3 Must Knows About Employee Stock Options

3 must knows about employee stock options: Understanding employee stock options (ESOs) can be a game-changer for both employees and employers. They offer the potential for significant financial gain, but also come with risks and considerations. This guide will break down the essentials, from the different types of options and their tax implications to the advantages and disadvantages, and how to maximize their value.

Employee stock options, or ESOs, are a powerful tool for employee motivation and retention. They can incentivize employees to work harder and contribute more to the company’s success. This post explores the intricacies of ESOs, helping you understand the complexities and benefits to make informed decisions.

Understanding Employee Stock Options: 3 Must Knows About Employee Stock Options

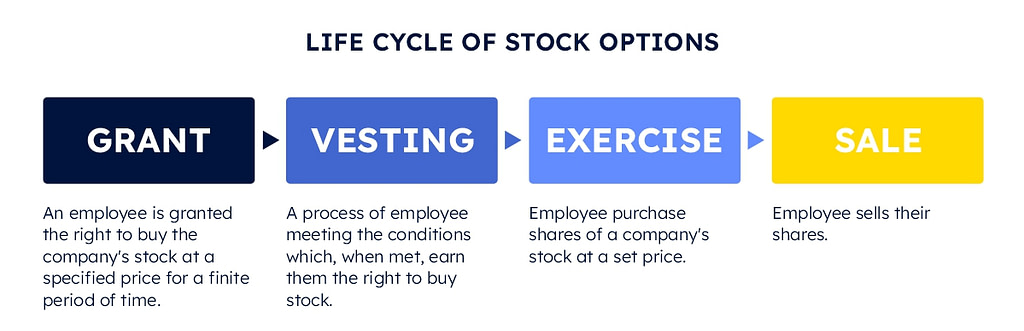

Employee stock options (ESOs) are a powerful tool for attracting and retaining talent, allowing employees to potentially share in the company’s success. They represent a right, not an obligation, to purchase company stock at a predetermined price (the exercise price) at a future date. This can incentivize employees to work towards the company’s growth, fostering a sense of ownership and aligning their interests with shareholders.Understanding the nuances of ESOs, including different types and tax implications, is crucial for both employees and employers.

Different types of options offer varying benefits and tax treatments, impacting both short-term and long-term financial outcomes.

Types of Employee Stock Options

Employee stock options are broadly categorized into Incentive Stock Options (ISOs) and Non-Qualified Stock Options (NSOs). These classifications have significant implications for tax treatment. ISOs offer potential tax advantages, while NSOs might result in higher tax burdens in certain situations.

Incentive Stock Options (ISOs)

ISOs are designed to provide tax benefits to employees. They often feature a specific vesting schedule and tax advantages. A key characteristic of ISOs is that the gain on the sale of the stock is taxed only when the employee sells the stock, and not when the option is granted. This can lead to lower immediate tax burdens.

So, you’re keen to learn about employee stock options? Three key things to know are vesting schedules, potential tax implications, and how they affect your overall compensation package. Thinking about hitting the slopes with the best ski backpacks? hit the slopes with the best ski backpacks is a great way to enjoy the winter season, but don’t forget those crucial details about employee stock options, especially if your company offers them.

Understanding these details is essential for making informed decisions about your financial future.

However, the sale price must exceed the exercise price by a certain threshold to achieve the tax benefits.

Non-Qualified Stock Options (NSOs)

NSOs offer flexibility but come with more complex tax implications. These options typically do not have the same tax advantages as ISOs. The difference in tax treatment is a key factor to consider. The employee will be taxed on the difference between the market value of the stock when the option is granted and the exercise price, even if the option is not exercised.

Tax Implications of ESOs

The tax implications associated with employee stock options vary significantly based on the type of option (ISO or NSO). The tax treatment differs significantly, depending on the employee’s circumstances and the type of option held. It is crucial to consult with a tax professional for personalized guidance on the specific tax obligations associated with employee stock options.

So, you’re curious about employee stock options? Three key things to know are the vesting schedule, potential tax implications, and the company’s financial health. Knowing how to properly configure security protocols, like enabling TLS 1.3 enable tls 1 3 , is crucial for your overall security posture, and these options are often tied to your employer’s IT security.

Understanding these details will help you make informed decisions about your future compensation and investment strategy.

Comparison of ISOs and NSOs

| Feature | Incentive Stock Option (ISO) | Non-Qualified Stock Option (NSO) |

|---|---|---|

| Vesting Schedule | Often subject to a vesting period, typically over a period of years, to ensure employee commitment to the company. | Vesting periods may vary, but the employee typically has full rights upon grant. |

| Tax Implications (Grant) | Generally, no tax is owed at the grant date. | Taxed on the difference between the fair market value (FMV) of the stock and the exercise price on the grant date. |

| Tax Implications (Exercise) | Taxed only when the stock is sold, potentially at a lower rate, depending on the sale price and the difference between the sale price and exercise price. | Taxed on the difference between the FMV and exercise price when the option is exercised. |

| Potential Benefits | Lower tax burden compared to NSOs in many scenarios, potential for significant gains. | More flexibility in terms of exercise, potentially a more straightforward approach for some employees. |

Benefits of Employee Stock Options

Employee Stock Options (ESOs) are powerful tools that can significantly benefit both employees and employers. They offer a unique opportunity for employees to share in the company’s success and for employers to incentivize and retain top talent. This dynamic relationship fosters a strong connection between the employee’s financial well-being and the company’s prosperity.ESOs act as a powerful motivator, aligning employee interests with the company’s long-term goals.

This alignment encourages employees to work diligently, contributing to increased productivity and company growth. The potential for financial gain further fuels this motivation, creating a win-win scenario where employees prosper alongside the company’s success.

Advantages for Employees

ESOs provide a unique opportunity for employees to participate in the growth and success of the company. This potential for financial gain is a significant motivator, encouraging employees to contribute to the company’s overall success. The ownership aspect fosters a stronger sense of commitment and responsibility, transforming employees from mere workers into stakeholders.

- Potential for substantial financial gain: Employees can benefit greatly if the company’s stock price increases. A successful ESO can lead to significant wealth creation, providing a strong incentive for employees to strive for company growth. This potential is crucial for attracting and retaining top talent. For example, if an employee exercised their options when the stock price was low and the company performed well, their investment could become very valuable.

- Alignment of interests with company success: ESOs directly link employee compensation to the company’s performance. This alignment of interests encourages employees to work towards the company’s success, fostering a sense of shared responsibility and commitment. This results in higher productivity and a more engaged workforce.

- Enhanced job satisfaction and motivation: The potential for financial gain, coupled with the sense of ownership, significantly increases job satisfaction and motivation. This translates to increased productivity and a stronger commitment to the company’s success. This improved motivation can be observed in a company’s culture and work environment.

Advantages for Employers

ESOs are a valuable tool for attracting and retaining top talent. They can motivate employees to work harder and smarter, contributing to the overall success of the company. The long-term commitment fostered by ESOs is a significant benefit, reducing employee turnover and maximizing the return on investment in employee training and development.

- Attracting and retaining top talent: ESOs are an attractive compensation package, enabling companies to attract and retain highly skilled and motivated employees. This is especially true in competitive markets where companies must offer competitive compensation packages to attract and retain top talent. Many companies successfully use ESOs to recruit and retain top-performing individuals.

- Increased employee motivation and productivity: The potential for financial gain motivates employees to work towards the company’s success. This can lead to increased productivity, efficiency, and innovation, as employees are more invested in the company’s success. This is often reflected in the company’s overall performance metrics.

- Reduced employee turnover: ESOs create a sense of ownership and shared responsibility, leading to greater employee commitment and loyalty. This, in turn, reduces employee turnover, saving the company time and resources that would otherwise be spent on recruiting and training new employees. This is a crucial factor in long-term sustainability.

Examples of Successful ESO Programs

Numerous companies have successfully implemented ESO programs, demonstrating their effectiveness in motivating employees and driving company growth. These programs often yield impressive results, aligning employee interests with the company’s overall success.

- Company A: Company A successfully implemented an ESO program that directly tied employee compensation to the company’s financial performance. This alignment of interests resulted in increased productivity and employee retention, contributing significantly to the company’s overall growth.

- Company B: Company B’s ESO program incentivized employees to focus on innovation and strategic initiatives. This led to several successful product launches and a significant increase in market share, demonstrating the positive impact of ESOs on company performance.

Comparative Analysis of ESO Benefits

| Company Benefits | Employee Advantages |

|---|---|

| Attracting and retaining top talent | Potential for substantial financial gain |

| Increased employee motivation and productivity | Alignment of interests with company success |

| Reduced employee turnover | Enhanced job satisfaction and motivation |

Risks and Considerations of Employee Stock Options

Employee stock options (ESOs) can be a powerful motivator and a significant source of wealth for employees. However, they come with inherent risks that must be carefully considered. Understanding these potential downsides is crucial for making informed decisions about accepting or exercising these options. Failing to anticipate these risks can lead to financial setbacks and disappointment.

Potential Drawbacks and Risks for Employees

ESOs, while potentially lucrative, aren’t without pitfalls. One major risk is the inherent volatility of the stock market. If the company’s stock price declines significantly before the option’s exercise date, the option’s value diminishes, and the employee may lose money. This risk is amplified if the employee invests heavily in the company’s stock, believing in its future prospects.

Importance of Understanding Terms and Conditions

Carefully reviewing the terms and conditions of an ESO agreement is paramount. This includes the vesting schedule, exercise price, and expiration date. Vesting schedules, for instance, dictate when an employee gains full ownership rights. A poorly understood vesting schedule can lead to missed opportunities. Understanding the exercise price, which is the price at which the employee can buy the company’s shares, is critical.

A high exercise price, coupled with a declining stock price, can make exercising the option unprofitable. Lastly, the expiration date is a deadline; missing it means losing the option entirely.

Potential Downsides Related to Market Fluctuations and Stock Performance

Market fluctuations significantly impact the value of ESOs. A downturn in the overall market can severely depress stock prices, even for companies that are otherwise performing well. For example, the 2008 financial crisis saw many companies’ stock prices plummet, impacting the value of employee options. Similarly, a company’s poor financial performance can lead to a decline in its stock price, making ESOs less valuable.

This highlights the importance of considering a company’s financial health and market trends before accepting ESOs.

Comparison of Risks and Rewards with Other Compensation Structures

Comparing ESOs with other compensation structures like salary increases or bonuses is essential. ESOs offer the potential for substantial gains, but also carry the risk of significant losses. Bonuses and salary increases, on the other hand, provide more immediate and predictable compensation, but lack the potential for substantial wealth creation. The choice between these structures depends on individual risk tolerance and investment strategies.

Consideration must be given to the employee’s long-term financial goals.

Common Risks and Considerations When Exercising Stock Options

Understanding the risks involved in exercising stock options is vital. A well-structured table outlining these risks and considerations is presented below.

| Risk Category | Description | Mitigation Strategies |

|---|---|---|

| Market Volatility | Stock prices can fluctuate significantly, potentially reducing the value of options. | Diversify investments, understand market trends, and consider exercising options strategically. |

| Company Performance | A decline in company performance can negatively impact stock price, decreasing option value. | Research the company’s financial health, assess its long-term prospects, and carefully weigh the risk. |

| Exercise Price | The price at which options can be exercised is crucial; a high price may make exercising unprofitable. | Analyze the exercise price relative to the expected stock price and market conditions. |

| Vesting Schedule | The vesting schedule dictates when options become fully owned; understanding this is essential. | Thoroughly review the vesting schedule and understand the implications for tax obligations and ownership timelines. |

| Expiration Date | Missing the expiration date results in forfeiting the option. | Plan the exercise strategy well in advance and maintain awareness of deadlines. |

Practical Implementation of Employee Stock Options

Putting employee stock options (ESOs) into practice requires careful planning and execution. A well-structured ESO program can motivate employees, align their interests with the company’s success, and attract top talent. Conversely, a poorly implemented program can lead to legal issues, operational complexities, and decreased employee morale. This section delves into the practical aspects of establishing and administering an ESO program.Establishing a robust ESO program demands meticulous attention to detail.

The program must be designed in a way that encourages employee participation while adhering to all applicable laws and regulations. A clear understanding of the steps involved in establishing an ESO program is crucial for its effective implementation.

Establishing an ESO Program, 3 must knows about employee stock options

A well-defined ESO program begins with a thorough plan. This includes outlining the eligibility criteria for employees, the grant amount, and the vesting schedule. The program must be tailored to the specific needs and goals of the company. Legal counsel should be consulted to ensure compliance with all applicable regulations.

Vesting Schedules

Vesting schedules are critical components of an ESO program. They dictate when employees become entitled to the stock options. Clear vesting schedules promote employee retention and commitment. A common vesting schedule structure involves a graded vesting period, where the employee earns a portion of the option over time.

- Graded Vesting: This schedule typically grants a percentage of the option each year or over a set period. For instance, an employee might receive 20% of the option after one year, 40% after two years, and the remaining 40% after three years.

- Cliff Vesting: This method grants the employee the entire option after a specified period, rather than gradually over time. A cliff vesting schedule might grant 100% of the option after three years of service.

Administering Employee Stock Options

Efficient administration is crucial for maintaining a successful ESO program. This involves tracking employee eligibility, calculating option grants, and processing exercises. A dedicated system for managing ESOs is recommended for accurate record-keeping.

- Employee Eligibility Determination: The program should clearly define who is eligible to participate in the ESO program. This should be clearly Artikeld in the company’s policy. Criteria might include job title, years of service, or performance metrics.

- Option Grant Calculation: Accurately calculating the number of options granted to each eligible employee is essential. The calculation should consider the company’s financial situation and the employee’s contribution.

- Option Exercise Procedure: The program should Artikel the steps involved in exercising the options. This should include the required documentation, deadlines, and any fees associated with exercising the options.

- Record Keeping: Maintain comprehensive records of all option grants, exercises, and other related activities. This is essential for compliance and financial reporting.

Compliance with Regulations

Adherence to relevant regulations is paramount for the smooth operation of an ESO program. This involves understanding and complying with all applicable federal and state laws, such as the Securities Act of 1933, the Securities Exchange Act of 1934, and any state-specific laws. Non-compliance can result in significant penalties.

“Strict adherence to all relevant regulations is critical for avoiding potential legal issues and maintaining the integrity of the employee stock option program.”

Legal Considerations

Legal considerations are integral to the implementation of an ESO program. This includes drafting comprehensive agreements that clearly define the rights and responsibilities of both the company and the employee. Seeking legal counsel to ensure the program is legally sound and complies with all applicable laws is crucial.

| Step | Description |

|---|---|

| 1 | Develop a comprehensive ESO plan document |

| 2 | Obtain legal counsel to ensure compliance with all relevant regulations |

| 3 | Establish eligibility criteria and vesting schedule |

| 4 | Develop a process for option grant calculation and administration |

| 5 | Establish record-keeping procedures |

| 6 | Conduct regular reviews and updates to the program |

Strategies for Maximizing the Value of Employee Stock Options

Unlocking the full potential of employee stock options requires a strategic approach. These valuable instruments can significantly boost your financial future, but understanding the nuances of the market and your company’s performance is crucial for maximizing their worth. This guide provides actionable strategies for navigating the complexities of employee stock options and transforming them into a powerful asset.Understanding the stock market’s intricate workings and your company’s financial trajectory is paramount to making informed decisions about your stock options.

Fluctuations in the market and company performance directly impact the value of your options. Being proactive and adaptable is key.

Understanding Stock Market Trends and Company Performance

Analyzing market trends and company performance is essential to effectively manage stock options. Monitoring economic indicators, industry news, and competitor analysis provides context for assessing potential gains and losses. Understanding the company’s financial reports, including revenue, expenses, and profitability, is crucial. These factors influence stock price movement, impacting the value of your options.

Effective Strategies for Managing Stock Options

A well-defined strategy is critical for managing stock options. Diligent monitoring of market trends and the company’s financial health is essential. Careful consideration of factors such as option vesting schedules and exercise prices is necessary. Understanding the potential risks and rewards is paramount to making informed decisions.

Key Strategy: Diversify your investment portfolio. Don’t put all your eggs in one basket, especially when dealing with an asset like employee stock options. Diversification can help mitigate risk and potentially maximize returns.

- Regular Monitoring: Track market trends, industry news, and company performance. Analyze financial reports and news articles to assess potential risks and opportunities. Stay informed about the broader economic climate, as it can influence your options’ value. Regular updates on the company’s performance are key to anticipating future movements.

- Vesting Schedules: Understand the vesting schedule for your options. This schedule dictates when you can exercise your options and claim the underlying shares. Timing your exercise strategically based on market conditions can significantly impact your gains.

- Exercise Prices: Pay close attention to the exercise price of your options. This price represents the amount you need to pay to purchase the underlying shares. If the stock price rises above the exercise price, exercising your options becomes financially advantageous. Compare the current market price with the exercise price to determine the best time to exercise.

- Professional Financial Advice: Seek guidance from a qualified financial advisor. They can provide personalized recommendations tailored to your financial situation and risk tolerance. A financial advisor can help you understand the nuances of employee stock options and navigate the complexities of the market. They can also provide strategies to diversify your investments and maximize returns.

Seeking Professional Financial Advice

Engaging a financial advisor is highly recommended. Their expertise can provide tailored advice based on your individual circumstances, risk tolerance, and financial goals. Professional guidance can help you navigate the complexities of employee stock options, optimize your investment strategy, and manage potential risks effectively. Experienced financial advisors can provide valuable insights into market trends, helping you make informed decisions about exercising or selling your options.

So, you’re looking to understand employee stock options? Great! Three key things to know are how they work, the tax implications, and the potential risks. While the recent UN climate report highlighted another record-breaking un climate report hottest year , it’s important to remember that these options are a significant part of many compensation packages and understanding them is crucial for both employees and employers.

These three key factors are a must to keep in mind when considering this form of compensation.

Seeking Expert Advice: A financial advisor can help you understand the nuances of employee stock options, assess the potential risks and rewards, and create a tailored strategy for maximizing their value.

Managing and Maximizing Stock Options: A Guide

Maximize Your Returns: A comprehensive strategy for managing employee stock options involves understanding market trends, company performance, and your personal financial situation. Consider the vesting schedule, exercise price, and potential market fluctuations.

| Strategy | Action | Rationale |

|---|---|---|

| Market Analysis | Monitor market trends and company performance. | Informed decisions about exercising options. |

| Vesting Schedule | Understand your vesting schedule. | Plan exercise timing strategically. |

| Exercise Price | Compare stock price to exercise price. | Determine the optimal time for exercising. |

| Diversification | Diversify your investment portfolio. | Mitigate risk and enhance returns. |

| Professional Advice | Seek guidance from a financial advisor. | Personalized strategies based on your circumstances. |

Employee Stock Options in Different Industries

Employee stock options (ESOs) are a powerful tool for attracting and retaining talent, particularly in high-growth companies. However, the optimal structure and implementation of ESOs can vary significantly across different industries, reflecting the unique characteristics and dynamics of each sector. Understanding these nuances is crucial for both companies and employees to maximize the benefits and mitigate potential risks.Employee stock options are not a one-size-fits-all solution.

Factors such as industry trends, competitive landscape, and company stage influence how ESO programs are designed and administered. The successful implementation of ESOs depends on a thorough understanding of the specific needs and context of the industry in which the company operates.

Implementation Strategies Across Industries

Different industries have varying needs when it comes to ESO programs. The structure and design of ESOs should align with the specific characteristics of each industry. For example, technology companies often use ESOs to attract and retain skilled engineers and developers, while established manufacturing companies may use them to incentivize long-term commitment from their production workforce. This necessitates careful consideration of factors like company size, growth trajectory, and the particular skills required in each industry.

Examples of Successful ESO Programs

Numerous companies have implemented successful ESO programs across different industries. For instance, in the technology sector, companies like Google and Amazon have leveraged ESOs to attract and retain top talent in software development, engineering, and other crucial roles. In the pharmaceutical industry, companies like Pfizer and Johnson & Johnson have utilized ESOs to incentivize innovation and research and development efforts.

These examples highlight the adaptability and effectiveness of ESOs when tailored to specific industry needs.

Variations in ESO Structure

The structure of ESOs varies significantly across different industries, reflecting the unique characteristics and dynamics of each sector. Factors like the nature of the company’s business, its growth trajectory, and the specific skillsets needed within the industry all influence the design of the ESO program. The table below illustrates some of these variations.

Table: ESO Program Variations Across Industries

| Industry | Key ESO Features | Example of ESO Structure | Rationale |

|---|---|---|---|

| Technology | Incentivizing innovation, rapid growth, attracting highly skilled employees | Performance-based options, shorter vesting periods | Faster turnaround times and the need for rapid talent acquisition |

| Manufacturing | Promoting long-term commitment, stability, employee retention | Longer vesting periods, performance metrics tied to overall company growth | Maintaining a stable workforce and ensuring long-term success |

| Healthcare | Incentivizing research and development, promoting ethical conduct, attracting skilled professionals | Options tied to specific milestones or projects, emphasis on ethical conduct guidelines | Balancing financial incentives with ethical responsibilities in the healthcare field |

| Finance | Rewarding financial performance, attracting high-achieving professionals, aligning incentives with company goals | Options linked to financial performance metrics, stringent vesting schedules | Ensuring that incentives are tied to financial results and align with company goals |

Ending Remarks

In conclusion, employee stock options are a multifaceted compensation strategy that demands careful consideration. Understanding the nuances, potential benefits, and associated risks is crucial for both employees and employers. By carefully evaluating the specifics and seeking professional advice when needed, you can navigate the world of ESOs effectively and potentially reap significant rewards. Remember to prioritize knowledge and professional guidance when dealing with such complex financial instruments.