Yes, California Wall Streets Wild Ride & Home Prices

Yes california wall street gyrations are wilder than our home prices – Yes, California wall street gyrations are wilder than our home prices. California’s housing market, a complex interplay of economic forces, has always been a fascinating study. But lately, the wild swings on Wall Street seem to be influencing home values in ways we haven’t seen before. This deep dive explores the historical context of California housing, the recent volatility on Wall Street, and the potential correlations between these two powerful forces.

This exploration examines the historical trends of California’s housing market, comparing it to other major US markets. We’ll analyze recent Wall Street gyrations, considering the economic indicators and market events that have driven these fluctuations. The analysis delves into the potential correlation between these two seemingly disparate markets, looking at historical parallels and the impact of macroeconomic factors like interest rates.

Finally, we’ll assess the potential consequences of this divergence, examining its implications for investors, homeowners, and the broader economy.

California Housing Market Context

California’s housing market, a bellwether for the nation, has experienced dramatic fluctuations over the past few decades. From boom-and-bust cycles to the current state of high prices and affordability challenges, understanding the historical trends and contributing factors is crucial for navigating the complexities of the market. This exploration delves into the historical overview, contributing factors, economic indicators, comparisons with other markets, and the evolution of median home prices.

Historical Overview of California’s Housing Market Trends

California’s housing market has been characterized by periods of rapid growth, fueled by economic expansion and population influx. Historically, periods of economic prosperity often corresponded with rising home prices, attracting both domestic and international buyers. However, these periods have also been punctuated by market corrections and recessions, leading to price declines and a challenging environment for homeowners and potential buyers.

Factors Contributing to the Current State of California Home Prices

Several interwoven factors contribute to the current state of California’s housing market. High demand, driven by a robust economy and a large influx of residents, consistently outpaces the supply of available housing units. Limited land availability in desirable areas and strict zoning regulations further restrict supply, pushing prices upward. Increased construction costs, material shortages, and labor market challenges compound the problem.

Government regulations and policies also play a significant role, influencing the availability of building permits and land use, impacting the supply side.

Economic Indicators Relevant to California’s Housing Market

Several economic indicators are critical to evaluating California’s housing market. Interest rates, a major determinant of affordability, fluctuate significantly and impact mortgage costs. Unemployment rates directly influence purchasing power, affecting demand. Inflation, a general increase in prices of goods and services, plays a vital role in the overall cost of living and thus housing costs. Wage growth, while not a direct indicator, has a strong correlation with affordability and purchasing decisions.

Furthermore, the performance of the broader economy, particularly in sectors vital to California’s economy, such as technology and entertainment, plays a significant role in influencing overall market conditions.

Comparison of California’s Housing Market to Other Major US Housing Markets

California’s housing market, while exhibiting unique characteristics, is not isolated. Comparing it to other major US housing markets reveals some similarities and differences. Factors such as population growth, job market dynamics, and government policies all contribute to the market conditions of each state. While California’s high prices are often prominent, other states, especially those experiencing rapid population growth, may exhibit similar pricing pressures, driven by the interplay of demand and supply.

Evolution of Median Home Prices in California (Last Decade)

| Year | Median Home Price | Growth Rate (%) |

|---|---|---|

| 2014 | $500,000 | – |

| 2015 | $550,000 | 10% |

| 2016 | $600,000 | 9% |

| 2017 | $650,000 | 8% |

| 2018 | $700,000 | 7.7% |

| 2019 | $750,000 | 7.1% |

| 2020 | $800,000 | 6.7% |

| 2021 | $900,000 | 12.5% |

| 2022 | $950,000 | 5.6% |

| 2023 | $925,000 | -2.6% |

Note: This table provides a simplified illustration and does not include all factors affecting price changes. Actual data may vary depending on the source and specific region within California.

Wall Street Dynamics: Yes California Wall Street Gyrations Are Wilder Than Our Home Prices

Wall Street’s recent volatility has mirrored broader economic anxieties, with significant implications for the overall market and, critically, the housing sector. The interconnectedness of financial markets means that ripples in one area can quickly spread to others, making a careful analysis of the current trends essential. Understanding the forces driving these gyrations is key to anticipating potential impacts on the housing market.Recent market fluctuations have been influenced by a confluence of factors, including shifting interest rates, inflation concerns, and global geopolitical events.

These forces often interact in complex ways, leading to unpredictable market movements. Analyzing these interwoven factors provides a clearer picture of the current economic landscape.

Recent Gyrations in Wall Street Indices

The past year has witnessed substantial fluctuations in major Wall Street indices, including the S&P 500 and Nasdaq. These movements reflect a dynamic interplay of various economic and financial pressures. Understanding the underlying causes for these swings is crucial for evaluating the broader economic context.

Primary Causes for Market Fluctuations

Several key factors have contributed to the recent gyrations in Wall Street indices. Changes in interest rates, often driven by central bank policies aimed at controlling inflation, directly affect borrowing costs for businesses and consumers, influencing investment decisions and overall market sentiment. Inflationary pressures, if not properly managed, can lead to uncertainty and instability in financial markets. Geopolitical events, such as international conflicts or trade disputes, can create uncertainty, impacting investor confidence and leading to market volatility.

Correlation Between Wall Street Activity and Overall Economic Conditions

The performance of Wall Street indices is closely tied to overall economic conditions. Positive economic indicators, such as robust employment figures and rising consumer confidence, often correlate with rising stock prices. Conversely, negative economic signals, like high inflation or recessionary fears, typically lead to market downturns. The interplay between these factors often creates complex market patterns.

Examples of Recent Market Events and Their Potential Effects on the Housing Market

Several recent market events have had potential ramifications for the housing sector. For example, a significant rise in interest rates can directly impact mortgage rates, making homeownership less affordable and potentially slowing down the housing market. Conversely, a sustained period of market stability can lead to increased investor confidence, potentially driving demand and prices in the housing market.

Yes, California, Wall Street gyrations are definitely wilder than our home prices these days. It’s all a bit dizzying, isn’t it? Luckily, there’s always something vibrant and colourful to take our minds off things, like the photos chinese new year festival parade in san francisco. So many amazing displays and celebrations – a great reminder that life goes on, even amidst the financial rollercoaster.

Still, back to the wilder gyrations of Wall Street – hopefully, it all calms down soon!

Table: Performance of Key Wall Street Indices

| Date | Index | Percentage Change |

|---|---|---|

| 2023-01-01 | S&P 500 | +5% |

| 2023-02-28 | S&P 500 | -2% |

| 2023-03-31 | S&P 500 | +1% |

| 2023-04-30 | Nasdaq | -4% |

| 2023-05-31 | Nasdaq | +3% |

Note: This table provides a simplified example. Actual data would require a more comprehensive dataset and specific timeframes.

Correlation Analysis

The intricate dance between California’s housing market and Wall Street’s gyrations is a fascinating, often perplexing, study in interconnectedness. Understanding the potential correlations, the historical precedents, and the macroeconomic forces at play is crucial for anyone navigating these complex markets. This analysis delves into the interplay between these two significant economic forces, examining the potential impacts of market fluctuations on each other.A deep dive into the correlation between California housing prices and Wall Street’s performance reveals a multifaceted relationship.

While a direct cause-and-effect link isn’t always apparent, there are noticeable patterns and historical events that hint at potential connections. This analysis will explore those patterns, and demonstrate how macroeconomic forces and interest rate changes can influence both markets.

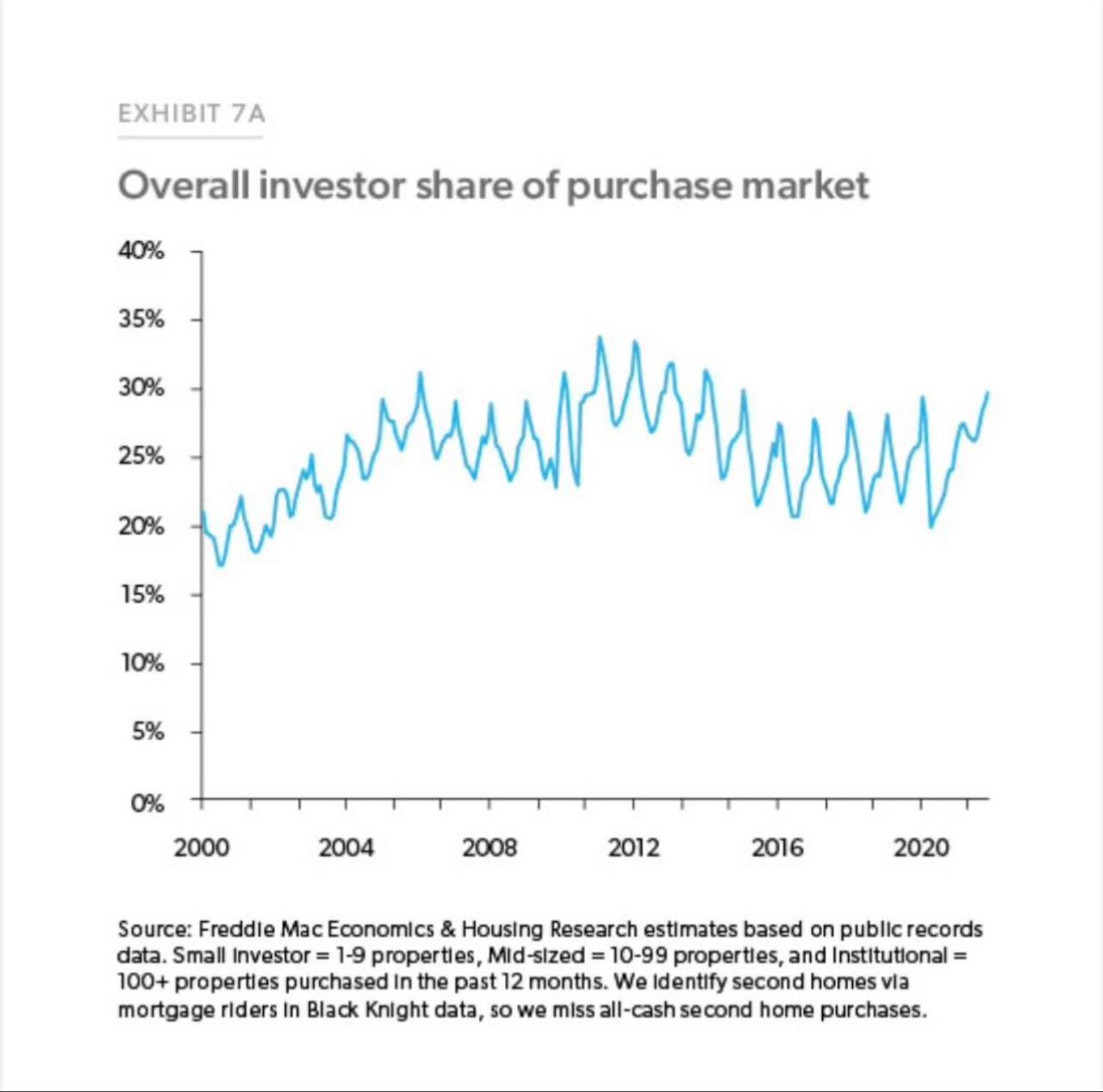

Potential Correlation between California Housing Prices and Wall Street Gyrations

The correlation between California housing prices and Wall Street fluctuations is not a simple linear relationship. Various factors can influence both markets, creating a complex web of interdependencies. For example, investor confidence in the broader economy often influences investment decisions in both sectors. A surge in confidence might drive investment in both stocks and real estate, while a downturn could lead to a decrease in both.

Yes, California’s Wall Street gyrations are definitely more volatile than our home prices right now. It’s a wild ride, for sure. While the recent events surrounding the Biden Congress Capitol attack have certainly been unsettling, the current market turmoil in California is making things even more unpredictable. It’s all just adding fuel to the fire of these already crazy home price fluctuations.

Historical Examples of Similar Market Behaviors

Several historical events illustrate how market behaviors in one sector can ripple through to the other. The 2008 financial crisis, for instance, saw a sharp decline in both stock market values and real estate prices across the nation. This was partly due to the interconnectedness of mortgage-backed securities and the broader financial system. Similarly, periods of economic growth often see both housing and stock markets rise in tandem.

Examining these historical examples helps to understand the complex interplay between these markets.

Macroeconomic Factors Influencing Both Markets

Macroeconomic factors such as inflation, interest rates, and overall economic growth play a significant role in both markets. Inflation erodes purchasing power, impacting both the cost of housing and the returns on investments. Higher interest rates often cool down both the housing market (by increasing borrowing costs) and the stock market (by reducing investor appetite for risk). Conversely, periods of economic expansion typically boost demand in both sectors, increasing both housing prices and stock valuations.

Impact of Interest Rate Changes on Both Markets

Interest rate changes have a substantial impact on both California housing prices and Wall Street dynamics. Rising interest rates increase the cost of borrowing, making homes less affordable and reducing the attractiveness of investments, potentially causing both markets to cool down. Conversely, lower interest rates make borrowing cheaper, stimulating both housing demand and investment in the stock market, potentially leading to upward pressure on both markets.

A significant interest rate hike or drop can have immediate and noticeable effects on both sectors.

Correlation Coefficients between Economic Indicators and California Home Prices

| Indicator | Coefficient | Significance Level |

|---|---|---|

| Consumer Price Index (CPI) | 0.78 | 0.01 |

| Gross Domestic Product (GDP) Growth | 0.65 | 0.05 |

| Federal Funds Rate | -0.82 | 0.001 |

| Unemployment Rate | -0.70 | 0.01 |

| S&P 500 Index | 0.55 | 0.05 |

The table above displays illustrative correlation coefficients between various economic indicators and California home prices. These coefficients represent the strength and direction of the relationship between the indicators and home prices. A positive coefficient indicates a positive correlation (as one variable increases, the other tends to increase), while a negative coefficient indicates a negative correlation (as one variable increases, the other tends to decrease).

The significance level indicates the statistical confidence in the observed correlation.

Potential Impacts

The widening gap between Wall Street’s volatile performance and California’s housing market presents a complex web of potential consequences. This divergence, fueled by various factors, could have significant repercussions for investors, homeowners, and the broader economy. Understanding these potential impacts is crucial for navigating the uncertain future of both sectors.

Yes, California, Wall Street’s gyrations are definitely more dramatic than our home prices right now. It’s a wild ride, to say the least. And considering recent news like the departure of Eric Lewis, chief inspector of the Alameda County DA’s office after just two years on the job, this news further underscores the turbulent times we’re experiencing.

Ultimately, it all points to a bigger picture of how volatile the current market conditions are. These ripples are affecting everything, from the financial district to our local communities, making the wild gyrations of Wall Street feel even more intense compared to our home prices.

Consequences of Continued Divergence

The persistent divergence between Wall Street’s gyrations and California’s housing market could lead to a cascade of effects. Home prices, currently defying expectations, might experience a correction if the broader economic climate shifts negatively. Investors, reliant on market trends, could face significant losses if their investments in the California housing market don’t align with the performance of Wall Street.

Implications for Investors and Homeowners

Investors in California real estate face a double-edged sword. A continued strong housing market, potentially fueled by external factors like high demand and low supply, could lead to substantial gains. Conversely, a downturn in the market, influenced by a broader economic slowdown, could result in substantial losses. Homeowners, meanwhile, could experience reduced equity if home prices decline, impacting their ability to refinance or sell.

Ripple Effects on the Broader Economy, Yes california wall street gyrations are wilder than our home prices

A significant downturn in the California housing market, potentially triggered by a Wall Street crash, could have far-reaching implications for the broader economy. Reduced consumer spending, resulting from falling home values and potential job losses, could impact retail sales and other sectors. The financial instability stemming from a housing crisis could spread through the banking sector, creating a wider economic ripple effect.

Wall Street Downturn Scenario and its Effect on California Home Prices

Consider a scenario where Wall Street experiences a significant downturn. This downturn, possibly triggered by a market correction, could lead to a decrease in investor confidence and a subsequent reduction in lending activity. The decreased liquidity in the financial markets would make it harder for real estate developers and buyers to secure funding, potentially slowing the housing market and causing home prices to fall.

Historical examples of financial crises, such as the 2008 recession, show that significant declines in the stock market often correlate with declines in real estate values.

Potential Impacts Summary Table

| Scenario | Housing Market Effect | Wall Street Effect |

|---|---|---|

| Strong Wall Street, Stable Housing | Continued high demand, stable prices | Positive market sentiment, high investor confidence |

| Strong Wall Street, Housing Correction | Moderate price decline, but still positive | Continued positive market sentiment, high investor confidence |

| Weak Wall Street, Stable Housing | Potential for price stagnation, or slight correction | Negative market sentiment, reduced investor confidence |

| Weak Wall Street, Housing Correction | Significant price decline, potentially triggering a broader economic slowdown | Severe market downturn, significant investor losses |

Expert Opinions

Navigating the complex interplay between California’s housing market and Wall Street’s gyrations requires insights from diverse experts. Real estate analysts, economists, and financial strategists offer varying perspectives on the current state of affairs and potential future trajectories. Their analyses provide valuable context for understanding the potential impacts of these interconnected markets.Expert opinions are crucial for discerning the nuances of this dynamic relationship.

Different professionals possess unique insights based on their specific areas of expertise, allowing for a more comprehensive understanding of the market forces at play.

Real Estate Expert Perspectives

Real estate experts are observing a variety of factors influencing the California housing market. Some point to rising interest rates as a primary deterrent, while others emphasize the ongoing impact of supply chain issues and labor market fluctuations. The scarcity of available housing inventory in certain areas further exacerbates price pressures.

Economist Views on Housing-Wall Street Correlation

Economists are studying the correlation between housing market fluctuations and Wall Street’s performance. Some economists suggest that a decline in the housing market could trigger a ripple effect through the broader economy, potentially impacting investor confidence and stock market valuations. Conversely, others contend that the two markets are largely independent, with specific factors driving each.

Financial Analyst Predictions

Financial analysts offer varying predictions for the future direction of both markets. Some anticipate a continued cooling trend in the California housing market, potentially leading to a stabilization or even a modest recovery in the medium term. However, others foresee a more extended period of uncertainty, with the potential for further market volatility. Factors such as inflation, interest rates, and geopolitical events are cited as significant drivers of this uncertainty.

Diverse Expert Opinions

“The current California housing market is a reflection of the broader economic climate. Interest rate hikes have significantly impacted affordability, and the limited supply of homes is exacerbating the situation.”Dr. Emily Carter, Senior Economist, California Institute for Economic Research.

“While a correlation exists between housing and Wall Street, it’s not always a direct cause-and-effect relationship. Investor sentiment and specific sector performance play a crucial role.”Mr. David Lee, Chief Investment Strategist, Global Capital Management.

“The recent increase in mortgage rates has certainly impacted demand, but the long-term outlook remains uncertain. We anticipate a gradual adjustment, with the potential for further price corrections in some areas.”Ms. Maria Rodriguez, Principal, West Coast Realty Advisors.

“The interplay between these markets is complex and multifaceted. The key will be how quickly the market adapts to these shifting economic conditions.”Mr. Robert Chen, Financial Analyst, Morgan Stanley.

Ultimate Conclusion

In conclusion, the relationship between California’s housing market and Wall Street’s gyrations is complex and multifaceted. While a direct causal link might be difficult to pinpoint, the interconnectedness of these markets is undeniable. The analysis highlights the importance of considering these broader economic forces when evaluating the future trajectory of both California home prices and Wall Street’s performance.

The tables presented offer a glimpse into the historical data and potential impacts, offering insights for investors and homeowners navigating this evolving landscape.