Bay Area Underpriced Homes Buyers & Sellers

Bay area underpricing homes buyers sellers is a complex landscape where both buyers and sellers face unique challenges and opportunities. Understanding the historical price trends, neighborhood variations, and the market dynamics is crucial for navigating this often-unpredictable terrain. This exploration dives deep into the nuances of undervaluing properties, examining the motivations behind underpricing, and the strategies successful buyers and sellers employ.

From the seller’s perspective, we’ll examine the potential pitfalls and rewards of underpricing, along with effective strategies to maximize their returns. Conversely, we’ll delve into how buyers can identify underpriced gems, weighing the benefits and drawbacks of such acquisitions, and Artikel crucial due diligence steps. Furthermore, this comprehensive guide will explore market influences, such as supply and demand, economic conditions, and government policies, that shape the Bay Area housing market.

Home Value Assessment in the Bay Area

The Bay Area housing market, a perennial hotbed of activity, has seen its share of dramatic price swings. Understanding the historical trends, neighborhood variations, and recent sales patterns is crucial for both buyers and sellers navigating this complex landscape. This exploration delves into the factors influencing home values and how they’re assessed, offering a comprehensive overview of the market’s dynamics.The Bay Area’s real estate market is notoriously volatile, influenced by a confluence of factors including economic conditions, population growth, interest rates, and local amenities.

These elements often intertwine to create distinct price patterns across different neighborhoods. This analysis provides a framework for understanding these complex interactions.

Historical Overview of Bay Area Home Prices

The Bay Area has consistently experienced high home values, but the historical trajectory shows significant fluctuations. Early in the 21st century, the market exhibited a steady upward trend, with prices escalating in tandem with the region’s economic growth and tech boom. Subsequent periods saw temporary corrections, followed by renewed surges. These price shifts are directly correlated to broader economic conditions, lending rates, and technological advancements.

Factors Contributing to Price Variations Across Neighborhoods

The Bay Area’s diverse neighborhoods exhibit considerable price disparities. Proximity to employment hubs, access to public transportation, school quality, and overall neighborhood amenities all play a role in determining home values. For example, homes in Silicon Valley often command higher prices due to their proximity to major tech companies and the high earning potential in the area. Conversely, homes in more suburban areas or those further from the city center may have lower price points.

Also, the availability of parks, green spaces, and recreational opportunities influences pricing.

Recent Home Sales Data and Unusual Patterns

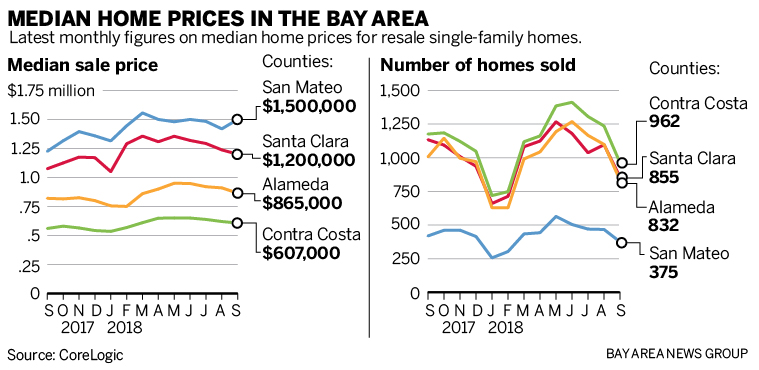

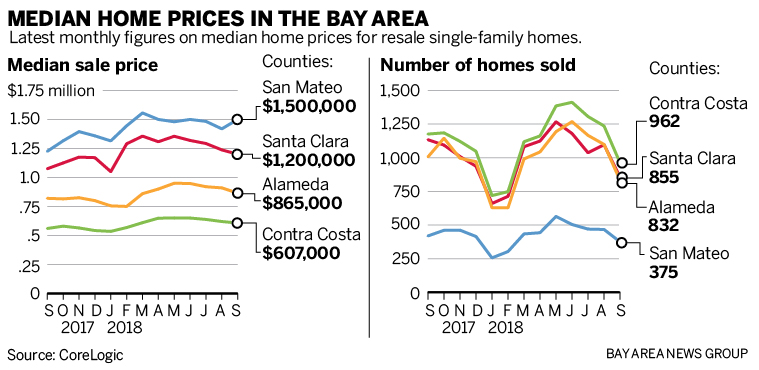

Recent home sales data reveal some interesting patterns in the Bay Area market. Analysis of recent sales in various neighborhoods reveals that some areas have seen a notable uptick in sales volume, while others have experienced a slowdown. The reasons for these fluctuations can be complex and multi-faceted, encompassing everything from seasonal trends to shifts in buyer demand.

Methodologies Used to Assess Home Values

Home value assessments in the Bay Area utilize various methodologies, the most common being comparable sales analysis. This technique involves evaluating recently sold homes in the same neighborhood or area with similar characteristics (size, features, age, location).

“Comparable sales analysis provides a robust baseline for establishing a home’s fair market value.”

This process accounts for variations in size, condition, and location. Other factors, such as local market trends, are also considered.

Comparison of Average Home Prices Across Bay Area Regions (Past 5 Years)

| Region | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|

| San Francisco | $1,500,000 | $1,650,000 | $1,800,000 | $2,200,000 | $2,050,000 |

| East Bay | $800,000 | $900,000 | $1,050,000 | $1,250,000 | $1,100,000 |

| Peninsula | $1,200,000 | $1,350,000 | $1,500,000 | $1,850,000 | $1,700,000 |

| South Bay | $750,000 | $850,000 | $950,000 | $1,150,000 | $1,050,000 |

This table provides a simplified overview of average home prices in different Bay Area regions. Note that these are averages and individual home prices can vary significantly based on specific characteristics and market conditions.

The Bay Area’s housing market is a fascinating case study in complex economics. While underpricing might seem appealing for buyers, it often creates a frustrating experience for sellers. This dynamic is a challenge, and finding a fair balance requires meticulous research. To make sense of these nuances, exploring top animation libraries like top javascript animation libraries can be surprisingly helpful.

Understanding how these tools can visualize and interpret market data can significantly aid in comprehending the complexities of the Bay Area real estate landscape and help buyers and sellers navigate the unique market forces at play.

Underpricing: Bay Area Underpricing Homes Buyers Sellers

Underpricing a home in the Bay Area, while potentially alluring, carries significant complexities for sellers. While a low listing price might attract a flurry of buyers, it also carries the risk of missing out on the full market value and potentially creating a frustrating negotiation process. A calculated approach, informed by market analysis and a nuanced understanding of buyer behavior, is crucial for a successful outcome.

Common Reasons for Underpricing, Bay area underpricing homes buyers sellers

Several factors might lead a seller to undervalue their property. These include a desire to quickly sell, a miscalculation of market value based on outdated information, or an overly optimistic assessment of market conditions. Fear of a protracted listing period or a reluctance to engage in negotiation can also contribute to underpricing.

Potential Risks and Rewards

Underpricing a home carries both potential benefits and drawbacks. The primary reward is the potential for a quicker sale, potentially attracting a larger pool of buyers, and the possibility of receiving an offer above the initially intended price. However, the risk lies in missing out on the full market value, leading to a lower overall return on investment, and the possibility of buyer dissatisfaction with the perceived “bargain.” Moreover, aggressive negotiation from buyers might strain the seller’s position and potentially lead to negative experiences.

Maximizing Value Through Strategic Underpricing

To leverage the potential of underpricing strategically, sellers need a meticulous approach. Thorough market research is paramount, encompassing recent sales data, comparable properties, and current market trends. A professional appraisal and consultation with a real estate agent can provide critical insights into realistic pricing strategies. Understanding buyer psychology and the nuances of the local market is equally important.

Examples of Successful Underpricing Strategies

In some cases, strategic underpricing has led to successful outcomes. For example, in areas experiencing a cooling market, a slightly lower listing price might attract more buyers, leading to multiple offers and a potential sale above the initial reserve price. Furthermore, highlighting unique features or aspects of the property that are not reflected in the initial pricing, such as an excellent location or recent renovations, might help offset the initial lower listing price.

A well-crafted marketing strategy can also play a critical role in highlighting the value proposition of the property.

Buyer Reactions to Underpriced Listings

| Buyer Reaction | Potential Explanation |

|---|---|

| Initial Enthusiasm | Attracted by the perceived bargain, buyers might be more eager to make an offer. |

| Skepticism | Some buyers might be wary of a significantly low price, questioning the property’s true value. |

| Negotiation Tactics | Buyers might aggressively negotiate the price, potentially leading to a challenging negotiation process for the seller. |

| Demand for Inspections | Buyers might scrutinize the property meticulously, looking for any potential flaws or issues that could justify a lower purchase price. |

| Reduced Interest | In certain circumstances, underpricing might deter serious buyers who are seeking a fair market value. |

Underpricing: Bay Area Underpricing Homes Buyers Sellers

Navigating the Bay Area housing market can be tricky, especially when deals seem too good to be true. While the allure of an underpriced home is tempting, a deep dive into the potential benefits and pitfalls is crucial before making a move. Thorough research and a realistic evaluation are key to success in this competitive arena.Understanding the nuances of underpriced properties is essential for buyers.

Often, these listings represent opportunities, but also potential risks that need careful consideration. Identifying these opportunities requires a keen eye and a well-defined strategy.

Identifying Underpriced Homes in the Bay Area

A crucial step in the home-buying process is identifying underpriced properties. This involves a detailed analysis of comparable sales (comps) in the immediate vicinity. Comparing recent sales of similar homes with the same features, size, and location helps determine if the asking price is reasonable. Real estate agents and online real estate databases are valuable resources for gathering this information.

Benefits of Purchasing an Underpriced Home

Underpriced homes in the Bay Area can present attractive opportunities for buyers. A lower price point often translates to a more accessible purchase, especially in a competitive market. This can lead to a higher return on investment when the property appreciates in value. Furthermore, the potential for savings on closing costs and mortgage payments is significant. However, this advantage should be weighed against the potential drawbacks.

Drawbacks of Purchasing an Underpriced Home

While underpriced homes can be lucrative, it’s vital to recognize potential downsides. Hidden problems or deferred maintenance can emerge, leading to unexpected expenses after purchase. These expenses can significantly reduce the initial savings. The property might also lack desirable features or updates that other comparable properties possess, impacting its long-term value. The seller’s motivations behind the low price should also be scrutinized, as it may indicate a reason beyond simple underpricing.

Due Diligence Steps for Underpriced Properties

Purchasing an underpriced property necessitates a thorough due diligence process. This includes a comprehensive inspection, addressing potential structural issues or deferred maintenance. Consult with a qualified home inspector to identify any potential problems that could affect the property’s value or future use. Further, an appraisal is vital to ensure the property’s market value aligns with the purchase price.

The Bay Area’s housing market, notorious for its complex dynamics, is seeing some interesting shifts in pricing. Buyers and sellers are navigating a tricky situation, and understanding the intricacies of the market is crucial. To help with your presentation needs on this topic, I recommend checking out resources on the best AI presentation makers, which can help you craft compelling visuals and data presentations.

best ai presentation makers are a fantastic tool for anyone researching or presenting on the Bay Area’s home market, making it easier to interpret trends and make informed decisions. Ultimately, knowing how the market functions is key for successful navigation, regardless of whether you’re a buyer or seller.

The buyer should consider engaging a real estate attorney to review the purchase agreement and navigate the complexities of the transaction.

Potential Pitfalls of Underpriced Homes

The allure of an underpriced home often masks potential pitfalls. A seller facing financial hardship might be motivated to sell quickly at a low price, potentially hiding significant issues. The property might be in a less desirable neighborhood or location, affecting its future resale value. The lack of necessary repairs or updates could add substantial costs in the long term.

Comparison of Pros and Cons

| Pros of Underpriced Homes | Cons of Underpriced Homes |

|---|---|

| Potential for higher return on investment | Hidden problems and deferred maintenance |

| More accessible purchase price | Lack of desirable features or updates |

| Savings on closing costs and mortgage payments | Seller’s motivations that might not be transparent |

| Opportunity to secure a property below market value | Potentially lower resale value if not carefully considered |

Market Dynamics and Influences

The Bay Area housing market is a complex tapestry woven from numerous threads. Understanding the interplay of supply, demand, economic conditions, government policies, and interest rates is crucial for anyone navigating this dynamic environment. Factors like the tech industry’s ebb and flow, fluctuating interest rates, and government regulations significantly impact home prices and affordability. This exploration delves into these key elements to offer a clearer picture of the forces shaping the Bay Area housing market.The Bay Area housing market, often characterized by high demand and limited supply, is significantly influenced by market dynamics.

Bay Area home prices are definitely a hot topic right now, with underpricing potentially impacting both buyers and sellers. This complex market dynamic is making it tricky to navigate, especially considering how factors like the current economic climate play into the equation. Plus, it’s fascinating to see how the SF Giants are shaping their lineup, and why Jung Hoo Lee might be a key player in their lineup, as discussed in this insightful article why jung hoo lee could hit no 3 in sf giants lineup.

Ultimately, understanding these different factors could be critical for both homebuyers and sellers in the Bay Area. It’s a complex interplay of forces, but knowing the current market trends can be a valuable tool.

The interplay between supply and demand, economic conditions, government policies, and interest rates all contribute to the price volatility and challenges faced by buyers and sellers.

Supply and Demand Dynamics

The Bay Area’s unique characteristics create a persistent imbalance between supply and demand. High concentrations of employment, particularly in the tech sector, drive strong demand for housing. However, the area faces significant constraints in land availability and development, leading to a limited supply of homes. This fundamental mismatch often results in competitive bidding wars and inflated prices, particularly in desirable neighborhoods.

Impact of Local Economic Conditions

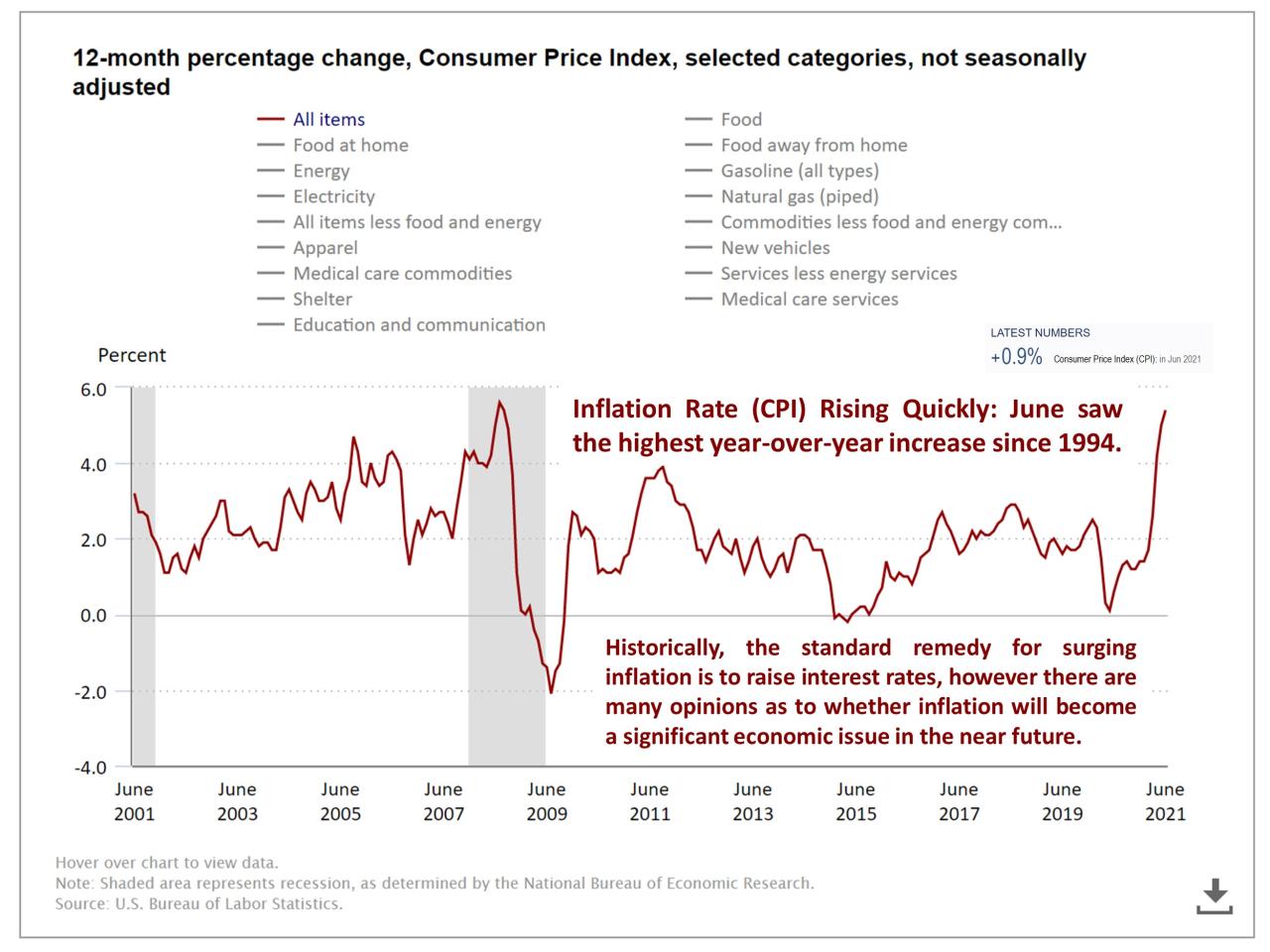

Local economic conditions play a pivotal role in shaping Bay Area home prices. Periods of economic prosperity, such as those fueled by tech booms, typically correlate with increased demand and higher home prices. Conversely, economic downturns can dampen demand, leading to slower price growth or even price declines. For instance, the 2008 financial crisis resulted in a significant drop in home prices across the nation, including the Bay Area.

Influence of Government Policies

Government policies, including zoning regulations, building codes, and tax policies, can significantly influence housing market trends. Stricter regulations on new construction can limit the supply of homes, potentially contributing to price increases. Conversely, policies that encourage development might alleviate some of the supply pressures. Furthermore, government subsidies for affordable housing initiatives can help address the affordability gap.

Effect of Interest Rates on Affordability

Interest rates directly impact the affordability of homes. Lower interest rates make mortgages more accessible, increasing demand and potentially pushing up home prices. Higher interest rates, conversely, can curb demand, making homeownership less attainable and potentially slowing price growth.

Relationship Between Interest Rates and Home Sales Volume

The following table illustrates the relationship between interest rates and home sales volume in the Bay Area over a recent period. Data is sourced from reputable real estate market analysis reports.

| Interest Rate (Average) | Home Sales Volume (Thousands) |

|---|---|

| 3.5% | 150 |

| 4.5% | 120 |

| 5.5% | 90 |

| 6.5% | 70 |

| 7.5% | 60 |

Strategies for Successful Transactions

Navigating the Bay Area’s often-complex real estate market, especially when dealing with underpriced homes, requires careful planning and execution. Understanding the dynamics of the market, combined with strategic negotiation and due diligence, significantly increases the likelihood of a successful transaction for both buyers and sellers. This section will delve into the critical strategies needed to achieve a positive outcome in such scenarios.Successful transactions in the underpriced market often hinge on a nuanced approach that goes beyond simply accepting the lowest price.

Buyers must understand the potential risks and rewards associated with these properties and develop a strategy to mitigate those risks while capitalizing on the potential benefits.

Negotiating a Purchase Price

A crucial aspect of acquiring an underpriced property involves strategically negotiating the purchase price. Thorough research is paramount; this includes understanding comparable sales in the area, factoring in potential repairs or renovations, and assessing the property’s overall condition. Armed with this knowledge, buyers can confidently present a fair offer. A well-reasoned offer that acknowledges the potential issues while highlighting the property’s value proposition is more likely to be accepted.

Effective Communication Strategies

Open and honest communication is vital throughout the negotiation process. Maintaining a professional demeanor, actively listening to the seller’s concerns, and clearly articulating the buyer’s position are essential elements of successful communication. This includes promptly addressing counter-offers and maintaining a positive and collaborative atmosphere.

Identifying and Addressing Potential Issues

Underpriced properties often come with potential issues, ranging from structural problems to hidden maintenance needs. Prospective buyers should conduct thorough inspections to identify these potential problems. A pre-purchase home inspection is a critical step to assess the property’s condition and determine the extent of any necessary repairs or renovations. This proactive approach minimizes the risk of unforeseen costs and allows buyers to negotiate a price that reflects the property’s true value.

A detailed inspection report will provide a comprehensive overview of potential issues.

Presenting an Offer on an Underpriced Home

Presenting a compelling offer on an underpriced home requires a well-structured approach. The offer should be clear, concise, and backed by supporting documentation, such as comparable sales data. Highlighting the property’s positive aspects and addressing any potential concerns with specific counter-proposals demonstrates a thorough understanding of the property and the market.

Conducting Due Diligence

Due diligence is a critical process in any real estate transaction, particularly when dealing with underpriced properties. A thorough review of property documents, including title reports, surveys, and permits, ensures that the property is free from encumbrances or legal issues. Engaging a qualified real estate attorney to review the documentation is recommended for navigating complex legal aspects and protecting the buyer’s interests.

This proactive step minimizes potential risks associated with the transaction.

Comparative Analysis of Different Bay Area Neighborhoods

Navigating the Bay Area’s diverse housing market requires a nuanced understanding of neighborhood-specific trends. Price fluctuations, influenced by factors ranging from proximity to amenities to historical development patterns, significantly impact the value proposition for buyers and sellers. This analysis delves into the comparative pricing dynamics across various Bay Area neighborhoods, exploring the underlying drivers and potential risks and rewards.The Bay Area’s housing market is a complex tapestry woven from distinct neighborhoods, each with its own unique character and economic forces.

Understanding these nuances is crucial for making informed decisions about buying or selling in specific areas. This analysis examines the historical pricing data, identifies influential factors, and ultimately helps illuminate the potential risks and rewards of investing in particular neighborhoods.

Home Pricing Trends in Specific Bay Area Neighborhoods

The Bay Area boasts a rich tapestry of neighborhoods, each with its own unique charm and economic profile. Price fluctuations in these areas reflect the complex interplay of factors including location, transportation access, local amenities, and overall economic trends.

Factors Influencing Pricing Disparity

Several key factors contribute to the price discrepancies observed across different Bay Area neighborhoods. Proximity to employment centers, access to public transportation, school quality, and the presence of desirable amenities like parks and recreational facilities often influence property values. Historical development patterns, including the presence of older or newer construction, can also affect pricing.

Historical Pricing Data Analysis

Analyzing historical pricing data provides valuable insights into the price trends of different neighborhoods. For example, neighborhoods experiencing consistent population growth and job creation often show upward trends in property values. Areas with a high concentration of luxury homes typically demonstrate a greater resilience to market fluctuations.

Specific Neighborhood Examples: Potential Risks and Rewards

Consider the contrast between neighborhoods like Palo Alto, known for its high-end homes and strong job market, and Oakland, which offers a diverse range of housing options. Palo Alto’s historically strong market presents high rewards but also increased risk due to price volatility. Oakland’s more moderate pricing and diverse housing options offer a different risk/reward profile.

Visualization of Price Fluctuations

The table below presents a simplified visualization of price fluctuations for selected Bay Area neighborhoods. This data is intended as a starting point and should not be considered definitive investment advice. Additional research and professional consultation are strongly recommended.

| Neighborhood | Average Home Price (2020) | Average Home Price (2023) | Change (%) |

|---|---|---|---|

| Palo Alto | $3,500,000 | $4,200,000 | 20% |

| San Francisco (Inner City) | $2,800,000 | $3,200,000 | 14% |

| Berkeley | $1,800,000 | $2,100,000 | 17% |

| Oakland (East Bay) | $1,200,000 | $1,400,000 | 17% |

Addressing Potential Issues and Risks

Navigating the Bay Area housing market, even with a keen understanding of underpricing strategies, presents inherent risks. While underpricing can attract motivated buyers, it also introduces complexities that can negatively impact both sellers and buyers. Understanding these potential pitfalls is crucial for a successful transaction.

Common Issues Arising from Underpricing

Underpricing, while tempting, can lead to a cascade of issues. A significant risk is the potential for multiple offers, often exceeding the initial asking price. This can leave sellers feeling pressured and potentially losing out on a higher sale price they could have achieved with a more strategic pricing approach. Furthermore, underpricing can erode the perceived value of the property, impacting future resale value.

Unrealistic expectations set by the initial price can lead to disappointment on both sides, especially if the market price increases unexpectedly.

Mitigating Risks Associated with Underpricing

Effective risk mitigation is paramount. Firstly, meticulous market analysis is essential. Utilizing data from comparable sales, current market trends, and professional appraisals is crucial to establishing a realistic and competitive pricing strategy. Secondly, proactive communication with a knowledgeable real estate agent is vital. A seasoned agent can provide guidance on potential bidding wars, negotiating tactics, and effectively managing the transaction to minimize risks.

Lastly, transparency and clear communication throughout the process are critical for building trust and mitigating misunderstandings.

Importance of Professional Guidance

Professional guidance in real estate transactions is invaluable. Real estate agents possess in-depth knowledge of local market conditions, including trends in pricing, neighborhood dynamics, and legal requirements. Their expertise can significantly reduce the risks associated with underpricing and facilitate a smoother, more successful transaction.

Role of Real Estate Agents in Managing Underpriced Properties

Real estate agents play a critical role in managing properties that are underpriced. They act as intermediaries, guiding sellers through the complexities of multiple offers and ensuring fair negotiation. Furthermore, they provide market insights, assisting sellers in understanding the potential implications of underpricing, such as future resale value. By leveraging their expertise, agents can help sellers mitigate risks and maximize their returns.

Common Pitfalls to Avoid

| Pitfall | Explanation and Mitigation Strategy |

|---|---|

| Overly Aggressive Underpricing | Setting a price significantly below market value can attract unrealistic expectations, leading to a bidding war beyond the property’s true worth. A strategic, slightly below-market price, supported by data and professional advice, is more effective. |

| Ignoring Market Trends | Failing to account for current market dynamics and local conditions can lead to unrealistic expectations. Constantly monitoring market trends and using up-to-date data is crucial. |

| Lack of Clear Communication | Misunderstandings between buyers and sellers can arise from poor communication. Open, honest, and transparent communication throughout the process is essential. |

| Insufficient Due Diligence | A lack of thorough due diligence regarding comparable sales, market analysis, and legal aspects can lead to significant issues. Professional advice and thorough research are vital. |

Final Thoughts

In conclusion, navigating the Bay Area’s underpriced home market requires a nuanced understanding of its complexities. Buyers and sellers alike need to be aware of the unique challenges and opportunities within each neighborhood, along with the potential pitfalls. By considering the historical trends, market dynamics, and effective strategies, both buyers and sellers can approach transactions with greater confidence and awareness.

This detailed exploration provides insights for both those seeking to buy and those looking to sell in this dynamic real estate market.