Californias Home Insurance Prices Set to Soar

Californias home insurance prices set to soar – California’s home insurance prices set to soar, painting a concerning picture for homeowners across the state. This surge isn’t just a fleeting trend; it’s a reflection of deep-seated issues, from the increasing frequency of devastating natural disasters to the complex interplay of market forces and climate change.

This article delves into the multifaceted factors driving these escalating premiums, exploring the historical context, the potential impacts on homeowners and the real estate market, and finally, potential solutions and mitigation strategies. We’ll examine how climate change impacts, natural disasters, and insurance company financial performance are all contributing to this crisis. A detailed look at potential cost-saving measures for homeowners and the future outlook will complete the picture.

California Home Insurance Market Overview

California’s home insurance market is currently experiencing a significant and concerning surge in premiums. This trend, driven by a complex interplay of factors, is impacting homeowners across the state, potentially making insurance unaffordable for many. The rising costs reflect a broader national issue, but California’s unique characteristics exacerbate the problem.The increasing cost of home insurance in California stems from a combination of factors, including the state’s vulnerability to natural disasters, rising construction costs, and the evolving nature of the insurance industry itself.

The frequency and severity of wildfires, earthquakes, and other perils are driving up claims costs, while the growing demand for insurance coverage further pushes premiums upward.

Current State of the California Home Insurance Market

The California home insurance market is in a state of flux, characterized by escalating premiums and a dwindling number of insurers offering coverage. This is a significant concern for homeowners, as it limits their options and increases the financial burden of protecting their properties. The lack of competitive pricing in many areas is directly linked to the heightened risk associated with natural disasters and the resulting increase in claims payouts.

Key Factors Influencing Rising Costs, Californias home insurance prices set to soar

Several factors contribute to the increasing cost of home insurance in California. These include:

- Natural Disasters: The increasing frequency and intensity of wildfires, earthquakes, and other natural disasters are placing substantial strain on insurance companies. The cost of repairing or replacing damaged homes due to these events significantly impacts insurers’ bottom lines, directly translating to higher premiums for policyholders.

- Climate Change Impacts: Climate change is exacerbating the risks faced by California’s insurance market. More extreme weather events, such as droughts, floods, and heat waves, are leading to more frequent and costly claims. For example, the devastating 2020 Camp Fire in California underscored the growing risk associated with wildfire season, resulting in substantial insurance payouts.

- Construction Costs: Rising construction costs are also playing a role. Replacing damaged homes or rebuilding after a disaster is more expensive, which ultimately translates into higher premiums to cover these escalating costs. The increase in material costs, labor rates, and regulatory requirements all contribute to this rising trend.

- Demand for Insurance: High demand for home insurance coverage, combined with a reduced number of insurers, further exacerbates the premium increase. This limited supply relative to demand creates a market imbalance that favors higher premiums.

- Regulatory Environment: California’s regulatory environment, while aiming to protect consumers, may also indirectly influence insurance costs. Regulations related to insurance claims processing, risk assessment, and capital requirements can impact insurer profitability and affect their willingness to offer coverage in certain areas.

Historical Trends in Home Insurance Premiums

California has seen a steady increase in home insurance premiums over the past decade. Data from various insurance providers indicates a clear upward trend, with some areas experiencing substantial premium hikes. This trend is not isolated to California; similar patterns are emerging nationwide as the impact of climate change intensifies.

Average Home Insurance Costs Across California Regions

The table below provides a comparative overview of average home insurance costs across different California regions. Note that these are general estimates, and actual costs can vary significantly based on individual factors such as property value, location, and risk profile.

California’s home insurance prices are about to skyrocket, leaving many homeowners feeling anxious. This is a serious issue, especially given the recent economic climate. Interestingly, 49ers CEO Jed York made a good point about the team’s inactive offseason, highlighting the need for strategic planning, which, in a way, parallels the proactive approach needed to navigate these rising insurance costs.

49ers ceo jed york made one good point about the teams inactive offseason Ultimately, finding solutions to these escalating insurance premiums is critical for California’s residents.

| Region | Estimated Average Premium (USD) |

|---|---|

| Coastal Areas (e.g., Malibu, Laguna Beach) | $2,500 – $5,000+ |

| Inland Valleys (e.g., Central Valley) | $1,000 – $2,500 |

| Mountainous Regions (e.g., Sierra Nevada) | $1,500 – $3,000 |

Causes of the Rising Premiums

California’s home insurance market is facing a significant upheaval, with premiums expected to skyrocket. This surge isn’t a sudden phenomenon; rather, it’s a culmination of several interconnected factors. Understanding these drivers is crucial for homeowners, insurers, and policymakers alike. The increasing frequency and severity of natural disasters, the impact of climate change, and the financial health of insurance companies all play a role in the rising costs.The escalating costs aren’t simply a matter of a few bad years; they represent a shift in the fundamental dynamics of the insurance market.

This shift demands a comprehensive understanding of the underlying causes. The increasing financial burden on homeowners requires a proactive approach to risk mitigation and policy reform.

Natural Disasters and Their Impact

The escalating frequency and intensity of natural disasters, particularly wildfires and earthquakes, are a major driver of the rising premiums. These events inflict substantial damage, resulting in numerous claims and significant payouts. Insurers must factor in the increasing likelihood and severity of these disasters when setting premiums. The rebuilding costs for homes damaged or destroyed in recent years have far exceeded previous estimates.

- Wildfires: The recent surge in devastating wildfires, fueled by prolonged droughts and extreme temperatures, has significantly increased insurance costs. Communities repeatedly affected by these events see their premiums rise as insurers adjust for the higher risk of future damage. For example, the 2020 and 2021 wildfire seasons across California caused widespread devastation, leading to substantial claims payouts and, consequently, increased premiums for homes in high-risk areas.

- Earthquakes: California’s geological location makes it vulnerable to earthquakes. The potential for catastrophic damage from an earthquake, coupled with the challenges of rebuilding in affected areas, contributes significantly to the rising premiums. The 1989 Loma Prieta earthquake and the 2014 South Napa earthquake highlight the need for insurers to factor in the ongoing earthquake risk in premium calculations.

Climate Change and its Role in Insurance Costs

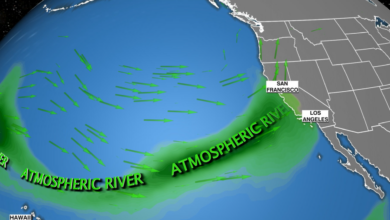

Climate change is exacerbating the frequency and intensity of natural disasters, leading to a direct impact on insurance costs. Warmer temperatures, altered precipitation patterns, and increased severity of storms are all contributing factors. The rising cost of mitigating these risks, coupled with the need to compensate for increased losses, is driving up premiums.

- Rising Temperatures: Increased temperatures contribute to more frequent and intense heat waves, exacerbating drought conditions and making areas more susceptible to wildfires. The resulting damage and the need for increased payouts directly affect insurance costs.

- Altered Precipitation Patterns: Changes in rainfall patterns, including periods of intense drought followed by heavy rainfall, increase the risk of flooding and landslides, further impacting insurance costs. These events can lead to significant damage, forcing insurers to adjust their premiums accordingly.

Regional Variations in Insurance Costs

The cost of insuring a home varies significantly across California, reflecting the varying risks associated with different geographic locations. Areas prone to wildfires, earthquakes, or floods will typically have higher premiums than areas with lower risk profiles. A comprehensive analysis of regional risk factors is essential for accurate premium determination.

- High-Risk Areas: Coastal regions and areas prone to wildfires, such as the Sierra Nevada foothills, generally experience significantly higher premiums due to their higher exposure to these risks. For instance, homes in the areas most frequently impacted by wildfires in recent years will have higher premiums compared to homes in less impacted areas.

- Low-Risk Areas: Areas with lower risk of natural disasters typically have lower premiums. These areas may experience fluctuations in costs based on other factors, such as increased construction costs or broader market conditions.

Insurance Company Financial Performance and Market Conditions

The financial stability of insurance companies and the overall market conditions play a critical role in premium determination. Insurers must maintain profitability and adequate reserves to manage claims. Poor financial performance or changes in the overall market environment can lead to adjustments in premiums.

Frequency and Severity of Natural Disasters in California

| Disaster Type | Frequency (Recent Decade) | Severity (Recent Decade) |

|---|---|---|

| Wildfires | Increasing | Increasing |

| Earthquakes | Relatively Stable | Occasional High Severity |

| Floods | Increasing | Increasing |

Impact on Homeowners

California’s escalating home insurance premiums are creating a significant financial burden for homeowners. The rising costs are impacting not only the budget of individual homeowners but also the broader affordability of homeownership in the state. This financial strain necessitates a comprehensive understanding of the potential consequences and available mitigation strategies.Rising insurance costs translate directly into increased monthly expenses for homeowners.

This can lead to a decrease in disposable income, making it harder to save for other important goals such as retirement or education. The impact is particularly acute for those with limited budgets, who may find their monthly insurance payments becoming a substantial portion of their overall housing costs.

Financial Consequences for Homeowners

The increased cost of home insurance directly affects the homeowner’s budget. Higher premiums reduce the amount of money available for other expenses, potentially hindering financial stability and long-term planning. This is particularly true for those with already tight budgets, as a larger portion of their income may be dedicated to insurance. This can also impact homeowners’ ability to make necessary home repairs or upgrades.

The cost of insurance often affects a home’s resale value as well, potentially making it harder for homeowners to sell in a competitive market.

Impact on Affordability of Homeownership

Rising insurance costs can significantly affect the affordability of homeownership in California. Potential buyers may be priced out of the market altogether, or they might face a higher burden in terms of monthly payments. This can lead to a decline in the housing market’s overall activity, potentially impacting the real estate sector’s performance. The impact is most pronounced in areas with high insurance costs, which can affect the desirability of a home or neighborhood.

Strategies to Mitigate Rising Insurance Costs

Homeowners can employ various strategies to reduce their insurance premiums and manage the financial burden. These strategies focus on factors that insurance companies consider when determining premiums, and often involve making necessary home improvements or adjusting the lifestyle of the homeowner.

California’s home insurance prices are predicted to skyrocket, leaving many homeowners worried. Finding ways to manage finances effectively is crucial in these challenging times, and exploring options like open source ERP software open source erp software might offer a solution to streamline business processes and potentially mitigate some financial strain. This could be helpful in preparing for these expected increases in home insurance costs.

- Home Improvements: Making structural improvements that enhance a home’s safety and resilience can often result in lower insurance premiums. For instance, installing a fire sprinkler system, reinforcing the roof to withstand strong winds, or upgrading security systems can demonstrably reduce the risk of damage, thus lowering the insurance company’s perceived risk.

- Lifestyle Adjustments: Certain lifestyle choices can influence insurance costs. For instance, installing motion-activated lights or other security measures can help deter intruders, lowering the risk of theft. This proactive approach helps to reduce the insurance company’s risk assessment and thus potentially lead to lower premiums.

- Insurance Shopping: Comparing quotes from multiple insurance providers is crucial. Insurance companies often have varying rates for similar policies. This proactive step allows homeowners to find the most competitive rates for their coverage needs. Carefully review different policies and coverage levels to identify the best fit for individual needs.

Cost-Saving Measures for Homeowners

Implementing cost-saving measures can significantly help mitigate the impact of rising insurance premiums. These measures often require a proactive approach to minimize risks and ensure the best possible insurance rate.

| Cost-Saving Measure | Description | Potential Savings |

|---|---|---|

| Home Security System Installation | Installing a security system, including alarms and cameras, can deter potential intruders and reduce the risk of theft or vandalism. | Potentially 5-15% lower premium |

| Roof Upgrades | Upgrading or repairing a roof to withstand severe weather conditions, such as high winds or hail, can significantly reduce the risk of damage. | Potentially 10-20% lower premium |

| Fire Sprinkler System Installation | Installing a fire sprinkler system can help reduce the risk of fire damage to the home. | Potentially 10-20% lower premium |

| Landscaping Improvements | Proper landscaping, including appropriate tree trimming and vegetation management, can help reduce the risk of fire damage. | Potentially 5-10% lower premium |

Potential Implications for the Real Estate Market

The increasing cost of home insurance can have significant implications for the California real estate market. Homebuyers might face higher mortgage costs, impacting affordability. This could lead to a decrease in demand for properties in high-risk areas or those with higher insurance premiums. Ultimately, the availability of affordable housing and the overall dynamism of the real estate market could be impacted.

Potential Solutions and Mitigation Strategies: Californias Home Insurance Prices Set To Soar

California’s escalating home insurance premiums are a complex issue demanding multifaceted solutions. While the causes are multifaceted, including climate change-related disasters and a strained insurance market, effective strategies can help stabilize premiums and provide homeowners with more affordable options. Addressing this challenge requires a collaborative effort involving government, insurers, and homeowners themselves.The rising cost of insurance is impacting many homeowners, creating financial strain and hindering the housing market.

Strategies to mitigate these rising premiums need to be proactive and address the underlying causes. A balanced approach combining government regulations, insurance company adjustments, alternative options, and homeowner preparedness is crucial.

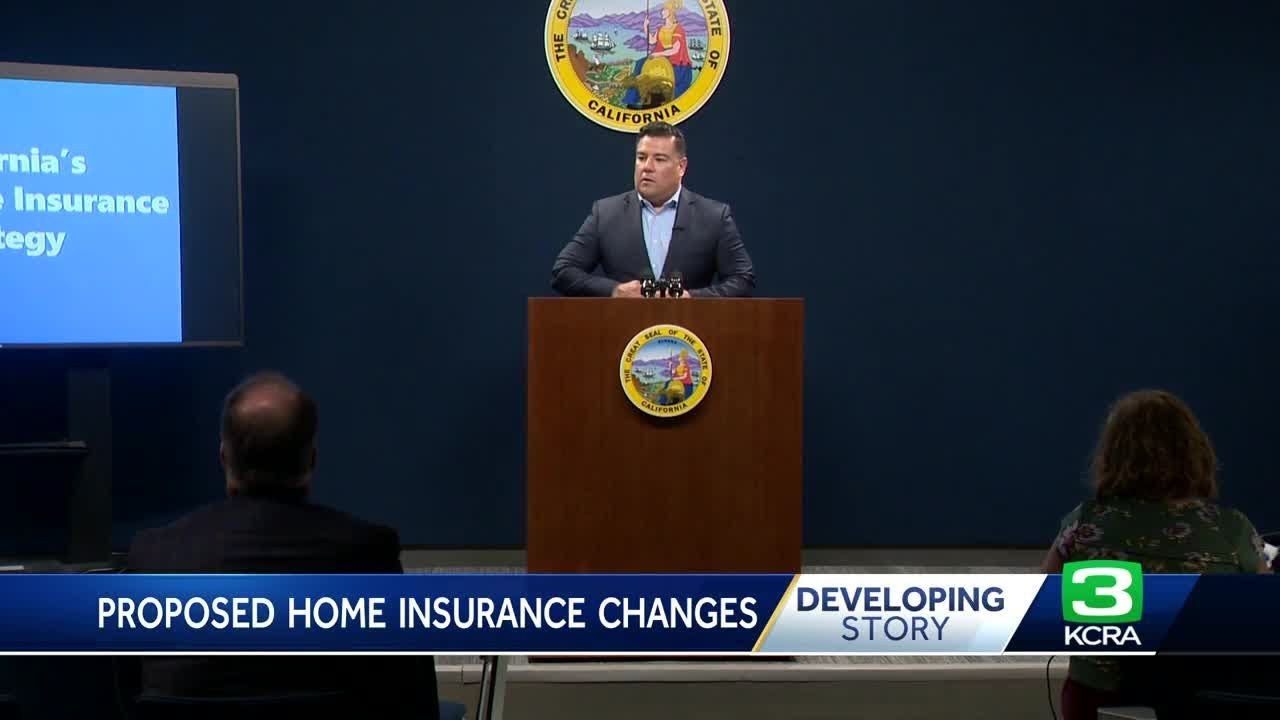

Government Regulations and Interventions

Government intervention can play a vital role in stabilizing the market. Regulations can include establishing standards for wildfire mitigation, requiring building codes that enhance resilience to natural disasters, and potentially implementing risk-based pricing models. For example, states like California could mandate that insurers factor in specific mitigation measures taken by homeowners, such as fire-resistant roofing or drought-resistant landscaping, to provide incentives for risk reduction.

Such policies can foster a more balanced and equitable insurance system.

Insurance Company Pricing Model Adjustments

Insurance companies need to adapt their pricing models to reflect current risk assessments accurately. A move away from solely relying on historical claims data towards incorporating factors like location-specific climate data, building materials, and proactive mitigation measures can provide a fairer and more transparent pricing system. Companies should also consider introducing tiered pricing options based on risk factors.

California’s home insurance prices are reportedly set to skyrocket, a truly concerning development for homeowners. This follows recent news about growing support for Trump’s outsider cabinet picks, which, while interesting, seems somewhat unrelated to the escalating insurance costs. Perhaps the recent economic shifts and the overall political climate are influencing both trends, but it remains to be seen how these factors will ultimately affect California’s housing market and insurance rates in the long run.

trump outsider cabinet picks support is an interesting angle to consider, but the real concern here is the potential financial burden on California residents.

Lower premiums could be offered to homeowners who demonstrate a proactive approach to reducing risks, such as installing fire-sprinkler systems or implementing drought-tolerant landscaping.

Alternative Insurance Options for Homeowners

The availability of alternative insurance options for homeowners can reduce reliance on traditional insurers. These may include risk-sharing programs, community-based insurance pools, or government-backed programs tailored to specific high-risk areas. This diversification can provide more affordable and accessible insurance options for homeowners, especially in areas with significant natural disaster risks.

Homeowner Proactive Risk Reduction

Homeowners can take proactive steps to reduce their insurance risk. These actions include implementing fire-resistant building materials, installing early warning systems, and implementing landscaping techniques that limit wildfire risk. Installing fire sprinklers in the home and developing evacuation plans are other critical steps. By demonstrating a commitment to risk reduction, homeowners can potentially negotiate lower premiums.

Insurance Coverage Options and Costs

| Coverage Option | Description | Estimated Cost (per year) |

|---|---|---|

| Basic Homeowners | Covers basic structure and contents | $1,000-$3,000 |

| Enhanced Homeowners | Includes additional coverage for specific risks like flood or earthquake | $2,000-$5,000 |

| High-Risk Homeowners | Designed for areas with high natural disaster risks | $3,000-$10,000+ |

Note: Costs are estimates and can vary significantly based on factors such as location, home value, and coverage needs.

Property Modifications to Lower Premiums

Homeowners can modify their properties to reduce insurance premiums. This may include upgrading roofing materials, installing fire-resistant siding, and implementing drought-tolerant landscaping techniques. These modifications can demonstrate a commitment to risk reduction and potentially lead to lower premiums. For example, upgrading to a fire-resistant roof or adding a fire-suppression sprinkler system can demonstrably reduce a home’s risk profile.

Future Projections and Trends

California’s home insurance market is facing a period of significant uncertainty, and the future trajectory of premiums is a major concern for homeowners and the broader housing market. Predicting the exact course is challenging, but analyzing current trends and potential factors offers insights into possible scenarios. This analysis explores future projections, potential impacts, and mitigating strategies.

Future Premium Trends

The escalating costs of home insurance in California are unlikely to stabilize anytime soon. Several factors are driving this trend, including the increasing frequency and severity of wildfires, more intense storms, and rising construction costs. These factors, combined with the current insurance market dynamics, suggest a continuation of rising premiums in the foreseeable future. The rate of increase may vary depending on the specific location and type of property, but a general upward trend is expected.

Potential Long-Term Impacts on the Housing Market

The persistent rise in home insurance premiums will undoubtedly affect the housing market. Homebuyers may be deterred by the added expense, potentially reducing demand and slowing down the market. This could lead to a decrease in property values, particularly in areas with a high wildfire risk. Conversely, some areas might see an increase in demand for properties with lower insurance costs, leading to more competition in those markets.

Overall, the impact on the housing market will be complex and multifaceted, potentially impacting affordability and investment strategies.

Consequences of Inaction

Failing to address the underlying causes of rising home insurance premiums could have severe consequences. The continued increase could make homeownership unaffordable for many, potentially leading to a significant decline in home sales. This could further depress property values, creating a downward spiral in the housing market. Inaction also risks exacerbating existing vulnerabilities in the state’s infrastructure and communities, making them more susceptible to future disasters.

This could lead to a decrease in the quality of life and an increased financial burden on homeowners.

Factors Influencing Future Premium Changes

Several factors could influence future premium changes, including changes in wildfire prevention strategies, improvements in building codes and construction standards, development of new insurance products, and the availability of government subsidies or incentives. The success of these strategies and the pace of their implementation will have a direct impact on the premiums. Additionally, the economic climate, including interest rates and inflation, can influence affordability and demand, affecting the market’s response to rising premiums.

Potential Scenarios for the Next 5-10 Years

Predicting the future with certainty is impossible, but considering various scenarios can help prepare for potential outcomes.

- Scenario 1: Steady Increase: Premiums continue to rise steadily, impacting affordability and potentially leading to a slowdown in the housing market. This scenario assumes a continued lack of significant advancements in wildfire prevention and insurance solutions.

- Scenario 2: Moderate Stabilization: Premiums increase at a slower pace than currently projected, possibly due to improved building codes or increased insurance company investment in new technologies. This assumes a more proactive approach by government and insurance providers to mitigate risk.

- Scenario 3: Accelerated Increase: Premiums rise rapidly due to a confluence of factors like severe climate events and a shortage of available insurance capacity. This scenario is more likely in the absence of preventative measures.

Comparative Potential Future Costs

The following table provides a simplified comparison of potential future costs for different types of properties. These are estimates and can vary based on location, construction type, and specific risk factors.

| Property Type | Potential Future Cost (Estimated increase in percentage) |

|---|---|

| Single-family home (high-risk area) | +30-50% |

| Single-family home (low-risk area) | +10-30% |

| Condominium (high-risk area) | +25-45% |

| Condominium (low-risk area) | +5-25% |

Final Wrap-Up

California’s home insurance crisis, fueled by a perfect storm of factors, poses a significant threat to homeowners and the state’s economy. The rising costs could make homeownership less accessible and potentially destabilize the real estate market. While the challenges are considerable, proactive steps from both homeowners and the government are crucial in mitigating the impact. This article offers a comprehensive overview, equipping readers with the knowledge to navigate this evolving situation and make informed decisions.