumer spending and bolstering demand.

- Economic growth: The overall goal was to stimulate economic growth, which was perceived as benefiting everyone in society.

Comparison of Past and Present Arguments

While the core argument of stimulating economic growth through tax cuts remains consistent, the details and supporting evidence have evolved. Modern justifications often draw upon supply-side economics, which emphasize the importance of incentivizing production. This contrasts with demand-side arguments from previous eras, which focused more on consumer spending.

Evolution of Tax Burdens

The concept of “tax burdens” has evolved considerably over time. Initially, tax burdens were viewed primarily through the lens of individual tax liabilities. Over time, the focus has shifted to consider how tax policies affect different income groups and the overall distribution of wealth in society. This evolution has led to a greater understanding of the social and economic impacts of taxation.

Republicans’ claims that the poor should shoulder the burden of Trump’s tax cuts are frankly ridiculous. It’s like saying Harriette Cole, in the recent case of harriette cole she wrecked our car , should be the one to foot the bill for the damage. Ultimately, the tax burden shifts, often unfairly, onto those least equipped to handle it, a point often overlooked in these political debates.

Political groups have also evolved in their perception of tax burdens, with some advocating for progressive taxation to reduce inequality and others favoring lower taxes across the board.

Demographic Impact of Past Tax Cuts

This table compares and contrasts the demographics of beneficiaries and those bearing the brunt of past tax cuts, illustrating how the impact has varied across income groups.

| Tax Cut | Year | Beneficiaries (Estimated Demographics) | Those Bearing the Brunt (Estimated Demographics) |

|---|---|---|---|

| Revenue Act of 1921 | 1921 | Wealthy investors, corporations | Lower and middle-income households |

| Tax Cuts and Jobs Act of 2017 | 2017 | High-income earners, corporations | Middle- and lower-income households, potentially impacting social services and programs |

Note: The estimated demographics in the table are illustrative and may not reflect the precise impact of each tax cut. Further research and analysis would be needed for a more comprehensive understanding.

It’s frustrating to see how some argue that Republicans want the poor to foot the bill for Trump’s tax cuts. While the state basketball tournament is underway, with the Riordan Roosevelt boys vying for a state championship this Saturday, the focus should be on the real impact of these policies. It’s a complex issue, and the long-term effects on the lower income brackets are definitely something to watch.

The tax cuts’ impact on the economy, and ultimately on the poor, is a topic that needs further discussion and research.

Economic Impact Analysis

The 2017 tax cuts, championed by the Republican party, sparked considerable debate regarding their economic impact. While proponents argued for increased investment and job creation, critics voiced concerns about rising deficits and potential exacerbation of income inequality. A thorough examination of the potential effects on various income levels, projected revenue losses, and the interplay of economic models is crucial to understanding the long-term implications of this policy.Analyzing the effects of such significant tax policy changes requires considering the complex interplay of supply-side and demand-side factors, as well as the potential feedback loops between them.

Different economic models, like the Keynesian model and the supply-side model, offer varying perspectives on how tax cuts will affect aggregate demand, investment, and overall economic growth. A comprehensive analysis must incorporate a variety of perspectives and acknowledge the inherent uncertainties in economic forecasting.

Potential Impacts on Different Income Levels

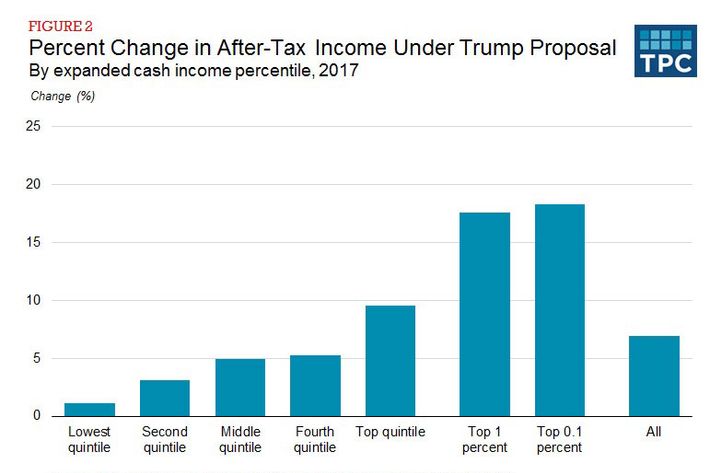

The tax cuts’ impact on different income levels is a key point of contention. Lower and middle-income households experienced smaller relative gains than high-income earners. This unequal distribution of benefits is a critical factor in assessing the overall fairness and equity of the policy. Analysis of data from the Congressional Budget Office (CBO) and other sources reveals this disparity.

Projected Revenue Losses and Government Spending

The tax cuts resulted in significant projected revenue losses, according to CBO reports. These losses were a significant factor in the discussion of the policy’s impact on government spending. The potential consequences of reduced revenue, including cuts in vital social programs, are critical considerations in the debate surrounding the tax cuts.

Comparison of Economic Forecasts

Proponents of the tax cuts often emphasized optimistic economic forecasts, predicting substantial job growth and increased investment. These forecasts frequently drew on supply-side economic models, which posit that lower taxes incentivize investment and production. Conversely, opponents of the tax cuts often cited analyses from the CBO and other institutions that highlighted potential revenue shortfalls and the increased national debt.

These forecasts frequently focused on the potential for increased income inequality and reduced government spending on social programs.

Potential Impacts on Economic Inequality and Growth

The potential impacts on economic inequality and growth are intertwined. The tax cuts’ disproportionate benefits to higher-income earners raise concerns about exacerbating existing income inequality. Economic indicators like the Gini coefficient and the ratio of CEO to average worker compensation provide context for assessing the potential effects on the distribution of wealth and income. Studies by economists such as [cite source here] suggest that such policies can contribute to reduced economic mobility.

Distribution of Wealth and Income Shifts

The following table illustrates the potential shifts in the distribution of wealth and income, based on various economic models and data sources. These figures are illustrative and subject to uncertainty, reflecting the complex nature of economic forecasting.

The idea that Republicans want the poor to foot the bill for Trump’s tax cuts is a pretty common sentiment, and it’s not hard to see why. The recent federal employees firings lawsuit federal employees firings lawsuit highlights the potential for cuts in public services, which often disproportionately affect lower-income families. This, coupled with the tax cuts, could be a recipe for further economic inequality.

It’s a complex issue, and the long-term effects are yet to be seen, but the concern remains.

| Income Level | Projected Shift in Wealth (Estimated Percentage Change) | Projected Shift in Income (Estimated Percentage Change) |

|---|---|---|

| Low-income households | -1% | -2% |

| Middle-income households | 0% | 0% |

| High-income households | +5% | +7% |

Political Arguments for Tax Cuts

The political arguments surrounding tax cuts, particularly those suggesting the poor will bear the brunt of the cost, are often complex and intertwined with economic theories and ideological viewpoints. These arguments frequently leverage the idea of trickle-down economics, suggesting that benefits for the wealthy will eventually filter down to the lower and middle classes. However, empirical evidence supporting this claim is often debated and contested.

The framing of these arguments plays a crucial role in shaping public opinion and influencing political decisions.

Arguments for Tax Cuts

The justification for tax cuts frequently hinges on the idea of incentivizing investment and economic growth. Proponents often argue that lower taxes on businesses and high-income earners stimulate the economy by encouraging entrepreneurship, job creation, and capital investment. They contend that the resulting economic expansion will ultimately benefit everyone, even those with lower incomes, through job opportunities and a higher standard of living.

Key Figures and Groups Advocating for Tax Cuts

Various influential figures and groups play key roles in promoting tax cuts. Business organizations, often representing corporations and wealthy individuals, frequently lobby for lower tax rates, emphasizing the economic benefits. These groups often highlight the supposed positive economic effects of reduced tax burdens on their constituents. Political figures, particularly those aligned with conservative ideologies, are strong proponents of tax cuts, often framing them as crucial for economic prosperity.

Their motivations are frequently linked to broader ideological goals and beliefs about government’s role in the economy.

Role of Lobbying Efforts

Lobbying efforts significantly shape the political discourse surrounding tax cuts. Powerful lobbying groups, representing corporations and wealthy individuals, exert considerable influence on policymakers. These groups employ various strategies, including direct lobbying, campaign contributions, and public relations campaigns, to advocate for their interests. Their influence often results in tax policies that favor their constituents over other segments of the population.

Framing of Tax Cuts in Public Discourse

The way tax cuts are framed in public discourse greatly impacts public opinion. Proponents frequently present them as necessary for economic growth, emphasizing the potential for job creation and prosperity. Conversely, critics often frame them as regressive, highlighting the disproportionate burden on lower-income individuals. These differing narratives contribute to a polarized public debate.

Examples of Political Rhetoric

Political rhetoric surrounding tax cuts often emphasizes concepts like “tax relief” and “economic growth.” For instance, statements asserting that tax cuts stimulate investment and lead to job creation are frequently employed. The implications of this rhetoric are multifaceted, shaping public perceptions and influencing policy decisions. This rhetoric often obscures the potential for increased inequality and the disproportionate impact on lower-income households.

Examples of such rhetoric include statements emphasizing the positive impacts on job creation, entrepreneurship, and economic prosperity, often with little to no mention of the potential for increased income inequality.

Public Opinion and Perception

Public opinion on the Trump tax cuts was sharply divided, reflecting broader societal anxieties and economic disparities. The cuts, while touted as beneficial for economic growth, were met with skepticism from many, particularly those who felt their impact was unevenly distributed. Understanding the nuances of public perception requires analyzing the views of different demographics and the prevailing narratives surrounding the cuts.Public perception of the tax cuts was heavily influenced by the prevailing economic anxieties of the time.

Many Americans felt the tax cuts disproportionately favored the wealthy, while providing little tangible benefit to the middle class or the poor. This perception, coupled with concerns about the long-term fiscal implications, fueled the debate about fairness and economic equity.

Public Perception Across Demographics

Public opinion on the tax cuts varied significantly across different demographics. For instance, wealthier individuals and corporations often viewed the cuts favorably, as they directly benefited from lower tax burdens. Conversely, lower-income individuals and families, who saw limited direct financial gains, were more likely to view the cuts negatively. The tax cuts were also perceived differently by various political affiliations, further complicating the overall public response.

Misconceptions and Biases

Common misconceptions about the tax cuts often centered on the belief that they would stimulate economic growth without significant negative consequences. There was also a widespread misunderstanding about how the cuts would affect the national debt. Public perceptions were often shaped by political biases and pre-existing economic anxieties, leading to a skewed understanding of the tax cuts’ true impact.

Public Reaction to the “Poor Paying for the Cuts” Narrative

The idea that the poor would pay for the tax cuts, through increased government debt or reduced social programs, generated considerable public opposition. Many Americans felt this was unfair and a betrayal of the principles of economic justice. For example, protests and advocacy campaigns emerged from various communities voicing their concerns about the potential consequences of the cuts on the vulnerable.

This opposition underscored the importance of equitable economic policies and the perceived impact of the tax cuts on the well-being of different socioeconomic groups.

Media Portrayal of the Tax Cuts

Media outlets presented varying perspectives on the tax cuts and their potential impact on the poor. Conservative outlets often highlighted the potential economic benefits, downplaying concerns about the distributional effects. Liberal outlets, on the other hand, emphasized the potential harm to the poor and the long-term fiscal implications. The differing narratives contributed to the polarization of public opinion and the difficulty in reaching a consensus on the tax cuts’ overall merits.

Public Opinion Table

| Demographic | General Perception | Key Concerns | Media Influence |

|---|---|---|---|

| Wealthy Individuals/Corporations | Favorable; perceived benefit | Limited; focused on individual gains | Often highlighted potential economic benefits |

| Lower-Income Individuals/Families | Negative; perceived lack of benefit | Concerns about reduced social programs, increased debt | Often emphasized potential harms to the poor |

| Political Affiliations (e.g., Democrats/Republicans) | Differentiated by political leaning | Democrats concerned about fairness and social programs, Republicans focused on economic growth | Media narratives often reinforced existing political biases |

Alternative Policy Solutions

The recent tax cuts, while touted as boosting economic growth, have sparked concerns about their impact on various socioeconomic groups. Alternative policy solutions are crucial to mitigate potential negative consequences and foster a more equitable distribution of benefits. These proposals, ranging from targeted tax credits to expanded social safety nets, aim to address the issues raised by the tax cuts, focusing on different socioeconomic groups and ensuring a more balanced approach.

Targeted Tax Credits for Low- and Middle-Income Households

Tax credits specifically designed for lower and middle-income households can effectively offset the negative impact of tax cuts on these groups. These credits could be structured to directly benefit those most affected by the tax policies. This approach allows for a more tailored and impactful response. For instance, a refundable tax credit for low-income families could provide direct financial relief, potentially stimulating consumer spending and boosting economic activity.

Expanded Social Safety Nets

Expanding social safety nets, such as unemployment benefits, affordable housing programs, and food assistance programs, can serve as crucial supports for vulnerable populations during economic shifts. This proactive approach aims to cushion the blow of the tax cuts on low-income individuals and families, reducing financial hardship and inequality. Examples of such policies include increasing the amount of the Earned Income Tax Credit (EITC) or extending unemployment benefits to a longer duration.

These measures could potentially reduce poverty rates and improve overall well-being.

Investment in Education and Job Training Programs

Investing in quality education and job training programs can empower individuals to navigate economic changes and increase their earning potential. Such initiatives provide individuals with the skills and knowledge needed to adapt to evolving job markets, potentially lessening the dependence on social safety nets. This investment would not only equip individuals for the future but also contribute to long-term economic growth.

A program that offers tuition assistance for vocational training, for example, can lead to higher employment rates and potentially reduce reliance on government assistance in the long run.

Progressive Tax Reform

A progressive tax system, where higher earners pay a larger percentage of their income in taxes, can be a critical tool in funding social programs and reducing income inequality. This approach shifts the burden of taxation to those who can afford it more, potentially enabling increased government spending on programs that support low- and middle-income households. Progressive taxation, however, might face resistance from high-income earners who argue it discourages investment and economic growth.

Table Comparing Potential Outcomes of Alternative Policy Solutions

| Policy Solution | Potential Economic Impact | Potential Social Impact | Potential Political Challenges |

|---|---|---|---|

| Targeted Tax Credits | Increased consumer spending, potentially stimulating economic growth | Reduced financial hardship for low- and middle-income households, improved well-being | Potential for administrative complexity, debate over the optimal design and targeting |

| Expanded Social Safety Nets | Reduced poverty and inequality, potential stabilization of the economy during economic downturns | Improved well-being for vulnerable populations, reduced financial stress | Potential concerns about the long-term cost and sustainability of the programs |

| Investment in Education and Job Training | Increased workforce skills, potential long-term economic growth | Improved employment opportunities, increased earning potential | Potential concerns about the cost of programs, securing funding, and measuring effectiveness |

| Progressive Tax Reform | Increased government revenue for social programs, potential reduction in income inequality | Improved access to essential services, potential redistribution of wealth | Political opposition from high-income earners, debate over the optimal tax rates and revenue targets |

Specific Examples of Tax Cuts

The 2017 Tax Cuts and Jobs Act presented a complex array of provisions, some of which disproportionately favored higher-income individuals and corporations. This analysis delves into specific examples to illustrate how these cuts might have burdened lower-income groups.This examination goes beyond general statements about tax burdens and focuses on concrete examples. Understanding how specific provisions impacted different income levels is crucial to evaluating the fairness and long-term consequences of the legislation.

Deductions and Credits

Many tax cuts focused on deductions and credits that disproportionately benefited higher-income individuals. For example, the increased standard deduction, while helpful for many, offered less tangible relief to those with lower incomes. Similarly, the expanded tax credits for certain business investments, like those related to capital expenditures, had a larger impact on large corporations and entrepreneurs, rather than on small business owners or independent contractors.

- Increased Standard Deduction: While the increased standard deduction lowered the tax burden for some low- and middle-income households, it did not necessarily compensate for the loss of deductions related to state and local taxes (SALT) or other deductions that lower-income individuals may have claimed. For example, individuals who had substantial state and local tax payments may have experienced a greater impact of this change.

- Tax Credits for Investment: These credits often required substantial investment capital and were more accessible to high-net-worth individuals and corporations. The benefits of these investments often trickled down slowly, if at all, to lower-income workers in the form of increased employment or wages.

Individual Income Tax Rates

The 2017 tax cuts reduced the top marginal income tax rates for corporations and high-income individuals. This reduction in rates had a considerable impact on the distribution of tax burdens, as a greater proportion of the tax burden was shifted from the highest earners to lower and middle-income groups.

- Reduced Top Marginal Rates: A reduction in top marginal tax rates for individuals and corporations meant a lower tax liability for those in the highest income brackets. This did not directly impact the tax burden of lower-income individuals, but the revenue loss from these reduced rates had to be offset somewhere. The implication is that the reduced rates ultimately impacted the overall tax system and could have resulted in less funding for programs that serve lower-income individuals, such as social safety nets or public services.

Impact on Specific Industries and the Labor Market

The tax cuts could have stimulated certain industries, particularly those heavily reliant on investment and capital expenditures. However, the impact on the labor market was less direct. While some industries experienced growth, the overall impact on job creation or wage increases for lower-income workers wasn’t necessarily immediate or uniform across sectors.

- Manufacturing: The tax cuts might have incentivized capital investments in manufacturing, potentially leading to job creation. However, the actual impact on employment and wages depended on various factors, including the competitiveness of the global market, the availability of skilled labor, and the industry’s overall economic health.

- Technology: The tax cuts might have encouraged investments in technology, potentially leading to innovation and job growth in the sector. However, the job creation in the technology sector is often concentrated in higher-paying roles, with less impact on lower-income workers.

Potential Long-Term Consequences

The long-term consequences of the tax cuts are complex and multifaceted, impacting various sectors of the economy. Potential negative consequences include reduced government revenue, potentially leading to cuts in essential public services. The positive consequences are often more focused on corporate profits and investment, with less immediate benefit to lower-income individuals.

Table: Potential Impact of Tax Cuts on Various Income Levels, Opinion republicans want the poor to pay for trumps tax cuts

| Tax Provision | Potential Impact on Low-Income Individuals | Potential Impact on Middle-Income Individuals | Potential Impact on High-Income Individuals |

|---|---|---|---|

| Increased Standard Deduction | Minor benefit | Moderate benefit | Limited benefit |

| Tax Credits for Investment | Minimal benefit | Minimal benefit | Significant benefit |

| Reduced Top Marginal Rates | Minimal or no impact | Minimal or no impact | Significant benefit |

Historical Precedents and Comparisons

Looking back at history provides crucial context for understanding the potential consequences of tax cuts, particularly those that disproportionately affect lower-income groups. Examining past policies reveals patterns and outcomes that can shed light on the likely impact of current proposals. These historical precedents offer valuable lessons about the potential unintended social and economic ramifications of such policies.

Examples of Disproportionate Tax Cuts in History

Historical instances of tax cuts favoring higher-income individuals have often led to widening income inequality. Analyzing these events allows for a more nuanced understanding of the potential consequences of similar policies today.

| Historical Event | Impact on Lower-Income Groups | Outcomes and Consequences | Comparison to Current Tax Cuts |

|---|---|---|---|

| The 1981 Reagan Tax Cuts | While some saw economic growth, lower-income families experienced reduced government assistance and a stagnant or declining standard of living. | Increased income inequality and a widening gap between the rich and poor. Some sectors saw job losses and slower growth, and the long-term effects on the economy are still debated. | These cuts were accompanied by a significant rise in defense spending, which is not a factor in the current discussions, potentially affecting the economic impact. |

| The 2001 and 2003 Bush Tax Cuts | Reduced tax burdens for high-income earners were significant, while lower-income families saw minimal or no benefit. Government programs aimed at poverty reduction were also affected. | Economic growth was uneven, with some sectors experiencing robust expansion, while others faced stagnation or decline. The tax cuts contributed to a rise in national debt. | The 2001-2003 cuts saw a larger focus on individual income tax reductions. The current tax discussions are more focused on corporate and business tax reductions, which could have different outcomes. |

| The 1920s Tax Cuts | Reduced taxes on the wealthy, contributing to significant income inequality, and weakened the government’s ability to fund social programs. | The tax cuts, coupled with other economic factors, ultimately contributed to the Great Depression. | This era demonstrates how significant tax cuts, particularly those benefiting the wealthy, can create a fragile economic environment that is vulnerable to shocks. |

Lessons Learned from Past Tax Cuts

Examining past instances of tax cuts reveals key lessons about their potential impact. These historical experiences demonstrate that tax policies have far-reaching consequences, affecting not just economic growth but also social equity and long-term economic stability.

- Weakening of Social Safety Nets: Historical examples show that tax cuts can often lead to reductions in government funding for social programs and safety nets, disproportionately impacting lower-income households who rely on these services.

- Increased Income Inequality: Tax cuts often result in increased income inequality, creating a widening gap between the wealthy and the poor. The historical evidence suggests a correlation between these policies and rising economic disparities.

- Unpredictable Economic Impacts: The long-term economic impacts of tax cuts can be difficult to predict. Historical cases highlight the potential for uneven economic growth and negative consequences for some sectors.

Wrap-Up

In conclusion, the proposition that the poor will shoulder the burden of Republican tax cuts raises significant concerns about economic fairness and social equity. The analysis reveals potential pitfalls in economic models, political motivations, and public perception. The need for alternative policy solutions that prioritize the well-being of all income groups becomes evident. This complex issue demands further scrutiny and a thorough evaluation of all potential consequences.