China-US Tariffs Whats Next?

China us tariffs whats next – China-US tariffs: what’s next? This complex issue has deeply impacted global trade and continues to shape economic landscapes. From the historical context of escalating trade disputes to the potential future scenarios, we’ll delve into the multifaceted effects on both nations, exploring potential solutions and the ripple effects on the world stage.

The history of tariffs between China and the US is long and intricate, marked by periods of cooperation and conflict. Understanding the economic impacts, global implications, and alternative strategies is crucial for navigating this complex situation.

Historical Context of Tariffs

The trade relationship between China and the US has been marked by periods of cooperation and intense conflict, often revolving around tariff policies. These disputes have had profound economic consequences for both nations and their global partners. Understanding the historical context is crucial to comprehending the current situation and anticipating potential future developments.The evolution of these trade disputes reveals a complex interplay of economic interests, political motivations, and shifting global power dynamics.

From initial trade agreements to the imposition of substantial tariffs, the history provides valuable insights into the patterns and trends that have shaped the present trade landscape.

Key Events in US-China Trade Disputes

The history of trade tensions between the US and China is replete with significant events. These events, ranging from initial trade agreements to recent tariff battles, demonstrate the dynamic nature of their economic relationship. The actions and reactions of both countries have often been driven by a complex interplay of economic interests and political considerations.

- Early Trade Relations (1970s-1990s): The establishment of diplomatic relations and subsequent trade agreements laid the groundwork for increased economic interaction. However, concerns about intellectual property theft and unfair trade practices began to surface, indicating the early seeds of future disputes.

- Accession to WTO (2001): China’s entry into the World Trade Organization (WTO) was a landmark event, signifying a new era of global trade integration. While promising, it also raised concerns about the fairness and effectiveness of the global trade system, especially in relation to China’s growing economic power.

- Rise of Trade Deficits (2000s): The growing US trade deficit with China, fueled by the production of goods in China and their import into the US, became a major point of contention. This led to calls for action to address the imbalance.

- Intellectual Property Concerns (2010s): Complaints about intellectual property theft and forced technology transfer intensified, adding another layer of complexity to the trade relationship.

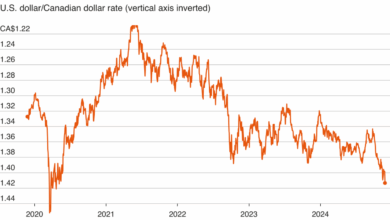

- 2018-2020 Tariffs: The most recent period of significant trade disputes began with the imposition of tariffs by the US on various Chinese goods, escalating into a full-blown trade war. This period was marked by retaliatory tariffs, economic disruptions, and significant uncertainty in global markets.

Evolution of Tariff Policies

The evolution of tariff policies between the US and China reveals a shifting approach. From initial cooperation to significant retaliatory measures, the policies have been influenced by a variety of factors. The different types of tariffs imposed (e.g., import tariffs, retaliatory tariffs) have had distinct economic effects, some of which are still felt today.

- Early Agreements and Gradual Escalation: Initial trade agreements focused on establishing basic trade rules and gradually increasing market access. However, the emphasis shifted over time to addressing perceived unfair trade practices, leading to more aggressive measures.

- Retaliatory Measures and Global Impact: The imposition of retaliatory tariffs by both countries disrupted global supply chains and led to uncertainty in international markets. These measures highlighted the interconnectedness of global trade and the potential for unintended consequences.

- Varying Impacts on Industries: The tariffs impacted various industries in both countries, leading to job losses and economic instability in some sectors. The consequences were unevenly distributed across different segments of the economy.

Types of Tariffs and Their Effects

Different types of tariffs have distinct economic consequences. Import tariffs increase the price of imported goods, while retaliatory tariffs are imposed in response to another country’s tariffs. Both types can affect consumer prices, production costs, and trade balances.

- Import Tariffs: Import tariffs increase the price of imported goods, reducing demand and potentially leading to a decrease in imports. However, this also can protect domestic industries from foreign competition.

- Retaliatory Tariffs: Retaliatory tariffs are imposed in response to another country’s tariffs. They aim to counter the negative impacts of the initial tariffs, but can often escalate the dispute and harm international trade relations.

Major Tariff Actions Table

| Date | Description of Action | Affected Goods | Amount |

|---|---|---|---|

| 2018 | Initial US tariffs on Chinese goods | Various manufactured goods | Varying |

| 2019 | Retaliatory tariffs by China | US agricultural products | Varying |

Economic Impacts of Tariffs

The imposition of tariffs, particularly between the US and China, has far-reaching economic consequences. These trade restrictions impact not only the directly involved nations but also ripple through global supply chains, affecting various industries and consumers. Understanding these impacts is crucial to assessing the overall economic health and stability of both countries.

So, what’s next for the China-US tariff situation? It’s a complex issue, but one thing’s for sure: real estate markets are still reacting. Just look at this recent sale of a townhouse in San Ramon for a cool $1.3 million. townhouse in san ramon sells for 1 3 million. This suggests underlying economic factors are at play, which likely impacts the global trade landscape, making the tariff situation even more unpredictable.

Overall, it’s a tricky game of global economics, and we’ll have to wait and see how it all shakes out.

Potential Consequences on US Industries

US industries, especially those reliant on imported components or raw materials from China, face significant challenges. Supply chain disruptions are a major concern, leading to production delays and increased costs. For example, if a US manufacturing company relies on Chinese-made microchips, a tariff could cause a shortage of these components, halting production and impacting the company’s bottom line.

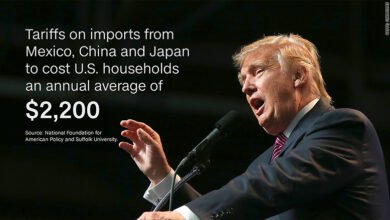

The resulting price increases for consumers are another consequence. These tariffs can lead to higher costs for finished goods, impacting consumer purchasing power and potentially reducing demand. Agriculture is also vulnerable, as tariffs can reduce export markets for US agricultural products, impacting farmers’ incomes.

Potential Consequences on Chinese Industries

Chinese industries, particularly those heavily export-oriented, face considerable pressures. Tariffs reduce demand for their products in the US market, potentially leading to job losses and economic slowdown in these export-dependent sectors. The Chinese government may respond by attempting to stimulate domestic demand, but the effectiveness of these measures is debatable and could have unintended consequences. Furthermore, Chinese consumers may face higher prices for imported goods, impacting their purchasing power.

Impact on Different Sectors

The impact of tariffs varies across different sectors. Manufacturing, heavily reliant on global supply chains, experiences the most significant disruptions due to component shortages and price increases. Agriculture, while not as directly impacted by tariffs as manufacturing, may experience a decrease in export markets and lower prices for their products. Services, such as technology and finance, are less directly affected, but global economic uncertainty can still impact investor confidence and market stability.

Projected Changes in Trade Volumes and GDP Growth

| Metric | Projected Change (US) | Projected Change (China) |

|---|---|---|

| US Trade Volume | Potential decrease in imports from China, potentially offset by increased imports from other countries. | Significant decrease in exports to the US. |

| China Trade Volume | Decrease in exports to the US | Potential shift in export destinations, possibly increased imports from other countries. |

| US GDP Growth | Potential decrease in GDP growth due to higher input costs, supply chain disruptions, and reduced consumer spending. | Potential decrease in GDP growth due to reduced exports to the US, potentially offset by government stimulus. |

| China GDP Growth | Potential decrease in GDP growth due to reduced exports to the US, and potentially reduced foreign investment. | Potential decrease in GDP growth due to reduced exports to the US and reduced foreign investment. |

The table above provides a simplified overview of potential impacts, as the actual effects depend on numerous factors and are difficult to predict precisely. Previous trade disputes offer some examples of how such events can affect trade volumes and economic growth, though each situation is unique.

Global Implications of Tariffs: China Us Tariffs Whats Next

The China-US tariff war, a protracted trade conflict, had far-reaching consequences beyond the immediate economic actors. Its ripple effects spread across global supply chains, impacting international relations, and prompting adjustments in trade strategies for numerous countries. Understanding these broader implications is crucial to comprehending the long-term ramifications of such trade disputes.The global implications of tariffs extend beyond the direct participants, influencing numerous countries through interconnected supply chains.

The disruption of these flows often leads to unexpected consequences, highlighting the complexity of global trade and the vulnerability of economies reliant on intricate international partnerships.

Ripple Effects on Global Trade and Supply Chains

The imposition of tariffs disrupts established trade patterns, forcing companies to adapt and potentially seek alternative suppliers. This often leads to increased costs for consumers and businesses, as the price of goods and services adjusts to reflect the added tariffs. Supply chains, which are intricate networks of suppliers and manufacturers, are particularly susceptible to disruptions. Shifts in sourcing or production locations can lead to shortages or delays, and even prompt a complete restructuring of global supply chains.

A shift away from a region like China may result in an increase in production costs for other countries that have to bear the burden of increased manufacturing expenses.

Impacts on International Relations and Cooperation

Trade disputes can strain diplomatic relationships and erode trust between nations. The China-US tariff war, for example, led to a period of heightened tension, impacting other international agreements and cooperation initiatives. This disruption of established trade norms can hinder efforts to foster international cooperation on broader issues like climate change or global health. It highlights the potential for trade disputes to escalate into broader geopolitical conflicts, impacting not just economic relations, but also diplomatic interactions and international cooperation.

Effects on Other Countries’ Economies and Trade Strategies

The tariffs imposed by the US on Chinese goods, and vice versa, had a significant impact on other countries. Many nations, who were trading partners of either China or the US, faced decreased export opportunities and adjustments to their economic strategies. For instance, some Asian countries experienced a reduction in exports to the US market, while others sought to diversify their export markets to mitigate the risks of relying heavily on a single trading partner.

This led to a more cautious approach to trade relations, and a greater emphasis on diversification and resilience.

Table: Impact of Tariffs on Global Trade Flows and Supply Chains

| Country | Impact on Trade Flows | Impact on Supply Chains |

|---|---|---|

| China | Reduced exports to the US, increased exports to other countries | Diversification of suppliers, increased domestic production |

| US | Increased prices for some consumer goods, reduced imports from China | Search for alternative suppliers, reshoring of some production |

| Japan | Reduced exports to the US, some shift to other markets | Re-evaluation of supply chain strategies |

| European Union | Reduced trade with China, search for alternative suppliers | Diversification of sources for raw materials and components |

| Other Asian countries | Reduced exports to the US, opportunities in other markets | Shift in production to countries with less tariff barriers |

Potential Future Scenarios

The ongoing trade war between the US and China presents a complex and evolving landscape. While the initial imposition of tariffs aimed to address perceived trade imbalances, the consequences have rippled through global supply chains and impacted both national economies. Predicting the future trajectory of these relations requires considering the potential for escalation, de-escalation, or a negotiated settlement, each with varying economic repercussions.The current situation necessitates a nuanced understanding of potential future scenarios.

The future of US-China trade relations hinges on the choices made by both governments, including the willingness to engage in meaningful negotiations and compromise. This intricate dance of economic and political forces will determine the fate of global trade and investment.

Continued Escalation of Tariffs

The ongoing trade war could escalate further, with both countries imposing additional tariffs on a wider range of goods. This scenario would likely lead to increased costs for consumers in both countries, potentially triggering inflation and economic instability. Supply chain disruptions would intensify, impacting businesses reliant on imports from either nation. For example, a further escalation of tariffs on electronics components could lead to higher prices for consumer electronics globally, impacting consumers in numerous countries beyond the immediate trading partners.

De-escalation of Tariffs

A de-escalation of tariffs, potentially through negotiation and compromise, would represent a more positive outcome. Reduced trade barriers could stimulate economic growth by increasing trade volumes and reducing costs for businesses. This scenario could also foster greater cooperation on other global issues. For example, the 2015 Iran nuclear deal demonstrated the potential for de-escalation in international relations, though the specifics of a trade agreement would be unique and complex.

Negotiated Settlement

A negotiated settlement, potentially involving a mutual reduction of tariffs, would be the most favorable outcome for both countries. This scenario could foster a more stable and predictable trading environment, leading to greater economic opportunities for both sides. A successful negotiation would require both nations to be willing to compromise on key issues, such as intellectual property rights or market access.

The North American Free Trade Agreement (NAFTA) renegotiation demonstrates that a negotiated settlement can be complex and lengthy.

Potential Policy Responses

Both governments would likely implement various policies to address the impacts of tariffs. The US might offer tax incentives to domestic industries to mitigate the effects of increased import costs. China could focus on developing its domestic market and reducing its reliance on exports. The precise policy responses will depend on the specific nature of the tariffs and the overall economic climate.

This is a fluid situation with the potential for a range of government responses.

Alternative Trade Strategies

Navigating the complexities of global trade requires adaptable strategies that can mitigate the negative effects of tariffs and foster sustainable economic growth. Diversifying supply chains, exploring new markets, and strategically employing regional trade agreements are key components of these alternative strategies. This section will explore these options, considering the potential for reduced reliance on single-country partners and the creation of more resilient global trade networks.

Diversifying Supply Chains

Diversifying supply chains is crucial for reducing vulnerability to trade disputes and ensuring consistent access to essential resources. This involves actively seeking alternative suppliers in different geographic regions. For example, a country heavily reliant on a single nation for electronics components could potentially establish relationships with suppliers in Southeast Asia or South America. This process can help reduce the impact of tariffs by creating multiple sources for crucial materials.

- Reduced reliance on single suppliers strengthens resilience against future trade disruptions.

- Geographic diversification can minimize the risk of supply chain bottlenecks and shortages.

- Greater competition among suppliers can drive down prices and improve quality for consumers.

- This strategy requires significant investment in developing relationships with new suppliers and adapting manufacturing processes to accommodate diverse inputs.

Exploring New Markets

Expanding into new markets provides opportunities for increased economic activity and reduces dependence on traditional trading partners. Companies can actively seek opportunities in regions less affected by trade conflicts, thus increasing the overall resilience of their operations. For instance, businesses from countries facing trade restrictions could explore markets in Africa or Latin America. This strategy can lead to new revenue streams and mitigate the impact of tariffs on existing markets.

So, China and the US tariffs – what’s next? It’s a complex situation, and honestly, it feels like a never-ending story. But amidst the trade negotiations, there’s a whole other world of awesome concerts happening! Check out the details on Tyler, the Creator’s upcoming shows in Oakland, San Francisco, and Sacramento here.

Hopefully, the global economy will get back on track soon, so we can all enjoy some live music and trade without any issues. The tariffs are still a huge factor, though, and a lot of people are watching closely.

- Exploring new markets diversifies revenue streams and reduces dependence on existing ones.

- Expansion into emerging economies can foster economic growth and development in both the exporting and importing countries.

- This approach requires market research, investment in infrastructure, and adaptation to new cultural and regulatory environments.

Regional Trade Agreements

Regional trade agreements can promote economic interdependence and reduce the impact of tariffs by creating preferential trade arrangements within specific geographic areas. These agreements can lower barriers to trade among member countries, fostering a more integrated and resilient regional economy. Examples of such agreements include the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the European Union.

- Regional trade agreements foster closer economic ties between participating countries.

- These agreements can reduce trade costs and increase market access for member countries.

- The effectiveness of regional agreements depends on the commitment of participating countries to uphold the agreement’s provisions.

Shifting to Non-Tariff Barriers

While tariffs are a significant concern, non-tariff barriers (NTBs) such as quotas, technical regulations, and sanitary and phytosanitary measures can also significantly affect trade flows. The focus on these NTBs may offer a path to reducing the impact of tariffs, particularly if countries find common ground on standards and regulations.

- Addressing NTBs can improve the predictability and efficiency of global trade.

- Collaboration on standards and regulations can minimize trade friction and foster greater openness.

- Negotiations to reduce NTBs can be more complex and time-consuming than tariff negotiations.

Subsidies for Affected Industries

Governments can implement subsidies to support industries directly impacted by tariffs. These subsidies can help maintain employment and production levels, mitigate the financial burden on affected businesses, and potentially encourage the development of new technologies and processes. For example, governments could offer tax breaks or grants to industries struggling to adapt to trade restrictions. This approach aims to maintain domestic economic stability and resilience.

- Subsidies can help mitigate the financial losses incurred by industries facing tariff increases.

- These measures can support jobs and maintain production levels in affected sectors.

- The effectiveness and fairness of subsidies are subject to scrutiny, and careful consideration of potential unintended consequences is necessary.

Public Opinion and Political Implications

The escalating trade tensions between the United States and China, fueled by tariffs, have significantly impacted public opinion and political discourse in both countries. These economic policies, intended to address perceived trade imbalances and unfair practices, have rippled through domestic politics, influencing policy decisions and altering international relations. Understanding the nuances of public sentiment and its effect on political strategies is crucial to comprehending the long-term trajectory of this complex trade war.

Public Opinion in the United States, China us tariffs whats next

Public opinion in the United States regarding tariffs has been a complex mix of support and opposition. Supporters often cited the need to protect American industries and jobs, while opponents emphasized the negative economic consequences for consumers and businesses. A variety of factors, including political affiliations, economic sectors affected, and perceived national security concerns, have influenced public views.

Surveys from various organizations have attempted to capture the sentiment.

Public Opinion in China

Public opinion in China regarding tariffs has been largely shaped by the impact on Chinese businesses and consumers. While the Chinese government has often presented a united front, public concerns regarding the economic fallout of tariffs have been evident. The government’s response to the tariffs, including countermeasures and support programs, has played a role in shaping public perception.

Impact on Political Relations

The imposition of tariffs has undeniably strained political relations between the United States and China. The tit-for-tat approach has escalated tensions, leading to diplomatic setbacks and reduced cooperation on global issues. The exchange of accusations regarding unfair trade practices has further exacerbated the conflict. This strained relationship has had ripple effects on other international relations, creating uncertainty and prompting other nations to consider their own trade strategies.

Influence of Domestic Politics

Domestic political considerations have significantly influenced trade policy decisions in both countries. In the United States, protectionist sentiments and the desire to bolster specific industries have played a role in shaping tariff policies. In China, the government’s need to safeguard national economic interests and maintain social stability has also influenced its trade responses. Political pressure from interest groups and the need to address domestic concerns have shaped the policies on both sides.

Summary of Public Opinion Data

| Country | Support for Tariffs (Estimated %) | Opposition to Tariffs (Estimated %) | Neutral/Undecided (Estimated %) | Source/Methodology |

|---|---|---|---|---|

| United States | 35-45 | 40-55 | 10-20 | Various polls and surveys from reputable organizations (Pew Research Center, Gallup, etc.) |

| China | 50-60 | 25-35 | 5-15 | Chinese public opinion surveys (access limited for foreign researchers) and inferred from government statements. |

Note: The data presented in the table is an estimated range, and exact figures are difficult to ascertain due to varying methodologies and access to data.

Illustrative Examples of Affected Industries

Tariffs, particularly those imposed between major economies like the US and China, ripple through various sectors, impacting consumers and businesses alike. These impacts are often multifaceted, affecting not only the price and availability of goods but also supply chains and overall economic activity. This section will examine specific instances of how tariffs have impacted key industries, illustrating the complex interplay between trade policies and economic outcomes.The automotive industry, for example, felt the brunt of the 2018-2019 tariffs, primarily on steel and aluminum.

This led to increased costs for manufacturers, impacting their profit margins and pricing strategies. The effects were not limited to the manufacturers themselves; the increased costs were ultimately passed on to consumers in the form of higher prices for vehicles. Consequently, consumers faced diminished purchasing power and a reduced selection of models, particularly those that heavily relied on imported components.

Automotive Industry

The imposition of tariffs on steel and aluminum significantly increased the cost of raw materials for automakers. This directly affected the production costs of vehicles, as these materials are critical components in car manufacturing. American automakers, heavily reliant on imported steel and aluminum, experienced a substantial rise in production costs, potentially leading to reduced profits. For example, Ford and General Motors faced increased input costs for their vehicles.

This directly impacted their pricing strategies and, ultimately, consumer prices.

- Increased production costs for vehicles, leading to price hikes for consumers.

- Reduced profit margins for automakers, potentially leading to job losses or reduced investment.

- Shifting of manufacturing to regions with lower tariffs to mitigate costs. For example, some manufacturers may have started sourcing components from countries with lower tariffs on steel and aluminum to maintain their profitability.

- Consumers facing higher vehicle prices and potentially a smaller selection of models available due to the higher cost of imports.

Agricultural Sector

Tariffs on agricultural products, particularly agricultural goods from China, had a substantial effect on the American agricultural sector. The tariffs were intended to protect domestic farmers from foreign competition, but the impact on consumer prices and farmers’ livelihoods was substantial.

China-US tariffs are a tricky situation, and predicting the future is tough. However, the recent legal battles in college sports, like the poaching penalty lawsuit impacting Pac-12 expansion and travel for Olympic sports, mailbag how poaching penalty lawsuit could impact pac 12 expansion travel for olympic sports gonzagas rev share edge and more , could offer some interesting parallels.

Ultimately, the next steps for these tariffs depend on a lot of factors, and it’s hard to say definitively what’s coming.

- Farmers experienced reduced export markets for their produce.

- American consumers faced higher prices for certain agricultural products.

- Certain agricultural products experienced reduced availability, particularly those heavily reliant on imports from affected regions.

Strategies Adopted by Affected Companies

Companies impacted by tariffs implemented various strategies to mitigate the negative effects. Some companies shifted their supply chains to source materials from alternative countries with lower tariffs. Others invested in developing domestic production capacity for previously imported components. Furthermore, some companies negotiated with suppliers to mitigate rising costs.

- Supply chain diversification: Companies like agricultural exporters shifted some of their supply chains to countries outside of China to avoid the tariffs.

- Increased domestic production: Some companies looked to domestic suppliers to reduce their reliance on imports and mitigate the impact of tariffs.

- Negotiations with suppliers: Companies engaged in negotiations with their suppliers to help reduce the rising costs associated with tariffs.

Long-Term Impacts and Projections

The protracted trade war between the US and China, punctuated by tariffs, has far-reaching implications for the global economy. Its long-term effects extend beyond immediate market fluctuations, impacting supply chains, investment patterns, and ultimately, the trajectory of economic growth for both nations and the world. Understanding these potential scenarios is crucial for businesses, policymakers, and individuals alike.

Global Economic Ripple Effects

The imposition of tariffs has created a ripple effect across global supply chains, leading to increased costs for consumers and businesses. Companies have adjusted their production strategies, seeking alternative sourcing and reducing reliance on specific regions. This restructuring can result in shifts in manufacturing hubs, impacting employment and economic growth in various countries. For example, the shift in production away from China has been observed in several sectors, impacting economies dependent on Chinese manufacturing.

The long-term consequences include potential instability in global trade relationships and reduced economic efficiency.

Projected Effects on Future Trade Relationships

The tariffs have undeniably strained the US-China relationship. The long-term trajectory of trade relations between these two economic giants is uncertain. Several scenarios are possible: a further escalation of trade tensions, a negotiated settlement leading to a more stable trade relationship, or the emergence of new trade blocs and alliances. The current geopolitical climate further complicates the prediction of future trade dynamics.

Potential Scenarios for Future Trade Relations

A potential scenario includes a continued period of uncertainty, with both countries imposing additional tariffs or implementing trade restrictions. This could lead to fragmentation of global supply chains, potentially fostering the growth of regional trade blocs. Another possibility is a negotiated resolution, leading to a more predictable and stable trading environment, although this may require concessions from both sides.

A third potential scenario involves the rise of alternative trade partners, such as nations in Southeast Asia, as companies seek to diversify their supply chains. It’s crucial to note that these are just potential outcomes, and the actual future trajectory will depend on a variety of factors, including political decisions and economic conditions.

Table: Projected Long-Term Impacts

| Sector | US Impact | China Impact | Global Impact |

|---|---|---|---|

| Technology | Potential loss of market share due to increased costs and supply chain disruptions. Potential development of domestic technology industries. | Reduced exports, potential decline in high-tech manufacturing jobs. Increased focus on domestic innovation. | Reduced global innovation due to reduced competition. Potential rise of new technology hubs. |

| Consumer Goods | Higher consumer prices, potential for reduced choice. | Reduced exports, impact on employment in export-oriented industries. | Increased costs for consumers globally. Potential search for alternative suppliers. |

| Agriculture | Impact on agricultural exports, potential shift in agricultural production. | Reduced agricultural imports, impact on food security. | Potential impact on global food prices and supply chains. |

| Manufacturing | Potential shift in manufacturing locations, reduced productivity. | Loss of export market share, potential decline in manufacturing jobs. | Impact on global supply chains and industrial production. |

Closing Summary

In conclusion, the future of China-US trade relations remains uncertain, with a multitude of potential outcomes. From a continued escalation to a negotiated settlement, the long-term implications for both economies and global trade are substantial. While alternative strategies like diversifying supply chains offer possible solutions, the political and public opinion factors also play a significant role in shaping the trajectory of these trade policies.