IRS Sends Immigrant Tax Data to ICE

Internal revenue service agrees to send immigrant tax data to ice for enforcement. This controversial move raises serious questions about data privacy, potential discrimination, and the impact on immigrant communities. The agreement between the IRS and ICE could significantly affect tax compliance rates, potentially leading to increased enforcement actions and penalties for non-compliance. Concerns about fairness and equitable treatment are paramount, and the potential for bias in the use of this data is a significant concern.

This data-sharing agreement will likely have wide-ranging consequences, impacting not only immigrants but also the broader tax system and public trust in government agencies. It’s crucial to understand the historical context of data sharing between these agencies, the legal framework governing such agreements, and the potential implications for various groups involved. This post will explore the multifaceted implications of this decision, examining potential impacts on tax compliance, legal and ethical considerations, public opinion, and potential alternatives.

Background and Context

The recent agreement between the IRS and ICE to share immigrant tax data raises significant concerns about privacy and potential discrimination. This data-sharing arrangement, while seemingly focused on enforcement, carries far-reaching implications for individuals and the broader societal trust in government institutions. Understanding the historical precedent, legal frameworks, and potential consequences is crucial for a comprehensive analysis.This agreement builds upon a complex history of interactions between these two agencies, often characterized by evolving interpretations of legal mandates and varying degrees of cooperation.

The specifics of the current agreement, however, signal a potentially substantial shift in the scope and nature of this data exchange. This prompts critical examination of the legal and regulatory landscapes that govern such exchanges, as well as the ethical implications for affected communities.

Historical Overview of Data Sharing, Internal revenue service agrees to send immigrant tax data to ice for enforcement

Historically, data sharing between the IRS and ICE has been limited and often subject to legal challenges. Previous agreements, while existing, have typically been focused on specific cases and lacked the broad scope of the current arrangement. This evolution reflects changes in enforcement priorities and legal interpretations.

Legal and Regulatory Frameworks

The legal frameworks governing data sharing between agencies are complex and often involve interpretations of existing statutes and regulations. The relevant laws often include provisions for confidentiality, exceptions for national security, and limitations on the use of such data. The exact scope of these regulations, in relation to the current agreement, remains to be fully clarified.

Potential Implications for Different Groups

This agreement’s potential implications are multifaceted. Immigrants, particularly those with pending legal status or those who are undocumented, are likely to face heightened scrutiny and potential repercussions due to the shared data. Taxpayers, regardless of immigration status, might experience a chilling effect on tax compliance if they perceive increased risk of enforcement related to their immigration status. The impact on the broader public trust in government agencies will also be a key consideration.

Potential Impact on Public Trust

The public’s trust in government agencies is vital for a healthy democracy. Such agreements can erode this trust if perceived as discriminatory or overly intrusive. This could manifest as reduced confidence in the fairness and impartiality of the legal system, particularly among vulnerable populations. The long-term effects on the public’s willingness to cooperate with government agencies could be substantial.

Comparison of Data Sharing Approaches

| Approach | Description | Potential Benefits | Potential Drawbacks |

|---|---|---|---|

| Limited Case-by-Case Sharing | Data sharing is restricted to specific cases identified through established legal procedures. | Preserves privacy and avoids broad-scale scrutiny. | May not address systemic issues or patterns of non-compliance. |

| Broad Data Sharing Agreement | Data is shared between agencies based on broader criteria, potentially involving large-scale analysis. | Potentially identifies patterns of non-compliance and facilitates proactive enforcement. | Raises serious privacy concerns and potential for discriminatory targeting. |

| Data Sharing with Transparency and Oversight | Data sharing is implemented with clear guidelines, robust oversight mechanisms, and transparent processes. | Balances enforcement needs with privacy concerns. | Requires significant resources for implementation and oversight. |

This table contrasts different approaches to data sharing, highlighting the potential benefits and drawbacks of each. The optimal approach would carefully balance the need for effective enforcement with the fundamental rights and concerns of individuals.

Potential Impacts on Tax Compliance

This agreement between the IRS and ICE regarding the sharing of immigrant tax data raises significant concerns about its potential impact on tax compliance. The implications for immigrants and the overall tax system are complex and require careful consideration. The increased scrutiny could deter some individuals from participating in the tax system, potentially leading to a reduction in tax revenue.This agreement could significantly influence the willingness of immigrants to file taxes.

The fear of repercussions, such as deportation or other enforcement actions, could be a substantial deterrent. This could have a ripple effect on the broader economy, as the loss of tax revenue would affect government services and programs.

The IRS agreeing to share immigrant tax data with ICE for enforcement is a pretty serious move. It feels a bit like a culinary dish where the focus is on a potent blend of flavors, like, say, salty pancetta and fermented pepper paste lending deep umami to a hearty meaty pasta dish. The complexity and potential implications for individuals are definitely a lot to unpack, and this kind of data sharing raises some serious concerns about privacy and potential discrimination, just like that delicious pasta dish has a strong, unforgettable flavor.

The whole thing just feels a bit heavy-handed and leaves me wondering about the bigger picture of how this impacts immigrants and their communities.

Potential Effects on Tax Compliance Rates for Immigrants

The fear of repercussions for non-compliance, combined with the increased scrutiny, is likely to create a chilling effect on tax compliance among immigrants. Individuals might be less inclined to file taxes accurately and completely out of fear of ICE involvement. This apprehension could lead to a decrease in reported income, impacting the accuracy of tax data. Historical data from similar scenarios in other countries show a similar pattern of reduced tax compliance following the introduction of enhanced enforcement measures.

Possible Influence on the Willingness of Immigrants to File Taxes

The potential for the IRS to share tax data with ICE for enforcement purposes significantly alters the risk-reward calculation for immigrants considering filing taxes. The fear of facing deportation or other immigration consequences could outweigh the perceived benefits of complying with tax laws. This could result in a considerable decrease in the number of immigrant taxpayers. For example, if a family is uncertain about their immigration status, the prospect of having their tax information shared with ICE could dissuade them from filing, regardless of their financial situation.

Potential Economic Consequences of the Agreement

The potential economic consequences of this agreement could be substantial and widespread. Reduced tax compliance could result in a loss of tax revenue, which could affect government spending on various programs. The following table summarizes the potential economic consequences on different groups:

| Group | Potential Economic Consequences |

|---|---|

| Immigrant Community | Reduced economic participation, decreased investment in the economy, potential for increased poverty and inequality. |

| Government | Loss of tax revenue, potential need for increased funding for enforcement agencies, decreased funding for social programs. |

| Businesses | Potential decline in consumer spending and investment, reduced labor pool, possible decrease in economic growth. |

Potential for Increased Enforcement and Penalties for Non-Compliance

The agreement’s potential for increased enforcement and penalties could create a climate of fear and distrust among immigrants. The IRS’s increased ability to share data with ICE could lead to more stringent enforcement actions for non-compliance, including audits, penalties, and potentially, legal action. This heightened scrutiny could have a substantial impact on immigrant financial well-being, potentially driving many into the shadows of the economy.

For example, businesses operating in sectors with a significant immigrant workforce might see a decrease in employees due to fear of increased scrutiny.

Potential Impacts on the Immigrant Community’s Financial Well-being

The sharing of tax data could lead to significant repercussions for immigrant families’ financial well-being. The fear of facing immigration consequences could discourage them from saving money or investing, impacting their future financial stability. Furthermore, the increased enforcement actions could lead to the seizure of assets or other financial penalties. The potential for financial hardship could be considerable.

“The potential for a ‘chilling effect’ on tax compliance by immigrants is substantial, given the heightened risk associated with their financial dealings.”

Legal and Ethical Considerations

Sharing immigrant tax data with ICE raises significant legal and ethical concerns that demand careful scrutiny. The implications extend beyond individual cases, potentially impacting the broader tax compliance landscape and the trust between taxpayers and the IRS. This examination will explore the potential legal challenges, ethical dilemmas surrounding privacy and civil liberties, the risk of discrimination, and the importance of transparency and accountability in this data-sharing agreement.

Potential Legal Challenges

The legality of this data-sharing agreement hinges on the interpretation and application of relevant laws, including the IRS’s authority to release taxpayer information and the Fourth Amendment’s protection against unreasonable searches and seizures. Potential legal challenges may arise from questions about the specific legal basis for the agreement and the scope of the information being shared. Challenges might also stem from concerns regarding the adequacy of safeguards to prevent unauthorized access or misuse of sensitive data.

Ethical Concerns Regarding Data Privacy and Civil Liberties

Data privacy is paramount, and this agreement raises serious ethical concerns. The sharing of sensitive financial information with ICE could lead to significant harm, especially for vulnerable immigrant populations. Potential repercussions include the chilling effect on tax compliance, the exacerbation of existing inequalities, and a erosion of trust in the government’s commitment to privacy. Individuals may be hesitant to file taxes, fearing that their information could be used against them.

Potential for Discrimination and Bias

The use of tax data for immigration enforcement raises the specter of discrimination and bias. There’s a risk that individuals from certain demographics might be disproportionately targeted based on their race, ethnicity, or nationality. Historical patterns of bias in law enforcement practices suggest a potential for this data to be used in discriminatory ways. This could lead to a biased application of immigration enforcement, which could violate the principle of equal protection under the law.

The possibility of misinterpreting or misapplying data in this context also warrants significant consideration.

Framework for Analyzing Ethical Implications

An ethical framework for evaluating this agreement should consider principles of fairness, justice, transparency, and accountability. The impact on individual rights and civil liberties, the potential for discrimination, and the societal consequences of this data-sharing practice must be rigorously examined. This framework should also consider the potential for the data to be used for purposes beyond its intended application, and the possibility of unintended consequences.

The use of an independent oversight body to monitor the data-sharing process is crucial.

Importance of Transparency and Accountability in Data Sharing Practices

Transparency and accountability are essential to maintaining public trust and upholding ethical standards. The agreement must be clearly articulated, outlining the specific criteria for data sharing, the safeguards in place to protect sensitive information, and mechanisms for oversight and redress. Regular audits and reporting mechanisms are necessary to ensure compliance with established guidelines and to identify potential areas for improvement.

Furthermore, public hearings and stakeholder consultations should be conducted to address concerns and gather feedback from various groups. Detailed documentation of the rationale behind the data-sharing agreement is crucial.

Public Opinion and Political Implications

The IRS’s agreement to share immigrant tax data with ICE for enforcement purposes has ignited a firestorm of debate, raising serious concerns about privacy and due process. Public reaction is likely to be highly polarized, with strong opposition from civil liberties advocates and potential support from those concerned about illegal immigration. This agreement’s political implications are significant, potentially shifting public opinion and influencing legislative agendas.

Potential Public Reaction

Public reaction to this agreement will likely be varied and intense. Concerns about government overreach and potential targeting of specific demographics are likely to dominate public discourse. Groups advocating for immigrant rights and civil liberties are expected to mobilize opposition, potentially through protests, legal challenges, and public awareness campaigns. Conversely, some segments of the public, particularly those who prioritize border security and law enforcement, may support the agreement.

Public opinion polls will be crucial in understanding the scope and depth of this reaction. Recent examples of similar data-sharing controversies have demonstrated the intensity of public discourse and the potential for prolonged legal and political battles.

Potential Political Ramifications

The political ramifications of this agreement are multifaceted and potentially far-reaching. The agreement could significantly impact political party platforms and strategies, with potential consequences for fundraising, voter mobilization, and electoral outcomes. Political parties emphasizing border security may see an increase in support, while those focused on civil liberties and immigrant rights could face a challenge in maintaining their voter base.

The IRS agreeing to share immigrant tax data with ICE for enforcement is a pretty concerning development. It raises some serious questions about privacy and due process, especially when you consider that Campbell, CA, boasts two California distinguished schools, like these two excellent institutions. Ultimately, this IRS decision feels like a step backwards in terms of fairness and equitable treatment for all, regardless of immigration status.

It’s a complicated issue, but one that deserves careful consideration.

Political leaders and candidates will likely face pressure to articulate their positions on the agreement and its implications. Historical examples of political divisions over immigration policies can provide insight into the potential for intensified political polarization.

Potential Responses from Advocacy Groups and Civil Rights Organizations

Advocacy groups and civil rights organizations are expected to respond forcefully to the agreement. Their responses may involve legal challenges to the data-sharing agreement, public awareness campaigns highlighting potential abuses, and legislative advocacy to introduce or modify legislation that would curb such data-sharing practices. These groups may also engage in grassroots activism to mobilize support for their cause.

Past instances of successful advocacy campaigns on similar issues provide valuable insight into the potential effectiveness of various strategies. For example, the ACLU’s response to similar government overreach has been swift and effective in mobilizing public support.

Potential Legislative or Regulatory Actions

The agreement could trigger legislative or regulatory actions at the federal and state levels. Legislation aimed at restricting or regulating the sharing of taxpayer data with law enforcement agencies is possible. The introduction of amendments to existing laws or the creation of new laws are likely scenarios. This would likely involve extensive debate and negotiation among lawmakers, reflecting differing perspectives on the balance between national security and individual rights.

Previous legislative battles over similar issues provide a useful reference for the potential course of action.

The IRS agreeing to share immigrant tax data with ICE for enforcement is a pretty concerning move. It raises some serious questions about privacy and due process. Meanwhile, if you’re a baseball fan, you might be more interested in checking out the San Francisco Giants’ opening day lineup against the Reds in Cincinnati, which you can find here.

Ultimately, though, this IRS decision feels like a step in the wrong direction regarding immigrant rights, and that’s something to keep in mind.

Possible Impact on Future Data-Sharing Agreements

The agreement may set a precedent for future data-sharing agreements between government agencies. This could lead to an increase in such agreements, potentially impacting various sectors, including but not limited to, financial institutions and healthcare. Concerns about privacy and the potential for abuse of data are likely to escalate. The potential for litigation and public outcry could create a chilling effect on future data-sharing initiatives, or, conversely, it could become a standard operating procedure for government agencies.

The precedent set by the agreement will have long-lasting effects on the future relationship between the public and their government.

Alternatives and Recommendations

The IRS’s agreement to share immigrant tax data with ICE raises serious concerns about fairness and potential for abuse. Alternatives to this approach, and a framework for a more equitable data-sharing system, are crucial to mitigate the risks. Recommendations for minimizing negative impacts on the immigrant community, while maintaining legitimate law enforcement goals, are essential for a just and transparent system.This section explores alternative data-sharing models, emphasizing the need for a more transparent and equitable system that protects the rights of all individuals while fulfilling legitimate law enforcement needs.

We’ll examine potential strategies to reduce the risks of bias and discrimination, along with best practices for ensuring data security and privacy.

Alternative Data-Sharing Models

The current agreement for sharing immigrant tax data is a blunt instrument. Alternative models could significantly reduce potential harm while still allowing for the identification of tax evaders. One alternative is to create a separate, confidential IRS database solely for tax compliance analysis, excluding sensitive information about immigration status. This database could be used for detecting patterns of non-compliance without compromising personal information.

Another option is to focus on tax evasion cases based on objective criteria, such as significant unpaid tax amounts or blatant inconsistencies in reported income. This targeted approach reduces the risk of unnecessary scrutiny for those who are compliant. A third option is to establish a joint task force comprised of IRS and ICE representatives with specific guidelines on data access and usage, clearly defined by law.

Framework for a More Equitable Data-Sharing System

A more equitable system should be founded on a robust framework of legal and ethical guidelines. The framework should include:

- Explicit legal limitations: Statutory restrictions on the types of data that can be shared and the circumstances under which it can be used. These restrictions must explicitly prohibit the use of tax data to target or discriminate against immigrants.

- Independent oversight: An independent body to review data-sharing requests and ensure compliance with legal and ethical standards. This oversight should include procedures for challenging potentially discriminatory or unfair data-sharing requests.

- Data minimization: Collecting only the minimum necessary data for the intended purpose. The system should avoid collecting and sharing excessive or sensitive personal information. This includes the limitation of data collected to the specific criteria of tax evasion.

- Transparency and accountability: Clear procedures for how data is collected, shared, and used. All parties involved must be held accountable for their actions and the consequences of their decisions.

Recommendations for Minimizing Negative Impacts on the Immigrant Community

The potential negative impacts on the immigrant community are substantial. Mitigation strategies are essential.

- Targeted outreach and education: Providing clear and accessible information about tax obligations and the importance of compliance to the immigrant community, particularly those in vulnerable situations. This includes educational resources in multiple languages.

- Fair and accessible legal assistance: Ensuring immigrants have access to legal representation to address any potential issues arising from data sharing. This should include funding and resources for legal aid organizations.

- Due process safeguards: Establishing clear procedures for immigrants to challenge any actions taken against them based on shared tax data. This includes provisions for appeals and hearings.

- Community support programs: Developing programs to support immigrants who might be affected by the data-sharing agreement. This includes mental health support and resources to help navigate the bureaucratic processes.

Potential Best Practices for Improving Data Security and Privacy

Robust security measures are crucial to prevent data breaches and misuse.

- Encryption and secure storage: Using robust encryption technologies to protect the confidentiality of sensitive tax data. Secure storage facilities should be used to protect this information.

- Regular security audits: Conducting regular security audits to identify and address potential vulnerabilities in the data-sharing system.

- Access controls and authorization: Implementing strict access controls and authorization procedures to limit access to sensitive tax data to only authorized personnel.

- Data breach response plan: Developing and implementing a comprehensive data breach response plan to mitigate the impact of any potential data breaches.

Strategies for Mitigating the Risk of Bias and Discrimination

The risk of bias and discrimination is real. Strategies are necessary to mitigate these risks.

- Blind data analysis: Developing methods to analyze data without considering sensitive information like immigration status, in order to prevent biased assessments.

- Regular bias training: Providing regular training to IRS and ICE personnel on unconscious bias and its effects to prevent discrimination.

- Independent audits for fairness: Implementing independent audits of data-sharing practices to assess for potential bias and discrimination.

- Community feedback mechanisms: Establishing mechanisms for the immigrant community to report instances of discrimination or unfair treatment related to the data-sharing agreement.

Illustrative Scenarios

This section delves into specific examples to illustrate the potential impacts of the IRS-ICE data-sharing agreement. Understanding these scenarios helps paint a clearer picture of the agreement’s practical consequences and potential risks. From the perspective of a concerned citizen, these hypothetical situations highlight the complexities and uncertainties surrounding such a policy.

Impact on a Specific Immigrant Family

The Rodriguez family, recent immigrants to the US, diligently filed their taxes each year, complying with all regulations. However, a clerical error in their initial tax return resulted in an inaccurate deduction. The IRS, now sharing data with ICE, flagged the error. While the error was unintentional, the family could face scrutiny and potential investigation by ICE, potentially impacting their immigration status and ability to remain in the country.

This scenario highlights the unintended consequences of the agreement, potentially penalizing families for minor errors in compliance.

Targeting Specific Groups

The agreement could potentially be used to target specific immigrant communities. If the IRS focuses on particular industries or professions with higher reported tax discrepancies, it might create an environment where specific groups face heightened scrutiny. The potential for profiling and disproportionate enforcement against particular groups underscores the need for careful monitoring and oversight of this agreement.

Preventing Tax Fraud

The data-sharing agreement can potentially aid in detecting tax fraud by allowing the IRS to identify patterns and anomalies in tax filings. By correlating tax data with other information, the IRS could uncover instances of fraudulent activity, leading to the recovery of unpaid taxes. However, this capability also raises concerns about the privacy implications of data sharing.

Immigrant Compliance Steps

Immigrant families should take proactive steps to ensure compliance. These steps include meticulously reviewing tax forms, seeking professional tax advice, and maintaining detailed records of all financial transactions. This includes documentation of all business transactions and receipts, to avoid potential errors. Maintaining transparency and meticulous record-keeping are critical for preventing misunderstandings.

Hypothetical Case Study: The Patel Family

The Patel family, owners of a small business, faced an IRS audit following an audit trigger in the data-sharing agreement. The audit centered on discrepancies in reported business expenses, a common occurrence in small business filings. Without proper documentation, the family faced the prospect of penalties and potential immigration consequences. This case illustrates the need for robust record-keeping and the potential for audits to trigger ICE investigations, even in cases of unintentional errors.

Visual Representation

This section dives into the visual tools that can help us better understand the IRS-ICE data sharing agreement. Visual aids, like flowcharts and graphs, make complex information accessible and easier to grasp, making it more impactful than just reading about it.

Data Flow Chart: IRS to ICE

Understanding the precise path of data exchange between the IRS and ICE is crucial. This flowchart will illustrate the steps involved in transferring tax data for enforcement purposes. The chart will visually represent the source of the data (IRS systems), the transfer mechanism (e.g., automated systems or manual processes), and the destination (ICE systems). This visual representation will clearly show the points of potential vulnerability and areas where oversight is needed.

Comparison of Data-Sharing Agreements

Visualizing the current agreement alongside previous data-sharing agreements helps highlight the changes and potential implications. A graphic organizer will be used, featuring a table with columns for each agreement (past and current). Rows will detail the scope of data shared, the purpose of the sharing, the legal basis, and the level of oversight. This table will allow for a side-by-side comparison, showing the evolution and potential expansion of data sharing.

| Agreement | Scope of Data | Purpose | Legal Basis | Level of Oversight |

|---|---|---|---|---|

| Previous Agreement 1 | Specific Tax Information | Tax Compliance Enforcement | Specific Legal Provisions | Limited Oversight |

| Previous Agreement 2 | Specific Tax Information | Tax Compliance Enforcement | Specific Legal Provisions | Limited Oversight |

| Current Agreement | Expanded Tax Information | Tax Compliance Enforcement & Immigration Enforcement | Amended Legal Provisions | Increased Oversight |

Potential Impacts on the Immigrant Community

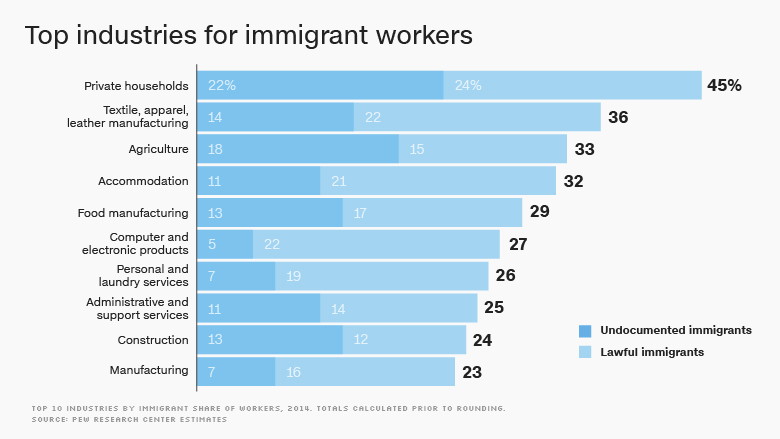

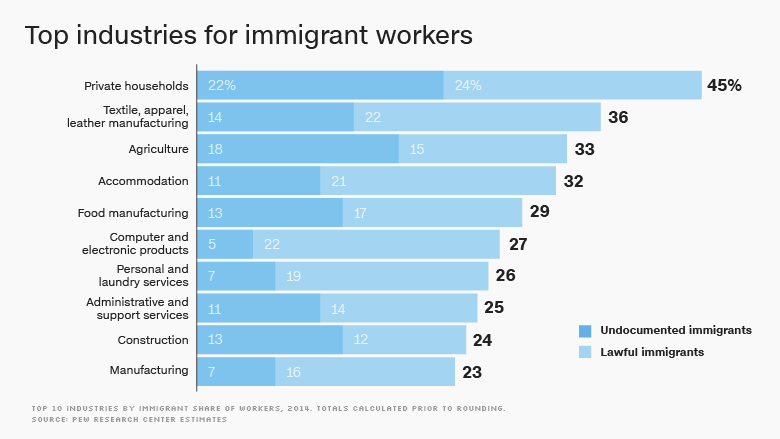

A pie chart will effectively illustrate the potential impacts on the immigrant community. The chart will segment the population into various categories (e.g., lawful permanent residents, temporary visa holders, undocumented immigrants). Each segment will represent the projected percentage of each group that might be affected by the agreement. Color-coding and clear labels will enhance comprehension. This visualization will help assess the potential disproportionate impact on certain groups.

Infographic: Key Aspects of the Agreement

To create an easily digestible infographic highlighting the key aspects of the agreement, the following steps will be taken:

- Identify the core elements of the agreement, including the types of data shared, the legal basis for the transfer, and the purpose for the data exchange.

- Choose an accessible visual style and color scheme that conveys the message effectively. Use a consistent font throughout to maintain readability.

- Develop clear and concise text elements for each aspect of the agreement.

- Use icons or symbols to enhance the visual appeal and reinforce the message. For example, a lock icon can represent the security aspects of data transfer.

Impact on Tax Revenue Collection

A bar graph will show the projected impact on tax revenue collection. The graph will have categories representing different immigrant groups, and bars for each group will show the predicted change in tax revenue collected. The bars will be color-coded, and a clear key will accompany the graph to differentiate the groups. This visualization will show the potential impact on tax revenue from different subgroups.

Final Summary: Internal Revenue Service Agrees To Send Immigrant Tax Data To Ice For Enforcement

In conclusion, the IRS’s decision to share immigrant tax data with ICE presents a complex and potentially problematic situation. The potential for increased enforcement, discrimination, and erosion of public trust requires careful consideration and discussion. Alternative approaches to data sharing, focusing on transparency and accountability, must be explored to mitigate the negative impacts on immigrant communities and ensure fairness within the tax system.

The future of this agreement and its potential implications for data sharing between government agencies warrants ongoing scrutiny and debate.