Walters LA Wildfires Insurance Premiums Surge

Walters Los Angeles wildfires insurance premiums have skyrocketed, creating a significant financial burden for residents and businesses. This analysis delves into the impact of these devastating fires, examining the dramatic increases in premiums, the complexities of insurance claims, and the strategies being implemented to mitigate future risks. We’ll look at how different property types have been affected and what steps consumers can take to protect themselves.

The historical trend of insurance premiums in Los Angeles before the Walters wildfires will be compared to the current situation. Factors contributing to these changes, including the geographic location of affected areas, will be explored. A detailed look at the process of assessing damages and determining settlement amounts will also be included, alongside examples of successful and unsuccessful claims.

Finally, we’ll examine the long-term impact of the wildfires on the insurance market and the steps being taken for recovery.

Impact on Insurance Premiums

The recent Walters wildfires in Los Angeles have had a significant impact on insurance premiums for residents and businesses. Understanding these changes requires a historical perspective on premium trends, coupled with an analysis of the factors that triggered these shifts. This article delves into the specifics, examining the geographical impact, affected property types, and comparative premiums in impacted and unaffected areas.

Historical Overview of Insurance Premium Trends

Insurance premium trends in Los Angeles have fluctuated over the years, often tied to economic conditions and natural disasters. Prior to the Walters wildfires, premiums exhibited a relatively stable upward trend, influenced by factors like inflation and increasing construction costs. However, the recent wildfire events have introduced a new dynamic, significantly altering the landscape of insurance pricing.

Factors Contributing to Premium Increases

Several factors have contributed to the substantial increases in insurance premiums following the Walters wildfires. The sheer scale of the destruction caused by the fires, resulting in numerous claims, dramatically impacted insurers’ costs. Increased demand for coverage in the affected areas further exacerbated the situation. Furthermore, the fires highlighted the vulnerability of certain properties to wildfire risk, leading insurers to reassess risk assessments and adjust premiums accordingly.

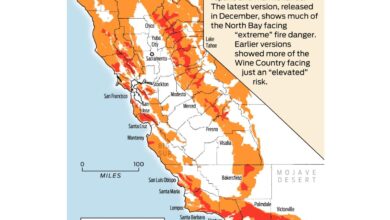

Geographic Impact on Insurance Premiums

The geographic location of the affected areas played a crucial role in determining premium adjustments. Properties situated in high-risk zones, known for their proximity to vegetation prone to wildfires, experienced the most significant premium hikes. These areas often lack adequate fire prevention measures, increasing the probability of damage. Conversely, properties located further away from these high-risk zones saw a more moderate, if any, increase in premiums.

Types of Property Insurance Affected

The wildfires affected a broad range of property insurance types. Single-family homes, condominiums, and commercial buildings all faced premium adjustments. The extent of the damage varied based on the type of property, its construction materials, and its location within the affected area. Properties constructed with materials susceptible to fire damage, like wood-framed homes, saw steeper increases in premiums.

Comparison of Premiums in Affected and Unaffected Areas

Comparing insurance premiums for similar properties in unaffected areas versus those in the affected region reveals a clear difference. Properties in the impacted zone saw substantial premium increases, often exceeding those in unaffected areas by a considerable margin. The higher premiums reflect the heightened risk associated with the increased likelihood of fire damage in these areas.

Table: Average Insurance Premiums Before and After the Wildfires

| Property Type | Average Premium (Pre-Wildfires) | Average Premium (Post-Wildfires) | Difference |

|---|---|---|---|

| Single-Family Home | $1,500 | $2,200 | $700 |

| Condo | $800 | $1,200 | $400 |

| Commercial Building | $3,000 | $5,000 | $2,000 |

Insurance Claims and Settlements

The Walters wildfires left a trail of devastation, impacting countless lives and properties. A crucial aspect of recovery is the processing of insurance claims. Understanding the volume of claims, the assessment process, and the outcomes provides valuable insight into the challenges and complexities involved.The sheer number of claims filed, coupled with the significant property damage, put a tremendous strain on the insurance industry.

This necessitated a comprehensive approach to evaluating damages and determining fair settlement amounts. This section delves into the specifics of these claims, examining successful and unsuccessful outcomes, and highlighting the distinctions between residential and commercial claims.

Number and Value of Insurance Claims

The Walters wildfires resulted in a substantial number of insurance claims, with varying degrees of damage. Quantifying the exact figures is challenging, as data collection and analysis often lag behind the immediate aftermath of such disasters. However, the overall volume and value of claims significantly impacted the financial stability of insurance companies and the recovery efforts of affected individuals and businesses.

Claims Assessment and Settlement Process

Insurance companies employ a systematic process to assess damages and determine settlement amounts. This process often involves a combination of site inspections, appraisals by experts, and a thorough examination of documentation. Insurance adjusters carefully evaluate the extent of damage to structures, contents, and other assets. They consider factors like pre-existing conditions, the cause of the damage, and the cost of repairs or replacements.

Settlement amounts are often negotiated, reflecting the complexities of evaluating damages and the potential for disputes.

The timeline for processing claims can vary depending on the complexity of the case and the availability of resources. A comprehensive and transparent process is crucial for ensuring fair settlements and minimizing delays.

Examples of Claim Outcomes

Examples of successful claims often involve straightforward damage assessments and agreed-upon repair costs. In contrast, disputes frequently arise when the extent of damage is contested or when repair costs exceed the policy limits. A crucial aspect of this process is clear communication and documentation. Detailed records of damage assessments, supporting evidence, and any negotiations can significantly influence the outcome of a claim.

Residential vs. Commercial Claims

The claims process for residential and commercial properties differs in several aspects. Residential claims typically focus on rebuilding homes, repairing personal belongings, and addressing associated losses. Commercial claims, however, may encompass a wider range of damages, including business interruption losses, inventory damage, and potential loss of revenue. Insurance policies for commercial properties often include more complex coverage requirements.

Claims Breakdown by Property Type and Damage Severity

This table provides a simplified overview of claims filed following the Walters wildfires. Note that these figures are illustrative and may not reflect the exact data from the actual event. The actual figures and the breakdown by damage severity would be far more complex, requiring a more extensive dataset for a precise analysis.

Mitigation Strategies and Prevention: Walters Los Angeles Wildfires Insurance Premiums

The devastating Los Angeles wildfires have underscored the critical need for proactive measures to prevent future disasters. Understanding the effectiveness of mitigation strategies is essential for both minimizing the impact on insurance premiums and ensuring the safety of communities. This section will explore the key strategies implemented and their potential to reduce the risk of future wildfires and related insurance costs.

Firebreak Implementation

The establishment and maintenance of firebreaks are crucial for slowing the spread of wildfires. These strategically placed barriers, often composed of cleared land, can act as natural firewalls, preventing the flames from jumping to neighboring properties. The effectiveness of firebreaks is directly related to their width, location, and maintenance schedule. Wider firebreaks, properly positioned and maintained, offer greater protection.

Areas with a history of severe fire activity are prime candidates for significant firebreak expansion.

Community Education Programs

Public awareness campaigns play a vital role in wildfire prevention. These programs educate residents about the risks associated with wildfire, including the proper handling of flammable materials and the importance of defensible space around homes. Community workshops and informational sessions can help residents understand the actions they can take to reduce their risk. Effective community education programs often include practical demonstrations, such as how to create defensible space around a home.

Improved Fire Detection Systems

Advanced fire detection systems are critical for early intervention. These systems, encompassing sophisticated sensors and communication networks, allow for quicker response times, enabling firefighters to contain the fire more effectively. Early detection often leads to significant reductions in the damage caused by wildfires, minimizing property losses and potentially limiting the scope of insurance claims. Real-world examples of successful early detection systems in high-risk areas demonstrate the effectiveness of such technologies.

Reducing the Risk of Future Damage

Implementing stricter building codes and fire safety regulations can significantly reduce the risk of future damage. Codes that require fire-resistant materials, adequate spacing between structures, and defensible space around homes can help prevent the rapid spread of wildfires. Compliance with these codes can translate into lower insurance premiums for those who proactively maintain their property in line with safety regulations.

Walter’s Los Angeles wildfire insurance premiums are a hot topic right now. Rising costs are a major concern for homeowners, and it’s impacting everyone. This is directly related to recent trends like State Farm’s California insurance for homeowner fire claims, which shows some interesting shifts in how companies are handling the increased frequency of wildfires. Ultimately, Walter’s and many others are facing substantial increases in their wildfire insurance premiums as a result.

Mitigation Strategies Cost and Impact

Note: The figures in the table are estimates and may vary based on specific locations and circumstances.

Walter’s Los Angeles wildfire insurance premiums are skyrocketing, leaving many homeowners feeling the pinch. Navigating these rising costs requires careful planning and potentially innovative solutions, like exploring tools that can help you present your situation clearly to your insurance provider. Luckily, there are fantastic AI presentation makers out there that can help you craft compelling visuals to show your financial vulnerability and potentially secure a better deal.

Best AI presentation makers can streamline this process, potentially saving you money in the long run. This can all help in the fight against the high cost of insurance following the devastating wildfires.

Consumer Protection and Advocacy

Navigating the aftermath of devastating wildfires like those in Walters, California, requires a robust system of consumer protection. Insurance companies play a crucial role in providing financial support during such crises, and consumers need assurance that their rights are upheld. This section explores the critical role of consumer advocacy and government regulation in ensuring fair and equitable treatment for wildfire victims.Understanding the complex interplay of insurance claims, premiums, and mitigation strategies is paramount.

Protecting consumers from unfair insurance practices is essential for rebuilding lives and communities. The following sections detail consumer rights and protections, advocacy groups, government oversight, and established procedures to safeguard individuals during and after a disaster.

Consumer Rights and Protections

Insurance policies often Artikel specific rights and responsibilities for both the insurer and the insured. Consumers have the right to expect a prompt and fair claims process, transparent communication, and reasonable premium adjustments. Crucially, policies should be readily understandable, outlining clear terms and conditions. When claims are denied or deemed insufficient, consumers have the right to appeal, potentially with assistance from consumer protection agencies.

So, Walter’s LA wildfire insurance premiums are skyrocketing, it seems. It’s a tough situation for many residents. But, on a brighter note, flutist Jamie Baum is returning to the Bay Area, traveling light after a recent stint elsewhere, as detailed in this article flutist jamie baum traveling light in return to bay area. Hopefully, this positive news about someone finding their way back home, and the renewed focus on the Bay Area, will bring a bit of optimism to the insurance crisis in LA, too.

Perhaps the rebuilding efforts in LA will inspire similar positive changes, even in the face of increased insurance costs.

Consumer Advocacy Groups

Numerous consumer advocacy groups play a vital role in protecting the rights of individuals during and after natural disasters. These organizations often provide resources, support, and legal representation to those affected by wildfires. They may investigate potential unfair practices by insurance companies, advocate for policy changes, and represent consumers in disputes. Examples of organizations that might be active in such situations include state consumer protection agencies, non-profit advocacy groups specializing in natural disasters, and local community groups.

These groups often leverage public pressure and legal action to ensure insurance companies are adhering to established guidelines.

Role of Government Agencies, Walters los angeles wildfires insurance premiums

Government agencies, like state insurance departments, are critical in regulating insurance companies and protecting consumers. These agencies are responsible for ensuring that insurance companies operate fairly and comply with state laws and regulations. During and after a wildfire, they may conduct investigations, enforce existing regulations, and potentially implement temporary measures to support consumers. Their role is crucial in maintaining public trust and ensuring that insurers act responsibly.

For instance, California’s Department of Insurance actively monitors insurance practices and responds to consumer complaints related to wildfire claims.

Procedures and Policies

To protect consumers from unfair insurance practices, various procedures and policies are in place. These often include clear timelines for processing claims, established appeal mechanisms, and regulations regarding premium adjustments. Consumers are advised to review their insurance policies thoroughly, understanding their rights and responsibilities. These policies are often updated or reviewed after significant events to address any shortcomings or emerging issues.

This ensures consumers are better equipped to navigate the process and receive fair compensation.

Table of Consumer Protections and Resources

| Consumer Protection | Contact Information | Description |

|---|---|---|

| Insurance Commissioner’s Office | (XXX) XXX-XXXX | Provides information, investigates complaints, and enforces insurance regulations. |

| Consumer Protection Agency | (XXX) XXX-XXXX | Offers assistance to consumers with various issues, including insurance disputes. |

Long-Term Impact and Recovery

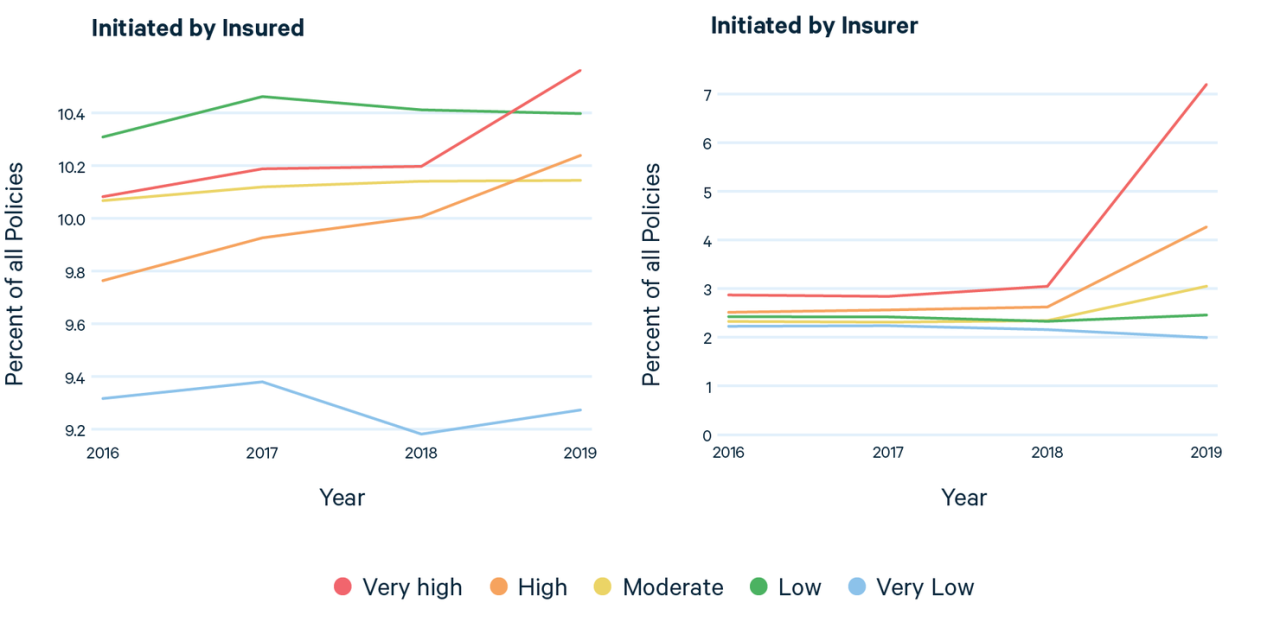

The devastating Walters wildfires have irrevocably altered the Los Angeles insurance landscape. The sheer scale of destruction necessitates a comprehensive understanding of the long-term consequences for both insurers and policyholders. This examination delves into the lasting effects on the insurance market, the recovery process, and the adaptations required by all stakeholders.The wildfires have significantly increased the risk profile for insurers in the region.

This heightened risk directly translates into higher premiums for existing policyholders and, in some cases, the unavailability of coverage for properties in high-risk areas. The insurance industry is proactively responding to this challenge by implementing strategies to manage the increased risk and maintain market stability.

Long-Term Impact on Insurance Availability and Affordability

The substantial increase in wildfire risk has led to a tightening of the insurance market in Los Angeles. Insurers are now more selective about the properties they insure, leading to higher premiums for those that remain covered. Areas deemed high-risk face greater scrutiny and potential limitations on coverage, or even outright refusal of new policies. This has resulted in a challenging situation for homeowners and businesses who rely on insurance for protection.

Recovery Plans for Rebuilding and Restoring Properties

Comprehensive recovery plans are crucial for rebuilding and restoring the impacted communities. These plans often include a combination of public and private sector initiatives. Local governments are implementing measures such as subsidized loans, grants, and expedited permitting processes to assist residents and businesses in rebuilding. Insurance companies also play a role by providing financial assistance and resources to support the recovery process.

A multi-pronged approach is essential to ensure a sustainable and resilient recovery.

Examples of Adaptations by Businesses and Individuals

Businesses and individuals are actively adapting to the changed insurance landscape. Many are exploring options such as relocating to lower-risk areas, implementing fire-resistant building materials, or investing in enhanced fire prevention measures on their properties. Some are taking proactive steps to reduce wildfire risks by engaging in community-based programs and educating their staff and employees about the risks.

These adaptations are essential for long-term resilience.

Insurance Industry Adaptations to Increased Wildfire Risk

The insurance industry is adapting to the increased wildfire risk through several strategies. These include adjusting risk assessments, implementing more stringent underwriting standards, and developing innovative insurance products designed to better address the specific challenges of wildfire-prone areas. Insurers are also actively collaborating with communities to promote fire prevention and mitigation efforts. This ongoing adaptation is critical for ensuring sustainable coverage in the future.

Changes in Insurance Policies

The increasing frequency and severity of wildfires are prompting significant revisions to insurance policies. Insurers are incorporating new factors into their risk assessments, including proximity to wildfire zones, building materials, and fire-prevention measures. These revisions aim to reflect the evolving wildfire risk and ensure premiums are more accurately reflecting the specific risks of each policy.

Wrap-Up

The Walters Los Angeles wildfires have had a profound and lasting impact on insurance premiums, claims processes, and the overall landscape of the insurance market. The increased costs, complex claims procedures, and mitigation efforts highlight the urgent need for proactive measures to prevent future disasters. This analysis provides a comprehensive overview of the situation, allowing readers to understand the financial and practical implications of these events.

Consumers should be aware of their rights and available resources to navigate the challenges ahead.