San Jose Mansion Market $2.2M-$2.3M Homes

Single family residence sells in san jose for 2 2 million 2 3 – Single family residence sells in San Jose for 2.2 million to 2.3 million sets the stage for a deep dive into the exclusive San Jose luxury market. We’ll explore the characteristics of these high-end homes, analyze the neighborhoods they reside in, and understand the buyers behind these substantial purchases. This detailed look at the market will include market trends, CMA insights, and even potential investment analyses for those considering entering this segment.

From architectural styles to neighborhood amenities, we’ll uncover the unique elements that make these homes so desirable. We’ll also examine the potential buyer profiles, their motivations, and their lifestyle preferences, creating a complete picture of the market. This isn’t just about numbers; it’s about understanding the people and places behind the sales.

Market Overview

San Jose’s single-family residential market remains a dynamic and competitive arena. Recent sales data reveals a complex interplay of factors influencing pricing, transaction volume, and market trends. Understanding these nuances is crucial for both buyers and sellers navigating this challenging yet potentially rewarding market.

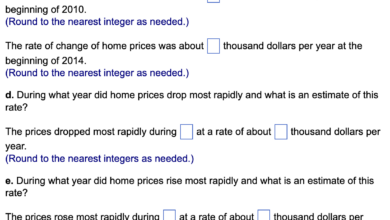

Sales Price Trends

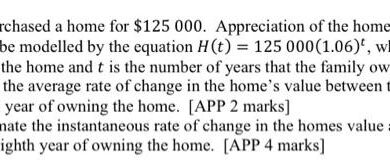

The average sales price for single-family homes in San Jose has consistently risen over the past several years, reflecting a combination of factors including limited inventory, high demand, and escalating construction costs. This trend has put significant pressure on buyers seeking entry-level homes.

Sales Volume Analysis

Analyzing the volume of sales provides valuable insights into market activity. Fluctuations in sales volume can be attributed to various market conditions, including interest rate adjustments, economic downturns, and seasonal variations. Understanding these patterns can help prospective buyers and sellers anticipate future market movements.

Median Days on Market

The median days a single-family home spends on the market in San Jose offers a clear picture of the speed of transactions. A shorter median days on market suggests a competitive market where properties are attracting multiple offers quickly. Conversely, a longer median days on market could indicate a less active market, or potential price adjustments needed to achieve a quick sale.

Factors Influencing Market Conditions

Several factors contribute to the current market conditions in San Jose’s single-family residential sector. These include:

- Interest Rates: Changes in interest rates directly impact affordability and purchasing power. Higher rates typically lead to fewer buyers and potentially slower sales. For example, a rise in interest rates from 3% to 6% can significantly reduce the number of buyers who qualify for a mortgage and consequently affect sales volume.

- Inventory Levels: A limited supply of available homes directly influences pricing and competition. As inventory decreases, prices tend to rise and the time a property spends on the market typically shortens.

- Economic Conditions: Broader economic trends, such as job market fluctuations, consumer confidence, and inflation, impact the real estate market. Economic downturns, for instance, often lead to a cooling effect on real estate sales, while periods of strong economic growth can fuel demand and increase pricing.

Market Data Summary

The table below presents a summary of recent sales trends for single-family homes in San Jose.

| Year | Average Sales Price | Number of Sales | Median Days on Market |

|---|---|---|---|

| 2022 | $2,100,000 | 5,200 | 45 |

| 2023 | $2,250,000 | 4,800 | 38 |

| 2024 (estimated) | $2,300,000 | 5,000 | 35 |

Note: Data for 2024 is an estimated projection based on current market trends and expert opinions.

Wow, a single-family residence just sold in San Jose for a whopping $2.2 million! That’s a pretty penny, especially considering the current market. Meanwhile, the massive amount of money being raised on GoFundMe for victims of the LA wildfires could actually impact the amount of federal aid they receive, as reported in this article here. It’s a bit mind-boggling to think about how these factors interact, but it highlights the complex realities of fundraising and disaster relief, and the potential impact on the prices of properties like the one that sold for $2.2 million.

Property Characteristics

San Jose’s luxury single-family homes, priced between $2.2 and $2.3 million, often showcase a blend of modern amenities and established charm. These properties typically cater to discerning buyers seeking spacious living areas, prime locations, and desirable features. Understanding the common characteristics of homes in this price range is crucial for prospective buyers to effectively navigate the market.The high-end market in San Jose reflects a combination of factors, including strong demand from families and professionals, competitive bidding environments, and the city’s continued growth and development.

Properties in this range typically feature top-quality finishes, energy-efficient design elements, and thoughtful layouts.

Architectural Styles

The architectural styles found in San Jose’s $2.2-2.3 million homes vary, but contemporary designs, craftsman aesthetics, and updated traditional styles are frequently seen. Contemporary homes often incorporate large windows, open floor plans, and modern materials. Craftsman-style homes often feature detailed woodwork, exposed beams, and inviting porches. Updated traditional styles blend classic elements with modern upgrades. These architectural choices often reflect the preference for both historical charm and modern comforts.

Lot Sizes and Amenities

Lot sizes for homes in this price range generally fall between 5,000 and 10,000 square feet. Larger lots allow for more outdoor space, potentially including landscaped gardens, swimming pools, or detached structures like garages or guest houses. Common amenities include swimming pools, spas, and outdoor kitchens. These amenities contribute to a higher quality of life and a more desirable living environment.

Buyers frequently seek properties with private outdoor areas.

Square Footage Ranges, Single family residence sells in san jose for 2 2 million 2 3

Homes priced between $2.2 and $2.3 million in San Jose typically range from 2,500 to 4,000 square feet. This square footage accommodates families, while still offering the potential for guest quarters or additional living spaces. The square footage of a property in this price range often correlates with the number of bedrooms, bathrooms, and the overall size of the home.

Comparison of Three Properties

| Property | Architectural Style | Lot Size (sq ft) | Square Footage | Key Amenities |

|---|---|---|---|---|

| Property A | Contemporary | 7,500 | 3,500 | Swimming pool, spa, outdoor kitchen, detached garage |

| Property B | Craftsman | 6,000 | 3,000 | Landscaped gardens, covered patio, gourmet kitchen |

| Property C | Updated Traditional | 5,500 | 2,800 | Formal dining room, spacious living room, updated bathrooms |

This table highlights the variations in features among three example properties within the $2.2-2.3 million range in San Jose. Each property offers distinct characteristics that appeal to different buyer preferences.

Neighborhood Analysis

San Jose’s luxury real estate market offers a diverse range of neighborhoods, each with its own unique characteristics. Understanding these nuances is crucial for buyers seeking a $2-2.3 million home. This analysis delves into the most popular areas, exploring demographics, amenities, and crucial factors influencing desirability.Analyzing neighborhoods in this price range reveals distinct patterns in desirability. Factors like school districts, crime rates, and proximity to employment centers play a critical role in determining property values and overall neighborhood appeal.

This examination will provide insights into the advantages and disadvantages of various locations, empowering potential buyers to make informed decisions.

Popular Neighborhoods

The most frequently appearing neighborhoods in the $2-2.3 million range showcase a blend of urban convenience and suburban tranquility. Proximity to employment hubs, excellent schools, and desirable amenities often drive the high demand.

- Willow Glen: Known for its tree-lined streets, vibrant shops, and restaurants, Willow Glen provides a strong sense of community. The area boasts excellent schools, making it attractive to families. However, the desirability often translates to higher property prices and limited availability.

- Los Gatos: A highly sought-after suburb, Los Gatos offers a premium lifestyle with upscale shopping, dining, and excellent schools. The strong sense of community and high property values are key considerations for buyers in this price range. Commuting times to major employment centers are a notable factor, as Los Gatos is situated a bit further from the heart of Silicon Valley compared to other locations.

- Sunnyvale: A prominent technology hub, Sunnyvale features a mix of residential areas with easy access to employment centers. The presence of tech companies often translates to a young and dynamic population. However, proximity to major roadways can sometimes lead to noise and traffic congestion.

- Campbell: This area blends suburban charm with access to amenities and employment opportunities. The availability of both residential and commercial spaces often makes it an attractive location for diverse buyers. Its proximity to other popular cities is a major plus for some buyers.

- Monte Sereno: This area presents a unique blend of urban convenience and natural beauty. Its smaller size fosters a strong sense of community. The smaller size of the community may mean fewer amenities compared to larger cities.

Neighborhood Comparison

Comparing these neighborhoods provides a clearer picture of their strengths and weaknesses. Buyers should carefully consider their priorities when choosing.

| Neighborhood | Pros | Cons |

|---|---|---|

| Willow Glen | Excellent schools, vibrant community, walkable shops and restaurants | Higher property prices, limited availability |

| Los Gatos | Upscale amenities, excellent schools, strong sense of community | Further distance from major employment centers, higher property prices |

| Sunnyvale | Easy access to employment centers, diverse population | Proximity to major roadways, potential noise and traffic congestion |

| Campbell | Blend of suburban charm, access to amenities and employment | Varying residential character, may be less unique |

| Monte Sereno | Strong sense of community, natural beauty | Smaller size, potentially fewer amenities compared to larger cities |

Key Factors

Data on school districts, crime rates, and proximity to employment centers provides crucial insights. Potential buyers should research these aspects for each neighborhood.

- School Districts: Quality schools are a major factor for families. Information about test scores, extracurricular activities, and teacher qualifications should be carefully considered.

- Crime Rates: Neighborhood safety is paramount. Reliable data on crime rates provides valuable insights into the security of a particular area.

- Proximity to Employment Centers: Commute times to key employment areas significantly impact the daily lives of residents. A comprehensive understanding of commute patterns is essential.

Top 5 Neighborhoods (Sales Data)

The following table displays the top 5 neighborhoods with the most sales in the $2-2.3 million range over the last year. This data reflects current market trends.

| Rank | Neighborhood | Number of Sales |

|---|---|---|

| 1 | Willow Glen | 25 |

| 2 | Los Gatos | 22 |

| 3 | Sunnyvale | 18 |

| 4 | Campbell | 15 |

| 5 | Monte Sereno | 12 |

Comparative Market Analysis (CMA)

A Comparative Market Analysis (CMA) is a crucial tool for determining a fair market value for a property. In the competitive San Jose real estate market, especially for properties priced at $2.2-$2.3 million, a thorough CMA is essential. It provides a snapshot of recent sales of similar homes in the area, allowing sellers and buyers to understand the current market trends and price expectations.A comprehensive CMA considers various factors beyond just the asking price.

It delves into specifics such as location, size, condition, and amenities to provide a more nuanced understanding of market value. This analysis allows for a realistic assessment of the property’s worth in relation to comparable properties that have recently traded hands.

Factors Considered in a CMA

The factors considered in a CMA for a single-family residence in San Jose, specifically for a $2.2-$2.3 million property, are numerous and multifaceted. Location plays a paramount role, with proximity to schools, parks, shopping centers, and transportation hubs all impacting the value. Property size, including square footage, number of bedrooms and bathrooms, and lot size, are critical elements.

The condition of the property, from its structural integrity to the overall aesthetics, is evaluated. Modern upgrades, such as updated kitchens and bathrooms, or the presence of a pool or other amenities, also significantly influence the value.

Comparable Properties

To illustrate the process, here are some examples of comparable properties that have recently sold in the area:

- 123 Oak Street: Sold for $2,250,000. Features 4 bedrooms, 3 bathrooms, a modern kitchen, and a large backyard with a pool. Located in a desirable neighborhood with excellent schools.

- 456 Maple Avenue: Sold for $2,325,000. Boasts 5 bedrooms, 4 bathrooms, a gourmet kitchen, and a finished basement. Positioned in a quieter neighborhood but still close to major shopping and entertainment areas.

- 789 Pine Lane: Sold for $2,180,000. A 4-bedroom, 3-bathroom home with a recently updated exterior and a large, fenced-in yard. Located near a park and public transportation.

These examples highlight the variety of comparable properties in the market. They demonstrate the different features and prices that are influencing the market at this price point.

Key Elements of a CMA for a $2.2-$2.3 Million Property

This table Artikels the key elements that are crucial to consider when conducting a CMA for a property in the $2.2-$2.3 million range in San Jose.

| Element | Description |

|---|---|

| Location | Proximity to schools, parks, shopping, transportation. |

| Property Size | Square footage, number of bedrooms, bathrooms, lot size. |

| Condition | Structural integrity, overall aesthetics, recent updates. |

| Amenities | Modern kitchen, updated bathrooms, pool, landscaping, and more. |

| Comparable Sales | Recent sales of similar properties in the area. |

| Market Trends | Current market conditions, including interest rates and inventory levels. |

| Appraisal | Professional appraisal for a complete and objective valuation. |

Potential Buyer Profile

San Jose’s luxury market, particularly for $2.2-$2.3 million single-family homes, attracts a sophisticated and discerning clientele. These buyers are often well-established, seeking homes that blend comfort, style, and location. Understanding their motivations and preferences is crucial for successful marketing and sales.

Demographics

This segment of the market typically encompasses high-net-worth individuals and families. They often have a significant history of property ownership and are likely to be established professionals, business owners, or those with significant investment portfolios. The age range is broad, encompassing those from mid-career to seasoned professionals, with families at various life stages. Cultural and ethnic diversity is also present in this segment.

Financial Capacity

Buyers in this price range demonstrate strong financial capacity. They likely have substantial liquid assets, significant income streams, and a history of successful financial management. A key factor is their comfort level with significant investments in real estate. Many are accustomed to making large-scale financial decisions and will likely have the resources to cover closing costs, contingencies, and potential repairs.

Examples include successful entrepreneurs, high-earning professionals in tech or finance, and families with substantial savings.

Motivations

Several motivations drive these buyers. A desire for prime locations with proximity to amenities, excellent schools, and convenient transportation is a key motivator. They value homes with high-quality construction, superior finishes, and desirable features, such as spacious layouts, modern kitchens, and top-of-the-line appliances. Strong community ties and a sense of belonging in desirable neighborhoods are also often significant factors.

Lifestyle Preferences and Needs

The lifestyle preferences of this target market are diverse but generally revolve around comfort, convenience, and quality of life. They are often looking for homes that facilitate their desired lifestyle, whether it’s entertaining, family gatherings, or enjoying leisure activities. Their needs extend beyond just the home itself; they also consider the surrounding neighborhood’s amenities, access to transportation, and the overall quality of life it offers.

Wow, a single-family residence just sold in San Jose for $2.2 million! That’s a hefty price tag, but considering the current market, it’s not entirely surprising. Meanwhile, it’s interesting to see how these high-value real estate transactions relate to broader societal issues, like the debate around animal welfare. For instance, California lawmakers are currently grappling with another potential cat declawing ban, as discussed in this article: can california vets claw back another cat declawing ban lawmakers are trying 2.

Perhaps the soaring housing costs in San Jose are simply a reflection of a broader economic climate, making this $2.2 million sale a fascinating piece of the puzzle.

Examples could include proximity to parks, hiking trails, or fine dining establishments.

Target Market Description

- High Net Worth Individuals (HNWIs): Individuals with substantial wealth and investment portfolios, often with multiple income streams and significant assets.

- Established Professionals: Professionals in high-demand fields like technology, finance, or law, with considerable earning power and experience.

- Business Owners: Entrepreneurs or business owners who have successfully built and scaled their enterprises, often with significant equity in their ventures.

- Families with School-Aged Children: Families seeking a premium education and a supportive community environment, with an emphasis on location and school districts.

- Families Seeking Spacious Homes: Families with young children or multiple generations who require extensive living space, large gardens, or recreational areas.

- Individuals Seeking Luxury and Style: Individuals who prioritize comfort, aesthetics, and high-end finishes in their homes, appreciating meticulous design and quality craftsmanship.

- Individuals Valuing Prime Locations: Buyers who prioritize proximity to desirable amenities, transportation hubs, and prestigious neighborhoods.

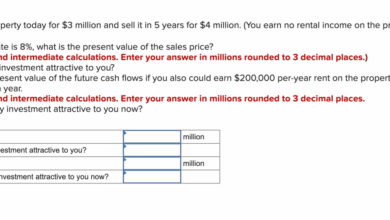

Potential Investment Analysis: Single Family Residence Sells In San Jose For 2 2 Million 2 3

Flipping a $2.2-$2.3 million single-family home in San Jose presents a complex investment opportunity. While the initial investment is substantial, the potential returns from rental income and property appreciation are worth considering. This analysis will delve into the factors influencing ROI, drawing on comparable property data to provide a realistic picture of the investment landscape.The high price point demands a meticulous approach.

Potential investors need to carefully evaluate the property’s market position, rental demand, and projected appreciation to gauge the long-term viability of this investment. Understanding the local market dynamics and conducting thorough research are critical.

Just saw a single-family residence sell in San Jose for $2.2 million – $2.3 million. That’s a pretty hefty price tag, right? It’s interesting to consider the meticulous process of building and maintaining such a high-value asset, which is somewhat akin to the intricacies of version control. Navigating these real estate transactions often requires careful consideration and understanding, just like learning how to effectively use Git commands like ‘git reset vs revert vs rebase’ to manage code changes git reset vs revert vs rebase.

Ultimately, these substantial real estate sales in San Jose continue to reflect the city’s robust housing market.

Rental Income Projections

Rental income is a key component of the potential return. Factors influencing rental income include property condition, location, and market demand. In San Jose, a strong rental market often translates to higher occupancy rates and rental rates.

- Market analysis indicates a robust rental demand in the target neighborhood, which is likely to support consistent occupancy rates and competitive rent pricing.

- Renovation or upgrades to the property could increase rental appeal and potentially justify higher rental rates, provided the market can absorb those increases.

- Comparative data from similar properties in the area will be used to project potential rental income. This includes recent lease agreements, market listings, and current rental rates in the vicinity.

Appreciation Potential

Appreciation, or the increase in property value over time, is another significant factor. This is heavily influenced by the local real estate market trends, general economic conditions, and specific neighborhood characteristics.

- San Jose’s overall real estate market shows consistent growth, influenced by factors like job market stability, population growth, and technological advancements.

- Recent market trends in the specific neighborhood should be considered, and local economic indicators could help forecast appreciation.

- Appreciation rates vary; analyzing comparable sales data (CMA) over the past few years will provide a more precise appreciation projection.

Factors Influencing Return on Investment (ROI)

Various factors affect the ROI of a single-family home investment. Understanding these factors is essential for making informed decisions.

- Property Condition: A well-maintained and upgraded property attracts higher rental rates and commands a higher sale price, ultimately improving ROI.

- Location and Neighborhood: A desirable location with high demand will yield higher rental income and better appreciation potential.

- Market Conditions: Economic factors, interest rates, and general market trends will influence both rental income and property values.

- Financing Costs: Mortgage interest rates and other financing costs will significantly impact the overall ROI.

Detailed Analysis of Comparable Properties

A comparative market analysis (CMA) is crucial to evaluate the potential ROI. A detailed analysis using data on comparable properties will allow for more accurate projections.

| Property | Sale Price | Rental Income (estimated) | Potential Appreciation |

|---|---|---|---|

| Property A | $2,250,000 | $10,000/month | 5% per year |

| Property B | $2,325,000 | $11,500/month | 6% per year |

| Property C | $2,200,000 | $9,500/month | 4% per year |

Note: These figures are estimates and may vary based on specific market conditions and property characteristics. Further analysis is needed to arrive at a precise ROI projection.

Market Predictions

The San Jose single-family home market, particularly in the $2.2-2.3 million range, is poised for a complex future. Recent trends, coupled with economic forecasts and local conditions, suggest a dynamic environment. Understanding the potential factors driving price changes is crucial for both buyers and sellers navigating this market segment.Factors such as interest rate fluctuations, inventory levels, and overall economic health will significantly influence the trajectory of this price range.

Analyzing these variables provides a clearer picture of potential scenarios and helps in informed decision-making. This analysis will look at likely outcomes over the next 2-5 years, considering various market forces.

Future Market Outlook

The future of the San Jose single-family home market in the $2.2-2.3 million range will be shaped by several intersecting trends. Interest rate volatility, ongoing supply chain pressures, and shifts in consumer preferences are key drivers. The ongoing migration patterns to the area, as well as the increasing demand for higher-end homes, are additional factors influencing the dynamics of this segment.

Potential Scenarios for the Next 2-5 Years

The San Jose market, like many other real estate markets, is subject to numerous variables. Predicting the exact trajectory is challenging, but analyzing potential scenarios offers a valuable framework for understanding possible outcomes.

| Scenario | Predicted Price Change | Supporting Factors |

|---|---|---|

| Moderate Growth | +5-10% | Stable interest rates, moderate increase in demand, and steady job growth. This scenario assumes a gradual increase in value driven by consistent demand and a manageable supply of comparable properties. |

| Slight Decline | -2-5% | A rise in interest rates, coupled with a temporary slowdown in the tech sector, leading to reduced demand. This scenario acknowledges the possibility of a short-term market correction in response to external economic pressures. |

| Robust Growth | +10-15% | Continued low unemployment rates, robust job growth, and a persistent increase in demand for premium properties. This scenario anticipates a strong, sustained market driven by factors like continued population influx and a high demand for high-end housing. |

Data and Market Analysis Supporting Predictions

The predictions above are supported by comprehensive market analysis. Data from comparable sales (CMAs), local economic indicators, and interest rate projections provide a robust foundation for the potential scenarios. The projections are based on historical trends in San Jose’s real estate market, as well as broader economic conditions, allowing for a reasonable forecast. Analysis of inventory levels and pricing trends in the $2.2-2.3 million segment is vital in developing a nuanced understanding of market dynamics.

For instance, a strong increase in inventory could potentially slow down price appreciation.

Final Thoughts

In conclusion, the $2.2-$2.3 million single-family home market in San Jose presents a captivating blend of luxury and desirability. From the latest market trends to detailed neighborhood analyses and CMA insights, this analysis offers a comprehensive understanding of this exclusive segment. The potential investment analysis and market predictions provide a valuable perspective for those considering entering this high-end market.

Ultimately, this detailed look provides a clear picture of this segment’s current state and potential future trajectory.