Tariffs How They Work A Deep Dive

Tariffs how they work are a crucial element in international trade. This exploration delves into the intricacies of tariffs, from their definition and historical context to their impact on global markets. We’ll uncover the mechanisms behind tariff imposition, examining their effects on domestic producers and consumers, and exploring the potential economic, political, and social ramifications.

Different types of tariffs, such as ad valorem, specific, and compound, will be explained, along with a comparative analysis. We’ll analyze the role of tariffs in international trade negotiations and explore alternative trade policies. A comprehensive overview of international trade agreements and the WTO’s role in regulating tariffs will also be covered.

Defining Tariffs

Tariffs are taxes imposed on imported goods. They represent a significant component of international trade policy, influencing everything from consumer prices to global economic relations. Understanding their mechanics and historical context is crucial for navigating the complexities of global trade.Tariffs are designed to protect domestic industries from foreign competition, and often play a role in geopolitical strategies. They can raise revenue for governments, but they can also lead to trade wars and negatively impact global economic growth.

Different Types of Tariffs

Tariffs are categorized into various types, each with unique characteristics. Understanding these distinctions is essential for comprehending their impact.

- Ad Valorem Tariffs: These tariffs are calculated as a percentage of the value of the imported good. They are the most common type and provide a relatively straightforward way to levy taxes on imports. For example, a 10% ad valorem tariff on a $100 item would result in a $10 tax.

- Specific Tariffs: These tariffs are levied based on a fixed amount per unit of the imported good, regardless of its value. For example, a specific tariff of $5 per kilogram on imported steel would apply the same tax to a small shipment or a large one.

- Compound Tariffs: These tariffs combine both ad valorem and specific tariffs. They impose a percentage of the value plus a fixed amount per unit. This combination allows for more nuanced control over imported goods.

Historical Context of Tariffs

Tariffs have been a part of international trade for centuries. Historically, they have been used for revenue generation, national defense, and industrial protectionism. The Smoot-Hawley Tariff Act of 1930, for example, saw the imposition of high tariffs on many imported goods, which is often cited as a significant contributor to the Great Depression. This highlights the potential for tariffs to have widespread and negative consequences.

Tariff Types Comparison

| Tariff Type | Description | Calculation Method | Example |

|---|---|---|---|

| Ad Valorem | Calculated as a percentage of the imported good’s value. | Tax = Value of good × Percentage | A 5% tariff on a $200 item results in $10 tax. |

| Specific | Fixed amount per unit of the imported good. | Tax = Fixed amount × Number of units | A $10 tariff per ton on imported steel. |

| Compound | Combines ad valorem and specific tariffs. | Tax = (Value of good × Percentage) + (Fixed amount × Number of units) | A 10% tariff plus $5 per unit on imported textiles. |

Role of Tariffs in International Trade

Tariffs significantly influence international trade flows. They can affect the competitiveness of domestic industries, potentially fostering growth in some sectors while hindering others. They can also lead to trade disputes and retaliatory measures from other countries, resulting in trade wars. The impact of tariffs on global economic stability is a complex issue with numerous interconnected factors.

Mechanism of Tariffs

Tariffs are a crucial component of international trade policy, impacting both domestic economies and global markets. Understanding how tariffs are imposed, collected, and their effects on various stakeholders is essential for evaluating their impact. This section delves into the practical mechanics of tariffs, examining their implementation and consequences.The imposition of tariffs on imported goods is a multifaceted process that begins with the identification of the imported item and its associated classification.

This classification determines the applicable tariff rate, which is a percentage or fixed amount levied on each unit of the imported good.

Tariff Imposition Process

The process of imposing tariffs on imported goods is governed by specific regulations and procedures in each country. A key step involves customs authorities verifying that the imported goods meet the required criteria and are properly documented. This verification process is crucial to ensure compliance with trade agreements and national regulations.

Tariff Collection

Tariff collection is a systematic process managed by customs authorities. Once the goods are cleared through customs, the appropriate tariff amount is calculated and collected. The collected tariffs are often deposited into government accounts, contributing to the national treasury. Several methods exist for collecting tariffs, such as cash payments, or electronic transfers. The method used often depends on the country and the specific circumstances of the import.

Impact on Import Prices

Tariffs directly impact import prices by adding a tax to the cost of the imported goods. This increase in price is passed on to consumers, either through higher retail prices or reduced quantities available. For example, a 10% tariff on imported steel would raise the price of steel products in the domestic market by 10%.

Impact on Domestic Producers and Consumers

Tariffs can have contrasting effects on domestic producers and consumers. Domestic producers may benefit from higher import prices, as it reduces competition from foreign producers. Consumers, however, generally face higher prices and reduced choices for imported goods. The net effect depends on the specific industry and the overall economic environment. For example, a tariff on imported cars might boost sales of domestic cars but lead to higher car prices for consumers.

Flow Chart of Tariff Application

(This space would typically be filled with a visual representation of a flow chart illustrating the steps involved in applying a tariff. A detailed description of the chart, including all the steps, would follow the image.)Example steps:

- Identification of imported goods and their classification.

- Verification of compliance with regulations and documentation.

- Calculation of the applicable tariff amount.

- Collection of the tariff by customs authorities.

- Deposit of tariff revenue into government accounts.

Impact of Tariffs

Tariffs, while seemingly simple instruments, can have far-reaching and complex effects on economies, trade flows, and global politics. Understanding these impacts is crucial for policymakers, businesses, and consumers alike. The consequences of tariffs extend beyond the immediate exchange of goods, influencing everything from production costs to consumer prices.The imposition of tariffs, designed to protect domestic industries, often leads to unintended and potentially negative outcomes.

The complexity arises from the intricate web of global supply chains and the interconnectedness of various economies. Analyzing the multifaceted impacts of tariffs is essential to assessing their effectiveness and broader implications.

Tariffs, essentially taxes on imported goods, can impact everything from the price of your morning coffee to the cost of a new car. They’re often implemented to protect domestic industries, but they can also significantly affect global trade relationships. Unfortunately, a second wind whipped wildfire is burning out of control in the Los Angeles area prompting more evacuation orders, highlighting how natural disasters can have unforeseen economic consequences.

The ripple effects of these kinds of events, and the subsequent recovery efforts, can make tariffs seem like a minor issue in comparison, but understanding how they work is still crucial in a globalized world. a second wind whipped wildfire is burning out of control in the los angeles area prompting more evacuation orders Ultimately, understanding tariffs involves looking at the interplay between domestic and international markets.

Economic Consequences of Tariffs

Tariffs can significantly affect prices, potentially leading to higher consumer costs for imported goods. This can impact purchasing power and inflation rates, depending on the specific goods affected and the elasticity of demand. Reduced imports might also lead to a decrease in the variety of goods available, thus limiting consumer choice. Furthermore, tariffs can disrupt the flow of inputs for domestic industries, increasing production costs and reducing competitiveness.

Effects on Trade Volumes

Tariffs directly influence trade volumes by increasing the cost of imported goods. This discourages imports and can lead to a decline in overall trade. Conversely, retaliatory tariffs from other countries can also decrease exports from the imposing nation. The net effect on trade volumes is contingent on the magnitude of tariffs and the reactions of trading partners.

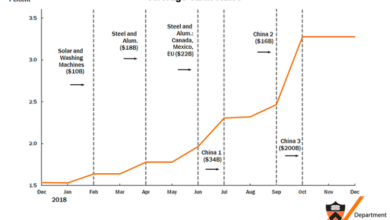

For example, the US-China trade war saw a reduction in bilateral trade as both countries imposed tariffs on each other’s goods.

Impacts on Global Supply Chains

Tariffs can disrupt global supply chains by increasing costs and making it less efficient to import intermediate goods. This can lead to production delays, increased prices, and reduced availability of products. Companies might be forced to relocate production facilities to avoid tariffs, impacting employment and investment in certain regions. The automotive industry, heavily reliant on global supply chains, often feels the brunt of such disruptions.

For instance, tariffs on steel or semiconductors can significantly affect car manufacturers worldwide.

Factors Influencing the Effectiveness of Tariffs

The effectiveness of tariffs is contingent on various factors, including the elasticity of demand for imported goods, the retaliatory actions of trading partners, and the overall health of the global economy. If the demand for imported goods is inelastic, consumers are less sensitive to price changes, and tariffs may have a greater impact. Conversely, a highly elastic demand might result in a smaller impact.

Also, retaliatory tariffs from other countries can neutralize the intended effect of the tariffs. A robust global economy may absorb the effects of tariffs more easily.

Tariffs are essentially taxes on imported goods, increasing their price for domestic consumers. This often impacts professional sports, like the San Jose Sharks facing the Washington Capitals, with players like Alexander Ovechkin, Georgi Romanov, Zack Ostapchuk, and Nikolai Kovalenkoi potentially affected by these trade policies. This article delves deeper into the possible financial implications of tariffs for hockey players.

Ultimately, tariffs can affect the supply chain and, in turn, the cost of goods, including equipment and apparel. This impacts the game at every level.

Potential Political Ramifications of Tariffs

Tariffs can have significant political ramifications, potentially escalating trade disputes and straining international relations. The imposition of tariffs can be viewed as an aggressive action by one nation, triggering retaliatory measures from other countries. This can lead to trade wars, impacting global trade and potentially creating political instability. The political climate surrounding trade negotiations and tariff implementation can be quite complex.

Tariffs are basically taxes on imported goods, impacting their price. Understanding how these work is crucial for businesses, especially startups navigating international trade. For example, when a company considers expanding their operations, they need to know about the different stages of funding, like seed funding and venture capital, which is well explained in this helpful guide on startup funding stages explained.

This knowledge, combined with an understanding of tariffs, helps them make informed decisions about where to source products and how to price them competitively.

Table: Possible Effects on Specific Industries

| Industry | Potential Impact of Tariffs (Positive/Negative) | Explanation |

|---|---|---|

| Automotive | Negative | Tariffs on steel and semiconductors increase production costs, impacting profitability and competitiveness. Disruption of global supply chains can also cause production delays. |

| Textiles | Negative | Tariffs on imported fabrics increase costs for domestic manufacturers, potentially reducing their competitiveness. A decline in imports could also limit consumer choice and variety. |

| Pharmaceuticals | Negative | Tariffs on imported active pharmaceutical ingredients (APIs) can increase drug production costs, affecting affordability and accessibility. Disruptions to global supply chains could impact timely access to life-saving medications. |

Tariff Structures and Policies

Tariffs, while a fundamental tool in international trade, are not applied uniformly. Different countries employ varying tariff structures and policies, reflecting their economic goals, political priorities, and historical contexts. Understanding these diverse approaches is crucial for comprehending the complexities of global trade. These structures significantly influence the cost of imported goods and can have profound effects on domestic industries and consumer prices.Tariff structures, broadly categorized, dictate how import duties are levied on goods.

This directly impacts the competitiveness of imported products and, in turn, influences consumer choice and domestic industry strategies. The policies employed by various nations further reveal their approach to trade, ranging from protectionist measures to more open market strategies. Examining these policies and their underlying rationales offers valuable insight into the dynamic nature of international commerce.

Tariff Structures

Different tariff structures shape the interplay between imported goods and domestic products. A flat rate tariff charges a fixed percentage on the value of imported goods, regardless of the quantity or origin. This simplicity makes it easy to administer but can disproportionately affect low-value items. A progressive tariff, on the other hand, increases the tariff rate as the value of imported goods rises.

This structure aims to discourage the import of luxury or high-value goods.

Examples of Tariff Policies

Many countries have implemented specific tariff policies reflecting their unique circumstances. For example, the United States often employs tariffs on steel and aluminum imports, a policy aimed at supporting domestic industries. Similarly, the European Union has a complex system of tariffs that aims to balance trade relationships and protect specific sectors. Canada, frequently engaged in trade agreements with its neighbor, often adjusts its tariff structures in response to these agreements, aiming to maintain a competitive position in the global marketplace.

Rationale Behind Tariff Policies

The motivations behind various tariff policies are multifaceted. Protectionist policies are often implemented to shield domestic industries from foreign competition, fostering domestic job creation and economic growth. However, retaliatory tariffs are sometimes used in response to perceived unfair trade practices by other countries. Countries also utilize tariffs as leverage in trade negotiations to secure favorable trade deals. The pursuit of national economic interests often drives the design and implementation of tariff policies.

Tariff Structures Across Countries

| Country | Tariff Structure | Rationale | Example Goods |

|---|---|---|---|

| United States | Mixed, often progressive, with significant use of safeguard measures | Protecting domestic industries, particularly in sectors such as steel and aluminum, and as leverage in trade negotiations. | Steel, aluminum, agricultural products |

| European Union | Complex, with varying rates based on origin and product category, often utilizing common external tariffs. | Promoting trade within the EU, protecting specific sectors, and achieving balance in trade relations. | Agricultural products, manufactured goods |

| China | Generally, a combination of flat rates and progressive tariffs, with exceptions for preferential trading partners. | Balancing economic growth and development, fostering domestic industries, and utilizing tariffs as leverage in trade negotiations. | High-tech products, raw materials |

Tariffs in Trade Negotiations

Tariffs are frequently employed as a critical tool in trade negotiations. Countries use the threat of tariffs or actual tariff imposition to pressure other countries to reduce tariffs on their exports or to adopt more favorable trade policies. For example, the imposition of tariffs can incentivize other countries to enter into agreements that lower barriers to trade, ultimately benefiting all involved.

The strategic use of tariffs can be a complex and often contentious aspect of international trade relations.

International Trade Agreements and Tariffs: Tariffs How They Work

International trade agreements play a crucial role in shaping global trade patterns, and tariffs are often a central point of negotiation. These agreements, encompassing various nations, aim to reduce barriers to trade and foster economic cooperation. Understanding how these agreements affect tariffs is vital for comprehending the complexities of global commerce.International trade agreements often include provisions that address tariffs.

These agreements can either set specific tariff levels or establish frameworks for reducing them over time. This reduction can be a bilateral agreement between two countries, or a multilateral agreement involving multiple nations. The overall impact on global trade can be substantial, leading to increased trade volumes and economic growth.

Impact of International Trade Agreements on Tariffs

International trade agreements significantly influence tariff levels. These agreements frequently commit nations to reducing or eliminating tariffs on specific goods and services. Such commitments can be time-bound, meaning that tariffs are progressively lowered over a period of years. This gradual approach allows countries to adjust their industries to the changing trade landscape. The impact of these agreements extends beyond the specific tariffs mentioned; it creates a framework for predictable trade relations, encouraging investment and economic growth.

Role of Organizations like the WTO in Regulating Tariffs

The World Trade Organization (WTO) is a crucial international organization in regulating tariffs. It acts as a forum for member countries to negotiate trade agreements and resolve disputes. The WTO’s core function is to establish rules and guidelines for international trade, including tariffs. These rules aim to ensure a fair and predictable trading environment. The WTO’s dispute settlement mechanism plays a vital role in addressing trade conflicts related to tariffs, ensuring that countries adhere to the agreements they have made.

Examples of Trade Disputes Related to Tariffs

Numerous trade disputes have arisen regarding tariffs. A notable example is the trade war between the United States and China in recent years, involving significant tariff increases on various goods. Another example involves disputes between European Union member states and other countries over specific tariffs on agricultural products. These disputes often highlight the complexities and potential for conflict when different nations have conflicting interests regarding tariffs.

These disputes underscore the importance of effective dispute resolution mechanisms.

Process of Resolving Tariff-Related Conflicts, Tariffs how they work

The WTO’s dispute settlement process is a formal mechanism for resolving tariff-related conflicts. It involves a series of steps, from consultations to the issuance of rulings. The process aims to provide a fair and impartial platform for resolving trade disagreements. The goal is to uphold the rules-based trading system and encourage compliance with trade agreements. A panel of experts is often involved to assess the situation objectively and provide recommendations.

Potential Benefits and Drawbacks of International Agreements Concerning Tariffs

International agreements regarding tariffs offer several potential benefits. These include increased trade volumes, reduced costs for consumers, and enhanced economic growth. However, drawbacks can also arise, such as potential job losses in certain industries, and concerns about national security. The impact of such agreements varies depending on the specific goods and services affected. Countries must carefully consider both the benefits and drawbacks before agreeing to trade agreements that involve tariffs.

Effect of Tariffs on the Terms of Trade

Tariffs can significantly affect the terms of trade. If a country imposes tariffs on imports, it may lead to a lower price for its exports, thus worsening its terms of trade. Conversely, if a country reduces tariffs on imports, it may lead to a higher price for its exports, thus improving its terms of trade. The impact on the terms of trade is complex and depends on various factors, including the size of the tariff, the elasticity of demand for imports and exports, and the reactions of other trading partners.

Alternative Trade Policies

Beyond tariffs, a diverse array of trade policies shape international commerce. These alternatives often aim to achieve similar objectives – fostering domestic industries, protecting consumers, or promoting fair trade – but employ different mechanisms. Understanding these alternatives is crucial for navigating the complexities of global trade.Alternative trade policies often target specific aspects of international trade, such as promoting certain industries, reducing reliance on imports, or addressing concerns about labor standards and environmental protection.

These policies can be more nuanced and targeted than tariffs, allowing for a more tailored approach to specific issues.

Non-Tariff Barriers

Non-Tariff Barriers (NTBs) represent a broad category of trade restrictions that don’t involve direct taxes like tariffs. These barriers can significantly hinder international trade, often creating complex regulatory environments that favor domestic producers. They encompass a wide range of measures, from stringent product standards to complex licensing procedures.

- Product Standards: Different countries often have varying standards for product safety, environmental impact, and labeling. These differences can act as significant barriers to trade. For example, stringent agricultural regulations in one country might make it difficult for farmers in another country to export their produce.

- Technical Barriers to Trade (TBT): These regulations are often complex and obscure, making it difficult for exporters to comply with them. TBTs can take many forms, including specific testing and certification requirements. Compliance can be costly and time-consuming.

- Import Quotas: These limits on the quantity of imported goods can restrict supply and potentially drive up prices for consumers. Import quotas, similar to tariffs, can also protect domestic producers.

- Government Procurement Policies: Governments often favor domestic suppliers in their procurement processes. This can limit the market access for foreign companies. For instance, a government might prefer domestic companies for infrastructure projects.

Subsidies

Subsidies are financial aids provided by governments to domestic industries. These can take various forms, such as direct payments, tax breaks, or low-interest loans. Subsidies can give domestic industries a competitive edge in the global marketplace, but can also distort international trade flows.

- Direct Payments: Governments may directly pay producers to support their output or operations.

- Tax Breaks: Governments might offer reduced tax rates to encourage specific industries to expand or invest.

- Low-Interest Loans: These can help businesses access capital at favorable rates, potentially boosting their competitiveness.

Trade Agreements and Preferential Access

These agreements can provide preferential treatment to specific countries or products, influencing trade patterns. Such agreements can reduce barriers, leading to increased trade volumes.

- Free Trade Agreements (FTAs): These agreements between countries eliminate or significantly reduce tariffs and other trade barriers on specific goods and services traded between the partner countries.

- Preferential Trade Agreements (PTAs): Similar to FTAs, but offer preferential treatment to certain countries or products, often as a stepping stone to more comprehensive agreements.

- Regional Trade Blocs: These groups of countries cooperate to reduce trade barriers within the bloc, potentially leading to increased intra-regional trade and economic integration. Examples include the EU and NAFTA (now USMCA).

Impact on Global Trade

Alternative trade policies can have significant impacts on global trade flows. The effect often depends on the specific policy, its magnitude, and the reaction of other trading partners. For example, a large subsidy in one country could incentivize increased production and exports, while potentially triggering retaliatory measures from other countries.

Comparative Analysis of Trade Policies

| Policy | Advantages | Disadvantages | Impact on Trade |

|---|---|---|---|

| Tariffs | Revenue generation, protection of domestic industries | Trade wars, reduced efficiency, higher prices for consumers | Potential for reduced trade volumes, distortion of trade flows |

| Non-Tariff Barriers | Specific targeting of concerns, potential for greater flexibility | Complex compliance, potential for trade friction, lack of transparency | Potential for reduced trade volumes, especially for specific goods or sectors |

| Subsidies | Support for domestic industries, potential for economic growth | Distortion of markets, potential for retaliatory measures, inefficient allocation of resources | Potential for increased exports and domestic production, but also trade conflicts |

| Trade Agreements | Increased trade volumes, reduced barriers, fostered cooperation | Potential for unequal benefits, limited scope for specific issues | Increased trade flows, particularly within partner countries |

Final Review

In conclusion, tariffs how they work are a multifaceted topic with significant implications for global trade. From the historical context to the potential impact on industries, this discussion has highlighted the complexities of tariffs and the interplay of economic, political, and social factors. Understanding tariffs is essential for navigating the intricacies of international trade and assessing the impact of various trade policies.