EOR vs Common Law Employer A Deep Dive

EOR vs common law employer: Navigating the complexities of choosing the right employment model is crucial for businesses. This comprehensive guide explores the differences, legal considerations, practical implications, and case studies surrounding EOR (Employer of Record) and traditional common law employer structures. Understanding the nuances between these models is vital for companies aiming to scale effectively and comply with legal requirements.

The decision between an EOR and a common law employer hinges on factors like legal responsibilities, tax implications, administrative burdens, and potential risks. This exploration aims to provide a clear understanding of each model, allowing businesses to make informed decisions based on their specific needs and circumstances.

Defining Employer Types

Understanding the nuances between Employer of Record (EOR) and common law employers is crucial for businesses operating in international markets or those seeking flexible employment models. These distinctions impact legal obligations, payroll procedures, and overall risk management. Navigating these differences effectively can lead to streamlined operations and compliance.EORs and common law employers differ significantly in their legal responsibilities and operational roles.

A clear understanding of these differences is essential for companies to choose the right model for their specific needs and context. This involves evaluating the implications of each model on employment law, tax regulations, and operational efficiency.

EOR Definition

An Employer of Record (EOR) acts as the legal employer of record for employees, handling all legal and administrative responsibilities associated with employment. This includes payroll, benefits administration, tax compliance, and employment law adherence. Essentially, the EOR takes on the employer’s legal obligations, allowing the hiring company to focus on its core business functions.

Common Law Employer Definition

A common law employer directly employs workers, bearing the full legal and financial responsibility for all employment-related matters. This includes complying with local employment laws, administering benefits, handling payroll, and ensuring tax obligations are met. They have direct contractual relationships with their employees.

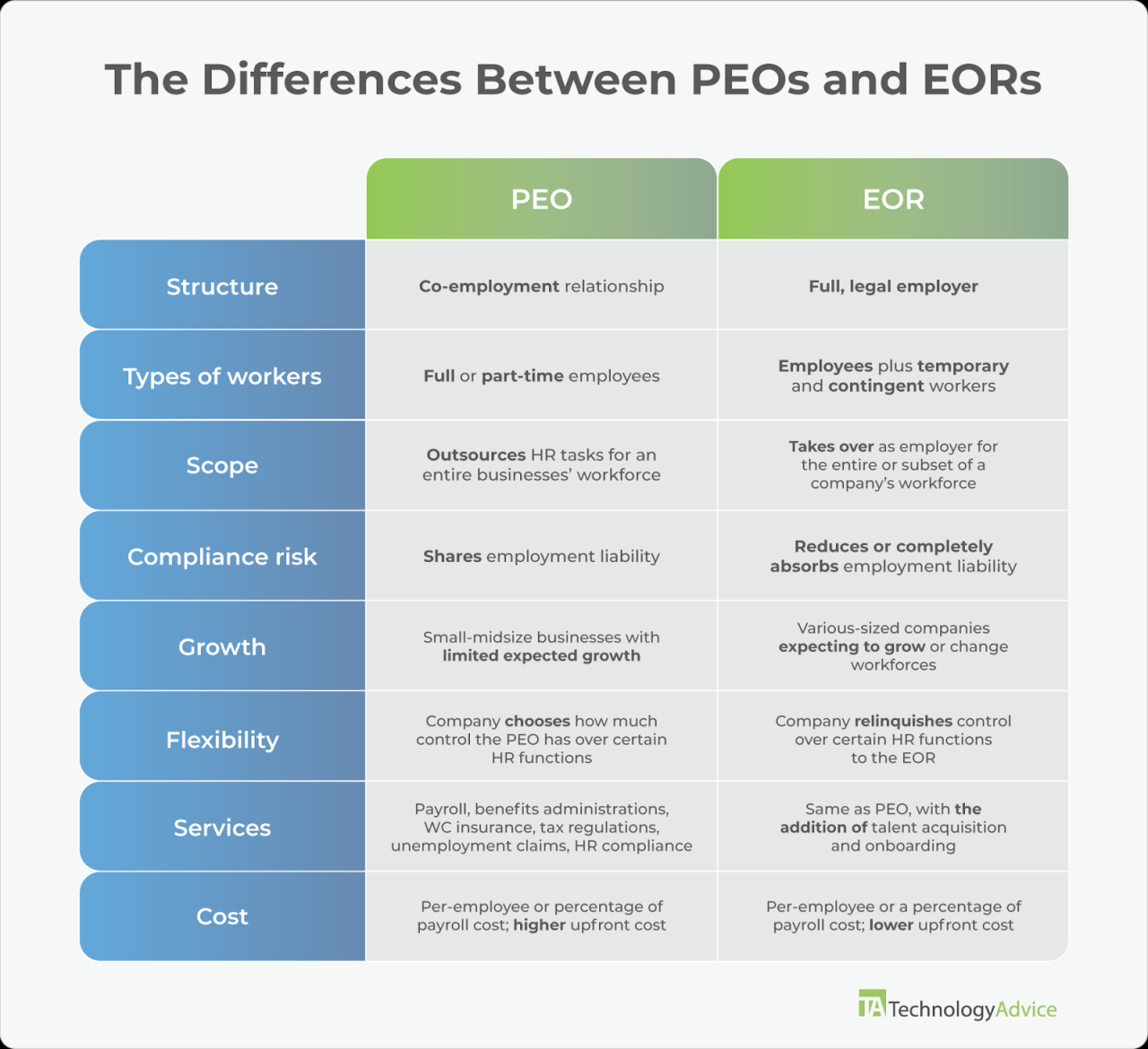

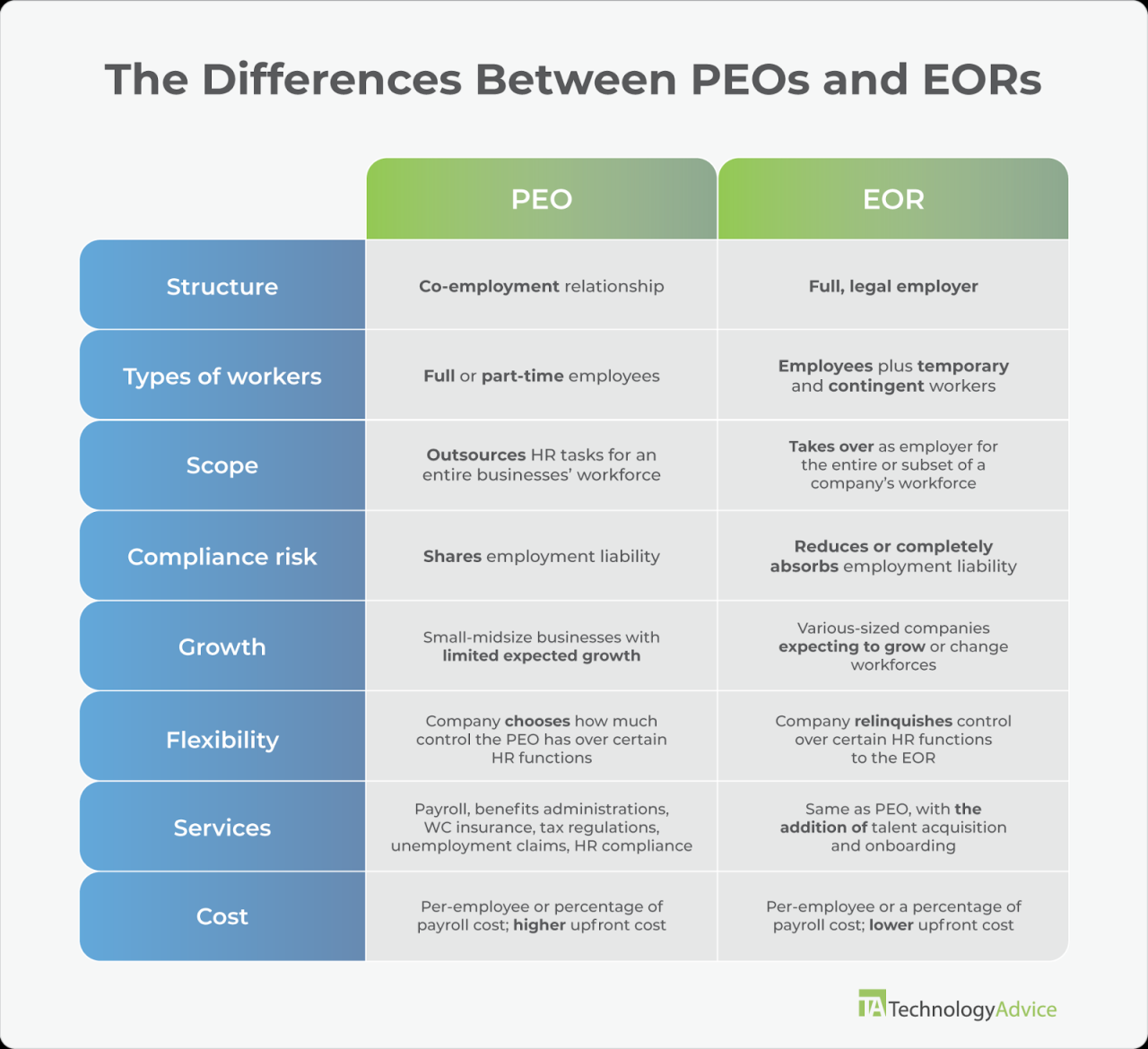

Comparison of Legal Responsibilities

EORs and common law employers differ significantly in their legal responsibilities. EORs act as the legal employer, handling compliance and administration, while common law employers bear the full legal and financial weight of the employment relationship. This distinction impacts liability for employment-related issues.

Liability for Employment-Related Issues

EORs generally limit their liability to fulfilling their contractual obligations as the employer of record. This often means they are not held directly responsible for employment disputes or other legal issues stemming from the employee-contractor relationship, although contractual terms can vary. Conversely, common law employers are directly liable for any employment-related issues, including disputes, non-compliance with labor laws, and payroll discrepancies.

For example, if a common law employer fails to comply with minimum wage laws, they are directly liable. However, with an EOR, the liability rests on the EOR.

Roles and Responsibilities in Contracts and Compliance, Eor vs common law employer

EORs handle the creation and management of employment contracts, ensuring they align with local laws and regulations. They manage the administrative tasks of employee onboarding and offboarding. Common law employers directly negotiate and manage these contracts, maintaining full responsibility for compliance. An EOR, for example, might be required to follow specific regulations in a given country regarding contracts, whereas a common law employer has to navigate those regulations directly.

Scenarios Favoring EOR Models

EORs are often preferred in situations where a company wants to minimize its legal risk and administrative burden, particularly in international markets with complex labor laws. For example, a US-based company hiring employees in Europe may choose an EOR to navigate the nuances of European employment laws. Another example is when a business is scaling rapidly and does not have the internal resources or expertise to handle employment-related compliance.

Comparison Table

| Aspect | EOR | Common Law Employer |

|---|---|---|

| Employee Relations | EOR manages employee relations on behalf of the hiring company, but the hiring company retains some influence. | Directly responsible for all employee relations. |

| Benefits Administration | EOR handles the administration of benefits programs, ensuring compliance with regulations. | Responsible for designing, administering, and managing benefits programs. |

| Payroll | EOR manages payroll processing, including tax withholdings and remittances. | Manages payroll, tax withholdings, and remittances directly. |

Legal Considerations

Navigating the legal landscape when choosing between an Employer of Record (EOR) and traditional common law employment can be complex. Understanding the potential legal implications, tax liabilities, and regulatory requirements is crucial for making an informed decision. This section delves into the specific legal considerations associated with each model, highlighting areas where risks and responsibilities diverge.

Legal Implications of Choosing an EOR Model

EORs act as a legal intermediary between the client company and the employee. This intermediary status impacts various legal aspects, including liability for employment laws, tax compliance, and regulatory adherence. EORs typically handle payroll, benefits administration, and other employment-related tasks, mitigating the client company’s direct legal exposure. However, understanding the specific terms and conditions of the EOR agreement is paramount to avoid unforeseen liabilities.

Examples of Legal Risk Differences

The legal risks associated with EOR and common law employment differ significantly in certain scenarios. For instance, in cases of employee claims related to non-compliance with labor laws, an EOR typically bears primary responsibility, shielding the client company from direct legal action. However, if an employee alleges discrimination or harassment, the client company could still face legal repercussions depending on the specifics of the EOR agreement and the jurisdiction.

Furthermore, issues surrounding independent contractor classification may differ between EOR and common law models, with EORs potentially mitigating the risk of misclassification but not eliminating it entirely.

Tax Implications for EOR and Common Law Employers

Tax implications are a key differentiator between EOR and common law employment. EORs handle the entire tax withholding and reporting process for employees, often simplifying compliance for the client company. However, the client company still bears responsibility for ensuring the EOR accurately handles these obligations. Conversely, common law employers have direct responsibility for withholding and reporting taxes, along with adhering to specific tax regulations for their jurisdiction.

The complexity of tax regulations varies significantly across countries, and each model necessitates careful consideration of tax implications in the relevant jurisdiction.

Regulatory Requirements

Regulatory requirements differ substantially between EOR and common law structures. EORs generally handle compliance with labor laws, payroll regulations, and benefits standards in the employee’s jurisdiction, reducing the client company’s administrative burden. However, the client company is still responsible for ensuring the EOR’s compliance and adhering to any additional regulations specific to their business activities. Common law employers, on the other hand, are directly responsible for ensuring compliance with all applicable regulations, which can include specific labor laws, minimum wage requirements, and overtime regulations.

The specific regulations vary across jurisdictions.

Legal Protections for Employees

Legal protections afforded to employees under both models vary depending on the specific jurisdiction and the terms of the agreement. EORs generally provide employees with the legal protections mandated by local laws. However, the extent of these protections might differ from the protections afforded to employees under common law employment, where the employer bears the direct responsibility for ensuring compliance with labor laws.

Understanding the precise protections and limitations under each model is essential for employees and employers alike.

Potential Disputes and Legal Challenges

Potential disputes and legal challenges vary between the two models. EOR disputes often involve disagreements regarding compliance, coverage, or performance under the EOR agreement. Common law employment disputes may involve a broader range of issues, such as wage claims, discrimination, or wrongful termination. Thorough due diligence, including careful contract review and legal consultation, is critical in mitigating potential legal risks under both models.

Figuring out the differences between EOR and common law employer can be tricky, right? It’s all about who’s responsible for what. This recent breakthrough at Lawrence Berkeley National Laboratory regarding dark energy, dark energy breakthrough lawrence berkeley national laboratory , highlights the complex interplay of responsibilities in various fields, which is surprisingly similar to the complexities of employer classifications, whether it’s EOR or common law.

Ultimately, understanding the nuances of these distinctions is key for any business owner navigating the legal landscape.

Employment Laws by Jurisdiction

| Jurisdiction | EOR Applicability | Common Law Applicability |

|---|---|---|

| United States | Federal and state labor laws apply, often handled by the EOR | Direct responsibility for compliance with all applicable labor laws |

| United Kingdom | Employment laws and regulations apply, often handled by the EOR | Direct responsibility for compliance with employment laws and regulations |

| European Union | EU directives and national laws applicable, often handled by the EOR | Direct responsibility for compliance with EU and national labor laws |

This table provides a general overview. Specific employment laws and regulations vary within each jurisdiction, requiring careful consideration by both EORs and common law employers.

Practical Implications

Navigating the complexities of employment law can be daunting for any business, especially when scaling or venturing into new territories. Choosing the right employment model—whether a traditional common law structure or an Employer of Record (EOR) solution—significantly impacts administrative burdens, costs, and operational efficiency. This section delves into the practical advantages and disadvantages of each approach, examining the potential pitfalls and opportunities for businesses.Understanding the implications of each model is crucial for informed decision-making.

Businesses must weigh the administrative overhead, potential costs, and scalability benefits of both EOR and common law models to determine the most suitable path for their specific needs and circumstances.

Administrative Burdens for Common Law Employers

Common law employers bear a substantial administrative burden. This includes managing a wide range of compliance tasks, from payroll processing and tax withholdings to benefits administration, employment contracts, and regulatory reporting. Each employee’s unique circumstances require meticulous attention to detail, often demanding significant time and resources. Errors in these processes can lead to penalties and legal repercussions.

For example, a company with 50 employees might spend several hours weekly on payroll processing, not accounting for potential issues or adjustments.

Figuring out the difference between an EOR and a common law employer can be tricky, but it’s crucial for understanding your employment rights. One key aspect is how information is presented, and we’ve opted for a “view more” button instead of traditional pagination on our site. This streamlined approach, as detailed in our article why we choose the view more button instead of pagination , makes navigating the complexities of EOR vs.

common law employer information much easier. Ultimately, understanding these distinctions empowers you to make informed decisions about your employment status.

Potential Benefits of Using an EOR

EORs offer significant advantages, particularly for companies with complex international operations or those focused on rapid expansion. The most prominent benefit is streamlined administration. EORs handle the complexities of local employment laws, payroll, taxes, and benefits, allowing companies to focus on core business functions. This frees up valuable internal resources and reduces the risk of costly legal errors.

Practical Advantages and Disadvantages of Using an EOR

Using an EOR offers several advantages. EORs are experts in global employment law, handling the complexities of local regulations, and ensuring compliance in various jurisdictions. This often translates to reduced administrative overhead and lower risk of legal violations. However, businesses should acknowledge potential disadvantages. EOR services may come with a fee structure that can increase the overall cost of employment.

The reliance on a third party also potentially limits direct control over employment-related processes.

Costs Associated with Each Model

The costs associated with each model vary significantly. A common law employer faces ongoing costs for payroll processing, benefits administration, tax compliance, and legal consultations. These costs can be substantial, particularly as the workforce grows. EOR services typically involve monthly fees based on the number of employees and other factors. While upfront costs might seem higher, the potential long-term savings from reduced administrative burden and risk mitigation can outweigh the initial investment.

Administrative Procedures and Time Investment

Administrative procedures for a common law employer are often complex and time-consuming. Payroll, tax compliance, and benefits administration require significant resources. In contrast, an EOR streamlines these processes, freeing up company time and resources for strategic initiatives. Companies using an EOR can potentially allocate staff to core business functions instead of administrative tasks.

Streamlining International Expansion with an EOR

EORs are instrumental in streamlining international expansion. They navigate the complexities of local employment laws, ensuring compliance in various jurisdictions. This removes a significant hurdle for companies seeking to enter new markets, allowing them to focus on market entry strategies rather than intricate legal procedures. For example, a US-based company expanding to Europe can use an EOR to handle all employment-related compliance in each country.

Cost Comparison Table

| Task | EOR | Common Law Employer |

|---|---|---|

| Payroll Processing | $50-$150 per employee per month (variable) | $25-$100+ per employee per month (variable) |

| Benefits Administration | $10-$50 per employee per month (variable) | $5-$20+ per employee per month (variable) |

| Tax Compliance | $25-$100 per employee per month (variable) | $10-$50+ per employee per month (variable) |

| Legal Consultation | Included in EOR fee (variable) | Variable, depending on need |

Note: Costs are estimates and can vary significantly based on factors like employee count, location, benefits offered, and complexity of legal compliance.

Case Studies and Examples: Eor Vs Common Law Employer

Choosing between an Employer of Record (EOR) and a traditional common law employer model is a crucial decision for companies expanding internationally or seeking to optimize their workforce structure. Understanding the practical implications of each model through real-world examples and case studies is vital in making informed choices. This section explores successful EOR implementations, potential challenges with common law models, and the benefits of each approach within specific industries.The diverse landscape of global employment regulations necessitates careful consideration of legal and logistical factors.

Each model presents unique advantages and disadvantages, and understanding these nuances is key to aligning business strategies with legal requirements and minimizing risks.

Successful EOR Implementation Case Study

A tech startup, expanding into the European market, faced complex local employment laws and regulations. Implementing a robust HR function in each new market would have been costly and time-consuming. Instead, they opted for an EOR solution. The EOR handled all employment-related administrative tasks, including payroll, compliance, and benefits administration in various European countries. This allowed the startup to focus on its core business activities and product development, while ensuring all employees were legally compliant.

The EOR’s expertise in local regulations minimized the risk of penalties or legal disputes. This streamlined approach allowed for rapid expansion into new markets, while significantly reducing the operational overhead.

Potential Challenges of the Common Law Employer Model

Companies operating under a common law employer model face numerous challenges, particularly when dealing with international expansion. Each country has its own unique labor laws, and navigating these differences can be complex. This involves understanding and complying with various regulations concerning working hours, leave policies, employee benefits, and termination procedures. For example, differences in minimum wage requirements, tax regulations, and social security contributions across countries create significant complexities for companies operating internationally.

Failure to comply can lead to substantial fines, legal disputes, and damage to the company’s reputation.

Benefits of Choosing One Model Over Another in a Specific Industry

In the creative industry, such as advertising or film production, EORs can offer significant advantages. The nature of the work, often involving temporary or freelance talent, makes compliance with local labor laws even more intricate. An EOR handles the necessary legal documentation and compliance, ensuring seamless onboarding and management of contractors and freelancers across different jurisdictions. This flexibility can help companies to quickly adapt to changing market demands and attract talent globally.

Onboarding Process Comparison

The onboarding process under both models differs significantly. With an EOR, the onboarding process is often more streamlined and standardized. The EOR handles the administrative tasks, including paperwork, compliance checks, and employee onboarding. With a common law employer, the company directly handles the onboarding process, requiring dedicated HR staff, thorough legal compliance checks, and comprehensive documentation.

Strategic Decisions by Companies

Many companies have made strategic decisions based on the advantages and disadvantages of each model. For example, a global retail giant might utilize an EOR in emerging markets with complex employment regulations while maintaining a common law employer model in their established markets. This demonstrates the adaptability and strategic importance of choosing the appropriate model for different market contexts.

A technology company focused on rapid international expansion might rely on EOR to navigate the complex labor laws in multiple jurisdictions, enabling a faster time to market.

Figuring out the differences between EOR and common law employers can be tricky. Knowing the nuances of employment law is crucial, and a big part of that is clear, concise writing. To help you navigate this, I recommend checking out these 5 ways to make writing easier 5 ways to make writing easier. This will help you clearly define the responsibilities and obligations of each type of employer, making the whole process of understanding EOR vs.

common law employer much simpler. Ultimately, understanding these differences is key to avoiding potential legal issues.

Employee Relations Differences

Employee relations under both models differ. An EOR model typically provides a more standardized approach to employee relations, with the EOR responsible for communicating and addressing employee concerns. Under a common law employer model, the company itself manages employee relations, often with direct communication channels and more tailored approaches to individual employee needs.

Comparative Table of EOR and Common Law Employer Models

| Feature | EOR Model | Common Law Employer Model |

|---|---|---|

| Compliance | EOR handles local compliance; less risk for the company | Company directly responsible for local compliance; higher risk |

| Cost | Fixed fees; potentially lower initial cost | Variable costs (salaries, benefits, taxes); potentially higher initial cost |

| Flexibility | High flexibility for scaling workforce; quick expansion | Lower flexibility for scaling workforce; slower expansion |

| Time Commitment | Less time commitment for HR tasks | More time commitment for HR tasks |

| Expertise | EOR provides specialized knowledge of local labor laws | Company needs internal expertise or external consultants |

| Risk | Lower risk for legal issues related to local employment laws | Higher risk for legal issues related to local employment laws |

Outsourcing and HR Solutions

Navigating the complexities of employment law is crucial for any business, especially when considering international expansion or managing diverse workforces. Outsourcing, particularly through Employment-Oriented Resource (EOR) models, can streamline operations and mitigate legal risks. Effective HR solutions are essential for maintaining compliance and fostering a positive employee experience under both EOR and common law employment structures.

Outsourcing as a Strategy

EORs provide a streamlined solution for companies managing employees in jurisdictions with different employment laws. This allows businesses to focus on their core competencies while adhering to local regulations. Common law employment, on the other hand, requires in-depth knowledge of local employment legislation. Outsourcing HR functions to specialized providers can help mitigate risks and streamline operations. This includes aspects like payroll processing, benefits administration, and compliance.

Outsourcing choices depend heavily on the company’s size, budget, and the complexity of its global operations.

HR Solutions in Managing Employment Relationships

Effective HR solutions are crucial for managing both EOR and common law employment relationships. These solutions can encompass a wide range of functionalities, from onboarding and payroll to performance management and compliance monitoring. HR solutions help organizations streamline processes, reduce administrative burdens, and ensure adherence to local and international labor laws. This is vital in maintaining a positive employee experience and minimizing legal risks.

Examples of HR Software Solutions

Numerous HR software solutions are available for both EORs and common law employers. Examples include BambooHR, Gusto, ADP, and Workday. These platforms offer various features, including employee self-service portals, performance management tools, and compliance reporting. The specific features and functionality required will vary depending on the organization’s size and needs. For instance, a small startup might benefit from a basic platform, while a large multinational corporation may require a more comprehensive solution.

HR Compliance for Both Models

Maintaining HR compliance is critical for both EOR and common law employers. Non-compliance can lead to significant financial penalties, legal disputes, and damage to reputation. Staying updated on evolving labor laws and regulations is crucial for preventing issues. EORs, by virtue of their structure, handle a significant portion of this compliance burden, while common law employers need to implement robust internal controls and procedures.

Utilizing legal counsel for regular reviews is an excellent way to ensure compliance.

Impact of Automation on Employment Practices

Automation is significantly impacting employment practices for both EOR and common law employers. Automation tools can streamline administrative tasks, improve data accuracy, and reduce manual errors in areas like payroll processing, benefits administration, and onboarding. Automation also facilitates faster responses to employee queries and updates. However, it’s crucial to consider the impact on human resources and potential job displacement.

Companies must carefully plan and implement automation strategies to maximize efficiency while mitigating risks.

Workflow and Systems for Employee Data

The workflow and systems for handling employee data differ between EOR and common law employers. EORs typically handle employee data centrally, providing a standardized process across various jurisdictions. Common law employers often manage employee data locally, with specific systems for each country or region. This difference necessitates a thorough understanding of data security and privacy regulations in each jurisdiction.

HR Solutions Applicability Table

| HR Solution | EOR Applicability | Common Law Employer Applicability |

|---|---|---|

| BambooHR | High | High |

| Gusto | High | High |

| ADP | High | High |

| Workday | High (for larger organizations) | High (for larger organizations) |

| Specialized EOR Platforms | Very High | Low |

Note: Applicability ratings are relative and depend on the specific features and functionalities required. For example, specialized EOR platforms might offer extensive international compliance features, making them more suitable for companies with global operations.

Closing Notes

In conclusion, the choice between EOR and common law employment structures involves a multifaceted evaluation. Factors like liability, administrative burden, and scalability are key considerations. This analysis highlights the potential benefits and drawbacks of each approach, equipping businesses with the knowledge to select the most suitable model for their operations. Ultimately, understanding the intricacies of EOR vs common law employment is paramount for success in today’s dynamic business landscape.