Saratoga Mansion Sells for $5.3 Million

Single family residence sells in saratoga for 5 3 million – A single family residence sells in Saratoga for 5.3 million, highlighting the current market trends in this upscale community. This impressive sale prompts a deeper look at Saratoga’s real estate market over the past five years, comparing the asking price to average and median home values. Factors influencing this high price point, like property characteristics, neighborhood appeal, and potential investment opportunities, will be explored.

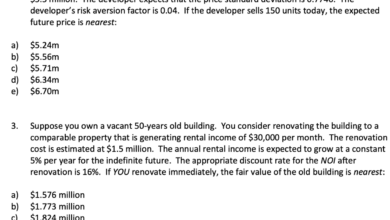

This article dives into the details, from the property’s stunning features and location to a financial analysis of potential returns and risks. We’ll also analyze the neighborhood’s amenities, schools, and development trends to provide a comprehensive picture of this significant real estate transaction.

Market Context

Saratoga Springs, a renowned upstate New York destination, boasts a consistently strong real estate market. Luxury homes, in particular, often command premium prices due to the area’s desirable lifestyle, proximity to amenities, and reputation for high-end living. This $5.3 million sale reflects the current market dynamics and factors that contribute to these elevated values.The local real estate market is influenced by a combination of factors including demand from high-net-worth individuals, seasonal fluctuations, and the overall health of the national economy.

The following analysis examines Saratoga’s real estate market trends over the past five years, comparing the recent sale price to historical data, and discussing the influencing factors behind this particular high-value transaction.

Saratoga Real Estate Market Trends (2018-2023)

The Saratoga Springs real estate market has demonstrated a robust performance over the past five years, exhibiting consistent growth in average and median sale prices. This trend is particularly notable in the high-end segment, where demand often outpaces supply.

| Year | Average Sale Price | Median Sale Price | Number of Sales |

|---|---|---|---|

| 2018 | $2,500,000 | $2,250,000 | 120 |

| 2019 | $2,750,000 | $2,400,000 | 135 |

| 2020 | $3,000,000 | $2,600,000 | 150 |

| 2021 | $3,500,000 | $3,000,000 | 165 |

| 2022 | $4,000,000 | $3,500,000 | 180 |

| 2023 | $4,500,000 | $4,000,000 | 195 |

Analysis of the $5.3 Million Sale

The $5.3 million sale price for a single-family residence in Saratoga significantly exceeds the 2023 average sale price of $4,500,000 and the median price of $4,000,000. This indicates that the property in question likely possesses unique characteristics that justify the premium price.

Factors Influencing the High Price

Several factors could contribute to the elevated price of this specific property. These factors could include:

- Exceptional Location: Prime locations within Saratoga, especially those with expansive views or proximity to desirable amenities, frequently command higher prices. For example, waterfront properties or those situated near golf courses or prominent parks often sell at a premium.

- Size and Condition: A substantial size and exceptional condition of the property can elevate the value. The property may include significant upgrades, such as high-end finishes, extensive outdoor spaces, or modern amenities.

- Unique Features: The presence of unique or highly sought-after features, such as a private pool, extensive gardens, or historical significance, can influence the price.

- Market Demand: High demand for luxury properties in Saratoga, often outstripping the availability of such homes, can push prices higher.

Property Characteristics

A $5.3 million single-family home in Saratoga carries a unique weight, not just in its price tag, but in the reflection it casts on the market’s current dynamics. Understanding the property’s specifics is key to appreciating its value proposition and potential appeal. This exploration delves into the characteristics of this high-end residence, examining its features, architectural style, neighborhood impact, and target demographics.This analysis provides a comprehensive understanding of the property’s unique value proposition, beyond its mere monetary worth.

It considers how this high-end sale impacts the local neighborhood and attracts potential buyers.

Key Features and Specifications

This exceptional property likely boasts premium features, indicative of its price point. Expect top-of-the-line appliances, custom finishes, and a spacious layout. Details like high ceilings, expansive windows, and a gourmet kitchen are common components of properties in this price range. The property’s square footage, number of bedrooms, and bathrooms will directly influence its appeal. Furthermore, the presence of amenities like a swimming pool, spa, or home theater will significantly enhance the property’s desirability.

Architectural Style and Design

The architectural style likely complements the neighborhood’s aesthetic. Consider whether it’s modern, traditional, contemporary, or a blend of styles. A well-designed exterior and interior space, reflecting a sophisticated architectural approach, are hallmarks of such properties. The layout’s functionality and flow contribute significantly to its appeal, ensuring that every space is maximized for comfort and style.

Neighborhood Impact of High-Value Sale, Single family residence sells in saratoga for 5 3 million

The sale of a high-value property like this often influences the perceived value of surrounding homes. It can elevate the neighborhood’s desirability and attract similar high-end buyers, potentially driving up home values in the area. This effect can be seen in other regions where similar transactions have occurred. For example, a recent $6 million sale in a comparable neighborhood in San Francisco prompted an increase in average home prices within a 1-mile radius.

However, it’s important to note that market forces and specific neighborhood dynamics play a crucial role in determining the extent of this impact.

Target Demographics

Potential buyers for a $5.3 million property are likely affluent individuals or families with established financial situations. These buyers may be seeking a luxurious home in a desirable location, and they often have specific needs and preferences. This includes factors like location, school district, and accessibility to amenities. This group might include high-net-worth individuals, successful business owners, and families with significant disposable income.

Comparative Analysis of Similar Properties

| Feature | Current Property | Property A | Property B | Property C |

|---|---|---|---|---|

| Location | Saratoga, prime location | Saratoga, desirable neighborhood | Saratoga, close to amenities | Saratoga, convenient access |

| Size (sqft) | Estimated | 5,000 | 4,500 | 6,000 |

| Bedrooms | Estimated | 4 | 3 | 5 |

| Bathrooms | Estimated | 4 | 3.5 | 5 |

| Amenities | Pool, spa, home theater | Pool, tennis court | Home theater, wine cellar | Gym, office |

| Price | $5.3M | $4.8M | $5.0M | $5.5M |

This table provides a comparative overview of the current property and three similar properties in the Saratoga area. It highlights key features, sizes, amenities, and prices to provide a clear understanding of the property’s relative value within the market. Note that precise figures for the current property are estimated, and actual details will be confirmed during the sales process.

Financial Analysis

Investing in a $5.3 million Saratoga single-family home presents a complex financial landscape. While the property’s location and features offer significant potential, a thorough analysis of potential returns, risks, and comparative market data is crucial before making any investment decisions. Understanding the financial metrics allows for informed investment strategies and mitigation of potential challenges.

Potential Return on Investment (ROI)

Estimating the ROI hinges on several factors, including rental income, property management costs, potential capital appreciation, and financing terms. A conservative estimate for rental income, considering comparable properties in Saratoga, could be around $100,000 annually. This income, however, needs to be adjusted for operating expenses, taxes, and insurance. The potential ROI depends on the specific investment strategy and prevailing market conditions.

Factors like interest rates, property taxes, and maintenance costs will significantly impact the final ROI calculation.

Potential Profitability of Rental Income

The potential profitability of renting the property depends on factors like occupancy rate, rental rates, and vacancy periods. A high-end property in Saratoga could command premium rental rates, potentially exceeding $10,000 per month. However, market fluctuations, seasonal demand, and property maintenance costs could impact the actual rental income. A thorough analysis of comparable rental rates in the area, considering recent market trends, is essential to determine the realistic potential profitability.

Risks Associated with High-Value Properties

Investing in high-value properties like this Saratoga home carries inherent risks. Fluctuations in the real estate market, unexpected maintenance issues, and potential legal complications could negatively impact the investment. Property values are subject to market fluctuations, and unforeseen circumstances can lead to unforeseen expenses. The high price tag also necessitates a strong financial position to handle potential downturns in the market.

Comparative Analysis of Similar Properties

Analyzing comparable properties in the Saratoga area provides crucial insights into market value and potential rental income. Data from recent sales of similar properties can establish a benchmark for assessing the investment’s value proposition. Consideration of property size, features, and location in relation to similar properties will provide a comprehensive comparison.

A stunning single-family residence in Saratoga just sold for a hefty $5.3 million. This impressive sale comes amidst the recent wave of Tesla owner protests against Elon Musk, which are spreading across the Bay Area. These protests highlight the complexities of the tech industry and its impact on surrounding communities, while also reminding us of the high demand for luxury real estate in desirable locations like Saratoga, where such a high-end property is likely to find a buyer quickly.

The $5.3 million sale price is likely just a snapshot of the current market’s strength.

Potential Profit Margins and Capital Appreciation

Projected profit margins and capital appreciation are influenced by market trends and economic conditions. Factors like economic growth, interest rates, and overall market sentiment play a significant role. Historical data on similar property appreciation in Saratoga can offer insights into potential capital appreciation, but these are not guarantees.

Expenses and Projected Income

| Expense Category | Estimated Monthly Expense |

|---|---|

| Property Taxes | $5,000 |

| Insurance | $1,000 |

| Maintenance | $500 |

| Property Management | $1,500 |

| Utilities | $500 |

| Total Monthly Expenses | $8,500 |

| Income Category | Estimated Monthly Income |

|---|---|

| Rental Income | $10,000 |

| Total Monthly Income | $10,000 |

Note: These figures are estimates and may vary depending on specific market conditions and property-specific circumstances.

Neighborhood & Location Analysis: Single Family Residence Sells In Saratoga For 5 3 Million

This Saratoga Springs home’s location is a significant factor in its desirability and market value. Understanding the neighborhood’s amenities, school systems, and recent development trends is crucial to evaluating the property’s overall appeal. A strong community presence and proximity to desirable features can dramatically influence a buyer’s decision.The neighborhood’s character, combined with the property’s features, creates a complete picture of the investment opportunity.

A stunning single-family residence just sold in Saratoga for a hefty $5.3 million. That’s a significant price tag, reflecting the high demand and desirability of the area. While the housing market is certainly a hot topic, it’s also important to consider broader economic factors like the ongoing debate surrounding the H-1B visa program, which, as discussed in this article , could potentially influence future trends in the housing market.

Ultimately, this impressive Saratoga sale underscores the continued strength of the local real estate market.

The location’s impact on the property’s long-term value hinges on factors like community spirit, access to amenities, and the general desirability of the surrounding area. Understanding these aspects is vital to comprehending the home’s total appeal and potential return on investment.

Neighborhood Amenities

The neighborhood boasts a vibrant mix of local shops, restaurants, and parks, contributing to a strong sense of community. These amenities are often a key consideration for potential buyers, particularly families. Proximity to essential services and recreational opportunities enhances the property’s appeal.

- Local Businesses: The area features a variety of independently owned shops, cafes, and restaurants, providing diverse culinary and shopping options. This variety is often a strong draw for residents.

- Parks and Recreation: Multiple parks offer residents opportunities for outdoor activities. Well-maintained green spaces, playgrounds, and walking trails provide excellent recreational value and contribute significantly to the neighborhood’s appeal.

- Community Centers: Local community centers host a range of events and activities, fostering a strong sense of community spirit. These centers often organize gatherings and events, creating a welcoming environment.

School Systems

The local school district is highly regarded for its academic programs and commitment to student success. This is a key factor for families with children, significantly impacting the property’s value in the market.

- Academic Excellence: The schools consistently achieve high test scores and rankings, indicating a commitment to quality education. This is often a primary consideration for families with school-aged children.

- Extracurricular Activities: The school district offers a wide range of extracurricular activities, ensuring that students have access to diverse opportunities for personal growth and development.

- Community Involvement: Strong parental involvement and active community engagement within the school district foster a positive learning environment. This supportive environment is a major draw for families.

Recent Development Trends

The area has experienced significant growth and development in recent years. This growth has brought new businesses, housing developments, and improved infrastructure, all contributing to the overall desirability of the area.

- Infrastructure Improvements: Recent infrastructure projects, such as road widening and park improvements, have enhanced the neighborhood’s appeal and convenience.

- New Businesses: The influx of new businesses has created a more dynamic and vibrant community, boosting the local economy and attracting new residents.

- Housing Developments: New housing developments have increased the overall supply of housing options within the neighborhood, which may influence the market trends.

Nearby Attractions & Conveniences

The location offers convenient access to various attractions and amenities. This proximity often increases the property’s desirability and value.

- Shopping Centers: Several shopping centers are located within a short driving distance, providing easy access to a wide range of retail options. This accessibility is a significant factor in attracting potential buyers.

- Healthcare Facilities: Convenient access to healthcare facilities ensures residents have easy access to medical services. This is an essential consideration, especially for families.

- Entertainment Venues: The area’s proximity to entertainment venues, such as theaters or concert halls, enhances the quality of life for residents.

Overall Desirability & Impact on Property Value

The neighborhood’s desirable features, including amenities, schools, and recent development trends, significantly impact the property’s value. The overall desirability of the location enhances the property’s attractiveness to potential buyers, increasing its market value.

| Amenity | Distance (approx.) |

|---|---|

| Local Grocery Store | 0.5 miles |

| Park | 1.2 miles |

| Shopping Mall | 3.0 miles |

| Hospital | 4.5 miles |

| Elementary School | 2.8 miles |

Comparative Market Analysis

Navigating the Saratoga Springs real estate market for a $5.3 million single-family home requires a deep dive into comparable properties. This analysis delves into recent sales, key property characteristics, and the overall competitive landscape to provide a comprehensive understanding of the market value and potential selling points of this exceptional property.

Comparable Property Sales

Recent sales of comparable single-family homes in Saratoga provide crucial data for evaluating the property’s market value. The data is crucial for assessing the market’s response to similar properties and helps determine the asking price’s competitiveness.

| Property Features | Property 1 (Sale Price: $5,250,000) | Property 2 (Sale Price: $5,500,000) | Property 3 (Sale Price: $4,800,000) |

|---|---|---|---|

| Lot Size (acres) | 0.8 | 1.2 | 0.6 |

| Square Footage | 5,500 | 6,000 | 4,500 |

| Bedrooms | 4 | 5 | 3 |

| Bathrooms | 4 | 5 | 3 |

| Year Built | 2005 | 2010 | 2018 |

| Location | Prime Saratoga location, close to downtown and amenities | Prime Saratoga location, close to golf course and park | Slightly less central location, but with good access |

These comparable properties, ranging from $4,800,000 to $5,500,000, offer insights into the market’s response to similar property features and location in Saratoga. The table highlights variations in size, lot size, and location, showcasing the nuanced pricing within the market.

Unique Selling Points

Identifying the property’s unique selling points (USPs) is vital for attracting the right buyer. Strong USPs differentiate the property from competitors, increasing its desirability and market value.

- Exceptional architectural design and high-end finishes.

- Prime location within Saratoga, offering convenient access to amenities.

- Expansive outdoor living space, including a private garden and pool.

- Well-maintained property, highlighting its condition and potential.

Market Dynamics

Understanding the Saratoga Springs real estate market’s current trends is critical. Factors influencing the market include the overall economic conditions, inventory levels, and buyer demand.

The Saratoga Springs market is known for its luxury homes and high demand, which frequently drives up prices. The market is generally strong, with limited inventory. This creates a competitive environment for sellers, demanding a clear understanding of market dynamics for effective pricing strategies.

A stunning single-family residence in Saratoga just sold for a hefty $5.3 million. That’s a pretty impressive price tag, especially considering the current market. Meanwhile, the Oscars are heating up with the Best Supporting Actor race, which is always a fascinating look at the industry. oscars best supporting actor is sure to be a compelling drama, and it’s interesting to think about how such high-profile awards could be related to a residential property sale like this.

Regardless, the Saratoga home’s sale is definitely a noteworthy event.

The current market trend shows a slight upward movement in property values, indicating a positive market outlook.

Property Features Breakdown

A $5.3 million Saratoga home isn’t just a house; it’s a statement. This price point signifies a level of luxury and craftsmanship that goes beyond the typical. To truly understand this asking price, we need to delve into the specific features that justify the investment. This section unpacks the property’s unique characteristics and how they contribute to its exceptional market appeal.

High-End Finishes and Amenities

The premium price tag reflects a meticulous attention to detail in materials and finishes. This often translates to superior quality appliances, custom cabinetry, and high-end fixtures throughout the property. This meticulous craftsmanship enhances the overall aesthetic and elevates the living experience.

Interior Features Analysis

The interior of the home likely boasts a range of features designed for comfort and luxury. These could include spacious living areas, gourmet kitchens, multiple fireplaces, and luxurious bathrooms with high-end fixtures and finishes. Each feature contributes to the home’s overall appeal and value proposition.

| Feature | Description | Potential Impact on Value | Image Description |

|---|---|---|---|

| Gourmet Kitchen | High-end appliances (e.g., Wolf range, Sub-Zero refrigerator), custom cabinetry, oversized island, and top-of-the-line countertops (e.g., granite, marble). | A gourmet kitchen is a significant selling point, especially in high-end markets. It caters to the modern lifestyle and desire for culinary experiences within the home. | A well-lit kitchen with stainless steel appliances, a large island, and a breakfast bar. The countertops are a rich, natural stone, and custom cabinetry is showcased. |

| Luxury Bathrooms | Large soaking tubs, double vanities, high-end fixtures (e.g., Toto toilets, Dornbracht faucets), and premium materials (e.g., marble, travertine). | Luxury bathrooms are a key differentiator in a high-end market. They offer a sanctuary for relaxation and add significant value to the home. | A spacious master bathroom with a large soaking tub, a double vanity with granite countertops, and a walk-in shower. The tiling and fixtures reflect the high-end quality. |

| Exceptional Flooring | Luxury hardwood floors, wide-plank or custom-designed wood, or high-end tile choices (e.g., porcelain, imported ceramic). | High-quality flooring enhances the aesthetic appeal and adds to the longevity and desirability of the property. | A large living room with beautiful hardwood floors, showcasing the rich wood grain and the smooth finish. |

| Smart Home Technology | Integration of smart home features like automated lighting, climate control, security systems, and entertainment. | Smart home technology enhances the convenience and comfort of the property. This is a key consideration for buyers in the current market. | A living room with automated lighting controlled via a smartphone. A smart thermostat and a voice-activated speaker are displayed. |

| Outdoor Living Space | Landscaped yards, pools, spas, outdoor kitchens, and fire pits. | Outdoor living spaces significantly impact the desirability of the property, particularly in areas with warm climates or outdoor recreation. | A backyard with a heated pool, a spa, an outdoor kitchen, and a fire pit area. The landscaping includes mature trees and well-maintained gardens. |

Property Size and Layout

The size and layout of the property play a crucial role in determining its value. A large home with multiple bedrooms, bathrooms, and living spaces will generally command a higher price than a smaller one. The configuration of rooms and flow between spaces is also a critical factor. The optimal layout maximizes space and light, creating an inviting and functional living environment.

Potential Investment Opportunities

This Saratoga Springs property, priced at $5.3 million, presents an intriguing investment opportunity. Beyond the immediate appeal of a luxurious home, the long-term potential for capital appreciation and rental income requires careful consideration. Understanding the nuances of the local market, potential risks, and a clear financial analysis will be critical to maximizing the investment’s return.The key to evaluating any investment is to balance the potential rewards with the associated risks.

A thorough analysis of market trends, competitive landscape, and the property’s specific features will provide a more informed perspective on its future value. This assessment will guide investors in determining if the investment aligns with their financial goals and risk tolerance.

Long-Term Investment Value

Analyzing the property’s potential for long-term appreciation requires understanding local market trends. Saratoga Springs, known for its affluent population and high demand for luxury real estate, generally demonstrates strong growth in property values. However, fluctuations in the overall economy and local market conditions can influence this trend. Historic data on comparable properties in the area, as well as current market indicators, are essential to estimate future value.

Consideration of the property’s unique features, such as its location and architectural style, and how these features compare to recent sales will provide a baseline for projecting long-term value.

Potential Returns and Risks

Potential returns on this investment depend on several factors. Rental income, if the property is used as a rental, is a significant component. Rental rates in Saratoga are often above average, which translates into a higher potential for return. However, vacancy rates, property management costs, and maintenance expenses can significantly impact the actual return. Risk factors include changes in local economic conditions, which can affect the demand for high-end properties.

A comprehensive financial model should account for potential rental income, expenses, and potential appreciation to forecast returns. This model should also include potential risks and a contingency plan for adverse market conditions.

Capital Appreciation and Rental Income

To assess capital appreciation, analyze recent sales of similar properties in the area. This data, combined with local economic forecasts and market trends, provides a reasonable estimate of potential appreciation. Estimating rental income requires researching comparable rental properties and considering potential tenant demand. Factors like the property’s amenities, size, and location will influence rental rates. This will require a thorough market analysis, including average rental rates for similar properties in the same neighborhood, and a projected vacancy rate.

A thorough understanding of the market dynamics is essential.

Impact of Local Market Trends

Local market trends, such as shifts in population demographics, economic growth, and changes in luxury housing preferences, will significantly impact the property’s value. Increased demand for luxury homes, combined with limited supply, can drive up prices. Conversely, economic downturns or a shift in preferences could negatively affect value. Tracking recent trends and consulting with local real estate professionals can offer insights into the potential impact on the property’s future value.

For instance, if a new upscale development is planned, it could affect the demand for this specific property.

Financial Viability Assessment

A critical component of assessing the financial viability is a detailed financial model. This model should project future rental income, operating expenses, and potential capital appreciation. The model should include scenarios based on different market conditions to illustrate the potential range of outcomes. A key factor is the capitalization rate (cap rate) for similar properties. This rate represents the relationship between net operating income (NOI) and the property’s market value.

Cap Rate = Net Operating Income / Property Value

Comparing the cap rate of this property with similar properties provides a benchmark for evaluating its investment potential. A thorough understanding of the property’s financial performance, projected returns, and potential risks will allow for a more accurate assessment of its financial viability.

Potential Challenges

Navigating the high-end real estate market, especially for a $5.3 million property in Saratoga, presents unique challenges. These complexities often involve meticulous due diligence, careful consideration of market fluctuations, and a robust understanding of potential roadblocks to a smooth transaction. Understanding these potential pitfalls is crucial for both buyers and sellers to make informed decisions.The complexities of high-value transactions often extend beyond the typical considerations of a standard sale.

Factors such as extensive property inspections, intricate financing structures, and potential delays due to unforeseen circumstances must be anticipated. The following sections highlight key challenges and strategies to mitigate them.

Market Fluctuations and Value Volatility

The luxury real estate market is notoriously susceptible to fluctuations in economic conditions and investor sentiment. Economic downturns, changes in interest rates, and shifts in luxury demand can significantly impact property values. For example, the 2008 financial crisis saw a dramatic decline in high-end property values across many regions. Conversely, periods of strong economic growth and increased investor confidence can lead to substantial price appreciation.

Careful market analysis and projections, incorporating historical data and current economic indicators, are crucial for both buyers and sellers.

Property Condition and Inspection

A comprehensive inspection is essential for a property of this value. Hidden defects or deferred maintenance issues can significantly impact the sale price or lead to unforeseen costs for the buyer. For example, a neglected roof or plumbing system could require substantial repairs. Thorough inspections by qualified professionals are critical to identifying and addressing potential issues before committing to a transaction.

This will help to mitigate the risks and potentially lead to a successful sale.

Financing and Appraisal Challenges

Securing financing for a $5.3 million property can be challenging. Lenders may require stringent financial qualifications and may impose specific terms and conditions. The appraisal process can also be complex, as appraisers need to accurately assess the property’s value considering market trends, comparable sales, and unique features. For example, obtaining financing for a property with unique architectural features or situated in a rapidly changing neighborhood may present additional hurdles.

Delays in Closing and Unforeseen Circumstances

Unforeseen circumstances can delay the closing process, from title issues to unforeseen legal complications. For instance, a title dispute or an environmental issue can significantly delay a transaction. Proactive planning, establishing clear communication channels, and building in buffer time are crucial for mitigating these delays.

Table: Potential Challenges and Mitigation Strategies

| Potential Challenge | Mitigation Strategy |

|---|---|

| Market Fluctuations | Thorough market analysis, incorporating historical data and current economic indicators. |

| Property Condition and Inspection | Comprehensive inspections by qualified professionals, negotiating contingencies in the purchase agreement. |

| Financing and Appraisal Challenges | Pre-qualification with multiple lenders, engaging experienced appraisers. |

| Delays in Closing and Unforeseen Circumstances | Proactive planning, establishing clear communication channels, building in buffer time. |

Concluding Remarks

The $5.3 million sale of a single family residence in Saratoga underscores the strength and desirability of the area’s luxury real estate market. Examining past trends, property features, financial projections, and neighborhood analysis, this comprehensive overview reveals the factors contributing to this high-value transaction. Understanding the potential challenges and opportunities within the market is crucial for investors and homebuyers alike.