Medical Debt Credit Reporting A Deep Dive

Medical debt credit reporting is a critical issue affecting many Americans. It impacts your credit score, potentially hindering your ability to secure loans, rent an apartment, or even buy a car. This article explores the intricate details of how medical debt is reported, the potential damage to your credit, and what steps you can take to protect yourself.

Understanding the process of medical debt collection and reporting to credit bureaus is essential. This involves recognizing the various stages, from initial billing to collection agency involvement. Knowing your rights and the procedures for disputing inaccurate reports is crucial for safeguarding your financial well-being. The article delves into the impact on healthcare access and the strategies for managing medical debt, emphasizing the importance of proactive measures to avoid potential financial pitfalls.

Impact on Credit Scores

Medical debt can have a significant and lasting impact on your creditworthiness. Understanding how it affects your credit reports is crucial for managing your finances and maintaining a healthy credit score. This knowledge empowers you to take proactive steps to address any issues and safeguard your financial future.Medical debt, like any other form of outstanding debt, is reported to credit bureaus, potentially lowering your credit score.

This is because lenders and creditors use your credit report to assess your creditworthiness and risk, and a history of medical debt can signal potential financial instability. Credit reports contain a variety of information, and medical debt is one factor in the overall picture.

How Medical Debt Affects Credit Reports

Medical debt, including unpaid bills from doctors, hospitals, and other healthcare providers, is reported to credit bureaus when the debt is sent to collections. This means that the debt is no longer being handled directly by the healthcare provider and is instead being managed by a third-party collection agency. Different types of medical debt can be reported, including bills for services like surgeries, procedures, and prescription medications.

The reporting of medical debt to credit bureaus can vary depending on the healthcare provider and the specifics of the debt.

Types of Medical Debt Reported

The types of medical debt reported on credit reports can include unpaid bills from hospitals, clinics, doctors’ offices, and other healthcare providers. These can range from routine checkups and procedures to more extensive treatments and surgeries. The amount owed, the date the debt originated, and the status of the debt (e.g., active, paid, or in collections) are all recorded in the report.

Comparison Across Credit Bureaus

While the specific reporting practices might have slight variations, the fundamental impact of medical debt on credit scores is generally consistent across the major credit bureaus (Equifax, Experian, and TransUnion). These bureaus utilize similar criteria for evaluating creditworthiness, so the effect of medical debt on your credit score is usually similar regardless of which bureau is reviewing your report.

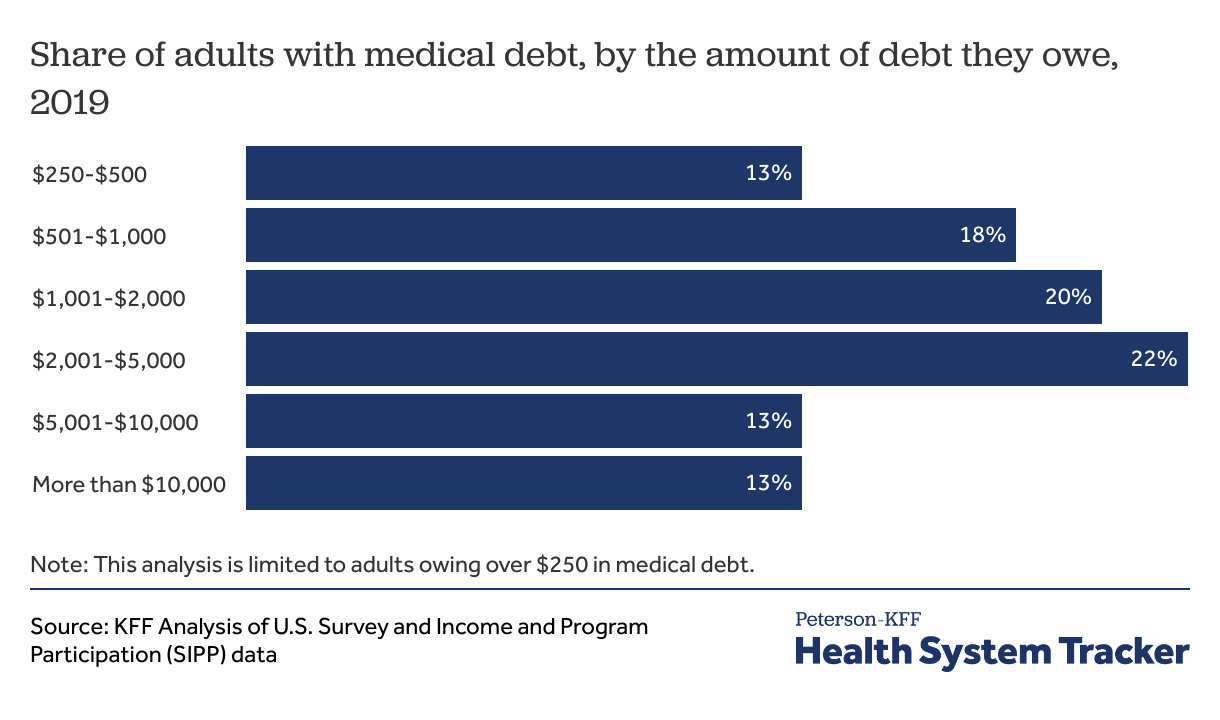

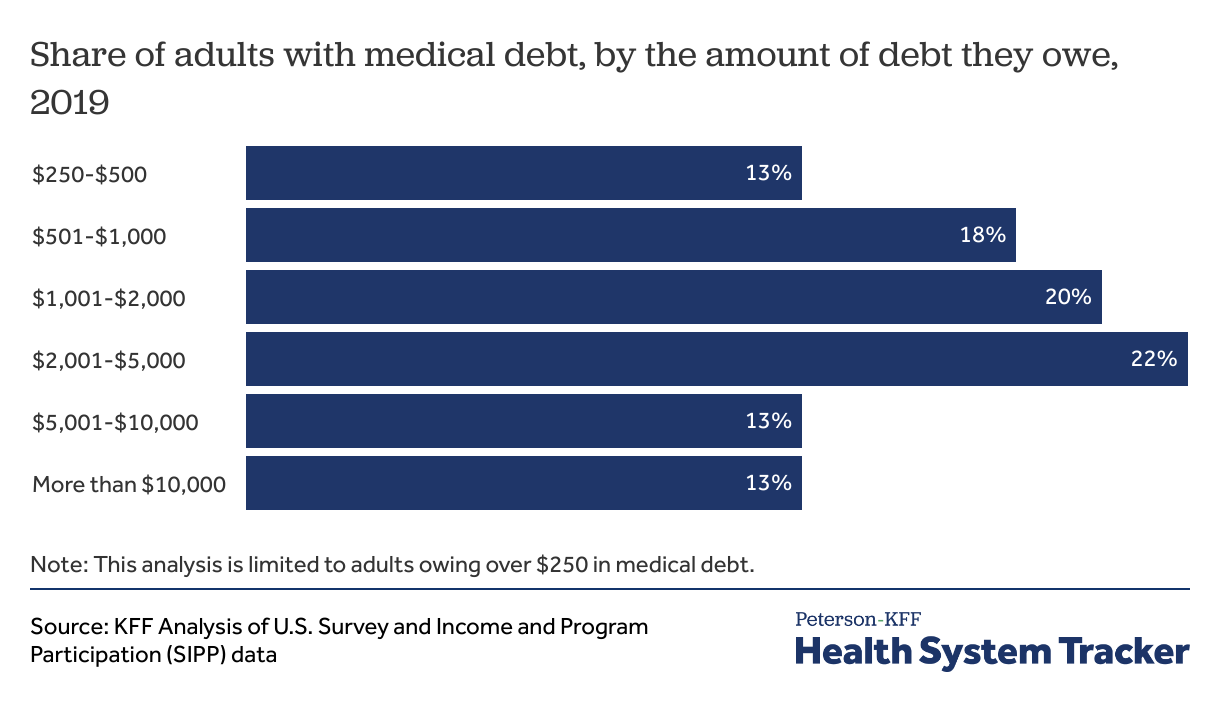

Correlation with Credit Score Deterioration

The correlation between medical debt and credit score deterioration is typically negative. A higher amount of medical debt, particularly if it’s in collections, is more likely to negatively impact your credit score. The extent of the impact depends on various factors, including the amount owed, the length of time the debt has been outstanding, and the presence of other factors affecting your credit score.

For instance, a single, small medical debt might not significantly impact a credit score, whereas multiple large medical debts over an extended period could have a more considerable negative effect.

Factors Influencing Impact Severity

Several factors influence the severity of the impact medical debt has on credit scores. The length of time the debt has been outstanding is a key factor; older debts often have a greater negative impact than more recent ones. The amount of the debt also plays a role, with larger debts generally having a more pronounced negative effect.

Medical debt credit reporting can be a real headache, impacting your financial health significantly. Finding the right solution for managing your debt is crucial. Fortunately, exploring resources like the best CS2 server hosting options best cs2 server hosting can actually help you prioritize and manage your finances more effectively, leading to a healthier credit report.

Understanding these strategies can make a big difference in your overall financial wellbeing, and in turn, your credit reporting.

The status of the debt, whether it’s active, in collections, or paid, also affects how it’s reflected on your credit report and, consequently, your credit score.

Potential Credit Score Impact

| Debt Amount | Estimated Credit Score Impact | Explanation |

|---|---|---|

| $500 | Potentially minimal | Debt amount is low and may not significantly impact credit score. |

| $1000 | Moderate | Debt amount could potentially lower credit score slightly. |

| $5000 | Significant | Significant impact on credit score due to high debt amount. |

Debt Collection and Reporting Practices: Medical Debt Credit Reporting

Medical debt can be a significant burden, often impacting credit scores and financial well-being. Understanding the process of debt collection and reporting is crucial for patients to navigate these situations effectively. This involves knowing your rights and responsibilities, as well as the potential consequences of non-payment.Medical debt collection and reporting procedures are governed by a complex system of laws and regulations.

This framework aims to ensure fairness and transparency while also protecting the interests of both medical providers and patients. Familiarizing yourself with these processes empowers you to take proactive steps to manage your debt effectively.

Common Methods of Medical Debt Collection

Medical providers often employ a range of methods to collect outstanding balances. These methods are designed to recover the owed amount, while adhering to legal and ethical standards. Initial communication often involves sending bills and statements. If the debt remains unpaid, the provider may escalate to more assertive measures. These often include contacting the patient directly via phone calls, letters, or emails.

In cases of persistent non-payment, debt collection agencies may be hired to pursue the debt. These agencies have specific procedures they must follow. They must adhere to the Fair Debt Collection Practices Act (FDCPA) to avoid potential legal challenges.

Process of Medical Debt Reporting to Credit Bureaus

Medical debt that remains unpaid and goes through the collection process can be reported to credit bureaus. This reporting can negatively impact credit scores. The specifics of how and when this occurs can vary. Often, it depends on the collection agency’s practices and the time period since the initial debt was incurred. Understanding this process allows patients to take steps to mitigate the impact on their creditworthiness.

If a debt is disputed or if the patient believes there are errors in the reported information, they should take the appropriate steps to challenge the report.

Importance of Timely Payment and Dispute Resolution

Prompt payment of medical bills is essential for maintaining good financial health and avoiding negative credit reporting. This includes understanding due dates and actively communicating with providers about payment options if necessary. If you disagree with the amount owed or believe there is an error in the bill, you have the right to dispute it. This process often involves providing supporting documentation to the provider to demonstrate why the bill is inaccurate.

It is important to initiate a dispute as soon as possible.

Legal Implications of Medical Debt Collection and Reporting

The Fair Debt Collection Practices Act (FDCPA) plays a significant role in regulating how debt collectors operate. This act sets forth guidelines to protect consumers from abusive or unfair debt collection practices. Understanding these regulations helps patients navigate the collection process with confidence. It also ensures that debt collectors act within the bounds of the law. Knowing these rights allows patients to take appropriate action if they believe the debt collector has violated these regulations.

If a debt is challenged or disputed successfully, it may not be reported to credit bureaus, or if already reported, may be removed.

Typical Timeframes for Medical Debt Collection and Reporting

The following table provides a general overview of the typical timeframe for different stages in the medical debt collection and reporting process. These are estimates and can vary based on individual circumstances.

| Stage | Timeframe (approx.) | Actions |

|---|---|---|

| Initial Billing | 0-30 days | Invoice sent, patient aware of outstanding balance. |

| Delinquent Notice | 30-60 days | Notice sent to patient regarding outstanding balance. |

| Collection Agency | 60+ days | Collection agency takes over debt collection. |

Consumer Rights and Protections

Navigating medical debt can be a daunting experience. Understanding your rights and knowing the steps to take when facing disputes is crucial. This section Artikels the legal protections available to consumers and provides practical guidance on resolving medical debt issues.Medical debt, while often unavoidable, is governed by specific legal frameworks designed to safeguard consumers. These regulations aim to prevent abusive practices and ensure fair treatment throughout the debt collection process.

Knowing your rights and utilizing available resources is vital for effectively managing medical debt and avoiding unnecessary stress.

Medical debt can really throw a wrench into your credit score, and unfortunately, it’s a pretty common problem. Knowing how this debt affects your credit reports is crucial, especially when you’re looking at someone like Joseph Schaefers in Cupertino, CA, who’s facing challenges with his credit. Understanding the nuances of medical debt credit reporting can help you navigate such situations, and potentially find solutions for better financial health.

A deeper dive into the specifics can be found by checking out Joseph Schaefers in Cupertino, CA. This will help you understand the potential impact on your own credit history if you face similar financial circumstances.

Legal Rights Regarding Medical Debt

Consumers have specific legal rights concerning medical debt, including the right to dispute inaccurate or incomplete information reported to credit bureaus. These rights stem from federal and state laws designed to protect consumers from unfair debt collection practices. Medical debt reported to credit bureaus must be accurate and verifiable, adhering to established legal standards.

Procedures for Disputing Inaccurate or Incomplete Medical Debt Reports

Dispute procedures vary based on the reporting agency and the specific nature of the inaccuracy. Consumers should meticulously document all correspondence with the credit reporting agency, collection agency, and the original creditor. A formal dispute letter is often the first step in this process. This letter should clearly and concisely Artikel the specific inaccuracies and include supporting documentation.

Examples of supporting documentation include copies of medical bills, payment records, and communication logs.

Medical debt credit reporting can be a real headache, impacting your credit score significantly. Fortunately, developers are constantly innovating tools like javascript frameworks for api to streamline and improve various financial processes. These advancements could eventually lead to better management of medical debt reporting, potentially making it easier to resolve issues and maintain a healthy financial standing.

Resolving Disputes with Creditors or Collection Agencies, Medical debt credit reporting

Effective dispute resolution often involves a multi-pronged approach. Initially, consumers should attempt to resolve the issue directly with the creditor or collection agency. Formal dispute letters, as mentioned earlier, are vital in this stage. If direct communication is unsuccessful, consumers may consider seeking legal counsel or contacting relevant government agencies.

Examples of Successful Debt Dispute Strategies

Numerous successful dispute strategies involve demonstrating clear evidence of the inaccuracies. This may include providing copies of payment records, medical records, or other documentation proving the debt has been paid or is inaccurate. A clear and concise explanation of the dispute is crucial. For instance, if a medical bill contains an incorrect amount, the consumer should present detailed proof of the correct amount.

A detailed timeline of communication and correspondence with the creditor or collection agency can also be helpful.

Role of State and Federal Laws in Protecting Consumers

Federal and state laws play a critical role in protecting consumers from abusive debt collection practices. These laws Artikel acceptable debt collection practices, set limitations on collection methods, and provide recourse for consumers who experience harassment or unfair treatment. Consumers are advised to familiarize themselves with relevant state and federal laws governing medical debt collection in their jurisdiction.

Resources for Consumers Regarding Medical Debt Disputes

Utilizing available resources can greatly assist consumers in navigating medical debt disputes.

- Consumer Financial Protection Bureau (CFPB): The CFPB provides information and resources on consumer rights, debt collection practices, and dispute resolution. Their website offers detailed guidance on resolving disputes with creditors and collection agencies.

- Federal Trade Commission (FTC): The FTC addresses consumer protection issues, including debt collection practices. Their website provides resources and information on resolving debt disputes and reporting fraudulent activities.

- State Attorney General Offices: State Attorney General Offices offer consumer protection services, including assistance with debt collection issues. These offices can provide valuable guidance and resources tailored to specific state laws and regulations.

Impact on Healthcare Access

Medical debt casts a long shadow, impacting not only credit scores but also the fundamental ability to access necessary healthcare services. This crippling financial burden can deter individuals from seeking preventative care or essential treatment, potentially leading to a cascade of negative health consequences. The cycle of debt and limited access can have far-reaching effects on individuals and families, creating a significant barrier to overall well-being.The consequences of medical debt extend far beyond the immediate financial strain.

Delayed or forgone medical care can exacerbate existing health conditions, leading to more expensive and potentially life-altering complications in the future. For families, the stress and worry associated with medical debt can significantly impact their overall quality of life. Furthermore, the fear of incurring further debt can prevent individuals from seeking timely medical attention, even when faced with serious health concerns.

Impact on Future Healthcare Services

Medical debt often discourages individuals from seeking necessary future healthcare services, creating a vicious cycle of limited access and worsening health outcomes. Individuals might postpone routine checkups, screenings, or necessary treatments due to fear of incurring additional debt. This can lead to the delayed diagnosis and treatment of chronic conditions, exacerbating the problem and resulting in higher healthcare costs in the long run.

The avoidance of preventative care can ultimately increase the risk of serious health complications.

Potential Consequences for Individuals and Families

The impact of medical debt on individuals and families can be substantial. Financial stress stemming from medical debt can lead to anxiety, depression, and relationship problems. The emotional toll on individuals and families is often overlooked but can be just as detrimental as the financial burden. Furthermore, medical debt can create a significant barrier to achieving financial stability, potentially affecting future opportunities and impacting long-term well-being.

Impact on Different Demographics

The burden of medical debt varies across different demographics. Lower-income individuals and families, minorities, and those with pre-existing conditions are disproportionately affected by medical debt. This disparity can exacerbate existing health disparities and create a cycle of limited access to quality healthcare. Unequal access to preventative care and timely treatment can result in significantly poorer health outcomes for these groups.

Factors Influencing the Prevalence of Medical Debt

Several factors contribute to the prevalence of medical debt. High healthcare costs, lack of insurance coverage, and the complexity of healthcare billing systems all play a significant role. Furthermore, the lack of transparency in healthcare pricing and billing practices can leave patients confused and vulnerable to unexpected costs. These factors often lead to individuals incurring substantial medical debt, making it challenging to manage and impacting their access to future healthcare.

Healthcare Provider Assistance with Medical Debt

Healthcare providers can play a crucial role in assisting patients with managing medical debt. Implementing clear and transparent billing practices, offering payment plans, and working with patients to develop affordable payment strategies are crucial steps. Additionally, providing patients with resources and information on financial assistance programs and government subsidies can significantly reduce the burden of medical debt.

Strategies to Improve Healthcare Access and Reduce Medical Debt

Improving healthcare access and reducing medical debt requires a multifaceted approach. Increasing access to affordable healthcare insurance, implementing more transparent and patient-friendly billing practices, and expanding financial assistance programs are crucial steps. Additionally, healthcare providers should prioritize educating patients about their financial rights and responsibilities, offering flexible payment options, and collaborating with community organizations to provide support resources.

These strategies can create a more equitable and accessible healthcare system for all.

Strategies for Managing Medical Debt

Medical debt can be a significant burden, impacting individuals’ financial well-being and credit scores. Understanding effective strategies for preventing, negotiating, and managing this debt is crucial for maintaining financial stability. This section explores practical methods for navigating the complexities of medical debt and offers tools to regain control of your finances.Managing medical debt requires proactive planning and consistent effort.

By understanding the potential pitfalls and implementing sound strategies, individuals can minimize the negative consequences of unexpected medical expenses. A comprehensive approach involves preventing debt, negotiating terms, budgeting effectively, considering consolidation options, and seeking assistance from dedicated organizations.

Preventing Medical Debt

Medical expenses can arise unexpectedly, often leading to substantial debt burdens. Proactive measures can significantly reduce the risk of accumulating medical debt. These preventative steps involve careful planning and responsible healthcare choices.

- Utilizing health insurance effectively. Choosing a comprehensive health insurance plan that covers a wide range of medical services is essential. Understanding the plan’s coverage limits, deductibles, and co-pays helps in anticipating potential out-of-pocket expenses. Prioritize preventative care, which can often reduce the need for more extensive and costly treatments.

- Estimating potential healthcare costs. Before undergoing any significant medical procedure, it’s wise to get detailed cost estimates. This helps in budgeting accordingly and potentially securing financing options. Consider seeking second opinions to ensure the chosen course of treatment is both effective and affordable.

- Exploring payment options. Many healthcare providers offer flexible payment plans or options for financing medical procedures. Taking advantage of these options can help in managing the immediate financial burden. Early communication about payment arrangements can prevent mounting debt.

Negotiating Medical Bills and Settling Debt

Negotiating medical bills involves assertive communication and a clear understanding of the debt. The process can often result in a reduced amount or a more manageable payment plan.

- Communicating with the healthcare provider. Contacting the provider directly to discuss payment options is crucial. Explain your financial situation and explore possible compromises. Maintain a professional and polite tone throughout the negotiation process.

- Seeking assistance from debt management services. Debt management programs can provide guidance on negotiating with creditors and establishing a structured payment plan. They can also assist in understanding your rights and obligations in the debt settlement process.

- Understanding debt settlement options. Explore different debt settlement options, such as debt consolidation or debt management programs. These options can offer streamlined payment structures, potentially reducing the overall amount owed. Consult with a qualified financial advisor to determine the most suitable approach based on your specific circumstances.

Budgeting and Financial Planning

A well-defined budget is essential for effectively managing medical debt and future expenses. Regular financial planning can significantly mitigate the impact of unexpected medical bills.

- Creating a comprehensive budget. A detailed budget Artikels income and expenses, providing a clear picture of your financial situation. Categorize expenses to identify areas where savings are possible. Allocate a portion of your budget specifically for potential medical expenses.

- Building an emergency fund. Establishing an emergency fund is crucial for unexpected expenses, including medical bills. Aim to save a minimum of three to six months’ worth of living expenses. This fund can serve as a buffer during periods of high medical costs.

- Seeking professional financial advice. Consulting with a financial advisor can provide personalized guidance on budgeting and financial planning strategies. They can help develop a tailored plan that aligns with your specific financial goals and circumstances.

Consolidating Medical Debt

Consolidating medical debt involves combining multiple debts into a single, more manageable loan or payment plan. This approach simplifies repayment and can potentially lower interest rates.

- Exploring debt consolidation loans. Debt consolidation loans can combine various debts into a single monthly payment. Research different loan options and compare interest rates and terms. Evaluate the potential impact on your credit score and monthly budget.

- Considering balance transfer credit cards. Balance transfer credit cards can offer a temporary solution for consolidating medical debt, often with introductory 0% APR periods. However, it’s essential to understand the terms and conditions, including the interest rates that apply after the introductory period.

Organizations Offering Assistance

Numerous organizations provide support and resources for individuals struggling with medical debt. These organizations offer guidance and assistance in navigating the complex landscape of medical debt.

- Patient advocacy groups. Patient advocacy groups offer support, resources, and guidance to patients facing medical debt. These groups can provide valuable information and connect individuals with relevant assistance programs.

- Nonprofit organizations. Nonprofit organizations dedicated to financial assistance often offer programs to help individuals manage medical debt. They provide counseling, resources, and financial aid to eligible individuals.

Proactively Managing and Tracking Medical Debt

Proactive management of medical debt involves regular monitoring and documentation. This strategy allows individuals to stay informed and address any issues promptly.

- Keeping detailed records. Maintain meticulous records of all medical bills, payments, and communications with healthcare providers. This documentation is crucial for tracking progress and addressing any discrepancies.

- Utilizing debt management software. Debt management software can help organize and track medical bills, payments, and deadlines. This can provide a comprehensive overview of your financial situation and facilitate proactive debt management.

Epilogue

In conclusion, medical debt credit reporting is a complex issue with significant consequences for individuals and families. Knowing how medical debt affects your credit score, the reporting process, and your rights as a consumer is paramount. Proactive management, understanding dispute resolution procedures, and utilizing available resources are essential steps in navigating this often-overlooked aspect of financial health. This article provides valuable insights into the topic, offering strategies to manage medical debt and protect your financial future.