California AI Insurance Ban A New Era

New California law ban artificial intelligence deny insurance claims is reshaping how insurance companies operate. This groundbreaking legislation aims to ensure human oversight in claim decisions, potentially impacting both insurers and consumers. The law’s specifics, potential impacts, and potential legal challenges are all being closely scrutinized, marking a significant step in the evolving relationship between technology and the insurance industry.

The law’s provisions will detail exactly how AI’s role in claim processing is restricted, and the extent of human intervention required. This could involve a wide range of adjustments, from retraining existing AI systems to establishing new protocols for claim review.

Overview of the Law

California’s recent legislation aimed at curbing the use of artificial intelligence (AI) in insurance claim denials marks a significant step in consumer protection. This law reflects a growing concern over the potential for bias and unfairness in automated decision-making processes within the insurance industry. The law seeks to ensure that human oversight plays a critical role in determining the validity of insurance claims.This new law, while intending to improve fairness and transparency, is expected to bring about significant adjustments in how insurance companies operate.

The specific provisions and limitations of the law will shape its practical application and long-term effects on the insurance landscape.

Specific Provisions and Limitations

The law Artikels strict guidelines for the use of AI in evaluating insurance claims. It prohibits AI from being the sole determining factor in denying a claim. A human review process must be in place to verify the AI’s assessment and provide a reasoned explanation for any denial. Furthermore, the law mandates the disclosure of the AI’s role in the claim decision-making process.

Rationale Behind the Law

The rationale behind this legislation is rooted in concerns about algorithmic bias and the potential for AI to perpetuate existing inequalities. AI models, trained on historical data, may inadvertently reflect and amplify societal biases, leading to unfair or discriminatory outcomes for certain demographics. The law prioritizes human oversight to address these concerns and ensure equitable claim processing.

Potential Impact on the Insurance Industry

The new law is likely to alter the existing insurance claim process, potentially increasing the administrative burden on insurance companies. The requirement for human review could lead to delays in claim processing and higher operational costs. Insurers may need to invest in additional resources and training to ensure compliance. This will necessitate a transition in the way insurers handle claims, potentially shifting toward a more manual or hybrid approach.

Summary of Key Provisions

| Section | Description | Example |

|---|---|---|

| Section 1 | Prohibits AI as the sole determinant in claim denial. | An AI system cannot automatically deny a claim for auto damage without human review. |

| Section 2 | Requires human review and justification for any AI-assisted denial. | If AI flags a potential fraud in a home insurance claim, a human reviewer must thoroughly investigate the claim and provide a detailed explanation of the denial decision. |

| Section 3 | Mandates disclosure of AI’s role in the claim decision. | The insurance company must inform the claimant if AI played a role in their claim denial and explain the specific factors considered. |

| Section 4 | Specifies training requirements for human reviewers on AI-assisted claim processing. | Insurance company employees handling AI-assisted claims must undergo training on identifying potential biases and evaluating claims fairly. |

Impact on Insurance Companies: New California Law Ban Artificial Intelligence Deny Insurance Claims

This new California law banning AI-driven denial of insurance claims presents significant challenges for insurance companies, requiring a fundamental shift in their operations. The law’s implications extend beyond immediate financial impacts, touching upon operational efficiency, claim processing, and the future of risk assessment. Understanding these multifaceted effects is crucial for insurers to navigate this evolving landscape.This law mandates a human review process for AI-driven claim denials, effectively placing a significant burden on insurers.

The need to adapt existing systems and potentially retrain personnel to handle these reviews will be crucial to successfully implement compliance strategies. Further, the law’s impact will vary across different types of insurance, necessitating tailored responses.

Potential Financial Implications

Insurers will face increased costs due to the necessity of human intervention in claim review processes. These costs include increased labor expenses for claims adjusters and potentially increased administrative costs associated with implementing new review procedures. For example, a large property insurer might experience substantial increases in their operational budget, as the manual review of AI-generated claim denials could significantly increase processing time.

Moreover, the potential for delayed claim payments could lead to increased legal costs and reputational damage.

Potential Operational Challenges

Implementing human review processes for AI-driven claim denials will present significant operational challenges. Insurance companies will need to re-engineer existing claim processing workflows to incorporate the human review step. This may necessitate significant investments in new technology and software to manage the increased volume of claims requiring manual review. Furthermore, ensuring consistent and unbiased human judgment across different claims will be critical to maintaining fair and equitable practices.

The potential for inconsistent interpretations of the law and the complexity of the claim evaluation process will also impact the efficiency and speed of processing.

Impact on Different Types of Insurance

The impact of the law will differ across various insurance types. Health insurance companies, for example, might face higher operational burdens due to the complexity of medical claims and the potential for lengthy appeals processes. Conversely, auto insurers may find the impact more manageable, as the claims might be less complex. Moreover, the law will affect the cost of insurance, potentially leading to price increases to cover the additional administrative costs.

Need for Adjusting Existing Claim Processes

Insurers will need to overhaul existing claim processes to incorporate the human review component. This might involve modifying existing claim forms, developing standardized procedures for human reviewers, and creating clear protocols for handling appeals. The key is to design processes that ensure both compliance with the law and efficient claim resolution.

Methods for Compliance

Companies can achieve compliance by training claims adjusters in evaluating AI-generated claims and implementing robust quality control measures. Further, developing a standardized procedure for human review of AI-generated claims is crucial. Transparency in the claim review process is essential, and detailed documentation of the review process is critical for legal purposes.

Impact on Different Insurance Company Sizes

| Insurance Company Size | Financial Implications | Operational Challenges |

|---|---|---|

| Small | Potentially significant financial burden, potentially impacting profitability due to limited resources. | Significant operational challenges, as small companies may not have the resources to hire additional staff or invest in new technologies. |

| Medium | Moderate financial impact, potentially impacting profitability, requiring careful resource allocation. | Moderate operational challenges, requiring adjustments to existing systems and workflow, requiring training and support for new procedures. |

| Large | Significant financial impact, potentially impacting profitability, but likely to have the resources to handle the adjustments. | Significant operational challenges, but potentially greater capacity to invest in new technologies and hire additional staff. |

Impact on Consumers

This new California law banning AI in insurance claim denials promises a significant shift in how consumers interact with their insurance providers. The core principle is to ensure fairness and transparency in the claim process, preventing potentially biased or inaccurate decisions made by algorithms. However, the actual impact on consumers is multifaceted, presenting both opportunities and challenges.This law aims to create a more human-centric approach to claim processing, potentially reducing instances where consumers feel unfairly targeted or penalized by automated systems.

However, the transition to a more manual process may introduce delays and other practical hurdles for both consumers and insurers. The long-term effects on premiums and overall insurance accessibility remain to be seen.

Consumer Access to Insurance

The law’s effect on consumer access to insurance is likely to be complex. While the intention is to create a more equitable system, insurers might face increased costs associated with manually reviewing claims. This could potentially lead to higher premiums for some consumers, especially if insurers struggle to absorb the increased workload and operational costs. Conversely, the law could incentivize insurers to improve their internal processes and adopt alternative, more human-centric approaches, potentially leading to more accessible insurance options for specific customer segments.

Potential Benefits for Consumers

This law has the potential to significantly improve the consumer experience. Consumers may encounter fairer claim processing due to the reduction in automated denials based on biased or inaccurate data. This, in turn, can lead to reduced frustration and potentially faster resolutions. The increased transparency in the claim process could give consumers greater control and insight into their claims, enabling them to better understand the rationale behind decisions.

- Reduced Bias: The elimination of AI-driven denials can lead to a decrease in discriminatory outcomes for specific demographics or individuals, thereby promoting fairer claim outcomes.

- Faster Resolution (in some cases): While some claims may take longer due to manual review, other, more straightforward claims could experience faster resolutions as the manual review process may be more efficient for them.

- Improved Transparency: Consumers will likely have more insight into the reasoning behind claim decisions, which can help them understand their rights and responsibilities.

Potential Drawbacks for Consumers

Despite the potential benefits, the law could present some drawbacks. Increased costs for insurers could lead to higher premiums for consumers. Delays in claim processing are also a possibility as insurers transition to manual review procedures. Additionally, there’s the potential for inconsistencies in claim handling across different insurance providers.

- Increased Premiums: Insurers may pass on increased costs associated with manual claim review to consumers in the form of higher premiums.

- Potential for Delays: The transition to manual claim processing could result in longer wait times for claim approvals and resolutions.

- Inconsistencies in Claim Handling: Different insurance providers may adopt varying approaches to manual claim review, potentially leading to inconsistencies in outcomes.

Fairer Claim Processing

The core objective of this law is to ensure fairer claim processing. By removing AI from the claim denial process, insurers will need to scrutinize each claim manually, potentially leading to a reduction in biased or inaccurate decisions. This, in turn, should lead to a more equitable and transparent process for consumers.

“The elimination of AI in insurance claim denials aims to create a more human-centric approach, reducing the risk of biased or inaccurate decisions.”

Consumer Scenarios

Let’s consider a few examples. A homeowner with a claim for storm damage might see a faster resolution if their claim is thoroughly evaluated by an insurance adjuster. Conversely, a consumer with a fraudulent claim might face a more rigorous investigation under the new process, which could lead to slower resolution times.

| Consumer Scenario | Potential Positive Outcome | Potential Negative Outcome |

|---|---|---|

| Homeowner with legitimate storm damage claim | Faster resolution and more thorough evaluation by an adjuster. | Potential for slight delays in processing, though this may be balanced by the greater thoroughness. |

| Consumer with a fraudulent claim | More rigorous investigation, potentially leading to a faster denial due to the heightened scrutiny. | Slower claim resolution due to the comprehensive review process. |

| Consumer with a complex claim requiring extensive documentation | Increased chance of a fair claim assessment with a more detailed review. | Potentially longer processing times due to the need for manual review of extensive documentation. |

Potential Legal Challenges

This new California law prohibiting AI from denying insurance claims presents a complex landscape of potential legal challenges. The law’s sweeping nature and the inherent complexities of AI algorithms raise concerns about its constitutionality and practical application. Navigating these potential pitfalls will be crucial for both insurance companies and consumers.This section delves into the potential legal battles that might arise from this groundbreaking legislation.

We will explore arguments for and against the law’s constitutionality, analyze possible interpretations of ambiguous clauses, and examine potential avenues for legal action from both insurers and policyholders.

Potential Arguments for the Law’s Constitutionality

This law aims to prevent discriminatory practices by AI in insurance claim denials. Proponents will likely argue that the law is a legitimate exercise of the state’s police power to protect consumers from unfair and potentially biased practices. They may cite examples of existing legislation addressing similar issues, such as anti-discrimination laws in employment or housing, to support the law’s constitutionality.

The argument could also center on the principle of consumer protection, arguing that the law is necessary to safeguard vulnerable consumers from unfair practices.

Potential Arguments Against the Law’s Constitutionality

Opponents of the law might argue that it constitutes an undue burden on insurance companies, potentially increasing premiums or hindering their ability to assess risk effectively. The claim could be made that the law is overly broad and interferes with the fundamental right of insurers to set their own pricing policies. They might contend that the law’s reliance on AI’s inherent limitations in certain contexts may lead to inconsistent or unjust outcomes, potentially resulting in a lack of accuracy or fairness.

Possible Interpretations of Ambiguous Clauses

The law’s language, while aiming for clarity, may contain ambiguous clauses that could be interpreted differently by courts. For example, defining “artificial intelligence” in the context of insurance claim denials could be problematic. Furthermore, determining the precise standards for evaluating whether an AI decision is discriminatory could prove difficult, particularly when considering the complexities of machine learning algorithms. This ambiguity could lead to conflicting interpretations in court cases, impacting both the insurance industry and individual policyholders.

California’s new law, banning AI from denying insurance claims, is a big step. It’s fascinating to see how this technology is being regulated, and while it’s important to consider the impact on insurance companies, it’s also crucial to remember the vital work of organizations like Stanford Blood Centers, who are continually giving back to those who give blood. Stanford Blood Centers giving back to those who give blood highlights the human element often overlooked in these technological advancements.

Ultimately, these advancements must consider the ethical implications and ensure fairness in access to resources like insurance. The new law is a good start, but it’s a complex issue with many factors to consider.

Potential Avenues for Legal Action

Insurers might challenge the law in court, arguing that it infringes on their right to conduct business and manage risk. Consumers, on the other hand, could initiate legal action if they believe their claims were unjustly denied due to the application of the AI system. Possible avenues for legal action include filing lawsuits claiming violations of the law, seeking injunctions to prevent its enforcement, or demanding compensation for damages incurred due to AI-related denials.

Comparison of Arguments for and Against the Law’s Constitutionality

| Argument | For | Against |

|---|---|---|

| Constitutionality | Legitimate exercise of state police power to protect consumers from unfair practices. Similar to existing anti-discrimination laws. | Undue burden on insurance companies, potentially increasing premiums or hindering risk assessment. Interferes with the right to set pricing policies. Potential for inconsistent or unjust outcomes due to AI limitations. |

| Ambiguity | Clear intent to prevent discrimination; however, specific criteria may need further clarification. | Ambiguity regarding the definition of AI and standards for evaluating discriminatory AI decisions. |

| Impact on Consumers | Protects consumers from potential discrimination; ensures fairer claim processes. | Potential for increased premiums, difficulty in appealing denials, and inconsistent application of the law. |

Technological Responses

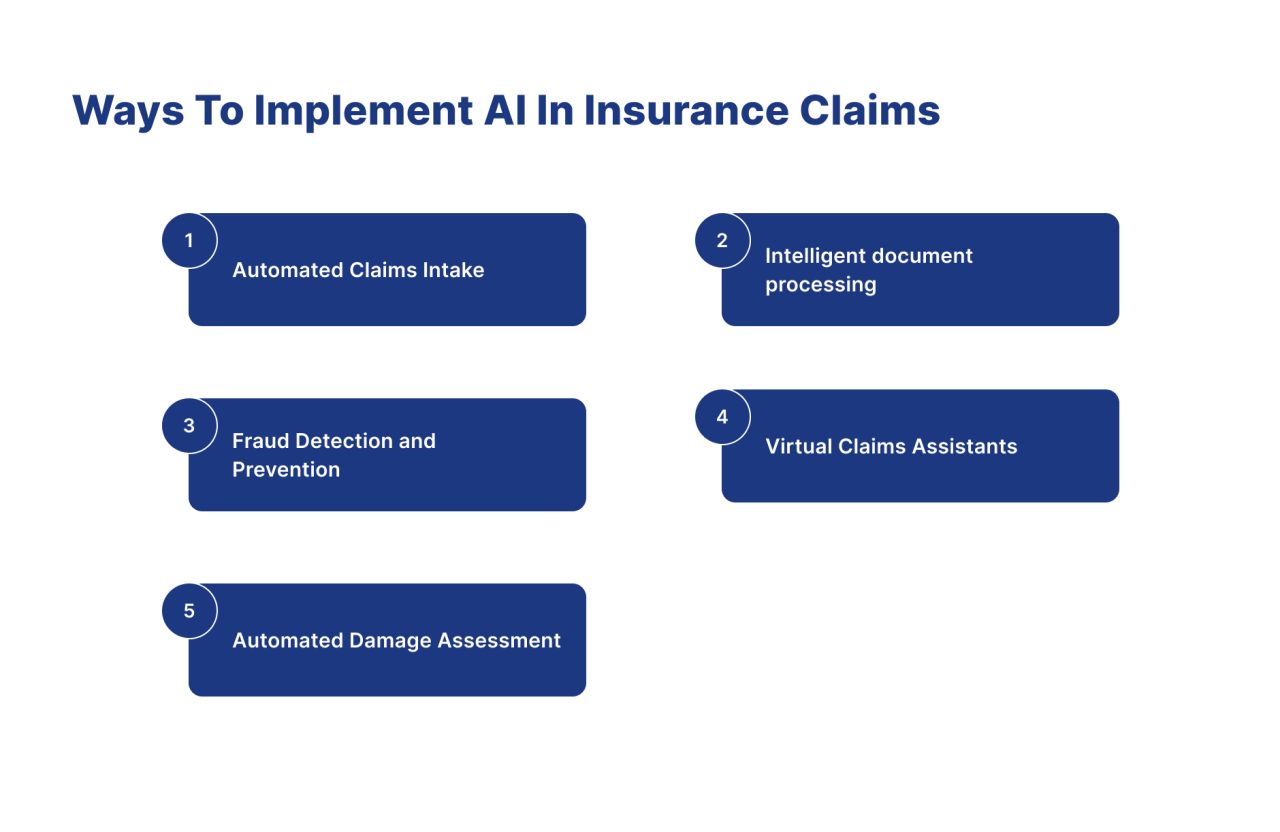

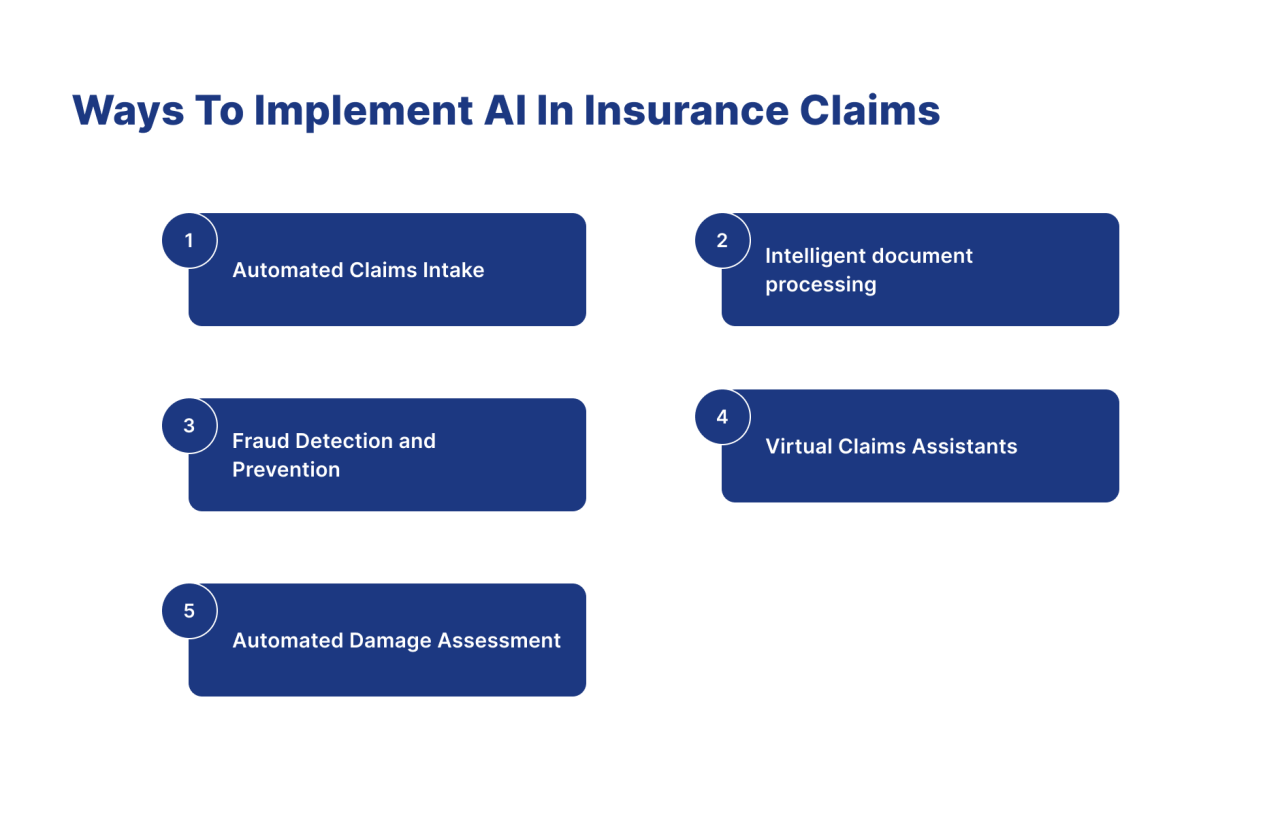

Navigating the complexities of the new California AI insurance claim ban requires innovative technological adjustments. Insurance companies must shift from relying solely on AI-driven assessments to a more human-centric approach, while simultaneously developing AI systems that comply with the new regulations. This necessitates a fundamental re-evaluation of current processes and the development of robust, transparent claim evaluation methods.

Potential Adjustments to AI Systems

The new law necessitates significant modifications to AI systems currently used in claim processing. Insurance companies need to re-engineer their AI algorithms to prioritize human oversight and avoid biased or discriminatory outcomes. This involves a meticulous examination of data inputs, model training, and output interpretation. A shift towards explainable AI (XAI) is crucial to ensure transparency and accountability.

Advancements in AI Systems to Avoid Violations

To prevent violations of the new law, insurance companies must implement AI systems that incorporate human-in-the-loop processes. This means developing AI that can flag potentially problematic claims for human review, providing clear justifications for automated decisions. Furthermore, the development of AI models capable of understanding and interpreting nuanced contextual factors is essential. For instance, an AI system designed to assess property damage claims might need to consider local building codes, environmental factors, and historical data specific to the affected area.

Role of Human Oversight in Claim Processes

Human oversight plays a critical role in maintaining fairness and accuracy in insurance claims. The new law emphasizes the need for human review and intervention in AI-assisted claim processing. This involves establishing clear guidelines for human intervention points, and training claim adjusters to recognize potential biases or anomalies within the data. Furthermore, clear documentation and audit trails for all claim decisions are essential.

Claims that exhibit inconsistencies, require further investigation, or fall outside predefined parameters must be flagged for human review. Human intervention is vital for maintaining the integrity and fairness of the claims process.

California’s new law, which prevents AI from denying insurance claims, is definitely a game-changer. It’s interesting to consider how this might affect real estate values, especially in a market like Oakland, where a single-family residence recently sold for a hefty $1.5 million. This recent sale in Oakland highlights the complexities of the current market, and it’s fascinating to think about how these factors might intersect with the new AI insurance regulations.

Ultimately, the new law is likely to have some ripple effects across the entire insurance industry.

Alternative Methods for Evaluating Claims

Beyond AI-driven assessments, alternative methods for evaluating claims can provide a more comprehensive and unbiased approach. Employing expert panels for complex claims, leveraging data from public records and external sources, and utilizing predictive modeling for risk assessment can be viable alternatives. For example, in cases involving medical claims, independent medical evaluations might be necessary to ensure the validity of the claim.

Illustrative Table of AI System Adaptations

| AI System Type | Current Function | Adaptation Needed to Comply | Example of Adaptation |

|---|---|---|---|

| Predictive Modeling for Risk Assessment | Estimates claim probability based on historical data | Incorporate human review of flagged cases, provide detailed explanations for risk assessment | Display the factors contributing to the risk assessment score, allowing adjusters to challenge or refine the model’s predictions |

| Image Recognition for Damage Assessment | Automatically assesses damage using images | Integrate human oversight for damage classification and estimation, ensure the accuracy of image analysis | Allow adjusters to review and refine the damage assessment, and provide detailed explanations of the damage identification process |

| Natural Language Processing for Claim Documentation | Automates claim documentation and data extraction | Develop clear guidelines for human intervention in cases with ambiguous or inconsistent information, ensure that claim summaries are understandable | Enable adjusters to review and edit claim summaries, adding clarifications and context where necessary. |

Industry Standards and Best Practices

Navigating the complex landscape of AI in insurance requires a robust framework of industry standards and best practices. The new California law banning AI-driven denial of insurance claims necessitates a significant shift in how insurers utilize this technology. Insurers must now prioritize transparency, fairness, and human oversight in their AI systems, leading to a reassessment of existing practices and a focus on proactive compliance.

California’s new law, which prevents AI from denying insurance claims, is pretty interesting. It’s definitely a step in the right direction for fairness and transparency, but it’s also worth noting that there’s a local prep roundup happening, with the Dublin boys basketball team beating Livermore St. Ignatius and the girls team taking down Valley Christian on Friday. Check out the full roundup here for all the exciting high school sports action.

Ultimately, the new AI law is a fascinating development, and hopefully it won’t lead to unintended consequences in the long run.

Influence of the Law on Industry Standards

The California law serves as a catalyst for the development of more robust industry standards for AI usage in insurance. Insurers are compelled to examine their current AI systems, identifying potential biases and areas where human intervention is crucial. This will likely result in a heightened emphasis on explainability and accountability in AI decision-making processes. Insurers will need to ensure that AI models are not only accurate but also demonstrably fair and equitable across all demographics.

Best Practices for Compliance

Implementing best practices for compliance is paramount. These practices should include rigorous testing of AI models to identify and mitigate potential biases. Detailed documentation of model development, training data, and decision-making processes is crucial for transparency and auditability. Furthermore, incorporating human review and oversight into the claims process is essential, especially in high-stakes or complex cases. Insurers must establish clear protocols for human intervention and define specific scenarios where human review is mandatory.

Potential Adjustments to Existing Industry Guidelines

Existing industry guidelines on AI usage in insurance will need significant revisions. These revisions must incorporate provisions for fairness, transparency, and accountability. Existing guidelines often lack specific protocols for bias detection and mitigation, which the new law addresses directly. Furthermore, clear guidelines for model explainability and human oversight are needed. Examples of adjustments could include incorporating metrics for bias detection into model evaluation and mandating regular audits of AI systems.

Collaborations Between Insurers and Tech Companies

Collaboration between insurers and tech companies is critical to develop effective and compliant solutions. Joint development efforts can lead to AI systems that meet the demands of the new law while also enhancing the efficiency and accuracy of insurance claims processing. Insurers can leverage tech companies’ expertise in AI development, while tech companies can benefit from the insights and data sets of the insurance industry.

This collaboration will also accelerate the development of AI models that are not only accurate but also address potential biases and ensure fair application.

Summary Table: Existing Standards vs. Proposed Modifications

| Existing Standard | Proposed Modification (in response to new law) |

|---|---|

| Limited documentation of AI model development | Comprehensive documentation of model development, including training data, algorithms, and decision-making processes. |

| Absence of explicit bias detection mechanisms | Inclusion of metrics for bias detection and mitigation in model evaluation and deployment. |

| Limited human oversight in AI-driven claims | Clear protocols for human review and intervention, especially in complex or high-risk claims. |

| Lack of transparency in AI decision-making | Detailed explanations of AI-driven decisions, enabling insurers to understand and justify outcomes. |

Illustrative Scenarios

Navigating the complexities of AI in insurance claims requires careful consideration of potential scenarios. The new California law, designed to curb the potential for bias and error, introduces a significant shift in how claims are processed. Understanding how this law will impact various claim types is crucial for both insurers and policyholders.

AI-Driven Claim Evaluation

The new law aims to create a more transparent and equitable system. AI tools can analyze massive datasets to identify patterns and potential fraudulent claims. For example, in property damage claims, AI algorithms could quickly assess the extent of damage based on images and historical data. This can streamline the claim process, particularly for low-value claims.

Human Review Requirements, New california law ban artificial intelligence deny insurance claims

While AI can expedite assessments, human oversight remains vital. The law necessitates human review in critical situations. In complex property damage claims involving structural damage, nuanced factors such as building codes and potential pre-existing conditions necessitate a human touch. Similarly, in health insurance claims, the law mandates human review for cases involving pre-existing conditions or unusual diagnoses, where AI may not fully understand the medical context.

The aim is to ensure accuracy and prevent potentially harmful misinterpretations of complex data.

Property Damage Claims

AI can efficiently process claims for minor property damage, such as hail damage to cars or damage from minor accidents. The new law mandates human review for larger or more complex claims, such as those involving structural damage to homes, significant storm damage, or claims with suspicious circumstances. Under the old law, these cases could have been solely assessed by AI.

The new law ensures human intervention for nuanced and complex claims, preventing potential errors in evaluation.

Health Insurance Claims

In health insurance, AI could initially evaluate claims based on common diagnoses and treatment patterns. However, the new law requires human review for complex cases involving pre-existing conditions, unusual diagnoses, or claims requiring specialized medical knowledge. This ensures that complex medical situations receive the appropriate consideration and reduces the potential for errors in assessing the claim’s validity.

Impact on Claim Evaluation (Table)

| Claim Type | AI Evaluation (Pre-New Law) | AI Evaluation (Post-New Law) | Human Review Requirement |

|---|---|---|---|

| Minor Property Damage (e.g., hail damage to car) | Potentially fully automated | Potentially fully automated | Limited or optional |

| Complex Property Damage (e.g., structural damage to home) | Potentially automated | Limited or non-automated; requires human review | Mandatory |

| Simple Health Claims (e.g., routine check-ups) | Potentially automated | Potentially automated | Limited or optional |

| Complex Health Claims (e.g., pre-existing conditions, unusual diagnoses) | Potentially automated | Limited or non-automated; requires human review | Mandatory |

Concluding Remarks

The new California law represents a bold experiment in balancing technological advancement with consumer protection in the insurance industry. While it promises a fairer and more transparent claim process, its implications for the insurance market are still unfolding. The impact on different types of insurance, the potential for legal challenges, and the need for technological adaptations will shape the future of AI’s role in claim processing.

Ultimately, this law could serve as a blueprint for other jurisdictions considering similar regulations.