Accounting Terms for Beginner A Simple Guide

Accounting terms for beginner can seem daunting, but they’re crucial for understanding business finances. This guide breaks down essential accounting concepts, making them accessible and understandable. We’ll explore different types of accounting, fundamental terms, key financial statements, and basic principles. From simple sales transactions to the impact on financial statements, you’ll gain a solid foundation in accounting principles.

This introduction to accounting terms for beginner provides a concise and engaging overview. We’ll delve into the world of business finance with examples, tables, and a step-by-step guide to help you grasp the essentials. By the end, you’ll have a strong understanding of the core concepts and how they interact.

Introduction to Accounting

Accounting is the process of identifying, measuring, recording, and communicating financial information about an organization. It provides a structured way to track and analyze business transactions, allowing stakeholders to understand the financial health and performance of a company. This information is crucial for making informed decisions about investments, operations, and future strategies.A fundamental purpose of accounting is to provide reliable and transparent financial reports.

These reports, such as balance sheets, income statements, and cash flow statements, summarize the company’s financial position, profitability, and cash flow over a specific period. This information is vital for investors, creditors, management, and other stakeholders to assess the company’s performance and make sound decisions.

Defining Accounting Types

Accounting encompasses various branches, each serving a distinct purpose. Financial accounting focuses on providing information to external users, such as investors and creditors. Managerial accounting, on the other hand, is designed for internal use by management to make informed decisions.

Financial Accounting

Financial accounting follows established principles and standards, like Generally Accepted Accounting Principles (GAAP) in the US or International Financial Reporting Standards (IFRS) globally. These standards ensure consistency and comparability in financial reporting across different companies and industries. The primary goal of financial accounting is to present a fair and accurate picture of a company’s financial performance and position to external stakeholders.

Examples include preparing balance sheets, income statements, and cash flow statements.

Managerial Accounting

Managerial accounting provides insights for internal decision-making. It focuses on providing relevant information to management for planning, controlling, and evaluating business operations. This type of accounting is more flexible and adaptable to specific company needs, often tailored to meet particular objectives. For instance, a company might use managerial accounting to analyze sales trends, evaluate the efficiency of different departments, or forecast future costs.

Understanding Accounting Basics: A Step-by-Step Guide

1. Identifying Transactions

Recognizing all financial activities within the company, like sales, purchases, payments, and receipts. For example, a customer buying a product on credit is a financial transaction.

2. Measuring Transactions

Assigning monetary values to identified transactions. Accurate measurements are essential for correct financial reporting.

3. Recording Transactions

Systematically recording all financial transactions in a journal. This includes details like date, description, and amounts.

4. Classifying Transactions

Categorizing transactions into specific accounts based on their nature, such as accounts receivable, accounts payable, or expenses.

5. Summarizing Transactions

Preparing financial statements that consolidate and present summarized financial data in a meaningful format. For example, the balance sheet summarizes assets, liabilities, and equity.

6. Analyzing and Interpreting

Learning accounting terms for beginners can be surprisingly straightforward. You’ll encounter things like assets, liabilities, and equity, which are fundamental concepts. Just like Hershey Felder’s return to the Bay Area with Rachmaninoff on his mind signifies a passionate return to his roots, grasping these core accounting principles will lay a strong foundation for your understanding. Hershey Felder returns to bay area with Rachmaninoff on his mind reminds us that passion and dedication can lead to beautiful things.

Understanding these terms will be key to interpreting financial statements and making smart financial decisions.

Examining financial data to identify trends, patterns, and insights that provide valuable information to management for decision-making.

Key Differences Between Financial and Managerial Accounting

| Feature | Financial Accounting | Managerial Accounting |

|---|---|---|

| Users | External users (investors, creditors, government agencies) | Internal users (management, employees) |

| Purpose | Providing a comprehensive view of the company’s financial performance and position. | Supporting internal decision-making processes. |

| Standards | Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS) | Not bound by specific standards, but often follows company-specific guidelines. |

| Time Horizon | Historical data and future projections. | Focuses on both historical data and future projections for short-term and long-term planning. |

| Frequency | Usually quarterly or annually | Can be daily, weekly, monthly, or as needed. |

Essential Accounting Terms

Understanding accounting terms is crucial for anyone involved in business, from entrepreneurs to investors. These terms provide a common language for discussing financial transactions and performance. A strong grasp of these fundamentals is essential for making informed decisions and evaluating the health of a business.

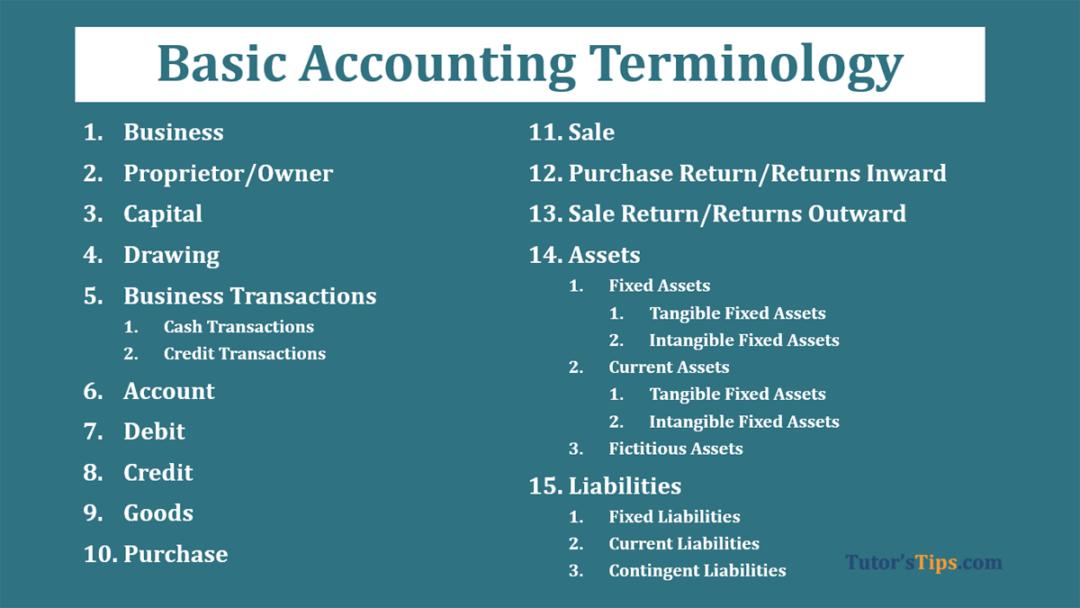

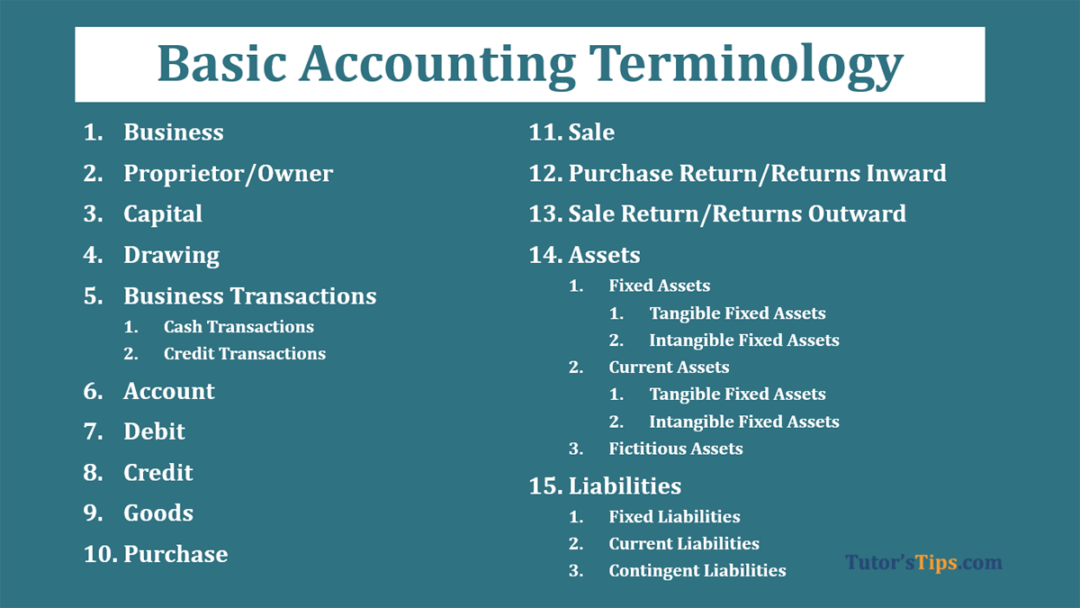

Fundamental Accounting Terms

This section introduces ten fundamental accounting terms, along with explanations, examples, and their significance in the accounting process. These terms are the building blocks of understanding financial statements and business performance.

- Assets: Assets are resources owned by a business that have future economic value. These can be tangible, like equipment and buildings, or intangible, like patents and trademarks. They represent the resources available to the company to generate revenue.

- Liabilities: Liabilities are obligations of a business to other parties. These represent what the company owes to others, whether to suppliers, employees, or lenders.

- Equity: Equity represents the owners’ stake in a business. It is calculated by subtracting liabilities from assets. It reflects the residual interest in the assets after deducting liabilities.

- Revenue: Revenue refers to the inflow of economic resources resulting from the sale of goods or services. It is the primary source of income for a business. Revenue is the total amount earned from normal business activities.

- Expenses: Expenses are the outflow of resources incurred in the process of generating revenue. They represent the costs of doing business, including wages, rent, and materials.

- Accounts Receivable: Accounts receivable are amounts owed to a company by its customers for goods or services delivered but not yet paid for. This represents money owed to the business.

- Accounts Payable: Accounts payable are amounts owed by a company to its suppliers for goods or services received but not yet paid for. This represents money owed by the business.

- Cash Flow: Cash flow represents the movement of cash into and out of a business. It’s a crucial indicator of a company’s ability to meet its short-term obligations.

- Net Income: Net income is the difference between revenue and expenses. It represents the profit earned by a business after all expenses are deducted.

- Profit Margin: Profit margin is a profitability ratio that expresses the percentage of revenue that is retained as profit. It’s calculated by dividing net income by revenue.

Illustrative Examples

The following table provides examples of each term using a fictional bakery business, “Sweet Treats.”

| Term | Definition | Example (Sweet Treats) |

|---|---|---|

| Assets | Resources owned by the business | Oven, flour, sugar, baking equipment, and cash in hand |

| Liabilities | Obligations to others | Loans from the bank, outstanding payments to suppliers |

| Equity | Owners’ stake in the business | The initial investment by the owner plus retained profits |

| Revenue | Inflow of resources from sales | Sales of cakes, cookies, and bread |

| Expenses | Costs incurred in generating revenue | Cost of ingredients, employee wages, rent |

| Accounts Receivable | Money owed by customers | Amount owed by customers who haven’t paid for their orders yet |

| Accounts Payable | Money owed to suppliers | Amount owed to suppliers for ingredients and equipment |

| Cash Flow | Movement of cash | Cash received from sales, cash paid to suppliers |

| Net Income | Profit after expenses | Revenue minus expenses |

| Profit Margin | Percentage of revenue as profit | Net income divided by revenue, expressed as a percentage |

Key Financial Statements

Understanding a company’s financial health requires delving into its key financial statements. These documents, meticulously prepared and reviewed, offer a snapshot of a company’s financial position and performance over a specific period. They are crucial tools for investors, creditors, and management alike, providing insights into profitability, liquidity, and overall financial strength.The three primary financial statements—the balance sheet, income statement, and cash flow statement—are interconnected and essential for a comprehensive understanding of a company’s financial situation.

Each statement focuses on different aspects of the business, but together they paint a complete picture.

Balance Sheet

The balance sheet provides a snapshot of a company’s financial position at a specific point in time. It summarizes assets, liabilities, and equity. Assets represent what the company owns (e.g., cash, accounts receivable, equipment). Liabilities represent what the company owes (e.g., accounts payable, loans). Equity represents the owners’ stake in the company.

A fundamental accounting principle is that assets must always equal the sum of liabilities and equity (Assets = Liabilities + Equity). This principle is crucial for ensuring the balance sheet’s accuracy.

Sample Balance Sheet (Simplified):

Getting comfortable with accounting terms can be tricky for beginners, but it’s crucial for understanding financial statements. Knowing how to properly back up your financial data is just as important, especially when dealing with sensitive information. Implementing robust data backup best practices, like those outlined in this article ( data backup best practices ), can prevent costly errors and data loss, which is something you absolutely want to avoid when managing your finances.

Ultimately, a solid grasp of these foundational accounting terms will make your financial life a lot smoother.

As of December 31, 2023

| Assets | Liabilities | Equity |

|---|---|---|

| Cash: $10,000 | Accounts Payable: $5,000 | Owner’s Equity: $15,000 |

| Accounts Receivable: $5,000 | Loan Payable: $10,000 | |

| Total Assets: $15,000 | Total Liabilities: $15,000 | Total Equity: $15,000 |

Income Statement

The income statement, also known as the profit and loss (P&L) statement, summarizes a company’s financial performance over a period of time, typically a quarter or a year. It details revenues earned and expenses incurred during that period. The difference between revenues and expenses determines the net income or net loss. A positive net income indicates profitability, while a net loss signifies that expenses exceeded revenues.

Sample Income Statement (Simplified):

For the year ended December 31, 2023

| Revenue | Expenses | Net Income |

|---|---|---|

| Sales Revenue: $25,000 | Cost of Goods Sold: $10,000 | |

| Salaries Expense: $5,000 | ||

| Rent Expense: $2,000 | ||

| Total Expenses: $17,000 | Net Income: $8,000 |

Cash Flow Statement

The cash flow statement tracks the movement of cash both into and out of a company over a period of time. It categorizes cash flows into operating activities (day-to-day business activities), investing activities (purchases and sales of long-term assets), and financing activities (raising capital and repaying debt). Positive cash flow indicates a healthy cash position, while negative cash flow suggests potential liquidity issues.

Sample Cash Flow Statement (Simplified):

Learning accounting terms for beginners can be tricky, but it’s crucial for understanding the financial world. While I’m trying to grasp concepts like assets, liabilities, and equity, it’s hard to focus when I’m distracted by the latest celebrity gossip. For example, did you see John Mulaney’s hilarious takedown of Meghan Markle and Prince Harry at the Netflix event?

This whole thing is a great reminder that even when you’re trying to understand debits and credits, sometimes a good laugh is all you need to keep things interesting. Hopefully, understanding these accounting terms will be easier after that!

For the year ended December 31, 2023

| Operating Activities | Investing Activities | Financing Activities |

|---|---|---|

| Cash from Sales: $20,000 | Purchase of Equipment: ($5,000) | Payment of Loan: ($2,000) |

| Cash from Operations: $18,000 | ||

| Net Cash from Operations: $18,000 | Net Cash from Investing: ($5,000) | Net Cash from Financing: ($2,000) |

| Net Increase in Cash: $11,000 |

Comparison of Financial Statements

| Statement | Focus | Time Period | Key Elements |

|---|---|---|---|

| Balance Sheet | Financial position | Specific point in time | Assets, Liabilities, Equity |

| Income Statement | Financial performance | Specific period (e.g., quarter, year) | Revenues, Expenses, Net Income/Loss |

| Cash Flow Statement | Cash inflows and outflows | Specific period (e.g., quarter, year) | Operating, Investing, Financing activities |

Basic Accounting Principles: Accounting Terms For Beginner

Accounting relies on fundamental principles to ensure consistency, transparency, and reliability in financial reporting. These principles, collectively known as Generally Accepted Accounting Principles (GAAP), provide a framework for businesses to prepare their financial statements, allowing investors, creditors, and other stakeholders to understand a company’s financial health and performance. Adherence to GAAP is crucial for fair and accurate financial representation.

Generally Accepted Accounting Principles (GAAP)

GAAP is a common set of accounting rules and standards that companies in the United States must follow when preparing their financial statements. These principles ensure consistency and comparability across different companies, enabling investors and other stakeholders to make informed decisions. They provide a structured approach to recording, classifying, and reporting financial transactions.

Importance of GAAP

GAAP’s importance stems from its ability to promote transparency and comparability in financial reporting. This ensures that financial statements accurately reflect a company’s financial position and performance, allowing stakeholders to make informed decisions. Consistency across companies allows for meaningful comparisons between entities and industries. The framework provides a standardized language for financial communication, fostering trust and confidence in the reported data.

Examples of GAAP Principles in Action

A company purchases inventory for $10,000. Under the matching principle, the cost of that inventory should be recognized as an expense when the related revenue is generated. This aligns expenses with the corresponding revenue they helped produce, ensuring accurate profit determination. Similarly, the cost principle dictates that assets should be recorded at their historical cost, not market value.

This principle ensures objectivity in financial reporting.

Categorized Table of GAAP Principles

| Principle | Description |

|---|---|

| Cost Principle | Assets are initially recorded at their historical cost. |

| Matching Principle | Expenses are recognized in the same period as the revenues they helped generate. |

| Revenue Recognition Principle | Revenue is recognized when it is earned, not when cash is received. |

| Full Disclosure Principle | Financial statements must include all relevant information that could impact the decisions of users. |

| Going Concern Principle | Financial statements are prepared on the assumption that the business will continue operating in the foreseeable future. |

Impact of GAAP on Financial Reporting

GAAP principles directly impact financial reporting by ensuring consistency and comparability. For instance, the revenue recognition principle mandates that revenue should be recognized when earned, not necessarily when cash is received. This practice ensures a more accurate representation of a company’s financial performance, as it records revenue when the company has completed the sales process and earned the right to the revenue.

This is distinct from cash-basis accounting, which records revenue only when cash is received. The matching principle further enhances accuracy by pairing expenses with the revenue they generate. This ensures that profits are not overstated or understated, reflecting the true economic performance of the business. Consequently, financial statements prepared under GAAP are more reliable and trustworthy, aiding stakeholders in making informed investment and credit decisions.

Common Accounting Transactions

Understanding common accounting transactions is crucial for accurately recording and reporting a company’s financial activities. These transactions form the basis of financial statements, providing insights into a company’s performance and financial position. Properly recording and classifying these transactions is essential for producing reliable financial reports.

Common Transaction Types

Common accounting transactions encompass a variety of business activities, including sales, purchases, expenses, and payments. Each transaction has a specific impact on the company’s financial statements, affecting assets, liabilities, and equity.

Impact on Financial Statements

Transactions influence the balance sheet and income statement in distinct ways. A sale, for example, increases revenue on the income statement, and simultaneously increases cash or accounts receivable on the balance sheet. Purchases affect both the balance sheet and income statement, impacting inventory and expenses.

Illustrative Transactions and Their Effects

| Transaction | Effect on Balance Sheet | Effect on Income Statement |

|---|---|---|

| Sale of goods for cash | Increase in Cash; Decrease in Inventory | Increase in Revenue; Increase in Cost of Goods Sold |

| Purchase of inventory on credit | Increase in Inventory; Increase in Accounts Payable | No immediate effect on Income Statement |

| Payment of salaries | Decrease in Cash; Increase in Salaries Expense | Increase in Salaries Expense |

| Utility expense | No direct effect on Balance Sheet | Increase in Utilities Expense |

| Collection of accounts receivable | Increase in Cash; Decrease in Accounts Receivable | No direct effect on Income Statement |

Importance of Proper Record-Keeping

Accurate record-keeping is fundamental to sound financial management. Consistent and detailed records ensure that transactions are accurately captured, providing an audit trail for verification. Errors in record-keeping can lead to inaccurate financial statements, impacting decision-making, tax obligations, and investor confidence.

Accounting Entries for a Sales Transaction

A simple sales transaction illustrates the double-entry bookkeeping system. Suppose a company sells goods for $100 cash. The accounting entries are as follows:

Cash (Asset) $100

Sales Revenue (Revenue) $100

This demonstrates the dual effect of the transaction. The increase in cash is offset by an equal increase in sales revenue. This is a crucial part of the accounting process, ensuring that every transaction is properly recorded and balanced.

Illustrative Examples

Understanding accounting principles is easier when you see them in action. This section presents a simple business scenario to illustrate how transactions are recorded and their impact on financial statements. We’ll use this example to demonstrate the accounting equation in a practical context.Applying accounting principles to real-world scenarios allows for a deeper understanding of how businesses track their financial activities.

The accounting equation is a fundamental concept that ties together all these components, providing a snapshot of a company’s financial position at any given time.

Simple Business Scenario

A bakery, “Sweet Treats,” starts operations. It buys ingredients (flour, sugar, etc.) for $500, and sells baked goods for $800. The bakery pays $200 in rent for its shop. These transactions form the basis of our example.

Recording Accounting Transactions, Accounting terms for beginner

The transactions are recorded in a journal, a chronological record of all financial activities. Each transaction is recorded with a debit and a credit, ensuring that the accounting equation remains balanced.

- Purchase of ingredients: Debit Inventory (asset) $500, Credit Cash (asset) $500. This increases the inventory and decreases the cash on hand.

- Sale of baked goods: Debit Cash (asset) $800, Credit Revenue (equity) $800. This increases cash and revenue.

- Payment of rent: Debit Rent Expense (expense) $200, Credit Cash (asset) $200. This decreases cash and increases rent expense.

Impact on Financial Statements

These transactions directly impact the balance sheet and income statement. The balance sheet reflects the assets, liabilities, and equity of the business, while the income statement shows the revenues and expenses over a period.

- Balance Sheet: The purchase of ingredients increases the asset “Inventory”. The sale of goods increases the asset “Cash”. The payment of rent decreases the asset “Cash” and increases the expense “Rent Expense”.

- Income Statement: The sale of baked goods increases revenue, and the rent expense decreases net income. The net income is calculated by subtracting total expenses from total revenues.

Accounting Equation

The accounting equation states that Assets = Liabilities + Equity. This fundamental equation must always balance. Every transaction affects at least two accounts to maintain this balance.

Visual Representation of the Accounting Equation

| Date | Account | Debit | Credit |

|---|---|---|---|

| Initial Balance | Cash | $0 | |

| Purchase of Ingredients | Inventory | $500 | |

| Cash | $500 | ||

| Sale of Goods | Cash | $800 | |

| Revenue | $800 | ||

| Payment of Rent | Rent Expense | $200 | |

| Cash | $200 | ||

| Final Balance | $1300 | $1300 |

Assets = Liabilities + Equity

In this example, the final balance of assets ($1300) equals the sum of liabilities (which are zero in this case) and equity ($1300).

Further Exploration

Diving deeper into the world of accounting reveals a wealth of resources and practical applications. This section will equip you with additional avenues for learning and understanding how accounting principles impact everyday life.

Additional Learning Resources

Understanding accounting concepts requires consistent effort and engagement. Supplementing your knowledge with external resources can significantly enhance your understanding and retention. These resources can range from comprehensive textbooks to interactive online platforms.

- Textbooks: “Accounting for Dummies” by Kenneth W. Boyd and “Financial Accounting” by Weygandt, Kimmel, and Kieso are popular choices for beginners. These textbooks offer clear explanations and practical examples, making complex concepts more approachable.

- Online Courses: Platforms like Coursera, edX, and Udemy provide numerous accounting courses, often delivered by experienced professionals. These courses often include interactive exercises and assessments, which can help you reinforce your understanding.

- Accounting Websites: Websites such as AccountingTools and Investopedia offer valuable information, definitions, and explanations of accounting terms and concepts. These sites can provide a quick reference for understanding specific terms or procedures.

- Professional Organizations: Organizations like the American Institute of Certified Public Accountants (AICPA) provide a wealth of information for aspiring accountants. Their resources often include updates on industry best practices and evolving accounting standards.

Learning Methods for Beginners

Effective learning strategies can significantly impact your comprehension of accounting. Experiment with different methods to find what works best for you.

- Practice Problems: Regularly solving accounting problems is crucial for solidifying your understanding. Start with basic exercises and gradually increase the complexity. Look for practice questions and problems in textbooks or online resources.

- Visual Aids: Utilize visual aids like flowcharts and diagrams to grasp complex processes and relationships between different accounting concepts. Visual representation can often clarify the connections between accounts, transactions, and financial statements.

- Real-World Examples: Relate accounting concepts to real-world scenarios. Consider how businesses use accounting to track their finances and make informed decisions. Understanding how businesses apply accounting concepts to solve their problems can help internalize the practical implications.

- Seek Mentorship: If possible, seek mentorship from an experienced accountant or financial professional. Their guidance and insights can provide valuable support and insights into the practical application of accounting principles.

Applying Accounting Terms in Everyday Life

Accounting principles are not limited to the business world; they have relevance in various aspects of daily life. Understanding these principles can help in making informed financial decisions.

- Budgeting: Creating and managing a budget involves fundamental accounting principles. Tracking income and expenses helps individuals understand their financial position and make informed spending decisions.

- Saving and Investing: Understanding accounting concepts like interest and returns on investments can guide informed decisions about saving and investing. Calculating returns and comparing different investment options require understanding of basic accounting principles.

- Financial Literacy: Understanding accounting principles enhances financial literacy. This empowers individuals to analyze financial statements, assess financial risks, and make better-informed financial choices.

- Personal Finance Management: Applying accounting concepts can lead to more effective personal finance management. Analyzing transactions, creating budgets, and monitoring cash flow are crucial for personal financial health.

Closure

This exploration of accounting terms for beginner has hopefully provided a clear and accessible introduction to the subject. Understanding these fundamental concepts is vital for anyone interested in business, finance, or simply navigating personal finances. Remember, consistent practice and application are key to mastering these principles. By building a strong foundation now, you’ll be well-equipped to tackle more complex financial situations in the future.