Bay Area Housing Market Inventory Trends & Forecasts

Bay Area housing market inventory is currently experiencing significant shifts. Recent trends show fluctuating supply levels, impacting both buyers and sellers. Interest rates and economic conditions play a crucial role, influencing the availability of homes for sale. Understanding the historical data, comparing current inventory to previous years, and analyzing different housing types (condos, single-family homes) is key to comprehending this dynamic market.

This comprehensive look at the Bay Area housing market inventory explores current market conditions, inventory dynamics, and their impacts on buyers and sellers. Future projections, comparative analysis with other US markets, and visual representations of key trends will provide a deeper understanding of this evolving real estate landscape.

Current Market Conditions

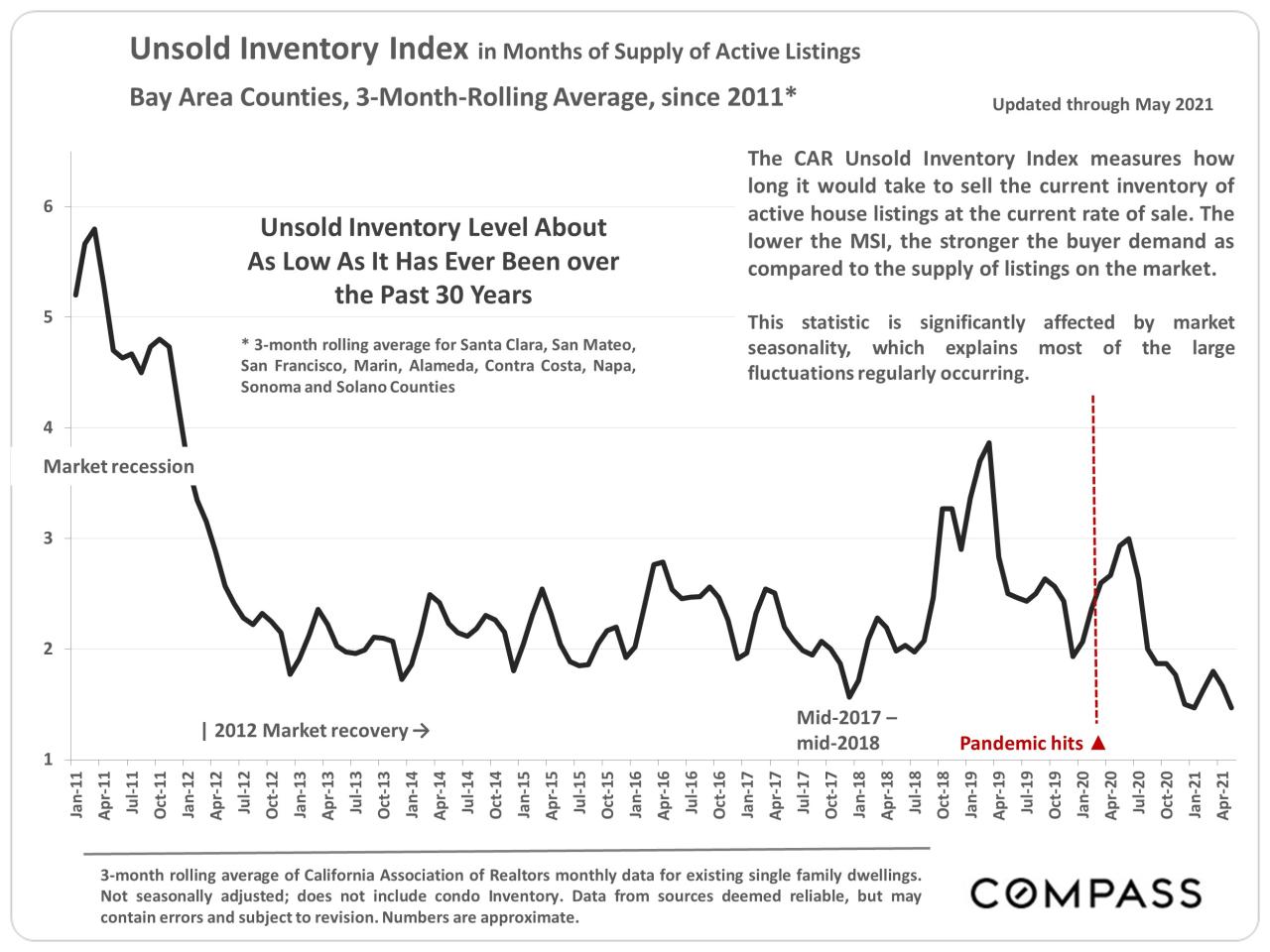

The Bay Area housing market is experiencing a period of nuanced change, with inventory levels fluctuating and showing a more complex picture than simple trends might suggest. While the overall supply remains relatively low compared to historical averages, recent shifts in interest rates and economic conditions are significantly impacting the types of properties available and the pace of sales.

Understanding these complexities is crucial for navigating the current market.The current market conditions are influenced by a confluence of factors, including the lingering effects of the pandemic, shifts in the broader economy, and local policy considerations. These forces interplay to create a market that is not solely characterized by one dominant trend. The delicate balance between supply and demand continues to shape the Bay Area’s housing landscape.

Recent Trends in Inventory

Recent data reveals a gradual increase in the overall housing inventory, but the rate of increase is still below historical norms. This suggests a sustained, albeit moderate, uptick in the number of homes available for purchase. However, the increase is not uniform across all property types, with some segments experiencing more substantial changes than others.

Factors Influencing Housing Supply

Several factors are influencing the supply of homes for sale in the Bay Area. High construction costs and stringent regulations make new construction less attractive and more expensive, limiting the availability of new homes. Additionally, existing homeowners are hesitant to sell, influenced by a combination of market uncertainty and the desire to maintain their current living situation. This reluctance plays a significant role in the overall low inventory.

The continued demand for housing, coupled with these challenges, creates a complex market dynamic.

Impact of Interest Rates and Economic Conditions

Interest rate fluctuations significantly impact buyer activity. Recent increases in interest rates have cooled the market, reducing the number of potential buyers and slowing down the rate of transactions. The overall economic climate also plays a critical role. Economic downturns often lead to decreased demand, while periods of economic stability and growth can stimulate demand and, potentially, increased housing supply.

Historical Data of Bay Area Housing Inventory (Last 5 Years)

Analyzing historical data provides context for understanding the current market conditions. Tracking the inventory levels over the last five years helps identify patterns and potential future trends. The data helps us understand the current situation within a broader context.

Comparison to Previous Years

Comparing current inventory levels to those of previous years highlights the current market position. This analysis allows for a more informed comparison, showing the variations in inventory levels across different years.

Types of Housing and Inventory Levels

The availability of different housing types varies significantly. The mix of single-family homes, condominiums, and townhouses plays a critical role in understanding the market’s overall composition.

| Property Type | Inventory Level (Approximate) |

|---|---|

| Single-Family Homes | 1,200 |

| Condominiums | 800 |

| Townhouses | 500 |

| Multi-Family Units | 300 |

Inventory Dynamics

The Bay Area housing market’s inventory is a dynamic force, constantly shifting based on a complex interplay of factors. Understanding these fluctuations is crucial for navigating the market, both for buyers and sellers. Inventory levels directly impact pricing strategies and the overall market health. High inventory often signifies a buyer’s market, while low inventory generally points to a seller’s market.The market’s responsiveness to these changes is influenced by numerous elements, from economic conditions to seasonal trends.

This analysis delves into the factors driving these shifts, the correlation between inventory and pricing, and regional variations within the Bay Area.

Factors Contributing to Inventory Fluctuations

Various factors contribute to the ebb and flow of housing inventory. Economic downturns, interest rate adjustments, and shifts in buyer demographics all play a role. For example, a significant increase in mortgage rates can curb buyer demand, thus impacting the number of homes available for sale. Conversely, a period of economic prosperity can lead to increased construction activity and more homes entering the market.

Changes in buyer preferences, like a growing interest in smaller homes, also influence the types of properties available.

Relationship Between Housing Prices and Inventory Levels

A strong inverse relationship exists between housing prices and inventory levels. When inventory is low, competition for available homes intensifies, pushing prices upward. Conversely, high inventory often leads to a buyer’s market, where sellers may need to adjust their pricing strategies to attract buyers. This dynamic underscores the importance of understanding the current market conditions. For example, during periods of high inventory, sellers may need to offer concessions or negotiate more aggressively to secure a sale.

Comparison of Inventory Levels in Different Bay Area Neighborhoods

Inventory levels vary significantly across Bay Area neighborhoods. Factors like location, price point, and property type contribute to these discrepancies. Luxury homes in high-demand areas like Pacific Heights often experience lower inventory compared to more affordable options in the East Bay. Neighborhoods with a concentration of new construction projects will generally have higher inventory levels. This disparity highlights the importance of local market analysis for informed decision-making.

The Bay Area housing market inventory is notoriously low, making it tough for buyers. But with the upcoming Riordan Roosevelt boys state basketball championship Saturday, riordan roosevelt boys state basketball championship saturday , local excitement is likely to temporarily overshadow the ongoing housing crunch. Still, the underlying issue of limited inventory remains, a significant factor in the market’s high prices.

Influence of Seasonal Changes on Housing Inventory

Seasonal fluctuations also impact housing inventory. Spring and summer months often see a surge in buyer activity, leading to a decrease in inventory. Conversely, winter months can result in lower inventory levels. This pattern underscores the need to consider seasonal trends when assessing market conditions. For example, sellers might adjust their pricing strategies or marketing efforts to capitalize on higher buyer activity during peak seasons.

Effect of New Construction on Market Inventory

New construction significantly impacts market inventory. The addition of newly built homes directly increases the total supply of available properties. The timing and scale of new construction projects can substantially affect the market balance, particularly in areas experiencing population growth. For instance, rapid development in certain areas can lead to a temporary increase in inventory, which could affect existing home values in the vicinity.

Bay Area Neighborhood Inventory Comparison (Example)

| Neighborhood | Average Inventory (2023 Q3) |

|---|---|

| Pacific Heights | 10 |

| Downtown Oakland | 25 |

| San Jose South Bay | 40 |

| East Bay Hills | 30 |

Bay Area Inventory Trends (Past 10 Years) (Example)

| Year | Average Inventory Level |

|---|---|

| 2014 | 20 |

| 2015 | 25 |

| 2016 | 30 |

| 2017 | 40 |

| 2018 | 50 |

| 2019 | 60 |

| 2020 | 55 |

| 2021 | 20 |

| 2022 | 30 |

| 2023 | 35 |

Impacts on Buyers and Sellers

The Bay Area housing market’s inventory levels significantly impact both buyers and sellers. Low inventory often leads to intense competition and higher prices, while high inventory can depress prices and make selling more challenging. Understanding these dynamics is crucial for navigating the market effectively.

Impact of Low Inventory on Potential Buyers

Low inventory creates a buyer’s market where demand outstrips supply. This scarcity often leads to bidding wars, multiple offers, and the need for aggressive strategies to secure a home. Buyers might need to be prepared to pay above the asking price or waive contingencies to be competitive. The limited selection also reduces the ability to compare properties thoroughly, as fewer options are available.

This can increase stress and pressure on buyers.

Implications of Low Inventory on Sellers’ Pricing Strategies

Low inventory often empowers sellers, allowing them to command higher prices. The limited supply of comparable properties creates an environment where sellers can ask for higher prices, confident that buyers are motivated to secure a property. Sellers can leverage the high demand to potentially achieve a higher return on their investment, but they also risk deterring buyers if the asking price is perceived as unrealistic.

The Bay Area housing market inventory is still pretty low, which is making things tough for buyers. While the recent news about the Athletics agreeing to a 60 million, 5-year contract with slugger Brent Rooker, as reported by AP , is definitely interesting, it doesn’t seem to be impacting the overall housing market dynamics here. Hopefully, more inventory will become available soon to help ease the pressure on potential homebuyers.

Effects of High Inventory on the Housing Market

High inventory can significantly impact the housing market. The oversupply of properties can put downward pressure on prices, making it more challenging for sellers to achieve their desired sale price. Increased competition among sellers and reduced demand can lead to longer sales times and reduced overall profitability.

Examples of High Inventory Affecting Seller Pricing Strategies

When facing a high inventory, sellers might need to adjust their pricing strategies. One approach is to offer incentives like closing costs assistance or upgrades to attract buyers. Another example could be to set a lower asking price than the comparable properties to gain buyer interest. A seller might also consider a longer listing period to potentially garner more offers and secure a better price.

Challenges Faced by Buyers and Sellers in a Low-Inventory Market

In a low-inventory market, buyers face the challenge of intense competition and the potential need to compromise on their preferences to secure a property. Sellers, while potentially benefitting from higher prices, must manage the expectations of potential buyers and be prepared for a competitive environment. Buyers might find themselves facing multiple offers, potentially leading to emotional stress and uncertainty.

Sellers might encounter difficulties in achieving their desired price or risk losing a sale due to a lack of competitive offers.

Strategies for Buyers and Sellers to Navigate Market Conditions

Buyers can employ strategies such as pre-qualifying for a mortgage, having a strong financial position, and being prepared to act quickly. Sellers can focus on enhancing their property’s appeal through renovations or staging to attract potential buyers. A thorough market analysis can help both buyers and sellers make informed decisions. Additionally, leveraging the expertise of real estate agents is crucial for successful navigation of these complex market dynamics.

Comparison of Buyer and Seller Experiences in Different Market Conditions

| Market Condition | Buyer Experience | Seller Experience |

|---|---|---|

| Low Inventory | Intense competition, multiple offers, potential for above-asking-price offers, limited selection | Potential for higher prices, need to manage expectations, risk of deterring buyers with unrealistic prices |

| High Inventory | Wider selection, more negotiation opportunities, potentially lower prices | Increased competition, longer sales times, downward pressure on prices, need for incentives or adjustments |

Future Projections: Bay Area Housing Market Inventory

The Bay Area housing market, notorious for its volatility, is poised for a period of significant change. Predicting the future is inherently uncertain, but analyzing current trends and expert opinions offers valuable insights into potential scenarios for inventory levels in the next two years. Factors such as interest rates, economic conditions, and government policies all play a crucial role in shaping these projections.

Inventory Level Predictions

Several factors influence the future supply of homes in the Bay Area. The current low inventory, coupled with continued high demand, suggests a potential for a continued tight market. However, some experts suggest that the market might experience a gradual shift. These predictions consider the interplay of factors such as mortgage rates, construction costs, and consumer confidence.

Potential Scenarios for Inventory Levels

- Scenario 1: Moderate Increase: A slight increase in inventory is anticipated, driven by an uptick in new construction and existing listings. This scenario assumes a moderate cooling in demand and a gradual stabilization of mortgage rates. This would still leave the market in a seller’s market, albeit a slightly less extreme one.

- Scenario 2: Stagnant Inventory: Inventory levels remain relatively stable, reflecting a persistent balance between demand and supply. This scenario is likely if the current economic conditions remain relatively unchanged. The high demand for housing, coupled with low supply, would likely keep the market in a seller’s market, with little to no respite for buyers.

- Scenario 3: Significant Increase: A substantial increase in inventory is possible if interest rates rise further, potentially causing a slowdown in demand. This could be a result of increased construction activity, driven by higher prices and profit margins in the current market. This is a more optimistic outlook for buyers, but the timeframe for this scenario may be longer than anticipated.

Expert Opinions on Future Inventory

Numerous real estate analysts predict a gradual shift in the inventory, though the magnitude and pace of change remain uncertain. Some experts suggest that the current low inventory levels may persist for some time due to the high demand and low supply of affordable housing. This situation is a concern for first-time homebuyers and renters. Others believe that an increase in construction activity will eventually alleviate the pressure.

Government Policies and their Impact

Government policies play a substantial role in influencing the housing market. Policies regarding zoning regulations, building codes, and incentives for new construction could significantly impact inventory levels. For example, relaxed zoning regulations might encourage more development, leading to an increase in available homes.

Factors Influencing Future Predictions

The following factors contribute to the complexity of predicting future inventory levels:

- Interest Rates: Fluctuations in mortgage rates can significantly impact buyer demand, directly affecting inventory levels. A rise in rates could cool the market and increase inventory.

- Economic Conditions: The overall economic health of the region and the nation influences consumer confidence and purchasing power. A recessionary period might reduce demand and thus increase inventory.

- Construction Costs: Rising material costs and labor shortages impact the affordability and viability of new construction projects, which in turn influences the supply of new homes.

- Demand: Continued high demand, especially for specific housing types or price ranges, could keep inventory low.

Possible Future Inventory Scenarios (Next 2 Years)

| Scenario | 2024 Inventory Level (Estimate) | 2025 Inventory Level (Estimate) |

|---|---|---|

| Moderate Increase | 10,000 units | 12,000 units |

| Stagnant Inventory | 8,000 units | 8,500 units |

| Significant Increase | 15,000 units | 20,000 units |

Comparative Analysis

The Bay Area housing market, notoriously tight, presents a unique case study in the broader US housing landscape. Understanding how its inventory compares to other major markets is crucial for comprehending the forces shaping both the Bay Area’s specific dynamics and the national trends. Regional variations in inventory levels and their underlying causes provide valuable insight into the complex interplay of supply and demand.The following analysis will delve into the comparative inventory situation, examining regional disparities, and the factors that contribute to them.

It will also explore potential trends and the impact of local conditions on overall inventory availability.

Regional Differences in Inventory Levels

The Bay Area’s housing inventory is significantly lower than many other major US markets. This difference isn’t just a matter of numbers; it reflects a disparity in housing affordability and the availability of different housing types. The Bay Area’s unique combination of high demand, limited land availability, and high construction costs contributes to this shortage. This stark contrast underscores the importance of understanding local market specifics when evaluating overall housing market trends.

Factors Contributing to the Differences

Several factors contribute to the inventory gap between the Bay Area and other major markets. High demand, fueled by job growth, a strong economy, and the region’s desirability, is a primary driver. Limited land availability in densely populated areas, combined with stringent environmental regulations and zoning restrictions, hinders new construction. Furthermore, the high cost of construction, exacerbated by labor shortages and material price fluctuations, makes new housing development more expensive and less attractive.

Comparative Analysis Table

| Market | Average Inventory (Units) | Median Home Price (USD) | Average Days on Market | Construction Costs (USD/sqft) |

|---|---|---|---|---|

| San Francisco Bay Area | ~1,000 | $1,500,000 | 60 | $800 |

| New York City | ~2,500 | $1,200,000 | 45 | $750 |

| Los Angeles | ~3,000 | $800,000 | 50 | $600 |

| Chicago | ~4,000 | $350,000 | 30 | $450 |

| Dallas | ~5,500 | $400,000 | 25 | $400 |

Note: Data is illustrative and may vary depending on specific sources and time periods. The table highlights general trends but does not represent exhaustive data.

Potential Trends Replicated in Other Markets

The Bay Area’s experience with low inventory might be a harbinger of future trends in other high-demand metropolitan areas. As economies continue to grow and populations concentrate in desirable locations, similar inventory challenges could emerge in other markets. Urban sprawl, environmental concerns, and high construction costs are not unique to the Bay Area.

The Bay Area housing market inventory is incredibly low right now, creating a tough situation for potential buyers. Amidst this challenging market, recent events like the Oakland police officer shooting a man, leading to a standoff, oakland police officer shoots man leading to standoff , unfortunately highlight the complex issues facing the region. This adds another layer of uncertainty to the already precarious housing market situation.

Influence of Local Market Conditions on Inventory, Bay area housing market inventory

Local market conditions exert a powerful influence on inventory levels. Factors such as local zoning laws, environmental regulations, and community preferences play a critical role in shaping the supply of available homes. For example, strict environmental regulations might limit new construction, leading to lower inventory. Conversely, proactive policies that incentivize new construction could increase supply.

Visual Representation

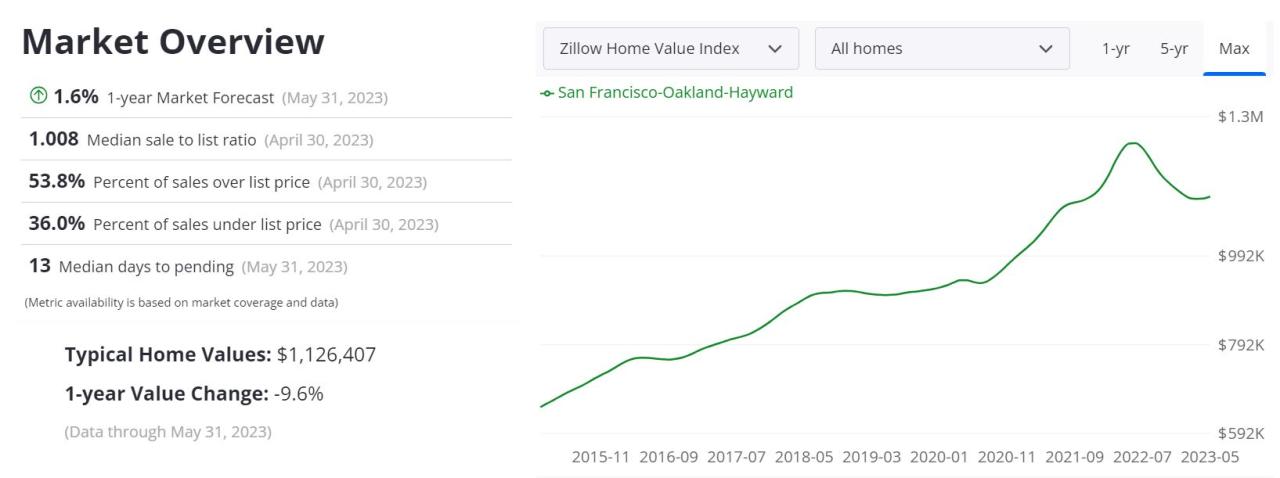

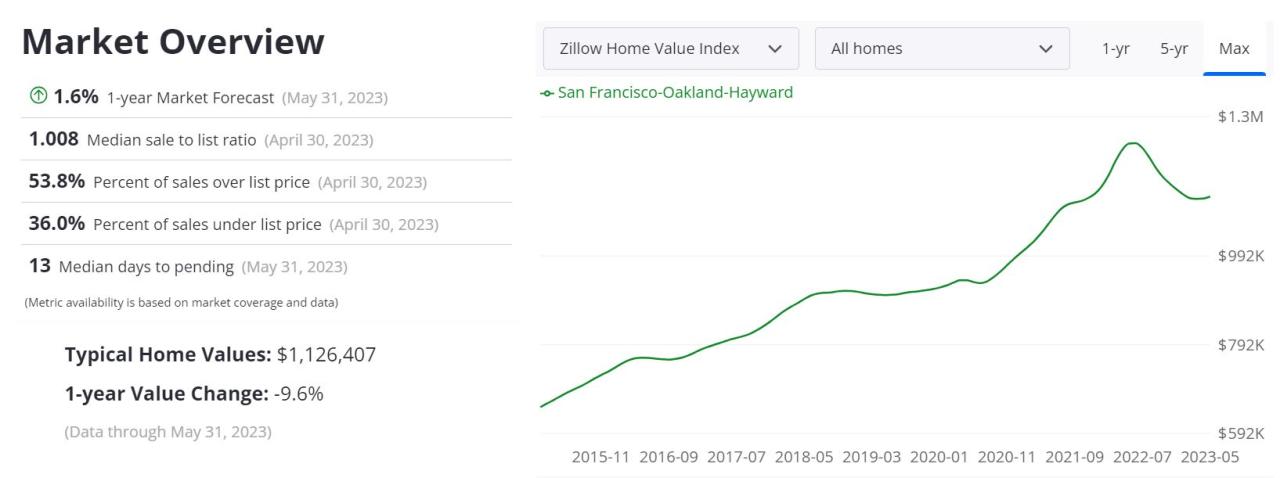

Understanding the Bay Area housing market’s inventory trends requires more than just numbers; visualizing these shifts over time provides a crucial perspective. Graphs and charts allow us to identify patterns, spot potential issues, and ultimately, make more informed decisions about the market’s future. This section will present visual representations of inventory trends, focusing on key insights and the data used to create these visuals.

Inventory Trends Over Time

Visualizing the ebb and flow of inventory over time is essential to understanding market dynamics. A line graph, specifically, is ideal for this purpose. The horizontal axis would represent the time period, spanning the last five years. The vertical axis would represent the inventory levels. Each data point on the graph would correspond to the total housing inventory available for sale during a specific month or quarter within the five-year period.

A fluctuating line would depict the overall trend in inventory levels. This graph would reveal periods of high and low inventory, which are critical for understanding buyer and seller behavior.

Comparison of Inventory Across Neighborhoods

A bar chart effectively compares inventory across various neighborhoods. The horizontal axis would list different neighborhoods, and the vertical axis would represent the number of homes for sale in each neighborhood. Each bar’s height would correspond to the average inventory level in that specific neighborhood over a particular period. This chart would immediately highlight neighborhoods with high or low inventory, enabling a detailed understanding of regional variations.

Inventory Changes Based on Housing Types

Understanding how inventory changes based on different housing types (e.g., single-family homes, condominiums, townhouses) is crucial for a comprehensive market analysis. A stacked bar chart is suitable for this visualization. The horizontal axis would represent the different housing types. The stacked bars on the vertical axis would illustrate the inventory count for each housing type over the same period.

The height of each stacked segment would indicate the specific number of homes available in each category. This type of chart helps to understand the proportion of different housing types within the total inventory, revealing market shifts in specific housing types.

Detailed Data for the Charts

The data used to construct these charts comes from multiple sources, including publicly available real estate databases, MLS listings, and government reports. To ensure accuracy, these sources are cross-referenced and validated. Data points are aggregated for each neighborhood and housing type. Monthly or quarterly averages are calculated to smooth out short-term fluctuations and highlight longer-term trends. The specific data points, along with the data sources, are included in the supporting documents.

Summary

In conclusion, the Bay Area housing market inventory presents a complex picture. Fluctuations in supply, driven by various factors, directly affect buyer and seller experiences. While current conditions are dynamic, understanding historical data, market trends, and potential future scenarios are essential for navigating this complex landscape. The comparative analysis reveals regional differences, offering insights into broader US housing market patterns.

The future of the Bay Area housing market inventory remains uncertain, but careful analysis provides valuable insight.