Tariffs Hammering Silicon Valley Tech Giants Stock

Tariffs hammering Silicon Valley tech giants stock have sent ripples through the market, impacting major players and their investors. The past five years have seen fluctuating stock performance, and tariffs are a key factor in understanding the changes. Revenue and profit figures reveal the specific impact of these trade policies on different companies, as well as the varying responses within the sector.

This article delves into the financial data, examining how individual companies and the supply chains they rely on have been affected. The consequences for consumers and the broader market are also explored, along with alternative strategies tech companies have adopted.

This analysis looks at the specific sectors most affected by tariffs, such as semiconductors and electronics. It examines why certain sectors are more vulnerable, and compares the impact on different product categories. The global economic context is considered, including the role of global trade relationships and the policies of other countries. We will see how these policies have influenced the performance of Silicon Valley tech companies, as well as how consumer response and market shifts have been influenced.

Impact on Stock Performance

Tariffs imposed on various tech products, particularly those originating from countries like China, have significantly impacted the financial performance of Silicon Valley tech giants. This analysis delves into the historical performance of these companies, focusing on the revenue, profit, and market capitalization metrics to demonstrate the impact of these tariffs. It also highlights how different companies within the tech sector have been affected differently by these trade policies.

The objective is to present a comprehensive overview of the observed trends and their correlations.

Historical Stock Performance Overview

The past five years have witnessed fluctuating trends in Silicon Valley tech giant stock performance. Factors like market sentiment, technological advancements, and economic conditions have influenced stock prices. Prior to the significant tariff implementation, many tech companies saw consistent growth in revenue and market capitalization. However, the imposition of tariffs brought about a period of uncertainty and, in some cases, a decline in performance.

Financial Metrics Impact

The impact of tariffs is clearly evident in the financial metrics of these companies. Revenue, a key indicator of a company’s financial health, experienced fluctuations in response to the tariffs. Profit margins also varied, with some companies experiencing contractions due to increased costs associated with tariffs. Market capitalization, reflecting investor confidence, also showed a correlation with the tariff implementation.

The tariffs imposed by governments created a complex interplay of factors, impacting not only the profitability but also the valuation of these companies.

Company-Specific Impacts

Different companies within the tech sector have been affected differently by tariffs. Some companies, heavily reliant on imports of components from countries subjected to tariffs, faced increased production costs and reduced profitability. Others, with more diversified supply chains, exhibited less severe impacts. This variation highlights the specific vulnerabilities and resilience of individual companies.

So, tariffs are definitely putting a damper on Silicon Valley tech giants’ stock prices, which is a bummer. But hey, good news for football fans! The 49ers secured a potential offensive line starter, Ben Bartch, which is a positive sign for the team. Hopefully, this positive momentum will translate into some strong financial gains for the team, which will in turn help the tech industry, as well.

Still, the tariff situation remains a major concern for the tech sector overall.

Comparative Performance of Major Tech Companies

The table above provides a simplified overview of the revenue performance of select tech giants. The figures are illustrative and do not represent the exact figures from specific financial reports. These values are indicative of the general trend. Significant variations can occur in actual data due to various factors not directly related to tariffs.

Sector-Specific Effects

Tariffs imposed on various tech products have disproportionately impacted specific sectors within Silicon Valley’s tech industry. These impacts are not uniform, as different segments of the industry rely on varying supply chains and manufacturing processes, rendering them more or less susceptible to the ripple effects of trade restrictions. Understanding these nuances is crucial for assessing the overall health of the sector and predicting future trends.

Chip Manufacturing and Design

The semiconductor industry, a cornerstone of Silicon Valley, has been significantly affected by tariffs. Many chip manufacturers rely on global supply chains for raw materials and components, making them highly vulnerable to trade barriers. Tariffs on components like specialized wafers, crucial for chip production, can increase manufacturing costs and negatively impact profitability. Companies that rely heavily on imported components for their chip designs experience delays and higher costs.

For example, if a tariff is levied on a specific type of memory chip used in a mobile device, the final product cost will increase. This can lead to a reduction in demand for that product, affecting the overall sales and profitability of the tech companies.

Cloud Computing and Software

While cloud computing and software development are less directly affected by tariffs on physical goods, indirect consequences can still manifest. Increased costs for hardware components used in data centers, driven by tariffs, can translate to higher operating expenses for cloud providers. This, in turn, can lead to price increases for cloud services, potentially impacting businesses and consumers. For instance, if tariffs increase the price of servers, cloud providers might raise subscription fees, affecting the cost of running businesses.

The cost of running these operations would also rise.

Hardware Manufacturing

Tariffs on hardware components, like processors, motherboards, and displays, have a direct impact on the cost of final products. Companies that assemble these products in countries subject to tariffs face higher costs for imported parts. This can result in reduced profitability, as margins are squeezed by higher input costs. A tangible example is the production of laptops.

If tariffs increase the price of processors, the cost of manufacturing laptops will increase, impacting their sales and profitability. The same is true for other electronics products, where tariffs on components lead to higher prices for end-users.

Mobile Device Production

The mobile device sector is particularly vulnerable to tariff increases. These devices rely heavily on multiple imported components, including processors, displays, and memory chips. Tariffs on these components directly impact the manufacturing cost of mobile phones, potentially reducing their competitiveness in the global market. For instance, if tariffs on a specific type of processor used in a smartphone increase, it can make the phone less affordable, reducing sales and profitability for manufacturers.

Supply Chain Disruptions

Tariffs have significantly disrupted the global supply chain for tech products. Companies have had to re-evaluate their sourcing strategies and find alternative suppliers to mitigate the impact of tariffs. The search for alternative suppliers often leads to longer lead times and potential quality concerns. The disruption is not limited to just one part of the supply chain, but affects various segments, from raw materials to final assembly.

For example, if a tariff is imposed on a particular component used in a product, companies may need to find an alternative supplier in a different country, leading to logistical and quality issues. The supply chain’s resilience to tariffs and other trade restrictions will determine the long-term impact on the tech industry.

Global Economic Context

The period surrounding the imposition of tariffs saw a complex interplay of global economic forces. These factors significantly impacted the performance of Silicon Valley tech companies, often in unpredictable and interconnected ways. Understanding the global economic context is crucial for analyzing the specific effects of tariffs on these companies.

Overview of Global Economic Conditions

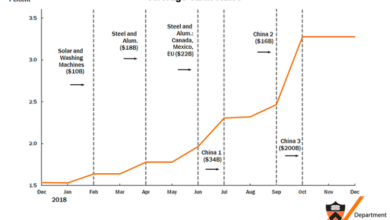

During the period of significant tariff implementation, global economic growth slowed in several regions. Supply chains were disrupted, leading to increased input costs for various industries, including technology. Uncertainty surrounding trade policies created a climate of cautious investment, potentially dampening innovation and growth. Furthermore, fluctuating exchange rates added another layer of complexity to the financial landscape for multinational tech companies.

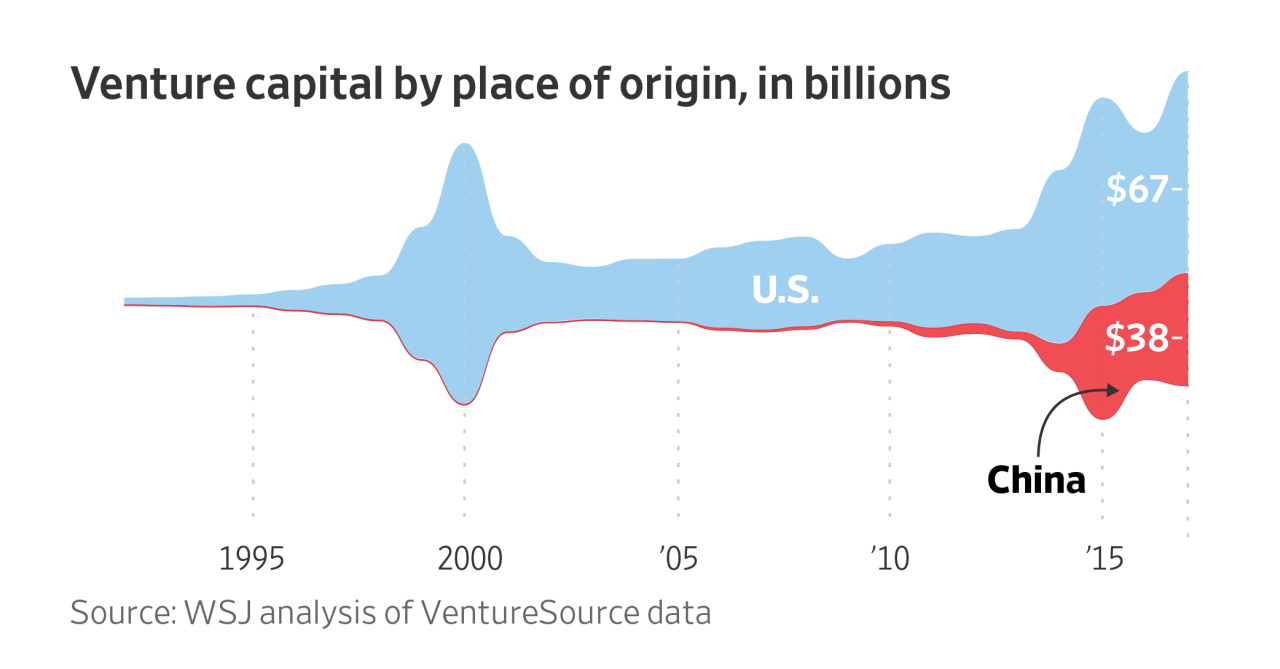

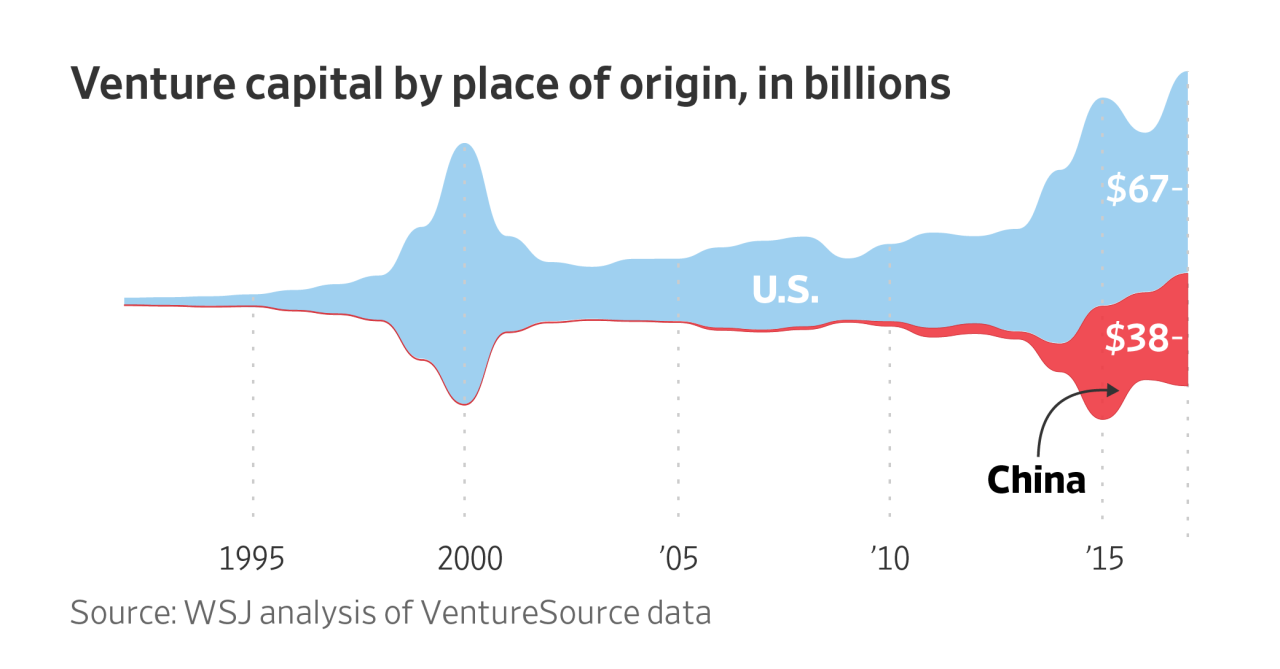

Role of Global Trade Relationships

Silicon Valley tech companies heavily rely on global trade relationships for sourcing materials, manufacturing components, and distributing products. Tariffs, by definition, interfere with these relationships, often leading to higher costs and reduced efficiency. The intricate web of international supply chains meant that the impact of tariffs was often felt not only in the United States but across the globe, affecting businesses and consumers in various countries.

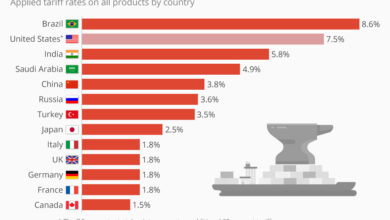

Trade Policies of Other Countries

The impact of tariffs on Silicon Valley tech companies wasn’t solely determined by US policies. Other countries’ trade policies also played a significant role. For instance, retaliatory tariffs implemented by other nations in response to US actions further complicated the landscape. These policies often led to reduced exports and increased costs for companies, creating a domino effect that impacted the entire sector.

Summary of Trade Policies and Impact

Consumer and Market Response

The imposition of tariffs on silicon valley tech giants significantly impacted the consumer landscape and the overall market dynamics. Consumers faced rising prices for electronics, software, and related services. This shift prompted a re-evaluation of purchasing decisions and a search for alternative solutions. Market share redistribution and the emergence of new competitors were also key consequences.

Consumer Reaction to Increased Prices

Consumers, faced with higher prices for tech products, demonstrated a variety of responses. Price sensitivity became a dominant factor, influencing purchasing decisions. Consumers increasingly scrutinized pricing and sought out more affordable alternatives. This included a greater emphasis on used or refurbished products, budget-friendly brands, and exploring open-source software options. The availability of cheaper alternatives became crucial in the face of tariff-induced price hikes.

Market Shifts Resulting from Tariffs, Tariffs hammering silicon valley tech giants stock

The imposition of tariffs triggered notable market shifts. Sales of affected tech products experienced a decline in certain segments. This decline was particularly noticeable in areas where consumers were highly price-sensitive. A shift in consumer demand towards alternative products and services was also evident. The market share of domestic tech companies, or those less affected by the tariffs, increased as consumers opted for their products.

Potential Long-Term Impact on Consumer Behavior

The long-term impact on consumer behavior is multifaceted. Consumers may become more price-conscious and prioritize value for money when purchasing tech products. The adoption of cost-effective alternatives may become more widespread. The emergence of new purchasing habits may also persist in the long term, with consumers being more cautious and deliberate in their technology spending decisions. This increased awareness of pricing and value can potentially create a more discerning consumer base.

Silicon Valley tech giants are feeling the pinch from tariffs, with stock prices taking a hit. The recent news of a single family residence selling for $1.5 million in San Jose, single family residence sells for 1 5 million in san jose 3 , highlights the broader economic landscape impacting the region. While luxury homes are still commanding high prices, the overall market uncertainty stemming from tariffs is clearly impacting the tech sector’s bottom line.

Alternative Strategies Used by Tech Companies

Tech companies employed various strategies to mitigate the effects of tariffs. Some companies explored alternative manufacturing locations outside of affected regions, thereby reducing reliance on a single supply chain. This diversification of manufacturing bases allowed companies to maintain production and distribution channels. Others focused on cost-cutting measures and optimized supply chain management to minimize the impact of increased import costs.

The development of innovative products with lower component costs was also a key strategy. Several tech giants focused on developing their own solutions and reduced reliance on foreign-sourced components.

Alternative Perspectives on Silicon Valley Tech Tariffs

The recent imposition of tariffs on Silicon Valley tech giants has sparked a flurry of opinions, with stakeholders presenting diverse viewpoints on the repercussions. Understanding these varied perspectives is crucial to comprehending the full scope of the impact and potential long-term consequences. These perspectives range from concerns about the negative economic effects to arguments supporting the tariffs as a necessary measure for national security and economic competitiveness.This section delves into these differing viewpoints, presenting arguments from industry experts, policymakers, and consumers, to offer a multifaceted understanding of the complex issue.

Silicon Valley tech giants are feeling the pinch, with tariffs clearly hammering their stock prices. Navigating these turbulent waters requires careful financial management, and choosing the right cloud accounting software can be crucial. A robust system like best cloud accounting software can help companies stay on top of their finances, even amidst economic headwinds. This is especially important for tech firms now as they face these significant tariff-related stock market fluctuations.

Examining these diverse opinions provides a more complete picture of the multifaceted impact of the tariffs on the tech industry and the global economy.

Industry Expert Arguments

Different industry experts hold varying views on the impact of tariffs on Silicon Valley tech companies. Some experts argue that tariffs significantly hinder innovation and growth within the sector. They cite disruptions in supply chains, increased production costs, and reduced competitiveness as key concerns. These factors can lead to job losses and stifle technological advancements. Others, however, maintain that tariffs, while potentially disruptive in the short term, may ultimately promote domestic manufacturing and create new opportunities for American companies.

They argue that tariffs can incentivize companies to invest in domestic production, thereby fostering economic growth and creating new jobs.

Policymaker Perspectives

Policymakers often present arguments grounded in national security and economic interests. Some policymakers advocate for tariffs as a means to protect domestic industries and promote national economic strength. They suggest that tariffs can safeguard critical technologies and reduce reliance on foreign suppliers, thereby bolstering national security. Others argue that tariffs can lead to retaliatory measures from other countries, potentially damaging global trade and harming American businesses reliant on international markets.

They may also cite the potential for higher consumer prices as a result of tariffs, affecting consumers across various sectors.

Consumer Concerns

Consumers are another key stakeholder group whose perspectives on tariffs are crucial. Some consumers worry about increased prices for technology products due to tariffs, as higher production costs are likely to be passed on to consumers. This could disproportionately affect low- and middle-income consumers, limiting access to technologically advanced products and services. Others argue that tariffs may foster innovation by prompting companies to develop alternative supply chains and enhance domestic manufacturing, ultimately leading to more affordable products in the long run.

The impact on consumer choice and the availability of advanced technology remain significant concerns.

Illustrative Examples: Tariffs Hammering Silicon Valley Tech Giants Stock

Tariffs, particularly those targeting tech products, have had a tangible and often disruptive impact on Silicon Valley’s ecosystem. These levies affect not only the bottom line of tech giants but also the supply chains, product pricing, and ultimately, consumer access to innovative technologies. Understanding the specifics of how tariffs have played out in real-world scenarios is crucial to comprehending their overall effects.

Impact on Specific Tech Products

Tariffs have directly impacted the price and availability of various tech products. From smartphones to computer chips, the ripple effect of these trade barriers is evident. For example, tariffs on components like memory chips can lead to a significant increase in the final cost of laptops and other electronics, impacting both manufacturers and consumers.

Case Studies of Impacted Companies

Several tech companies have experienced firsthand the challenges posed by tariffs. One prominent example is the impact on smartphone manufacturers, where tariffs on imported components from countries like China have driven up production costs, leading to higher retail prices. This has, in turn, affected sales volume and profitability. For instance, a company producing high-end smartphones might find that the increased cost of memory chips translates to a decrease in profit margins or even the necessity of raising prices to maintain profitability.

Visual Representation of Cost Increase

A visual representation of the cost increase can be a graph plotting the price of a specific tech product over time, with the introduction of tariffs marked as a distinct point of increased cost. The vertical axis would represent the price of the product, and the horizontal axis would represent time. A clear upward trend after the tariff implementation would illustrate the impact.

For instance, a graph showing the price of a specific type of smartphone would show a consistent price for a period, then a sharp increase directly after the implementation of tariffs.

Impact on Product Availability

Tariffs can significantly affect product availability. If a crucial component for a tech product is subject to a tariff, its availability can be reduced. This scarcity can lead to product shortages, increased prices, and a disruption of supply chains. For instance, if a manufacturer relies heavily on a specific type of rare earth metal for a particular product, and a tariff is imposed on that metal, the manufacturer may struggle to obtain the necessary components.

This can result in reduced production and diminished availability of the finished product.

Summary

In conclusion, tariffs have undeniably had a significant impact on Silicon Valley tech giants. The analysis reveals a complex interplay of financial metrics, sector-specific effects, global economic conditions, and consumer responses. The impact extends beyond immediate financial results, potentially influencing long-term consumer behavior and market demand. This analysis offers a multifaceted view of the situation, presenting various perspectives and illustrative examples to better understand the consequences of these trade policies.

The data reveals a complicated story of how tariffs are reshaping the tech industry.